- The market has intensified amid the growth of bitcoin.

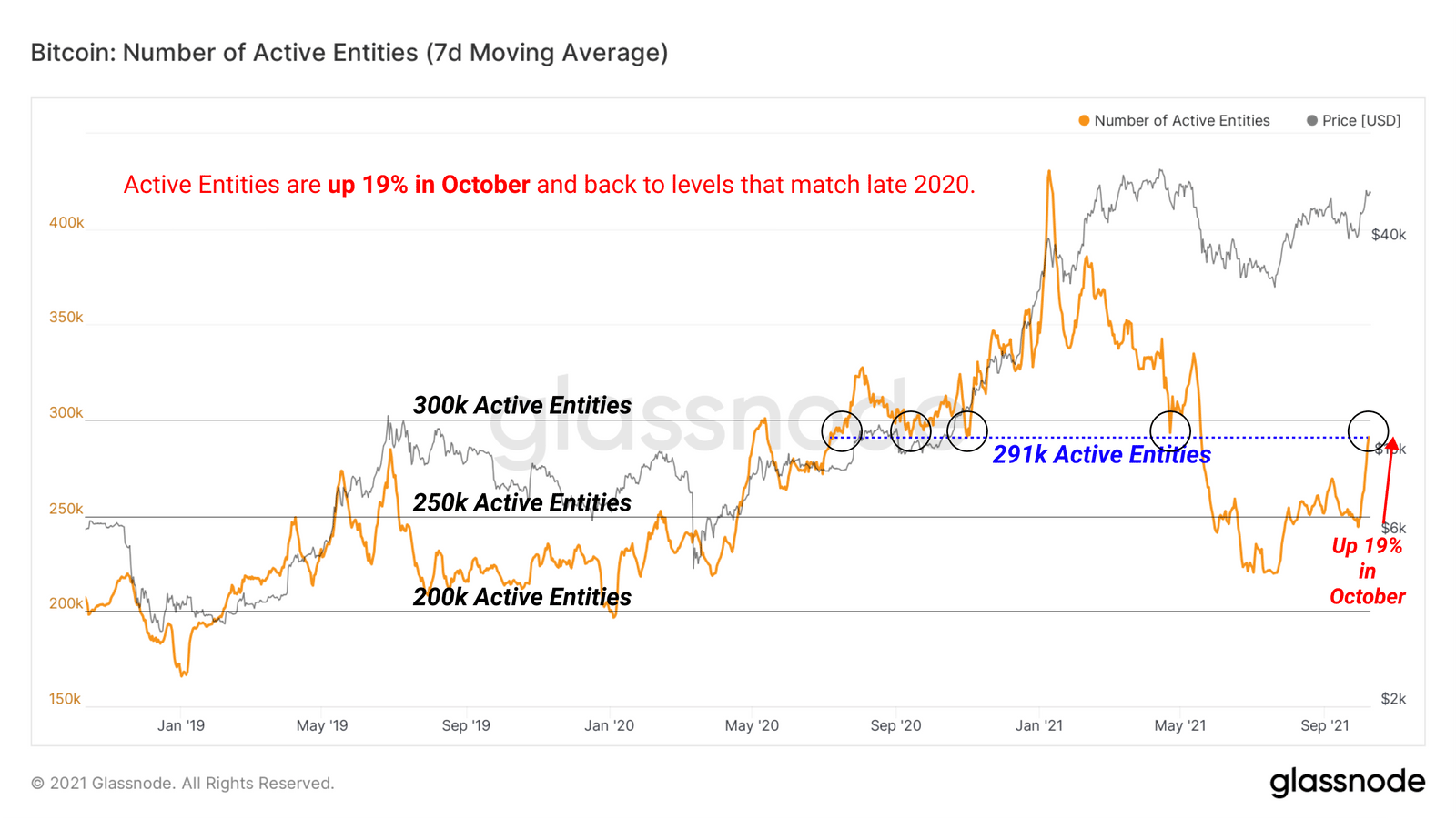

- The number of active wallets reached the values of September 2020of the year.

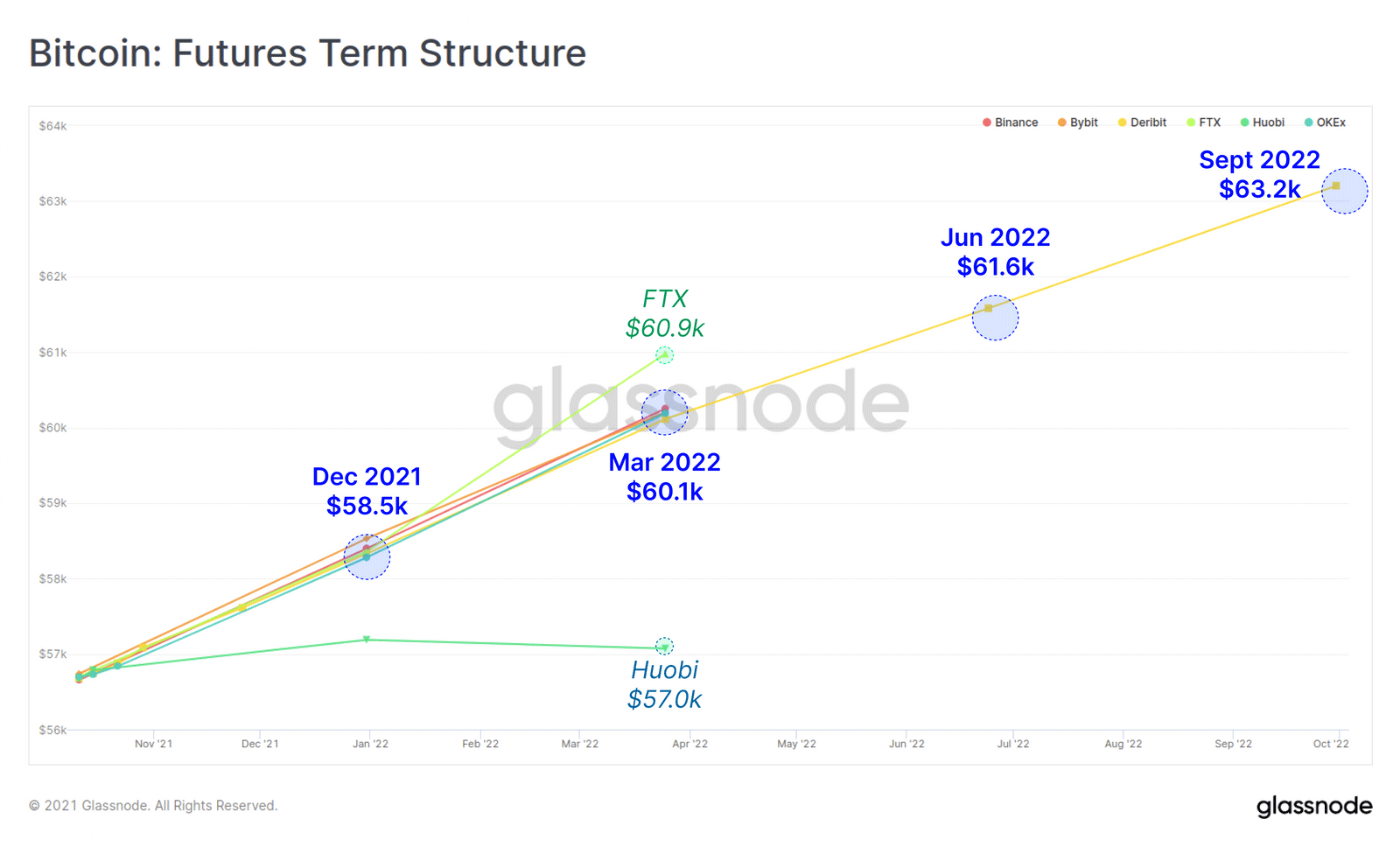

- Most traders are waiting for Bitcoin at $ 60,000 in March 2022.

The outbreak of on-chain activity in the Bitcoin (BTC) network may signal a new wave of demand covering the cryptocurrency market, Glassnode found out.

At the beginning of October the number of daily activewallets in the Bitcoin blockchain jumped by 19% to a level of 219,000 units. Glassnode analysts report this in their new report. According to published data, Bitcoin on-chain activity has increased to the levels of September 2020. Then such activity was followed by a Bitcoin rally, which raised the price of the cryptocurrency sixfold.

According to experts, the activity of earlymarket participants have historically correlated with growing interest in an asset during the early stages of bullish trends. Since mid-September, the average size of a Bitcoin transaction has also increased. It is now worth over 1.3 BTC (~$74,750). The last time the Bitcoin network recorded an average transaction size above 1.6 BTC was March 2020. At the same time, a well-known collapse in liquidity occurred, after which the market began to grow.

Analysts also found that over the past 7For months, the main strategy of the majority was hodling. For example, more than 2.3 million BTC were transferred from short-term to long-term storage (~155 days). To put this into context, during this same period, only 186,000 BTC were mined. This means that long-term investors received 12.7 times more coins than cryptocurrency miners managed to produce.

That Bitcoin may have a long-term footholdAt levels of $50,000-$60,000, future prices on Bitcoin futures are also indicated. Most crypto exchanges (Binance, Bybit, Deribit, OKEx) expect Bitcoin to reach $60,100 by March 2022. FTX traders are slightly more optimistic and expect BTC at $60,900 in March. Huobi has a slightly different opinion. There traders are waiting for Bitcoin at $57,000.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.4 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | OKEx | https://okex.com | 6.5 |

| 5 | Bybit | https://bybit.com | 6.3 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Additional features and services— futures, options, staking, NFT marketplace.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication