How to evaluate China's ban on cryptocurrency activities - as a crushing blow or justa minor battle lost in a larger war of recognition? Investors are divided on this issue.

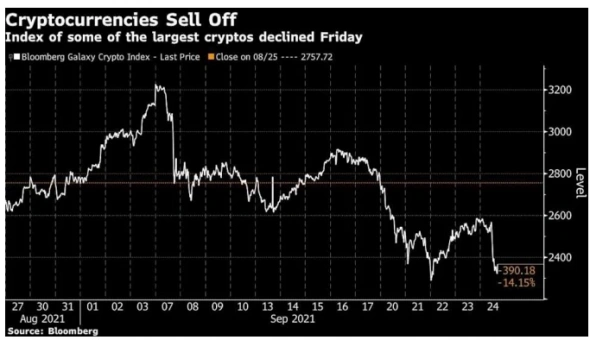

Digital currencies suffered a sell-off after...how China's central bank said all cryptocurrency-related transactions were illegal, according to a statement posted on a dedicated section of the People's Bank of China website. Bitcoin, the largest digital coin, fell 8.9% as a result, while Ethereum fell by about 13%. The Bloomberg Galaxy Crypto Index, which tracks several major cryptocurrencies collectively, lost as much as 11%.

“This is the latest step in a multi-year restrictionusing Bitcoin and other cryptocurrencies,” said Antoni Trenchev, managing partner and co-founder of Nexo, one of the largest crypto lenders in London. “At the moment, Bitcoin cannot take a break; it is being bombarded from all sides,” he added.

Here is how specialists and experts reacted to this event:

Chen Arad, COO of cryptocurrency market research firm Solidus Labs:

“While China’s move looks particularly dramatic, it’sreflects similar concerns with which regulators around the world view the lack of control over the cryptocurrency market and its role in illegal activities. Manipulation and fraud are not unique to the cryptocurrency space, but as a new asset class, digital currencies pose unfamiliar challenges and still have a lot to prove to regulators and the public. "

Stephen McClerg, Chief Investment Officer at Valkyrie Investments, a cryptocurrency fund manager:

“This year, China has banned cryptocurrencyactivity at least a dozen times. The volatility we see today may be a spontaneous reaction from some, but most market participants have already appreciated China's ban since the beginning of the summer. ”

Chris Dick, London-based Quantum Trader at B2C2 Crypto Trading Firm:

“If this news is just tougherrestrictive language before the launch of its own digital currency in China, or if China once again expresses its negative attitude towards the mining process, then in this case there will be no lasting effect, ”he said. "But if repressive measures affect key elements of the market infrastructure, such as major exchanges, then market volatility will continue to grow."

George Monaghan, Analyst at GlobalData Topic Group:

"China, which announced cryptocurrency transactionsillegal, would be disastrous for the cryptocurrency sector. Being excluded from the mainstream world market is terrible for any product, and it is the clearest demonstration of China's anti-crypto sentiment, ”Monaghan said. “However, this is not the first time that China has threatened with decisive action, but has so far failed to carry it out. The next few weeks will be tough for the cryptocurrency markets, which were already on the brink following the recent comments from the US Securities and Exchange Commission, but only the current legislation will have a long-term effect.

Alex Tapscott, Managing Director, Digital Asset Group, Ninepoint Partners:

“Experienced traders are used to not paying attentionbad news from China and buy on “drawdowns”, but could it be different this time? There are several good reasons for the cautious behavior, including China's oppression of its high-tech sector, its push for a digital yuan, and a number of other factors.