This article offers Politeia Digest editor and crypto enthusiast Richard Red's perspective onblockchain and cryptocurrency management. According to him, he was not particularly interested in the blockchain space until the summer of 2017, before the fork of Bitcoin Cash and its reasons attracted his attention. Let's find out what conclusions he made after a detailed immersion in aspects of the crypto space.

</p>I began to research and found interest inhow similar decentralized networks / projects / currencies make decisions about their development paths. On the one hand, these are (mostly) open source software projects, but on the other hand, the software is used to manage networks that contain hundreds of millions of dollars of value. Who decides when to change this software and the rules that it enforces, and how does this process work? If the expectation of a significant impact of blockchains on the world is true, then it will be important to understand the answers to these questions.

This publication is an attempt to recapwhat I learned so as to introduce newcomers to the current and recently intensified cryptocurrency management dispute. It tells instructive stories from the history of influential projects and examines the nascent variety of management approaches.

As I see it, there are two aspects of management:

- How does cryptocurrency ensure that users follow the rules?

- How are these rules defined?

I am more interested in the second aspect, but a detailed examination of it is impossible without understanding the first.

Cryptocurrencies in their essence are softwaresecurity. Each blockchain user must install software that is compatible with its rules. There are often predominant versions of this software that are used by the majority of participants. It is this software and the computers on which it runs that enforce the rules, so any change to the rules implies that participants are using a new version of the software. Such rules are calledconsensus, because for the functioning of the network everyone shouldto agree with them. There must be a consensus on the rules. This is a common property of all cryptocurrencies and blockchains. There are differences in how exactly the software enforces the rules and how users of the blockchain decide to use a new version of the software that changes the rules.

1. Bitcoin

Bitcoin is a good starting point, because it is an original and universally recognized cryptocurrency. Therefore, it is best known, best studied and most often discussed.

Bitcoin is complicated. You can write entire books about “how Bitcoin works” and why it is needed. It’s not so easy to even define “what is Bitcoin” (software, network, currency, social contract). Going further and figuring out “why Bitcoin is just like that” is an even more ambitious venture.

2. Enforcing Bitcoin Consensus Rules

Compliance with Bitcoin rules is ensured by miners inproof of work (PoW) models. Miners are people (using computers) who compete to find the answer to a complex and arbitrary problem. Miners prepare the block they want to broadcast by filling it with transactions waiting to be processed (in the memory pool). In order for this new block to be accepted, it must pass a specific test. Miners pass a combination of inputs through a hash function:previous block title, current labelof time, a Merkle tree representing the transactions they want to include in a new block, and an arbitrary value. For a new block to be accepted by the network, the hash issued by this function must begin with a certain number of zeros (determined by the current level of complexity). It’s impossible to find out if the hash is acceptable,if you don’t try to do this operation, then change an arbitrary value and try again. This is “work” in proof of completion. This process is often called hashing. The frequency with which a computer offers options depends on how quickly it can calculate the hash function, its computing power.

The difficulty of the task is adjusted every two weeks.so that the more miners offer options, the more difficult it is to find a solution. This adjustment is designed so that the average time between blocks remains at about 10 minutes. Nevertheless, we are talking about random guessing, so the actual interval between the blocks varies.

New blocks are tracked by full network nodes. Full nodes run software running the full Bitcoin blockchain(history of all completed transactions). This makes Bitcoin decentralized.the registry. By storing and processing this blockchain, complete nodes know which bitcoins can be spent by which private keys (and what is the origin of these bitcoins).

Full nodes check new blocks for compliance with the rules, in particular:

- The hash of a block must meet the complexity criteria, and when decoded using the same hash function, its contents must meet the specifications of a Bitcoin block. This amounts toevidence that the miner completed the required work.

- Each transaction must be signed with the private key of the wallet from which it was sent(which ensures that only the owner of the private key can spend bitcoins).

- Wallets conducting transactions must have enough Bitcoin to support those transactions(which guarantees the impossibility of "double spending" bitcoins).

If the new block is valid, the nodes add itinto their version of the blockchain and broadcast this version. The contents of this block determine the possible solutions for broadcasting the next block. One of the required hash function inputs has changed, so the guessing process starts anew.

Each new block allows you to claim a certain number of new bitcoins -block reward. To receive a reward, miners includeinto a block transaction sending it to a wallet controlled by them. Miners also receive a commission from transactions that they include in the block (and therefore they are motivated to include transactions that offer the highest commissions).

The fact that anyone can find a solution to broadcast the next block is another reason why Bitcoin is called decentralized.

Now Bitcoin is participating in miningexclusively ASIC miners. These are specialized computer microcircuits whose sole purpose is to offer solution options by performing the Bitcoin hash function. They are designed to do this as efficiently as possible. In principle, you can mine bitcoins using any computer, and in the past they did. Faster processors are better because they can produce more options per second or per watt of electricity; graphics cards are even better. Now compete effectively with ASIC. Although I can mine a block using my CPU, it’s very unlikely that I will find a solution faster than one of the many ASICs that I compete with, and I still need to pay for the electricity consumed by the CPU, so there is a chance that I will incur losses .

If you take the next step, now Bitcoinsthere are so many ASICs mined that even if I have one ASIC, I may never find a valid block, or it can take years. Therefore, most miners participate in pools, where all participants send their proof of work, and if one of them finds a valid solution, a new block is formed on behalf of the pool, and the reward is distributed among the participants in proportion to their contribution to finding a solution in the form of work. Pools make Bitcoin mining not so decentralized, because in fact, a limited number of pools produce new blocks. However, a miner can move from one pool to another relatively easily and at low cost. If the miners do not agree with the actions of the pool operator, they can easily transfer their computing power to another pool.

Miners are stakeholders since they invested inequipment and pay for the electricity consumed by this equipment in search of new units. Blocks broadcast by the miner must follow the rules of the software of Bitcoin nodes, otherwise these nodes will not accept blocks in the blockchain. Only when the nodes collectively accept my version of block 1234567, saying that the reward is sent to my wallet X, I receive a reward for my work. Miners must adhere to the same rules as nodes in order to be part of the same network and the same blockchain.

Understanding how cryptocurrencies work is not about knowing the rules. Another key to understanding network behavior isincentives. There is no rule that says howthe miner must choose the transactions to be included in the new block, or that the miner should include any transactions at all. Miners sometimes mine empty blocks. A miner (or, more realistically, a miner pool) may decide not to include certain transactions. If desired, he can blacklist a specific address.

Miners usually include transactions with the mosthigh commission because it motivates them. This maximizes their profits. If Miner A prefers the wallets of his friends and allows them to conduct transactions with a low commission, and Miner B prefers transactions with a higher commission, then over time Miner B will earn more rewards that he can reinvest in order to increase his mining power faster than Miner BUT.

Miners also have broader motivations,to monitor the health of the network. If all miners start mining empty blocks, then Bitcoin will be paralyzed and lose its usefulness. Without utility, it will have no value, which will hurt miners because the rewards they earn will not be worth anything. The expensive ASICs they use will not be able to generate income since they have no use other than mining Bitcoin. Bitcoin's value proposition—the ability to transfer value in a reliable and censorship-resistant manner—relies not only on miners following rules, but also ontheir actions are consistent with their incentives.

By the way, that’s why decentralization is suchan important topic among blockchain enthusiasts. The system is based on the assumption that since I can offer a fee for including my transaction in the blockchain, I can be sure that I can conduct this transaction. I can conduct any transaction permitted by the rules if I offer a sufficient commission. If all new blocks mine eight pools, this will introduce a certain degree of centralization. If all these pools decide (or someone convinces them of this) not to include transactions from my address, then my bitcoins will become useless.

3. Establishing Bitcoin Rules

Bitcoin, like most other cryptocurrencies,uses open source software. The whole point of cryptocurrency is the lack of the need to trust individual participants and the ability to rely on cryptographic truth and following rules and incentives. Closed-source software is incompatible with this ideal, since it requires trust in its (closed) code. Open source software means the ability to check it and learn in detail what it will do after launch. In practice, most of us trust in certain sources that provide us with software that behaves the way they describe, because we lack the qualifications or dispositions to test it ourselves. The basis of this trust is the fact that people can and do audit such software and have channels to report any problems found.

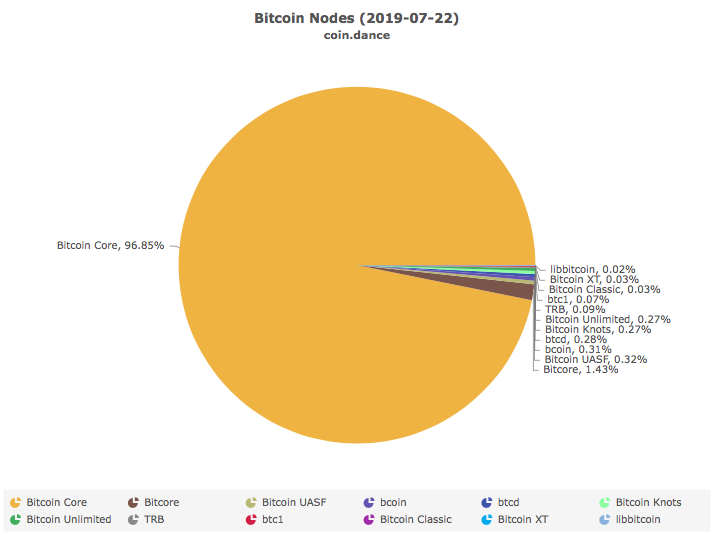

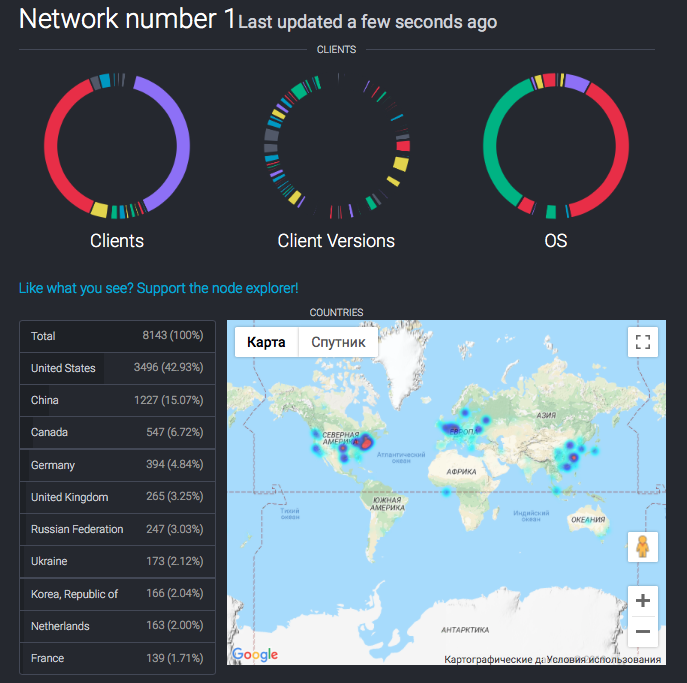

Bitcoin Core is the software used by mostfull nodes of the Bitcoin network: it is now installed on 93.6% of the 10,923 full nodes of Bitcoin. Bitcoin Core is the original full node of Bitcoin, and for almost two years after Bitcoin's launch it was the only full node implementation. There are now alternative Bitcoin full node implementations that follow the same consensus rules and are therefore compatible and can run on the same network/blockchain.

: Coin.dance

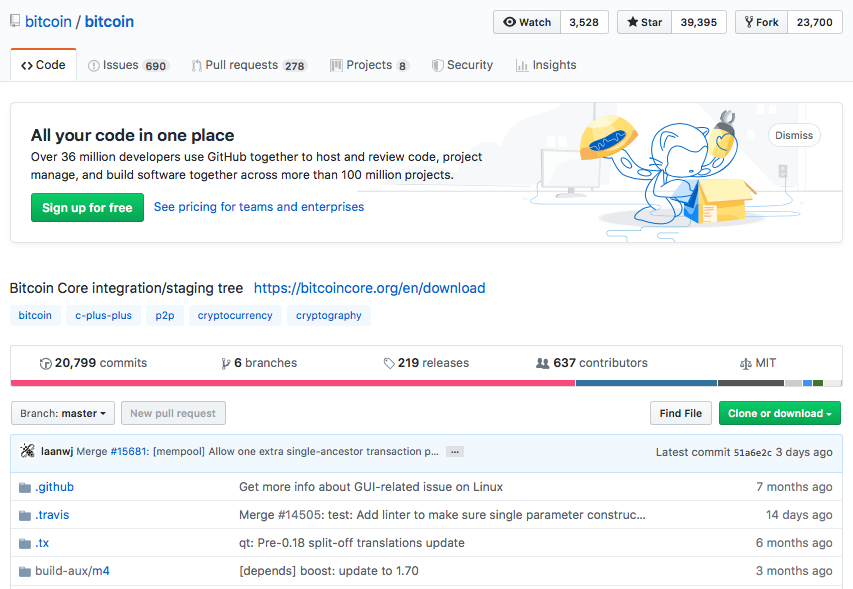

Open source enables widespread participation insoftware development. Anyone can copy (clone) the software, fix bugs or add new options. If I clone Bitcoin Core and fix a bug or improve something, I can doinclusion request, suggesting that the changes I made be included inmain version of Bitcoin Core. Anyone can do this. Currently, the Bitcoin Core repository on GitHub lists 637 contributors who have made some kind of contribution to the software. I can also clone Bitcoin Core (or any full node software) and make changes without intending to include those changes in the original version. It is calledfork.

: Github

Since full node software enforces Bitcoin's rules, changing those rules is possible by changing the software.When deciding to include changes affecting consensus rules in the new release of the full Bitcoin nodes software, the requirements are very high.

The right to approve changes to the Bitcoin repositoryOnly certain people have a Core. I did not find a particularly good source, but this comment on Reddit says that only two people have access to commits, and this post on Bitcointalk two years ago speaks of four people / accounts, and in the history of Bitcoin Core there were twelve access to commits accounts. The fact that only a limited number of people have the technical right to accept changes in the main branch is true in the case of all software projects. The scope of these decision-making powers of these people depends on the social project management method. I did not find any documents on the decision-making process for Bitcoin Core, but this comment (potentially biased) on Reddit describes the voting of Bitcoin Core contributors for or against, after which the maintainers interpret further actions on this basis, which seems to be satisfactory.

Bitcoin Core release(or any software of a full cryptocurrency site)changing consensus rules differs from most software projects in the importance of obtaining prior approval from stakeholders.

4. Soft forks, hard forks, blockchain splits and free coins!

Both soft forks and hard forks imply changes to Bitcoin's consensus rules.

Soft forkintroduces a new rule or makes the rules morelimiting. In the case of Bitcoin, the key decision makers for a soft fork are the miners. If the majority of miners agree to a soft fork, then it will be implemented, because it is the miners who decide how new blocks are built. Soft forks are, in a sense, backwards compatible. Full nodes that do not update will recognize the new blocks as valid because the blocks still follow the old rules verified by the nodes. However, a full node that has not updated may misinterpret some transactions that use the new rules.

Hard forkeliminates or relaxes consensus rules.Once the hard fork is activated and miners start producing blocks according to these relaxed rules, nodes that have not updated to the new rules will reject these new blocks. This may causeblockchain splitif some miners and nodes continue to use the old software, while others switch to the new one.

Examples of forks:Bitcoin originally had no size limitblock. The 1MB limit was added in September 2010. It was a soft fork because it added a new rule. The nodes that did not update continued to follow the correct blockchain because the block size did not matter to them. The minority miners who did not want this limit were forced to upgrade to software that followed the new rules, as their mined blocks larger than 1 MB were rejected by nodes and miners who adhered to the new rules. This change was introduced via a soft fork, but cannot be undone without a hard fork - this is true for all soft forks implemented.

Bitcoin hadthree blockchain splits. The first one happened in 2010., when a transaction that spent 184.5 billion bitcoins was included in the block, there was a bug in the software rules that allowed huge transactions to be accepted. The bug was fixed with a soft fork that added a clear rule that a transaction cannot spend more than 21 million bitcoins (the maximum supply). It took 5 hours to release the patch, and the “bad blockchain” managed to mine 51 blocks before the good blockchain (with the bug fixed) beat it in PoW. This leads to an interesting point. In the event of a Bitcoin blockchain split, the accepted method for determining which blockchain "is the real Bitcoin" is to look at the length of the PoW chain - the blockchain with the most accumulated work“There is real Bitcoin”.

Orphaned blocks are found periodically,because it takes time to spread the news about the new block over the network, and the hash of the last block determines the decision of the next block. If Miner A and Miner B broadcast a new block at the same time and half of the nodes first see block A and the other half see block B, then until the next block is found there will be two competing blockchains (branches). If the next block finds a miner using block B, then block B will be a good blockchain, and block A an orphaned one, since the nodes will consider branch B to be “real Bitcoin”, since it has a longer PoW chain.

This is why sellers often wait for two or moreconfirmations before accepting payment. The number of confirmations means that after the block containing the transaction, X further blocks were added. The last block can always be orphaned(i.e. do not become part of the Bitcoin blockchain), but if several blocks were added after it, its transactions become an immutable part of the Bitcoin registry.

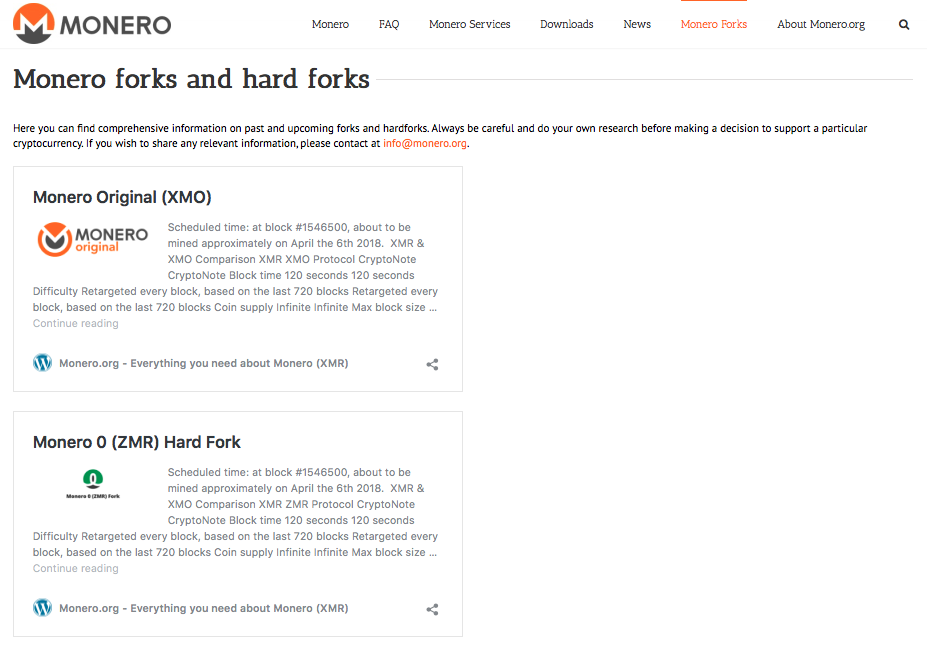

Some hard forks are thought of as updates.If there is consensus thata rule change will be favorable, users coordinate to implement this change at a certain block height. Since it is important that everyone adopts the new rules at the same time, a version of the software is usually released containing both sets of rules, with logic that says:“Use rules before block X, and use others after block X”. Monero has hard forks that were not intended forBlockchain splits occur approximately every six months. They are announced well in advance so that node operators have time to download software that follows the new rules. Bitcoin hard fork Segwit2X was intended as an upgrade(increase the maximum block size to 2 MB). It did not take place due to the perceived lack of stakeholder support. More on this later.

Some hard forks are thought to split the blockchain.A well-known example is Bitcoin Cash (BCH), andAfter it, several more similar Bitcoin hard forks occurred. Monero also had a hard fork intended to split the blockchain (MoneroV). Such hard forks happen when some cryptocurrency users decide to change the rules, realizing that not everyone will switch to the new rules. They are also usually announced in advance. People using the new software know that after a certain block they will move to another blockchain with its own consensus rules.

: https://monero.org/forks/

Some see blockchain split as a proposalfree coins. Bitcoin Cash mined its first block as a block478559 after Bitcoin block 478558. If you had 1 BTC at block 478558, then at block 478559 you still had it, but your private key also worked on the BCH blockchain and therefore you also had 1 BCH, because before that At this point, both blockchains are identical. This can be seen as getting 1 BCH for free, but it can also be argued that your 1 BTC has split, just like the blockchain, because most of the resources that gave BTC its value(buyers, miners, those who accept payments by them)are now split between BTC and BCH.

5. How is Bitcoin evolving?

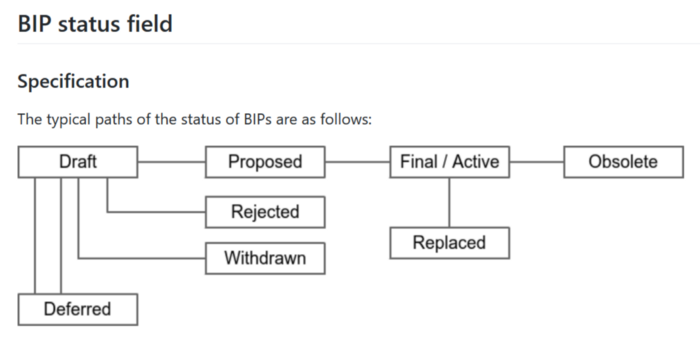

There is no simple answer to this question, but since August2011 there is a clear procedure: Bitcoin Improvement Proposals (BIP). BIP has its own repository on GitHub. The procedure for handling BIPs was set out in the original BIP-001, but this has been superseded by BIP-002. Below I will outline my understanding of the procedure described in BIP-002.

: Github

Each BIP must have an author / advocate who will oversee it.

- You should submit an idea through the Bitcoin developers mailing list.

- If the mailing list subscribers make it clear that they are ready to consider, you should send the draft BIP in the same way.

- If there is no objection, BIP should be uploaded to the appropriate repository on GitHub as a request for inclusion. BIP must follow a specific format.

- The BIP editor (someone Luke Dashjr) will review it, and if it meets certain minimum criteria, it will be accepted and will receive a number and category.

- The BIP editor decides whether to assign status"proposed" or "final/active", while the BIP author can change the status to "suspended" or "withdrawn". To move from draft status to proposed status, the BIP must disclose all details and provide an implementation model. This is important: the author/developer must put in the effort to implement their idea into usable code before the BIP can move forward.

- BIP-002 also defines the method of obtainingcomments on BIP through a public wiki space where anyone can participate, but where “participants should voluntarily refrain from commenting beyond their area of expertise or qualifications. However, comments should not be censored, and participation should be open to the public. ”

“BIP soft fork strictly requires an explicit majority of miners, expressed by voting on the blockchain (for example, using BIP 9).”

Miners can use the “version” field inblock header to signal support for the proposed soft fork. Voting lasts for a certain period, and you can find out about the support by the miners of the change (measured by their computing power) by looking at the number of blocks signaling support.

Most Bitcoin miners(i.e. miners controlling most of the processing power)may accept a soft fork(add new rules). This is because miners create blocks. If most miners decide that the new block size limit is 50 KB, and other nodes will still recognize large blocks as valid, then most of the computing power following the same set of more restrictive rules will produce the longest PoW chain. These miners will not recognize blocks that do not follow the new rules.

In the case of BIP consensus rules changeHard fork is becoming more and more difficult, since the status of “definitively / actively” is assigned only when “the entire economy of Bitcoin” is adopted. BIP-002 states the following:

BIP hard fork requires adoption by the entire economyBitcoins, including those who sell demanded goods and services in exchange for payments in bitcoins, as well as bitcoin holders who, in the case of a hard fork, may want to spend their bitcoins (including selling for other currencies) differently. Acceptance should be expressed through the actual use of hard fork in practice (rather than simply expressing public support, although this is a good step to reaching agreement before accepting BIP) ...

... Miners are not included in the economy, since they are justonly rely on others to sell / spend their otherwise useless mining product. Therefore, they must accept the directions of everyone else when deciding on consensus rules.

Exchanges are not included in the economy, since they are justonly provide services, linking sellers and users who want to trade. Even if all exchanges refuse Bitcoin, these sellers and users can always trade directly and / or create their own exchanges.

Developers are not included in the economy, since they just write code, and others decide to use this code or not ...

This BIP does not seek to determinethat “should” be the basis for decisions. Such a statement, no matter how ideally justified, would be useless without ways to force others to stick to it. The BIP procedure is not intended to serve as a compulsory “management” of Bitcoin, but merely provides a collective repository to offer and provide information on standards that people can voluntarily adopt or not. One can only hope for accuracy with respect to the “status” field, trying to reflect the reality of what it really is, and not what it * should * be.

The BIP procedure says very little about how a BIP requiring a hard fork must receive approval from the "entire Bitcoin economy"(defined as merchants accepting payments by bitcoins and holders), but only defines this criterion for changing the status of BIP in the repository on GitHub.

I understand the logic - participants in the Bitcoin economycan freely choose which software to use and what consensus rules this software should follow. But how to get Bitcoin's entire economy to accept changes to consensus rules requiring hard fork? This seems complicated given that the entire Bitcoin economy must accept a hard fork at the same time to avoid a split in the blockchain. It is perhaps not surprising that not one of the BIP hard forks mentioned has reached the status of “active”.

From my point of view of an external observer, the bestThe chance to achieve adoption of changes to the Bitcoin consensus rules requiring hard fork seems to be the introduction of these changes in the new version of Bitcoin Core, software used by 96.5% of complete nodes. I also believe that most sellers who are in the hands of the final solution according to BIP-002 are not too worried about changes in Bitcoin rules that do not directly affect them, given that they simply immediately convert the received bitcoins into a more stable currency.

BIP-002 lists a number of stakeholders and explains why they are not part of the “economy” and therefore do not decide to adopt the BIP:miners, exchanges and developers. It seems to me that everything is just the opposite, because, based on my observations, it is these three groups of participantshave the power to decidehow Bitcoin will evolve.

My observations are mainly based on hard forks.Bitcoin Cash and Segwit2X. I will talk about them here to explain why I believe that these stakeholders have influence. As a small user / holder of bitcoins, I basically end up in a group that must decide whether the hard fork is “real Bitcoin”. But I did not feel it at all; in fact, when all this unfolded, it was difficult for me to understand what was happening.

Developershave an impact because any changesconsensus rules must be displayed in code. In particular, Bitcoin Core developers have a lot of influence, as this software uses 96.5% of full nodes. I would also venture to guess that many of the operators of these nodes trust new versions of Bitcoin Core without checking the code personally - and this trust may well extend to a new version that changes the consensus rules. I don't know how the Bitcoin Core developers make decisions, but they meet every week on IRC and post logs. This is really great, I fully support transparency, but I don't have time to keep track of all these meetings and it takes specialized knowledge to understand anything about it.

Minershave influence because any version of Bitcoin,changing the consensus rules needs miners, otherwise it will literally go nowhere. The rules for determining “which blockchain is the real Bitcoin,” since they exist in a form other than social consensus, also point to the blockchain with the most proof of work (i.e. hashing power).

Miners decide what to include in each block, andif most of the computing power agrees with the new rule, then it can be adopted as a soft fork. BIP-0016 was passed with 55% computing capacity approval. Miners who did not update along with the majority simply created invalid blocks over the following months.

The only influence the rest of the Bitcoin economy has to counter the majority of miners comes down to the ability to veto miners, and changes to the PoW algorithm(i.e., all of their ASICs will no longer be able to mine bitcoins).This will require a huge degree of coordination among other stakeholders who will need to reach collective agreement and convince the world that what Bitcoin has always been(blockchain launched by Satoshi with the longest PoA chain based on SHA-256)is no longer it. The Bitcoin Gold fork changed the PoW hash function, but I don’t think it really claimed to be “real Bitcoin”, and the fact that its initiators opened a two-week window to mine 100,000 coins on their own did not play in their favor .

Bitcoin Cash was a hard fork of Bitcoin becausehe relaxed the rules by increasing the block size limit from 1 MB to 8 MB. This was argued by the fact that 1 MB is too small with such an active use, which was observed in Bitcoin, because of which people had to pay too high a commission that did not allow Bitcoin to function as a currency. There is a whole discussion, apparently unfolding for more than one year, about whether Bitcoin should be scaled “on-chain” (through large blocks) or using “second-level” solutions - I do not touch on this.

In addition to increasing the block size limit, the rulesBitcoin Cash added a disclaimer stating that if new blocks arrive insufficiently fast, complexity should decrease sharply. An adjustment of this kind was necessary in order to maintain the functioning of the BCH in case most miners do not switch to mining it instead of BTC. Bitcoin Cash did not change the PoW hash function, so Bitcoin ASIC operators could choose which blockchain to mine in.

This "Emergency Difficulty Adjustment" (EDA)had interesting consequences. When the complexity of BCH fell after EDA, mining it became more profitable, as finding new blocks and getting rewards was easier (although the cost of each BCH unit was lower). Bitcoin miners acted predictably - they followed incentives (profitability). When BCH complexity was low, some miners switched to mining this blockchain. When she corrected up again, they switched back to BTC. So both blockchains developed, but inconsistently. When the complexity of BCH was high, most miners were not interested and it could take 100 minutes to find a new block. When the difficulty sharply corrected down, it attracted a lot more miners and the blocks were kept every few minutes until the complexity was again corrected up and these miners returned to BTC. This also affected the search time for the BTC block, but to a lesser extent, since the cost of BTC was higher and therefore most miners stayed with it, even when the complexity of the BCH became low.

The interval between the blocks of Bitcoin Cash from August 2017 to January 2018.: bitinfocharts

In a sense, it was good, becauseconfirmed that the behavior of miners, key Bitcoin participants, can be predicted (controlled?) using economic incentives - I recall that for Bitcoin this should be true. From the user's point of view, this was bad, as it became more difficult to predict how long it would take to wait for the transaction to complete. This dynamics became quite piquant in early November 2017, when the price of Bitcoin Cash grew rapidly, and the price of Bitcoin fell. This behavior of the price was accompanied by a jump in the number of small transactions in the Bitcoin blockchain, which caused the fees to increase sharply. Some described it as a civil war, and there were rumors of a conspiracy to overthrow Bitcoin. They even speculated that Bitcoin could wait for a deadly peak, as people sell bitcoins because they can’t conduct transactions, which pushes the price down, which, in turn, decreases attractiveness for miners and slows down the creation of new blocks, which provokes a loop feedback that can lower the price so much that the remaining computing power will not be enough to find new blocks.

Bitcoin Cash went through another hard fork on November 14, 2017 (for the purpose of an update) to make the difficulty adjustment smoother, resulting in normalized block search times.

Exchangesimportant as public spaces because theyare sites where the price of cryptocurrency is determined, and they also have direct influence. In the Bitcoin Cash example, the exchanges had influence in the sense that they decided that Bitcoin Cash was not Bitcoin (BTC). However, many major exchanges have decided to support Bitcoin Cash and trade it as BCH. Some have chosen to recognize that those who held BTC at block 478558 also became owners of a similar amount of BCH. Exchanges were not required to do this. When bitcoins are stored on an exchange, the exchange owns the private keys that allow them to be spent. I doubt that the exchanges stipulated that clients would become owners of coins on new blockchains that split off from those whose coins are in their accounts.

Many exchanges have also opened markets for trading.BCH, which contributed to its legitimacy. The relative price of BTC and BCH is important, as it dictates what holders of these coins can buy, influencing the behavior of miners - and this price was determined on exchanges.

The exchanges were probably even more influential in relation to the Segwit2x fork, which never happened.

Segwit2x Prerequisites:May 23, 2017, after a meeting of certain Bitcoin stakeholders at a conference, a statement was published (the New York Agreement). Conference attendees were said to have agreed on how Bitcoin should scale: a soft fork to implement Segregated Witness, and then a hard fork within six months to double the block size limit from 1 MB to 2 MB. The agreement allegedly had the support of major players, including miners who controlled 83.28% of Bitcoin's hashing power, and a number of companies that together accounted for a significant share of the "Bitcoin economy" - such as BitPay, a payments processor that helps merchants receive bitcoins in exchange for goods and services.

The agreement turned out to be controversial (more aboutthis - further). Exchanges played a role here, as when it “became clear” that the Segwit2x fork was controversial, they began declaring that they would support trading of coins on both the Segwit2x blockchain and the original BTC blockchain. This in itself is remarkable, since the Segwit2x hard fork was intended to be an upgrade. If exchanges are planning to support trading of two coins, then this clearly indicates that they do not expect the update to go smoothly, but expect a blockchain split. Additionally, the tickers they assigned to these blockchains largely gave primacy to the original BTC blockchain(example: BTC and B2X). Perhaps no less remarkable, someexchanges began to offer trading in "Segwit2x futures", allowing speculation on the value of Segwit2x relative to the original BTC. The message from the participants in these markets was that they expect the Segwit2x to cost significantly less than the original BTC.

6. Assessment of the mood of the “Bitcoin economy”

How did it become clear that the Segwit2x update was inconsistent, or how did the Segwit2x inconsistency appear?

I won't go into details about thisinconsistency, but I can give my opinion as an outside observer, and since I was not an interested person at that time, I think my point of view is quite unbiased. In the absence of a generally accepted method of obtaining“Bitcoin's economic endorsement”hard fork, a reasonable starting point for meit seems a meeting of a large number of major players in this economy to reach an agreement. However, transparent and open decision-making also seems to be an important part of Bitcoin's governance philosophy. An in-person meeting that was not recorded or minuted in any way, and to which millions of participants in the Bitcoin economy were not invited, is not consistent with this philosophy. When the outcome of such a meeting is summed up in two paragraphs explaining that “this is how Bitcoin will be as we decide,” it is not surprising that many of those who were not invited to the meeting feel ignored.

This raises a number of interesting questions,for example: how to involve “the entire economy of Bitcoin” in the decision-making process on changing the rules? It seems that this process is expected to be transparent and inclusive, but how to effectively include such a large number of people into the process?

An estimated 2.9 million to 5.8 million people holdone or another cryptocurrency. To be conservative and for the sake of simplicity, let's say that 1 million people hold bitcoins. As already mentioned, many of these people are probably not worried about changing consensus rules, but even if 10% of the holders do not care, there are 100 thousand people who want to participate or at least feel involved.

Thanks to the internet and social networks, all these people canspeak out, and some part can even be heard. Anyone can join Bitcointalk and write messages there, but who has the time to read 50 page topics? Many crypto enthusiasts are registered on Twitter, but there the ability to be heard depends on the popularity and number of subscribers (as well as the whims of social network administrators). Reddit offers a scalable solution, because support for points of view can be expressed by voting - although in fact the “yes” votes should be used for posts and comments that make a constructive contribution to the discussion.

The problem is that all these publicspaces are vulnerable to: 1) censorship; and 2) abuse / distortion / cheating. Moderators can delete posts and comments. / R / Bitcoin even has a rule that states:

"Campaigning for client software trying to change Bitcoin's protocol without overwhelming consensus is prohibited."

BIP cannot be considered offered without a workingimplementations, and the largest subreddit dedicated to Bitcoin does not allow discussing client software trying to change the protocol without overwhelming consensus. Thus, / r / Bitcoin can hardly be considered a public space for the Bitcoin community to reach consensus.

Participants with resources(time to create and promote puppet accounts, money to pay people), may create the appearance of dot supportthere is more vision in the community than it really is. All this happens in an opaque and difficult to measure way; we only occasionally see indicators that something is wrong.

If you go back to Segwit2x, users/ r / Bitcoin seemed to be opposed, and many categorically. This protest, apparently, was based not so much on a direct change in the block size limit from 1 to 2 MB, but on the lack of ownership. People objected to what was perceived as a backstage arrangement that tried to dictate Bitcoin's future to them. However, there were accusations of / r / Bitcoin in censorship, which excludes certain points of view.

Reddit is also vulnerable to manipulation(Apparently, all parties acknowledge that the other side is capable of this). So what weight should be given to moods,expressed in reddit? Were the moods against Segwit2x in social networks the reason for its cancellation? Did Segwit2x futures play a role in this? These futures markets had very low volume and were therefore also vulnerable to manipulation. The only ones who know why the Segwit2x fork was actually canceled are the six who signed the cancellation email.

7. Characteristics of Bitcoin management

Bitcoin management is characterized by inertia andconfusion. Inertia is associated with a high barrier to accepting changes to consensus rules. Bitcoin’s entire economy must accept software that implements the new rules — and there is no generally accepted procedure for defining this new consensus until the magical moment when everyone begins to follow the new rules.

The lack of a generally accepted procedure also causesconfusion, since no one knows what to expect. Miners can signal what they want on the blockchain, development groups also have channels that allow them to be heard - but when it comes to users, there remains a cacophony of unreliable signals in various social networks and speculation about the relative price of the new blockchain, if indeed there will be a split. Users do not have a generally accepted and effective way to signal their wishes, which limits their ability to coordinate and reduces their influence.

8. How can a Bitcoin hard fork happen?

I see three scenarios:

- Bitcoin will never change consensus rules to trigger a hard fork. Bitcoin in a sense is constrained by breadth andthe variety of its user base and the fact that there is no established method for evaluating whether an attempt at a collective hard fork will succeed or cause a split in the blockchain. Perhaps this is as it should be, and inertia means strength. To some extent, this is because the ease of changing consensus rules would be dangerous for Bitcoin. The complexity of changing the rules is good, but I don’t see how Bitcoin can become a global digital currency in the future if it is impossible to change the rules. For example, even if the Lightning network expects great success, mass use still implies a large number of on-chain transactions for opening and closing channels, which will be costly without at least a moderate increase in block size. If we admit that rule changes will be necessary, then we return to the mechanism of giving these changes importance.

- Bitcoin Core developers will release a new version leading to hard fork. It seems to me quite possible, and thisBitcoin's most likely hard fork without chaos. Inertia plays into the hands of Bitcoin Core: 96.5% of complete nodes already use this software and trust it, and some part of these nodes - I think it's big enough - will stick to the Bitcoin Core hard fork. Of course, there are no guarantees; Bitcoin Core developers do not have the power to force a hard fork, but it seems to me that their chances of achieving this are highest.

- Another Bitcoin development team will do a hard fork, and its full node implementation will become dominant, possibly after a blockchain split. Bitcoin Cash could and still could potentially achieve this(although I believe that in the early days, while the blockchains had not yet dispersed too much, this was more likely). Segwit2x had no developer supportBitcoin Core; if the initiative had been implemented, it would have been an alternative full node implementation. It's worth noting that Bitcoin Core played an active role in the Segwit2x story by issuing a warning that stated:“This hard fork is not supported by mostBitcoin users and developers, and therefore is competing. Accepting this hard fork means switching to an alternative currency (altcoin) that is incompatible with Bitcoin. ”. In this warning, Bitcoin Core speaks on behalf of Bitcoin users, advising to beware of those who support the fork.

9. A look at the management of Bitcoin from a frog perspective

“The frog perspective is a bottom view, as ifthe observer would be a frog. The opposite is a bird's-eye view. In such a perspective, the object looks tall, strong and powerful, while the observer feels like a child or powerless. ” - Wikipedia

From a Bitcoin user's perspective, I can say without hesitation thatBitcoin management is inefficient. Confusion is just the tip of the iceberg, an iceberg of bile and hatred. Let's get back to the examples of Bitcoin Cash and Segwit2x for a short while.

The question is whether to increase the size limitThe Bitcoin block was the subject of controversy long before the big block supporters left the ship and launched the Bitcoin Cash fork. This fork not only divided users, the network effect and the computing power of Bitcoin - it spawned two communities, the most active participants of which spend a lot of time and effort hating another blockchain and its users. Perhaps calling it a civil war is an extreme, but sometimes such associations arise.

The proposed fork Segwit2x met with bitterness on / r / Bitcoin, and its opponents spoke out loud and unpleasant(including personal insults towards Segwit2x supporters), and some users ran to / r / btc, saying they were banned for expressing opinions in support of Segwit2x.

Bitcoin users have a nominalpower, but without an established channel for the application of this power, they turn into spectators / fans applauding and hooting from the stands. The assumed sovereignty and significance of these users is further aggravated, because other stakeholders, such as developers and miners, should listen to them. And that means that there is motivation to scream the loudest and be heard. In essence, the perception that a person, group, or community speaks on behalf of Bitcoin users is power.

With the rise in the value of Bitcoin and its economythere is more and more sense in investing resources in the manipulation of the Bitcoin community or its intended opinion. The public spaces where the Bitcoin community gathers (forums, Reddit, Twitter) are vulnerable to manipulation through censorship and Sibyl attacks.

I have already mentioned censorship, and in this postAnother possibility is that /r/ Bitcoin is being censored as part of a larger effort to manipulate the Bitcoin community. I don't take sides on the veracity of such accusations, but they are plausible and enough to cause damage. I see suspicions of manipulation all over the cryptocurrency subreddits(which is also true for other topics such as politics), sometimes with evidence.

Platforms like Reddit, Twitter and publicforums are vulnerable to Sybil attacks. If a social platform allows registration without identity verification, then it is vulnerable to a Sybil attack - the only question is whether a potential attacker can earn enough to invest resources(time / money to promote, steal, buy or bribe accounts)was justified.As the value and adoption of cryptocurrency increases, there is more at stake, more to gain from influencing public perception, and therefore a greater likelihood of serious manipulation on social media.

Bitcoin is now powerful enough toposed a serious problem. I don't see how you can get a signal from the Bitcoin user community that you can trust. If you can't trust the opinions of pseudonymous strangers expressed through likes or votes, then who can you trust? You can trust that the desires of Bitcoin miners are accurately communicated via on-chain signals because computing power cannot be counterfeited. You may also prefer to pay attention to certain entities that you trust and who have channels of communication(pages on social networks, accounts on GitHub, sites). If you are a user with no reputation inspace, your role in this discussion can be fabricated or marginalized in a cost-effective way by anyone with a personal interest and resources to pursue it.

Besides the problems associated with gauging user sentiment, I believe thatBitcoin community suffers from lack of dispute resolution process.

If I am a member of a group who wants to change the rulesBitcoin in one way or another, when should we abandon this venture? Should our BIP not have much support among developers? But the developers do not speak on behalf of all Bitcoin. Should miners signal a lack of support? Miners also do not speak on behalf of all Bitcoin. Should most people on the / r / Bitcoin and Bitcointalk forums criticize our plan? But these forums are vulnerable to manipulation. If we implement our own fork of Bitcoin and its token will be traded at 0.1, or 0.01, or 0.001 BTC, should we abandon the idea that our vision is real Bitcoin? The only thing that will immediately kill the fork (or any blockchain) is if the miners stop mining new blocks.

The role that users play in managementBitcoin, I don't like it. And this is normal, since no one forces me to participate. If I do not buy or hold coins and do not use Bitcoin, then this is unlikely to affect me somehow. This is because the scale of Bitcoin is still relatively small, but it will cease to be so if Bitcoin becomes the actual global currency of the Internet. With an eye to the future, it is worth considering the dynamics of management as the adoption and importance of the blockchain grows.

10. Blockchain management when scaling projects

images: bitnovosti.com

The new blockchain begins with software - for miningnew blocks and the functioning of complete nodes for blockchain validation. A person or organization creates this software with an initial set of consensus rules. It is also standard practice to publish a whitepaper or roadmap explaining how the blockchain should function or what it is intended for. The best practice is to announce the launch of a new cryptocurrency before the start of mining. The announcement before the launch is considered fair, as it gives those who are not involved in the project, the opportunity to participate in mining from the very beginning.

When software developers mine in their ownblockchain before its launch is announced, this is known as the premine. A similar concept is instamine, where block rewards are very high and this allows the original miners (most likely people on the project team) to mine a significant portion of the total supply. Projects with an initial coin offering (ICO) one way or another have a premine, since this is where the coins that are sold to ICO participants come from. In some projects, the premine is 100%, i.e. the entire available supply already exists at the time the project is launched (examples: Ripple and EOS). They can also be described as non-mining projects as they have an alternative method of distributing tokens to users. The development of blockchains with full or partial premine is fundamentally different from those where open mining occurs from the very beginning. This has implications for management in the early stages of a project, so I will consider these cases separately.

Bitcoin is a good example of cryptocurrency without a premine.On October 31, 2008, Satoshi Nakamoto sent a letter to the cryptography mailing list saying:

“I am working on a new e-cash system, completely peer-to-peer, without trusted third parties. The document is available at: http://www.bitcoin.org/bitcoin.pdf. ”

January 3, 2009 Satoshi was mined the Bitcoin genesis block, Bitcoin software was released on January 8, and full mining began on January 9. Blockchain and Bitcoin software started with a set of consensus rules, but at the start, Satoshi was the only participant. When others began to mine on the blockchain, it can be said that he had a network and these others adopted the consensus rules established by Satoshi.

For a long time after launch, Bitcoin did not haveany expressed value. It was only in October 2009 that the first Bitcoin exchange, New Liberty Standard, opened, offering a rate of 1309 BTC for $ 1, or about $ 0.008 for 1 BTC.

Asset Tracked by Distributed Registryblockchain has no value until someone wants to accept it in exchange for something else. At this stage, there is nothing to distinguish cryptocurrency project management from any other open source software project. Miners and developers are most likely the same people. While the value of the asset that is being mined is low, there is little reason to be particularly interested in the project for someone outside the development team. At this stage, project management can probably easily follow any open source project management model.

When a blockchain-monitored asset receivesgenerally accepted cost, management is complicated, as there are stakeholders who are not involved in the development. Miners can mine on the blockchain, because they perceive the economic benefits in this. Users buy and sell an asset because it is useful to them or they speculate on the growth of its value. The cost of the blockchain is tied to its network, and not to its software. With the growth of the value of the blockchain, the influence associated with managing its development also grows.

So there is a dynamics unfamiliar to projects withopen source and their management models. If there are unsolvable disagreements in the open source project team regarding further development, a fork is usually a good solution. Developers from the original group may have the advantage of recognizing the old name behind them, but the binding effect is very small, since the cost of the software is usually not based on network effects. Nobody lost on the fact that Ubuntu broke away from Debian - we all benefited from a larger selection of Linux distributions.

Cryptocurrencies are different because they are largerare like protocols. Their cost depends on what is built on top of them, and they rely on everyone on the network following the same rules. Software is also a means of putting these rules into action. Since the launch of any blockchain, there is a norm that determines the acceptance of a set of rules by new participants(and, at least in the beginning, software)from the developers who launched this blockchain. By default, these developers are required to be trusted, which gives them influence.

Projects with ICOdiffer in that their coins/tokens havecost even before the blockchain is launched, sometimes when there is no software yet. The balance of power is also different because the development team receives an advance payment for the work they promise to do. They can hold 40% of the assets, plus the $10 million paid by others for the remaining 60%. Developers on such projects may be less accountable to other stakeholders because they have already been well compensated. Even if the project fails, they can cash out the assets received in exchange for the sold tokens. For this reason, some consider ICO projects to be essentially scam-like.

I seemany similarities between cryptocurrencies and companies. Stakeholders such as developers and miners,provide a service to users / customers, and the cost of this service is determined by market forces. The people involved in the provision of this service are united by an interest in increasing its perceived value. Developers often have significant reserves of the asset from the early days when its value was low and it almost did not attract external interest. Miners invested in equipment, and the potential return on their investment is related to the perceived value of the asset they mine.

Some cryptocurrencies are managed more or lessas a company because there is an organization that openly controls the network. NEO and XRP rely on a small number of trusted validator nodes to operate their networks, and these validators are chosen by the companies (OnChain and Ripple respectively). For now, at least, it appears that the governance of these blockchains is closely tied to the governance of specific companies.

Most cryptocurrencies differ from companiesby the fact that they do not have a central authority deciding who can play a certain role in the network. Traditional hierarchical organizations can be important players in such networks, but cannot impose their will on the networks. Although the goals of the network may be similar to those of the company, the network cannot rely on traditional management approaches.

I also see similarities between cryptocurrencies andcompanies for failure. The failure of the cryptocurrency harms the participants - developers, holders, miners and users - but we have not yet reached the stage where the failure of any cryptocurrency could affect anyone other than these stakeholders. At present, it is not so significant if flaws are discovered in the project management and bad decisions are made or no decisions are made - failure means to leave the ship and try something else.

The goal of any cryptocurrency project is massiveAdoption. He seeks to revolutionize various industries and to supplant institutions and organizations. If a cryptocurrency project reaches its goal by providing a new infrastructure for a particular aspect of the economy or society, it will achieve a degree of attachment that we have not yet seen. If the cryptocurrency becomes “too big to collapse” (without significant collateral damage), is it also too big to change the rules or management method?

Altavista and Friendster failed, notcausing a special effect. Google and Facebook have won their battles and now seem too solid and powerful to fail so easily. Perhaps we, as a society, should have taken into account the business models of our search engines and social networks. Most of us have lost sight of the long-term consequences of exchanging data for services, and we have preferred providers that offer the most attractive services. It is difficult to imagine a scenario where Google or Facebook users are massively migrating to another service in sign of rejection of company practices. However, Google and Facebook are traditional, hierarchical, centralized companies. They are accountable to their shareholders and the governments of the states in which they work, and through these institutions, in principle, we can to some extent control their behavior.

Cryptocurrencies, thanks to itsdecentralized nature, resistant to coercion and control, and this is one of the arguments in their favor. The thought that Bitcoin is striving to become a world currency, its management model makes me feel awkward. Is it really a currency that gives miners the freedom to change the rules, while we can only collectively say, “This is no longer Bitcoin,” more desirable than central banks? Looking at how Bitcoin managed to change the block size limit, I am glad that I can just pass by. I do not like the prospect that this could become a model for managing our global currency.

Democracy provides us with the means torepresentation in decision making. Although it can be argued that certain formulations are better than others, great value is the mere presence of a process that most people are willing to adhere to. Elections and referenda may be shared, but this separation is limited and controllable due to the process, and even if this time we didn’t get what we wanted, there are peaceful ways to pursue our goals - or, if no one shares them, understand this and abandon them.

11. Flexibility of institution or management reform

With the growing importance and value of cryptocurrency,most likely, changing her approach to management will be more difficult. The higher the cost of the network, the more powerful will be the stakeholders to whom the network brings influence and income. Bitmain, a major player in Bitcoin (and other PoW coins), received $ 3-4 billion in profit in 2017. Bitcoin miners are interested in maintaining their influence and have the resources to pursue this goal.

Bitcoin users (or full nodes) inin principle, they may decide to establish a new form of management that reduces or balances the influence of miners, but: 1) without the established process, there is a significant obstacle to the implementation of these changes; and 2) if miners do not approve of these changes, they have the resources to resist them.

In the early stages of a cryptocurrency, it is much easier to change the rules because there are fewer stakeholders and their interests are more aligned. To make decisions, one or another combination is sufficientfollowing the leaderAndfollowing the plan.Any project starts with a leader– a person or organization whose ideasthe project was founded and who implements the first version of the software and the genesis block. People are interested in a project because they believe in its ideals, and usually this also includes faith in the dedication of the person or team who created the project and in their ability to see it through to completion.

The leader of Bitcoin, of course, was Satoshi, and judging byeverything, at an early stage of the project, the word Satoshi was practically considered a law. Bitcoin is interesting in this regard because Satoshi left his position and disappeared. We won’t know how long he could have dictated the course of Bitcoin. This can be seen as Bitcoin's strengths, as the only leader that everyone follows is a centralized point of failure. A person can make mistakes or, under duress, take actions that weaken the network.

In the absence of a leaderBitcoin still has a plan– original whitepaper.Such documents are important because they help align the expectations of participants. They set the framework for what the project aims to achieve. People who do not want to achieve these goals have no reason to join the project. Bitcoin is a “peer-to-peer electronic cash system.” At least, the participants should not have disagreements on this. However, no plan can anticipate all the issues that may arise or all the decisions that will need to be made along the way. If a leader is absent, there is no one who can clearly interpret the correct course of action to implement the plan. Proponents of Bitcoin and Bitcoin Cash refer to the “Satoshi Vision” but have different interpretations of it and the course of action it suggests.

The overall plan is a good basis for making decisions onmanagement until situations arise that were not clearly foreseen, and the further course of action becomes ambiguous. Following a leader is an effective way of managing until that leader disappears or the participants lose confidence in his decisions.

12. Ethereum and The DAO hard fork

The DAO is an interesting management experimenton the blockchain. When the vulnerability was discovered and exploited, it gave interesting observations regarding blockchain management (Ethereum). The DAO was conceived as a decentralized autonomous organization that investors will be able to control through a complex smart contract scheme. It was supposed to function as a kind of venture fund, where anyone could invest capital and these investments gave a share of the income and the right to vote in determining what The DAO should do. There was no traditional (human) management structure, such as a CEO or a board of directors that would interpret and implement stakeholder voices - decisions had to be made and implemented directly on the Ethereum blockchain using smart contracts.

Before The DAO embarked on a full-fledgedAt work, someone found a way to exploit the vulnerability of these smart contracts and take control of all the ether invested by stakeholders in The DAO - worth $ 150 million at the peak. A wait period was built into The DAO before the recipients could spend the money. The attack triggered a 27-day period when the Ethereum community could take action to mitigate before the funds could disperse throughout the Ethereum ecosystem. In a blog post on Ethereum where Vitalik Buterin (its founder) announced this exploit, he also suggested a soft fork, which actually had to block or blacklist the stolen ether, if it was accepted by most miners. The soft fork seemed to have received the approval of the miners and was planned for implementation, but a vulnerability was found that exposed the entire Ethereum network to the danger of a DoS attack - if you read between the lines, this post tells the miners that they should vote against the soft fork.

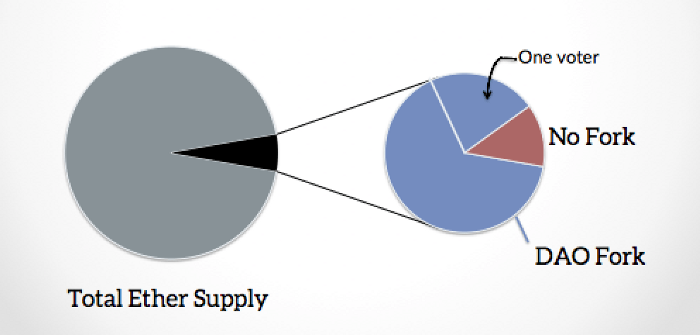

Thus, in the absence of a solution in the formsoft fork, the Ethereum community had to decide whether to use a hard fork, which would actually rewrite the story recorded on the Ethereum blockchain. The Ethereum Foundation has been offered a hard fork that transfers all of the air held by The DAO smart contracts to a new contract through which those who sent The DAO air can get it back. This proposal was accompanied by a voting tool that allowed Ethereum stakeholders to express their opinion on further actions, and the results of this vote should have determined the default value in the new version of the software for full nodes: whether to use fork or not.

Voting was conducted on the basis of 1 broadcast = 1 vote, and not on the basis of one vote per wallet or person. It was the so-called«voting in rubles». The largest stakeholders had the largestinfluence. There is a tendency to conduct all voting on blockchain management on the same principle, because blockchain is a register of which private keys belong to which assets. Any complete node can find out how much bitcoin or ether is controlled by a private key, but it is in no way possible to find out how many people have Ethereum wallets or how many wallets this or that person controls. Voting on the principle of one vote per person is impossible, because in such a vote (for example, one vote per wallet or node) it would be easy to use puppets - the Sibyl attack.

In this case, 87% of the ether votethe hard fork said yes, and the hard fork was implemented, with 85% of the computing power switched to the new blockchain, where all The DAO investors got their broadcast back. Such an outcome is not surprising, since 15% of all the ETH proposals in circulation at that time were at stake. This should have affected a significant portion of ETH holders who were facing substantial personal losses. This is a strong motivation to vote for the fork, while the motivation to vote against is more based on principles. Hacking The DAO could tarnish the reputation of the young project, and the hacker could throw his ETH into the market, and, besides, the creators of The DAO could wait for a protracted lawsuit. The catastrophic failure of the flagship project of Ethereum could be a significant drawback, so canceling the damage was an attractive option.

In this case, the leaders (Ethereum Foundation)proposed software that contradicted not only the Ethereum plan, but also the fundamental rule common to all blockchains: immutability. Apparently, the role of the Ethereum Foundation in this process was decisive (I did not witness this personally, but this is the impression I got after reading this article). The first post about this from the foundation, written by Vitalik, suggested a soft fork if people (miners) wanted it. This post didn't say that "this needs to be done" and therefore the choice should have been up to the miners - but it could well have said:“We have no intention in the fund to solve this with the help of a fork, as this will be a gross violation of the principles on which the project is based”, - and then everything could unfold in a different way.

Interesting relationship between the Ethereum Foundation andether holders. In 2014, a crowdsale was held to raise funds for the development of Ethereum, and about 25,000 BTC was collected (or about $ 17 million at the 2014 exchange rate). I could not find information about whether the fund retained part of the original ETH or bought it for BTC, but this article says that in May 2017 it had 800 thousand ETH. At least the Ethereum Foundation was originally funded by ETH customers.

Early investors in exchange for their investmentsWhat they received was not an asset that could be used, but promises to develop software, launch the Ethereum blockchain, and distribute coins that investors could use on that blockchain.Trust Ethereum Foundationembedded in the very structure of the Ethereum community. This background creates a different dynamic between the Ethereum Foundation and Ether holders than the dynamic between Bitcoin Core and Bitcoin holders.

Ethereum Foundation could not order to holda hard fork of the Ethereum blockchain to abolish The DAO, but he made this possible by sending an appropriate signal to ETH holders. I like that a vote was taken to evaluate the opinions of ETH holders. 87% of ETH voters voted in favor of hard fork, but only 4.5% of all ETHs in circulation participated in the vote, and, as I have already noted, those who invested in The DAO had a strong motivation to vote “for” .

The Minority of Ethereum Miners Who Didn't Accepthard fork, they continued to mine in the blockchain with the compromised The DAO, which became known as Ethereum Classic. Unsurprisingly, the Ethereum Foundation decided to focus on the blockchain that forked to cancel The DAO, helping to legitimize that blockchain as the “real Ethereum.” While miners and users who did not accept the hard fork were able to continue working on their own blockchain, what they were left with was somewhat inferior as it no longer had the support of the well-resourced Ethereum Foundation, a fund funded by Ethereum investors/holders ( before the fork).

Be that as it may, this fork does not seem toled to the level of hostility between the ETH and ETC communities that is observed in the case of BTC and BCH. It is possible that this is somehow connected with the possibility for stakeholders to express their desires through a clearly defined (albeit situational) process and see the results.

Apparently, one of the management issues, bywho now have no consensus in Ethereum as to whether, and if necessary, how, to return ETH from smart contracts that are functioning incorrectly. It seems that a solution to this problem is not yet in sight, and it is impossible to find out what it could be. This, for example, is not very happy for those who "hold" 513 thousand ETH who are stuck in the Parity multi-signature contract.

13. A Brief Overview of Alternative Methods for Securing Distributed Consensus

Not all cryptocurrencies rely on proof of work to ensure consensus. The most famous alternative isproof of ownership (PoS), where nodes that create new blocks are selected onthe basis of the currency they hold and sometimes the length of time they hold it. The reasoning behind this is that you can trust the random selection of nodes based on their share of ownership because they have a strong motivation to behave honestly(they have something at stake). PoS members can be rewarded for honest contributions by receiving rewards for blocks, or punished for dishonest behavior by losing part of their share of ownership.

Now only a few rely on PoScryptocurrencies with high market capitalization. There are theoretical problems that need to be addressed, and it has not yet been proven that this method reliably leads to distributed consensus. The main problem is that for any split in the blockchain, the stakers (who place their stake on the con) are motivated to put on the tokens in both blockchains, which they can easily do. PoW miners cannot do this, because they need to decide in which blockchain to mine, or share their computing power between blockchains.

The coins I know of that rely on PoS are NXT, Ardor, and Pivx. Ethereum has long had a plan to transition from PoW to PoS, but the fund has not yet decided on a specific PoS implementation.

Another method currently used isdelegated proof of ownership (DPoS), where holders can vote (in proportion to their reserves), choosing a limited number of those who have the exclusive right to create new blocks. Lisk holders choose 101 delegates, and Ark holders - 51. Of those delegates, those who create new blocks and get rewards for them are randomly selected.

There are also cryptocurrencies that use some hybrid of PoW and PoS to achieve consensus. Their common characteristics aremasternodes. These are nodes that occupy a special place in the network andoften providing special services. For masternodes, there is a requirement for a certain amount of currency. This is argued by the fact that masternodes will honestly fulfill their duties, because they have put at stake a substantial amount, which motivates them to take care of the health of the network. The first masternode project was Dash. In the case of Dash, they implement the functions of InstandSend and PrivateSend on the network and receive 45% of the rewards for the blocks. A list of cryptocurrencies with masternodes (adapted for investors / holders) can be found here.

Cryptocurrency using to achievePoS consensus gives power to token holders. That is, to understand who has influence in the corresponding network, it is necessary to consider the distribution of coins(both the initial distribution and current fees for blocks and transaction commissions). Currency holders manage - and in a sense, own - a network.

PoW miners incur relatively high costs(purchase of equipment and electricity for his work)and therefore forced to sell some partremunerations received to cover them. This ensures a stable flow of currency into the market. PoS nodes incur very little transaction costs since they do not use large amounts of energy (this is one of the arguments in favor of PoS), and therefore they can keep more of the rewards they earn. Stakers are not under the same pressure to sell part of their rewards. In a system where all block rewards or all inflation goes to stakers, they can safely keep their share of the currency, while non-stakers' reserves will be constantly diluted. A person who had 50% of the coins to begin with can retain that 50% and the corresponding influence simply by running a few nodes - users of the currency who do not stake their stake will effectively pay him rent in the form of transaction fees.

14. Ongoing discussions on blockchain management

The rest of this article will be devoted to presenting my views on three popular publications on blockchain governance and,in particular, about onchain managementthat appeared in November-December 2017. Each of them sets out convincing arguments of influential people in the blockchain world, so that they deserve attention.

- Fred Ersham “Blockchain Management: Programming Our Future”

- Vlad Zamfir “Against Onchain Management” - criticism of an article by Fred Ersham

- Vitalik Buterin “Notes on blockchain management”

On-chain governance means that the protocol includes a formal process for accepting changes to the consensus rules. The norm for blockchains is off-chain governance. There is one or another process(we already examined the process of Bitcoin and Ethereum)through which various participantsagree on the changes and download the new software version introducing new rules after a certain block, or some participants do not accept the changes and a split occurs in the blockchain.

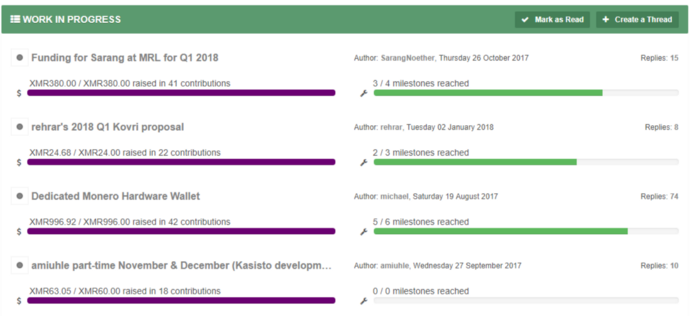

Decred is the only project I know of withfunctioning on-chain protocol change management, so I will describe it in a little more detail. The Decred project is the most interesting to me because it relies on voting to control the protocol(and in the near future - to finance the development of the project). In fact, one of the reasons I startedwrite this article, in that the three above-mentioned publications on the on-chain management of protocol changes do not mention the only project that really uses this.

15. Decred

Decred uses for actuation.consensus rules for both PoW and PoS. PoW miners receive the largest share of block rewards (60%) and serve the same role as in Bitcoin. PoS miners/validators/voters receive 30% of block rewards, and their role is to vote on changes to the consensus rules and ensure that those rules are properly enforced by miners. The remaining 10% goes to the project budget fund.

Decred holders can buy tickets by blockinga certain amount of DCR until their ticket is voted on. When mining each new block, five are pseudo-randomly selected from the pool of active tickets. At least three of these five tickets must vote to approve the block, otherwise the miner will not receive his reward. After a ticket has been successfully voted, its owner is returned its price plus a reward. Tickets are voted on on average after 28 days. If a ticket has not voted in 142 days, it expires and the owner can revoke it and return the blocked DCRs - approximately 0.5% of tickets do not have time to vote before their expiration date. The target active ticket pool size is 40,960 tickets. The price of tickets goes up or down depending on whether there are more or less tickets in the pool compared to that target.

Blocking funds for an unknown period of up to 4months to buy tickets is a Decred mechanism that motivates voters to take care of the health of the network. To have a significant impact, you need to block a significant amount of DCR. If, due to your vote, DCR loses value, you will not be able to quickly exit your position to avoid consequences.

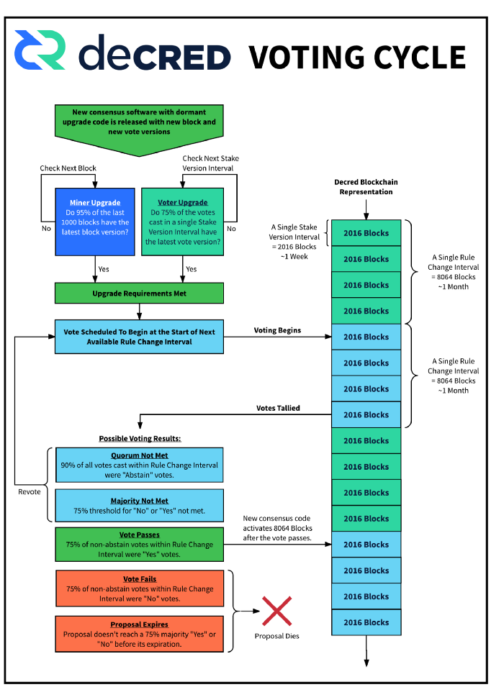

The on-chain process for accepting changes to consensus rules is as follows. Changes to the Decred protocol are included in the new software in standby mode. Upon reaching a certain threshold(the new version should use 95% of the computing power of PoW miners and 75% of PoS voters)The voting period starts.Voters decide whether to vote their tickets for or against the changes, with votes from selected tickets counted over the course of one month (8064 blocks). For a motion to pass, at least 10% of the votes must be for or against (i.e., not “abstain”). If the 10% participation threshold is not reached or there is not a clear majority of 75% for or against, another month-long voting period opens. If there are 75% "no" votes, the proposal is rejected. If 10% participation is not reached in the second round of voting, the proposal expires. Accepted offers are automatically activated one month (8064 blocks) after acceptance.

Decred voting cycle.

Such a system should give voters more freedom to decide what constitutes a valid bloc(i.e. what are the consensus rules). PoW miner whose block is not approved by voterswill not receive a reward, while a PoS voter for a vote against the block still receives a reward. PoS voters, in principle, can implement their own “soft forks” punishing miners who behaved improperly, for example, refusing to update and allow the vote to take place or mine empty blocks.

The system must also resist splits.blockchain caused by competitive hard forks. It will be difficult for a breakaway blockchain supported by a minority of voters to find new blocks, because it will select tickets from the pool that votes to invalidate the blocks. The only way for a minority of voters to survive and add new blocks is to remove this requirement. Of course, this is possible: as in any other blockchain, Decred software can be changed. However, since the principle of stakeholder voting is part of Decred’s foundation and identity, it’s difficult to imagine a scenario where any doubts might arise about which blockchain is “real Decred”.

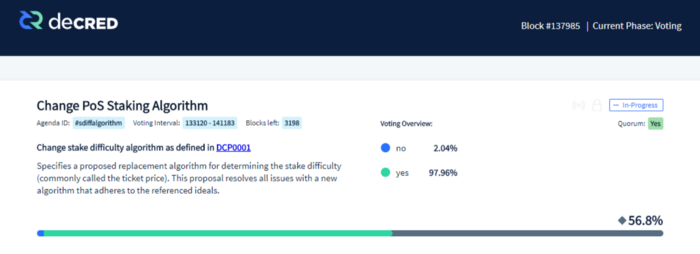

Decred stakeholders have voted in favoradoption of two changes to consensus rules. In the first case, the ticket pricing algorithm has changed (so that the result is a reduction in fees for PoW miners, playing against their interests). In the second case, the change necessary for integration with the Lightning Network was adopted.

Display of active voting on poll.decred.org for April 2017. The screenshot was taken from the waybackmachine archive, as there are no polls currently running.

16. Returning to ongoing discussions

Fred Ersham's article has a whole section aboutonchain governance, where Tezos and DFINITY are mentioned in the present tense - while at the time of writing, neither of these projects has launched its main network. Decred, a project that has already approved two changes to the consensus rules in the form of a hard fork through on-chain voting by stakeholders, is not mentioned at all.

Fred’s article contains some good arguments aboutwhy blockchain management is important, and interesting speculation about the future. It provides a brief and simplified overview of management and motivation in Bitcoin and Ethereum. This is understandable, I can confirm what happens when you try to describe it in more detail; The article you are reading is a good example, and it only touches the surface.