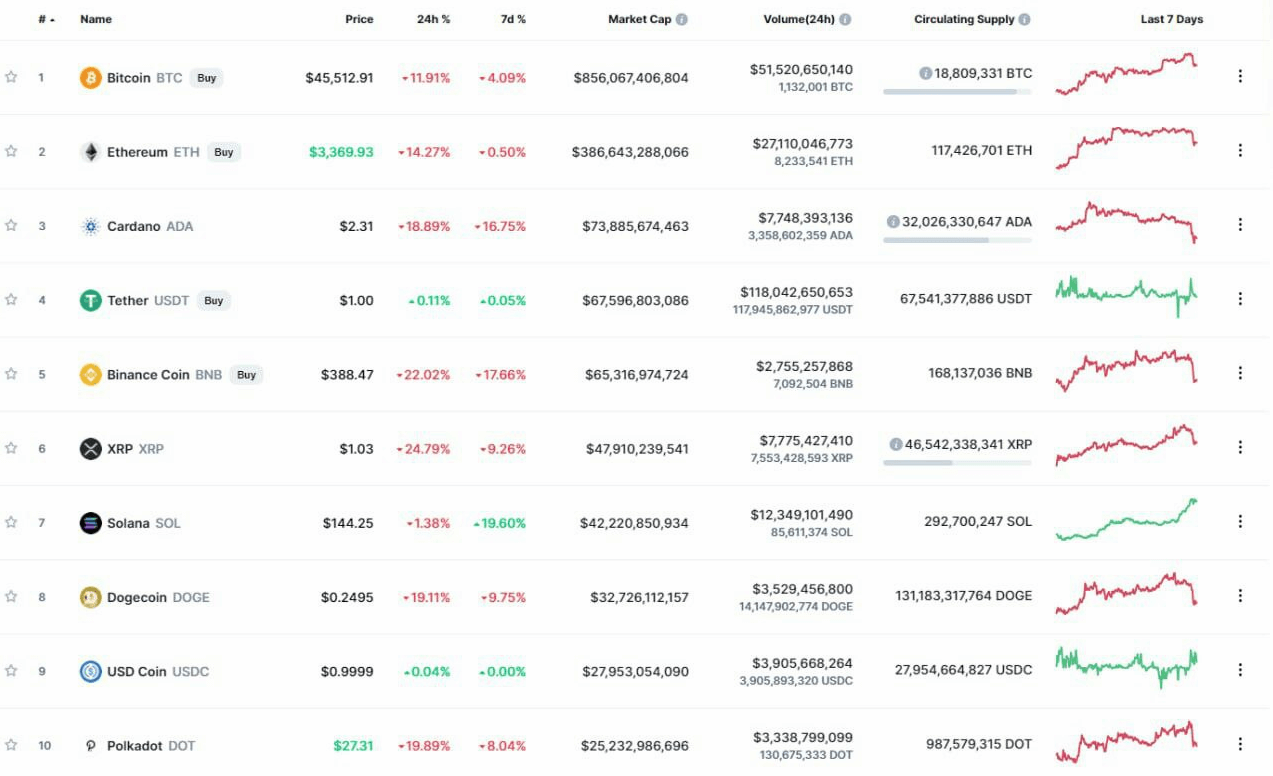

- The beginning of this week was difficult for the crypto industry - the cost of major cryptocurrencies decreased by15–20%, and the exchanges experienced difficulties in their work.

- A possible reason for the fall lies in the overestimated expectations of market participants and a large volume of margin positions.

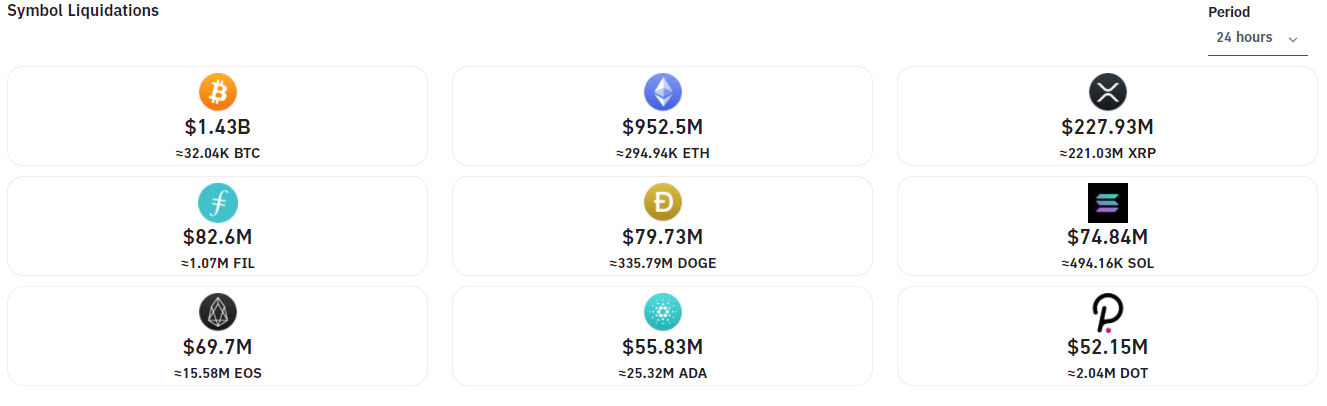

- The total volume of liquidations in the last 24 hours exceeds $ 3.75 billion.

The last days for many crypto traders have beenrestless as the leading cryptocurrencies have lost a significant chunk of their value. Bitcoin lost more than $ 10,000 in a matter of hours, which at the moment was about 20%.

Altcoins showed an even stronger fall:

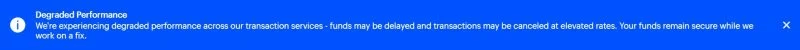

The storm did not spare crypto exchanges either. The largest platform in the United States, Coinbase, posted a warning on its website about a decrease in performance.

The Kraken exchange is experiencing connectivity issues.to accounts and mobile devices, as well as problems with delivery of messages to email. Gemini also experienced issues with its trading platform, which it quickly resolved.

It seems that most cryptocurrency traders were also not prepared for such an outcome. The market seemed calm, the news background was favorable:

- The popularity of NFT is growing;

- El Salvador has accepted Bitcoin as legal tender in the country;

- The desire to legalize cryptocurrencies was announced in Panama.

Why have the prices of all cryptocurrencies fallen?

"That's all. Such large-scale stories often lead to an overestimation of the market. It looks like it was this time too ", Arcane Research analyst Vetle Lunde told Decrypt.

The most likely reason for the fall isonce in an optimistic mood of traders. From July 4, when El Salvador's President Nayyib Bukele introduced a bill giving bitcoin legal tender status, to the law's entry into force on September 7, bitcoin has risen in value from $ 37,000 to $ 53,000 in just three months. However, the moment of official recognition of BTC actually became the moment of collapse.

In fact, this price behavior is notrare since many traders adhere to the buy-by-rumor, sell-by-fact rule. That is, traders and investors bought cryptocurrencies amid expectations about the entry into force of the Bitcoin bill, and after the release of the official news, many simply began to close their long positions, fixing profits. But this was only the beginning of the future fall.

Price decline was exacerbated by too high volumemargin positions, or more precisely, their liquidations. Based on the good news background and the general bullish mood in the markets, many traders opened positions with leverage, that is, they used borrowed funds to buy cryptocurrencies. This was potentially a big profit on the upside, but when the price fell, it caused an avalanche of liquidations of long margin positions, which led to a snowball effect and provoked more liquidations. As a result, cryptocurrency prices plummeted.

One of the options for the development of events was published by the analyst Willy Woo on his Twitter:

“The day began without much risk.Someone sold BTC. Sales are average. Liquidation of margin positions begins. $ 1.1 billion in liquidation of Bitcoin positions. The market does not support the decline. Purchases begin on the stock exchanges. "

Day opened with equities risk-off.

Some sell down of BTC.

Medium levels of fundamental inflows (selling).

Then stop hunt / liquidity collapse.

$ 1.1b of BTC liquidations.

Overall unsupported by investor fundamentals on-chain.

Exchanges are now in outflows (buying)

- Willy Woo (@woonomic) September 7, 2021

As for altcoins, the situation wassimilar. The good news background and the renewal of historical highs with many coins provoked traders to open long-leveraged margin positions. They became the catalyst for a precipitous decline.

According to the Bybt website, the total volume of liquidations in the last 24 hours is $ 3.75 billion, of which:

- $ 1.43 billion - BTC;

- $ 952.5 million - ETH;

- $ 227.93 million - XRP;

- $ 82.6 million - FIL;

- $ 79.73 million - DOGE.

The strongest looking girl was Solana, whoFor a short period of time, it even surpassed XRP in capitalization, taking 6th place. But now the coin is back at number 7, and the price change over the last 24 hours does not stand out much compared to other coins in the top 10.

Where is it more profitable to buy cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://okex.com | 6.5 |

| 5 | Bybit | https://bybit.com | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Additional features and services— futures, options, staking, NFT marketplace.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication