Bitcoin is digital gold. This is the main idea today, stimulating adoption and disseminationbitcoin.To be a good store of capital, bitcoin's growth rate must consistently be at least as high as inflation. But it seems that some people have lost the idea of what this means.

Obviously, not everyone is convinced that Bitcoin can serve as a hedge against inflation.

Bitcoin isn't behaving as an inflation hedge today.

Instead it looks like a tech stock. https://t.co/kY1z92pd75

— Joe Weisenthal (@TheStalwart) May 12, 2021

@TheStalwart:

Bitcoin does not act like a hedge against inflation today. Rather, his behavior resembles technology stocks.

And you know what? Joe's remark (that BTC is declining amid rising inflation) is correct. Invalid output.

But let's back up for a minute.

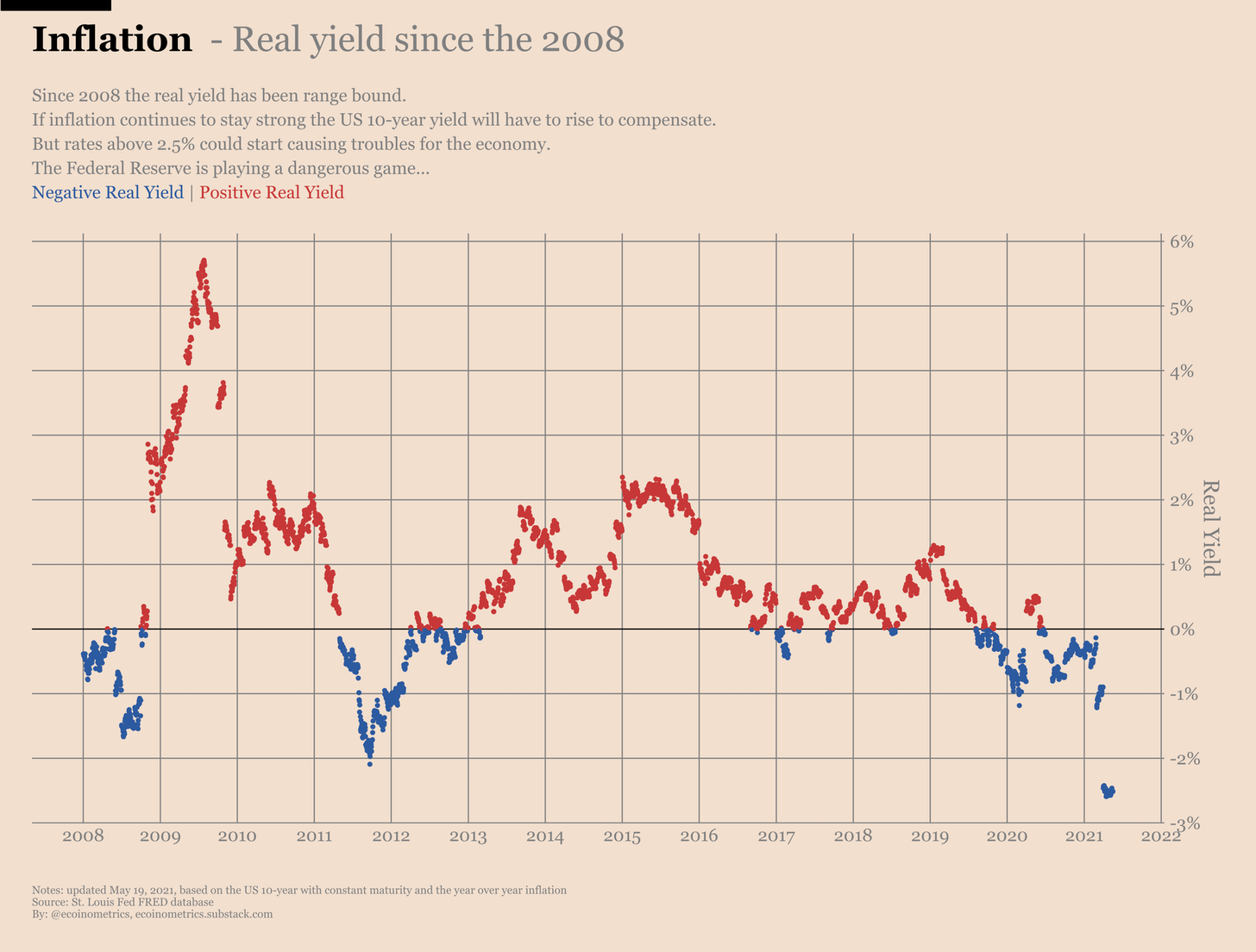

Inflation data released in Mayconsumer price index, which turned out to be higher than expected. Stronger inflation than expected, coupled with a relatively stable yield on 10-year bonds, pushed real yields outside of the range established since 2008.

Real US Bond Yields Since 2008

To calculate real profitability, you need toyields on your favorite bonds—here, the 10-year U.S. bond—subtract inflation. If the real return is positive, then such bonds actually preserve your capital. If real yields are negative, then holding these bonds is not enough to keep up with inflation.

Capital preservation tools such as goldor bitcoin do not generate profits. Therefore, if you can get positive real returns with bonds, holding capital in such assets may look less attractive to you. But when the real yield on bonds goes into the negative zone, then turning to other means of preserving capital becomes justified.

Now, what is the point of view based onthat Bitcoin does not behave like an inflation hedge: after the publication of US inflation data in May, the price of BTC continued to decline. Conclusion of the thesis authors: Bitcoin is not a hedge against inflation.

But excuse me: wouldn't it be somewhat lightweight to base such an inference on a single data point?

The point is that to qualify Bitcoin asAs an inflation hedge, its price behavior on any given day is irrelevant. Inflation is a phenomenon that erodes the purchasing power of your cash over a period of time. But the duration of this period of time is definitely more than one day. We are talking about a process that usually plays out over a period of months or years.

So no, the behavior of BTC's price over the past couple of weeks does not disprove Bitcoin's ability to hedge against inflation.

But the observation of the authors of the thesis under consideration onis essentially true. That is, while Bitcoin can serve as a hedge against inflation in the long run, it is not traded as such on a day-to-day basis. And the reason is simple.

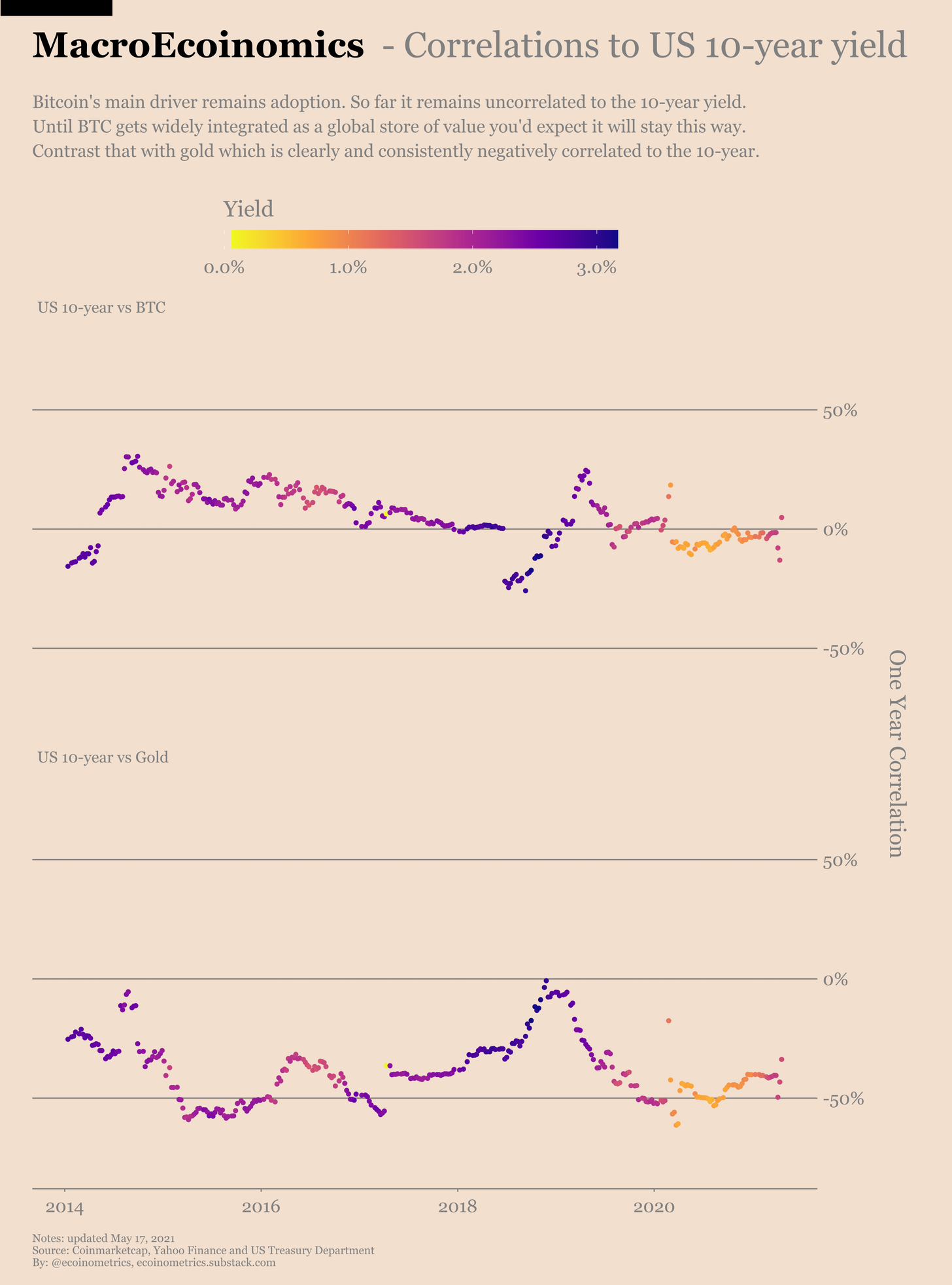

Short-term trading on inflation is engaged inmostly only financial institutions. But most financial institutions have not yet entered Bitcoin. As a consequence, Bitcoin trades differently from gold.

This behavior is just a function of the acceptance levelbitcoin as a store of capital within the global financial system. In fact, this can be used as another measure of Bitcoin adoption by the traditional finance world. The more sensitive Bitcoin becomes to changes in real returns, the more it looks like a traditional store of capital.

So how does the benchmark store of wealth, gold, perform relative to real returns?

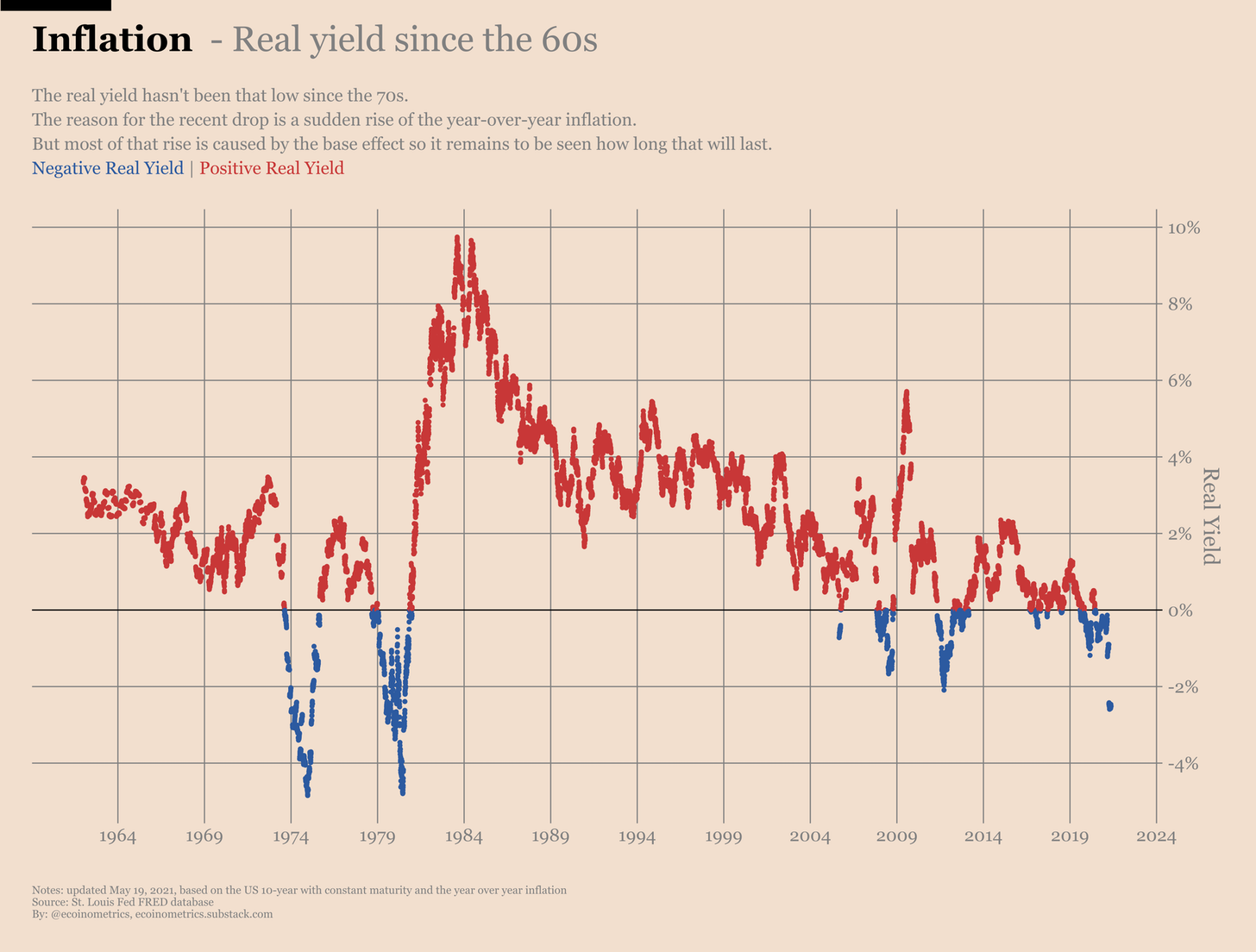

Well, if you go back, then in the 70s and earlyIn the 1980s, real bond yields were negative on average. Then, in the mid-1980s, the situation improved significantly. And since then we have been in a very long downtrend, associated more with falling bond yields than with rising inflation.

Check it out:

Real US bond yields since the 1960s.

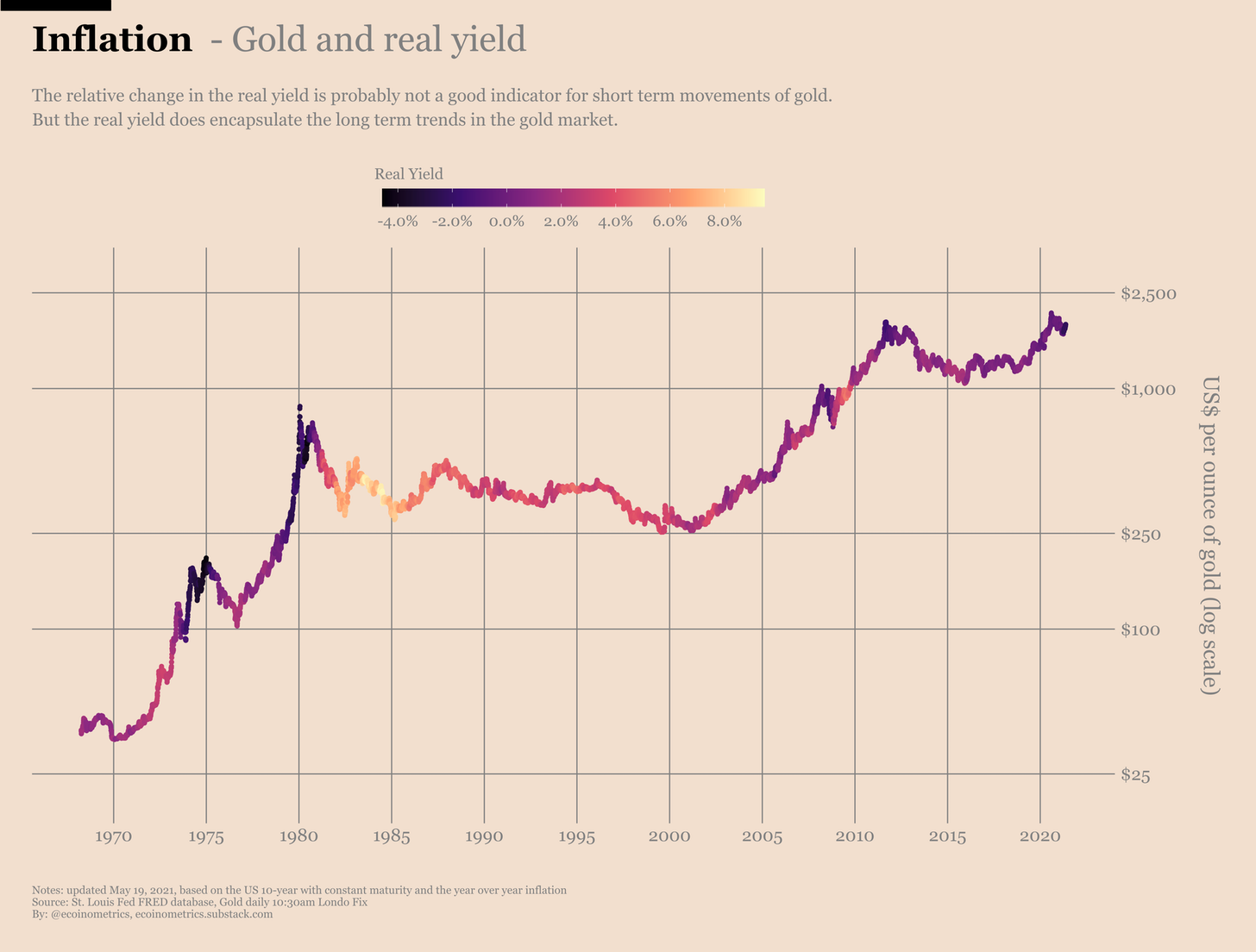

Now let's do this:

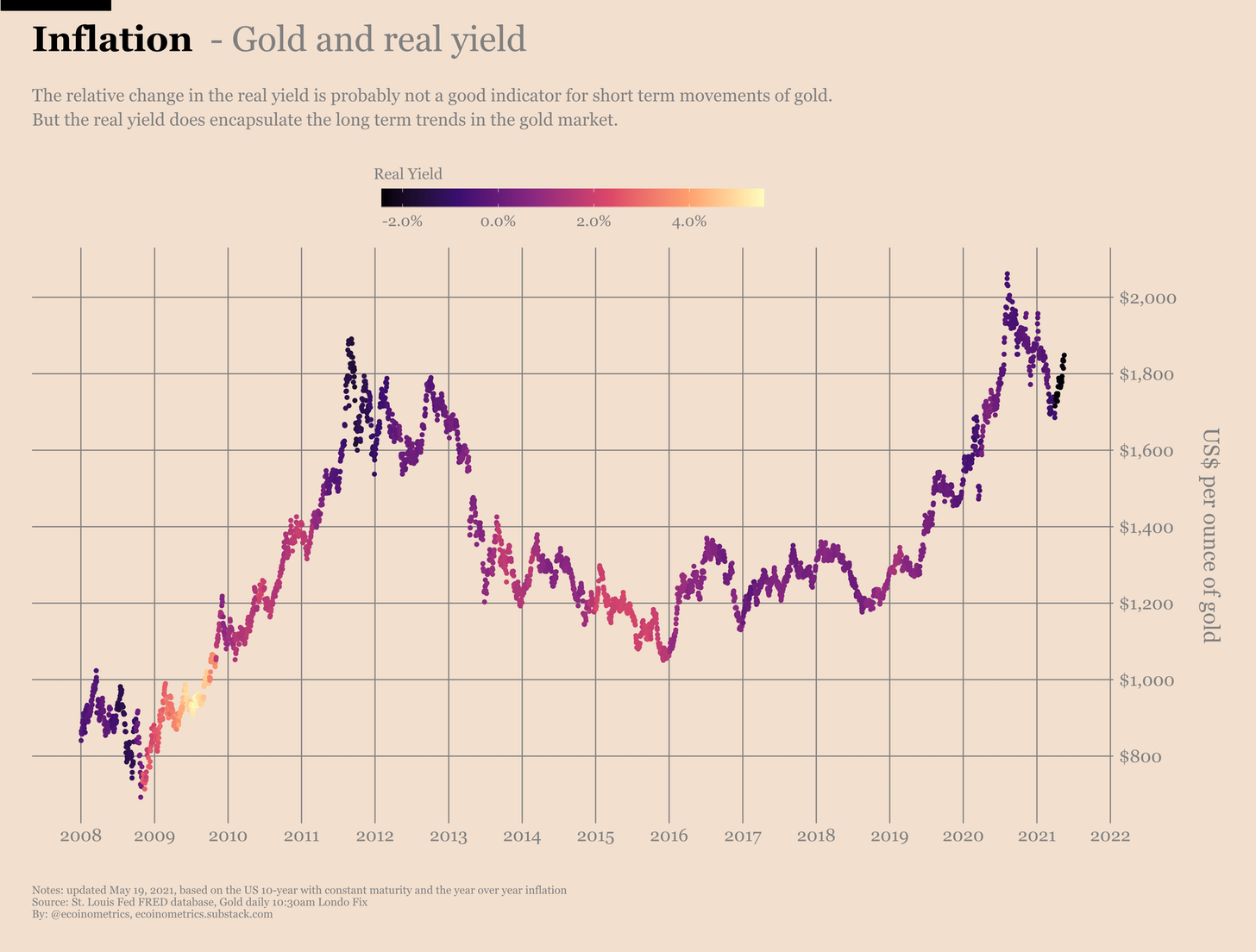

- Let's plot the price of gold from 1970 to the present (on a logarithmic scale).

- Each dot representing the price of gold is colored according to the actual return on that day.

- The lighter the color, the higher the real profitability. The darker the color, the lower the real profitability.

This is what we get as a result:

Gold rate and real bond yield

Observations:

- Relative changes in real yields seem to explain the long-term trends in the gold market fairly well.

- Usually, when the color of the curve changes from light to dark, the price of gold rises. Conversely, when the color of the curve changes from dark to light, the price of gold declines.

- But this is not an exact science.

- It definitely looks like investors are startingconsider buying gold only if the real return is below 2%. Relative changes above this level do not appear to have any long-term impact on the trend.

For a more detailed picture, below is the same graph from 2008 to present.

Gold rate and real bond yield

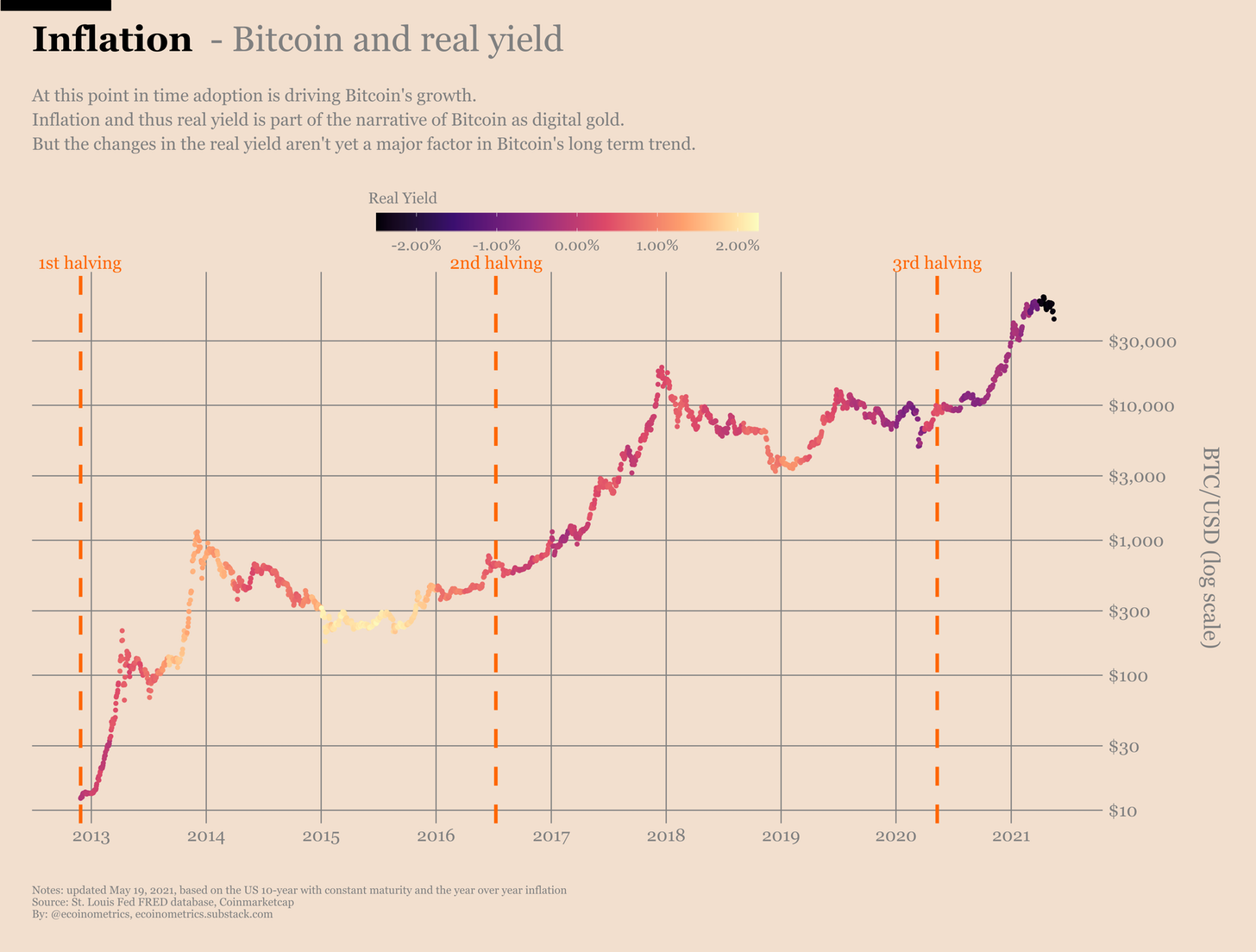

In the case of bitcoin, we don't (yet) have the luxurygo back in search of patterns 50 years ago. But as you might suspect, in the last three cycles, real returns have not had an impact on the bitcoin market. The increase in demand due to the adoption of bitcoin, coupled with the decrease in supply due to halvings, is the main driving force behind the big price trends.

See for yourself:

BTC rate and real bond yield

When Bitcoin gets bigger and its adoptionmore broadly among financial institutions, we are likely to see real returns play a more important role in Bitcoin's long-term trends. But we have not yet come to this phase of development.

As long as you can enjoy Bitcoin as an asset, don'thaving a strong long-term correlation with the gold and bond markets. For a time, its growth alone should be enough to keep up with inflation.

Correlation with 10-year US bond yields for BTC (top) and gold (bottom)

�

</p>