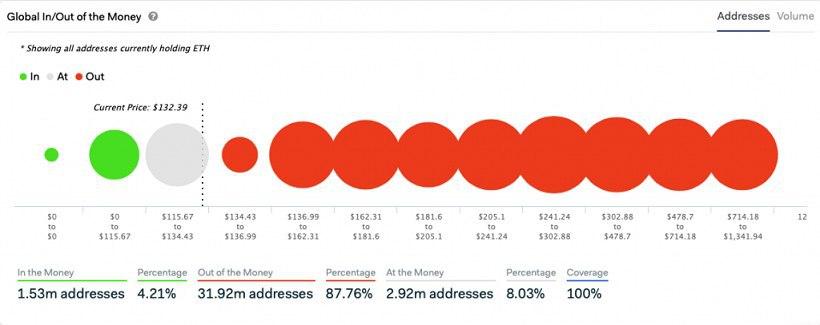

At 31.9 million Ethereum addresses (87.8% of the total), coins are purchased at an average price above $ 132.4 - current at the time of the study conducted by IntoTheBlock.

</p>Researchers note that a similar ratioshould not be surprising. Quotes of the second cryptocurrency three weeks earlier fell to below $ 90, which is close to a minimum of $ 80.6 since December 2018. At the same time, the bull market peaked at levels above $ 1,400 in January of that year.

Thus, in conditions of such turbulence inonly those who acquired the air in the initial stages of market growth in 2017, or those who have shown such activity in the last couple of weeks, can remain positive.

As you can see from the graph below,the highest purchase intensity was in the range of $ 241.24-302.88. At the same time, when the price of ether rises above $ 250 (that is, approximately twice as high as the current values), half of the addresses will turn into a plus.

Data: IntoTheBlock

The owners of 4 million ETH addresses (approximately 10% of the total number) will have much patience. Their purchases came at prices between $ 714 and $ 1340.

At IntoTheBlock, noticed a drop innetwork of the number of large transactions with a volume of over $ 100 thousand. According to analysts, this serves as a signal to maintain bearish sentiment in the short term.

Recall, Covalent analytic startup concluded that the growing popularity of decentralized finance applications has a negative impact on other transactions in the Ethereum network.