The “bubble” in the Bitcoin market that formed in 2021 has recently been gradually deflating and bringingthe loss of a $ 1.3 trillion industry built on speculation and active use of leverage.

The damage from the latest sale extends to the field of cryptocurrency loans, options and futures, reducing the effectiveness of various investment strategies in these market sectors.

Even with Wednesday's rebound, Bitcoin at around $31,700 is still trading near the bottom of its range over the past two months, down about 50% from its April peak.

This means that the bulls are being taught restraint as hedging costs rise and trading activity in the much-hyped decentralized finance community wanes.

“The hype has died down,” said George Dawn,CEO of cryptocurrency brokerage company Bequant. “This is a 24/7 market, so it is a grueling process for the entire industry. When summer comes, it is a very good time to take a little rest.”

Here are some signs thatcrypto speculators have not yet recovered from the May debacle. According to the information portal CryptoCompare, the turnover of spot and derivatives transactions this month is $ 2.6 trillion, which is the lowest since December. The number of active and new Bitcoin addresses has also declined. On Deribit, the world's largest options exchange, Bitcoin's implied volatility indicator is up 88% this week from its recent low.

Another testament to how decliningBullish sentiment is a reversal of indicators in the once profitable quant strategy, which is based on the spread between the futures market and the spot price.

When in April the target price of bitcoin in forecastsreached $ 100,000, the annual premium on futures was approximately 50%. This effectively meant that some traders were so confident in the underlying asset that they were willing to pay dearly for their bet.

But after the May crash, interest rates that bulls pay to roll over their futures have plunged to zero or even turned negative.

But after the May crash, interest rates that bulls pay to roll over their futures have plunged to zero or even turned negative.

According to him, over the past month and a half or so, the fund's indicators have remained at the same level, while for the current year the overall gain is 30%.

On the CME Group Inc. Bitcoin's initial curve is nearly flat - unlike a few months ago, when the steep curve still signaled ever-increasing optimism.

In the so-called future-orientedIn the DeFi world, where financial initiatives such as lending are implemented on the blockchain by pooling coins across the Internet, trading activity is slowing down. The total estimated value of DeFi resources fell to $ 54 billion from $ 89 billion at its May peak.

Great motivation for placing coins in thesepools is to receive high returns, which are now falling as the cost of tokens decreases and the bullish sentiment decreases, and retail traders are less interested in raising funds.

According to the consulting company LoanScan,interest rates on borrowing on several lending platforms for currencies pegged to the US dollar fell to about 2% compared to the period before April, when they usually rose above 10%.

“This is all very interconnected and not a big surprise as the DeFi space has been the source of a lot of leverage,” said George Zarya.

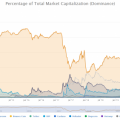

While bitcoin's fall since its peak in 2021has created a domino effect throughout the cryptographic complex, which industry advocates consider to be a temporary phenomenon, as the digital currency revolution is gradually taking over Wall Street.

“Professional crypto traders in quantitative analysis generally believe that we are still in a 'super bullish cycle,' said Reisman of YRD Capital.