- The influx of investments into crypto funds has been going on for 15 weeks in a row

- Based on the results of the last week, thisthe figure was $ 306 million, according to CoinShares

- However, the size of assets under management of funds has decreased slightly due to price pressure

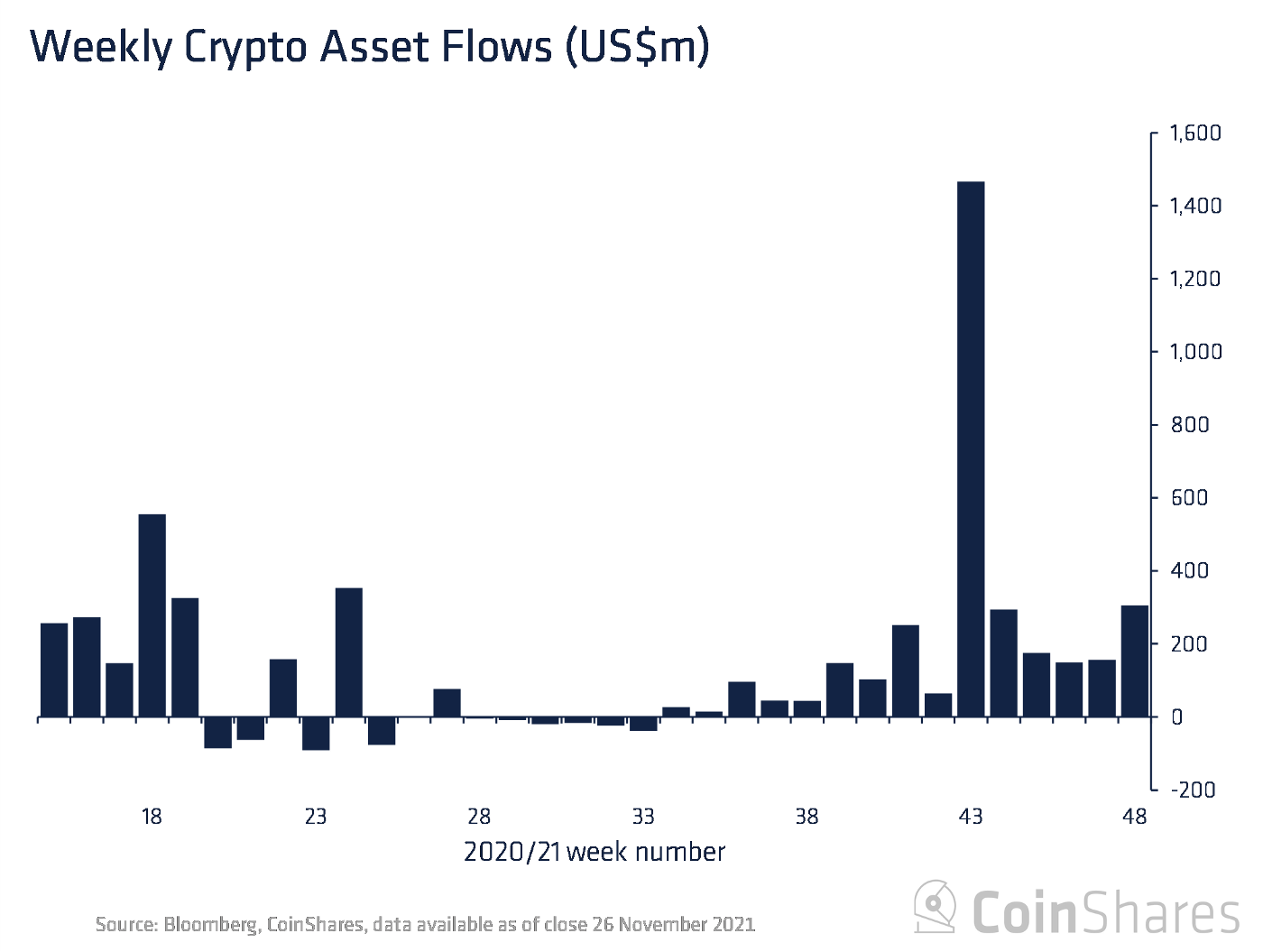

The inflow of new capital into crypto funds has remained in the green zone for 15 weeks in a row. At the end of the last week, it amounted to almost $306 million.

Investors believe in crypto funds

CoinShares, digital management companyassets, published a regular weekly report on cash flows in the digital asset market. According to data for the week of November 26, the influx of new capital into cryptocurrency investment products and crypto funds has continued for 15 consecutive weeks.

During the reporting week, this figure amounted to $305.6 million, significantly exceeding the result of the previous week of $154 million, as well as the two weeks preceding it.

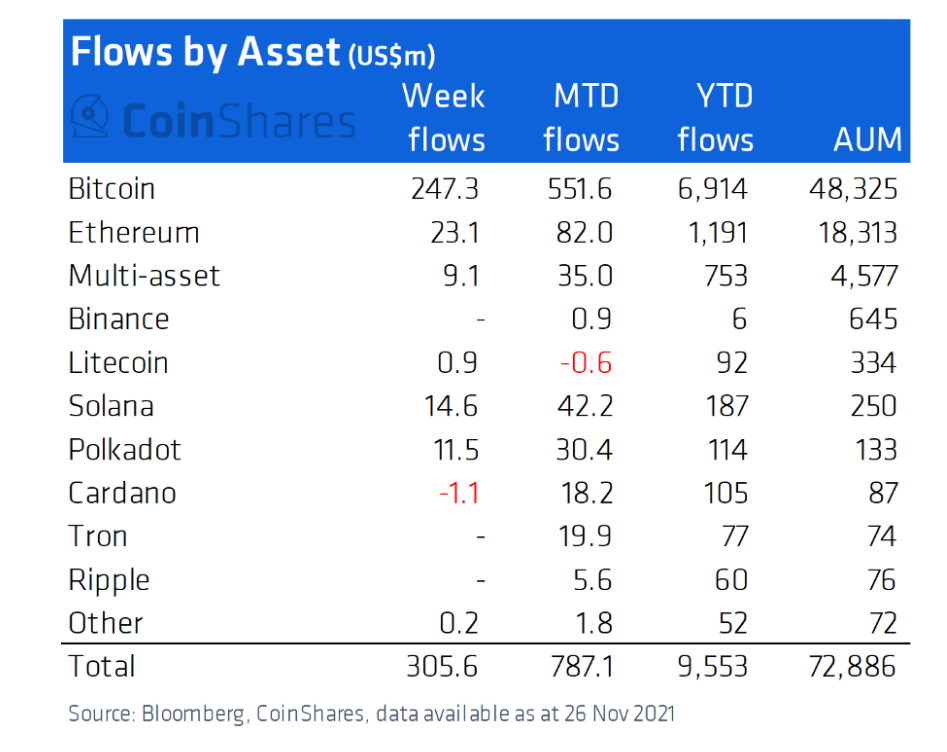

As a result, the total amount of capital inflow toCrypto funds since the beginning of the year are now a record $ 9.5 billion. However, the total size of assets under management of funds (AuM) dropped to $ 72.9 billion from $ 75.4 billion due to the current price pressure.

Bitcoin and Co.

Most of the funds last weekwas still traditionally directed towards Bitcoin. At the same time, the size of investments in this cryptocurrency turned out to be the maximum in five weeks and amounted to $247 million. This increase is explained by the launch of another investment product in Europe. The total capital inflow into BTC since the beginning of the year has amounted to $6.9 billion.

It is noteworthy that last week the stripThe net inflow of funds into Bitcoin products was not interrupted, even despite the beginning of a noticeable drawdown in the price of BTC. Analysts attribute this to the high popularity of such a financial instrument as the recently launched first ETFs for BTC futures.

Investment products based on the Ethereum blockchain took second place. The influx of funds into ETH has continued for 5 weeks in a row, and for the reporting week it amounted to $23 million.

Among other altcoins, popular altcoins such as Solana and Polkadot ($14.6 million and $11.5 million, respectively) continued to see capital inflows.

Where is it more profitable to buy cryptocurrency? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://okex.com | 6.5 |

| 5 | Bybit | https://bybit.com | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Additional features and services— futures, options, staking, NFT marketplace.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.