Several factors contributed to bitcoin's rise above $55,000 this week, and their persistence will support themfurther growth, analysts at JPMorgan Bank say.

During the first half of the summer, asthe decline in bitcoin from the highs, JPMorgan analysts warned of the disappearance of institutional interest, and with the beginning of the market recovery in July, they shifted their attention to the risks of excessive euphoria.

"Increasing the share of bitcoin is a healthy development as it is more likely to reflect institutional participation than an increase in the share of smaller cryptocurrencies.", - says the latest report.

At the beginning of the month, JPMorgan analysts noted thatEthereum futures are in the highest demand among institutional investors, while bitcoin derivatives have faded into the background. Commenting on the bias of preference back in favor of Bitcoin, they write:

“Preferences appear to change sincethe end of September, along with a sharp recovery in bitcoin performance. This recovery is at least partly due to the covering of short positions, the liquidations of which have increased dramatically over the past week or two. "

JPMorgan names the following factors for the resumption of the rally in Bitcoin:

- Promises by the US authorities not to follow China's example in banning cryptocurrencies;

- The proliferation of second-tier payment solutions such as the Lightning Network, along with the acceptance of bitcoin in El Salvador;

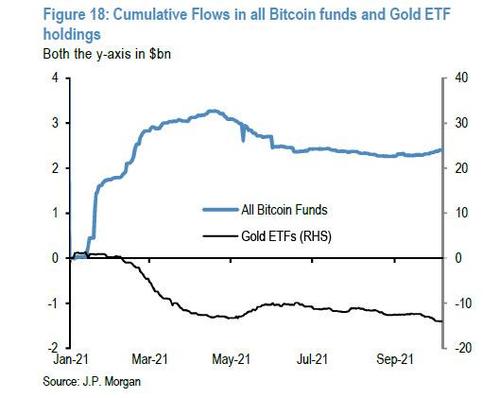

- Renewed fears about inflation andthe associated growth in the demand for bitcoin as a hedging tool. The attractiveness of bitcoin has increased due to the fact that gold in this regard did not support investor expectations and over the past weeks has been more responsive to changes in real interest rates than to inflation.

“Renewed fears about inflation amonginvestors have sparked an increase in interest in bitcoin as a hedging tool. Institutional investors appear to be returning to Bitcoin, seeing it as a better inflation hedge than gold. Preliminary signs that were seen during the previous shift in preference from gold to bitcoin during much of the fourth quarter of 2020 and early 2021 have begun to manifest themselves again in recent weeks. ", Added JPMorgan analysts.

Where is it more profitable to buy and sell cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://okex.com | 6.5 |

| 5 | Bybit | https://bybit.com | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Additional features and services— futures, options, staking, NFT marketplace.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication