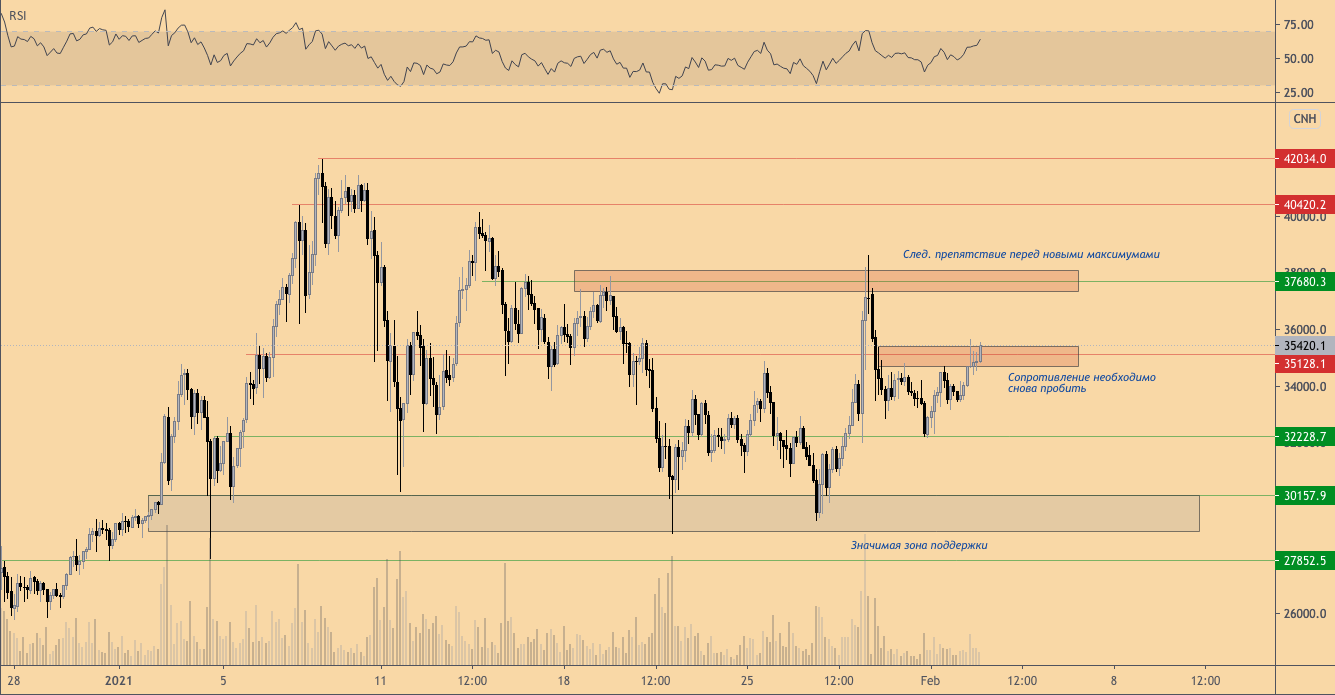

The bulls need to overcome a serious obstacle before it is possible to talk about the likelihood of newhighs.

In the last few days in the bitcoin marketturbulence reigned after Elon Musk tweeted support for the cryptocurrency amid the collapse (after a dizzying rise) in GameStop shares. However, after Musk's tweet, the price of BTC quickly corrected to its previous values.

Since then she has faced seriousan obstacle in the $35-35.2 thousand area on the way to testing all-time highs. If this level is broken through and turns into support, we can seriously talk about the likelihood of a movement to new highs.

Bitcoin failed to hold the $35K level and should now turn it back into support

XBT/USD, 3-hour chart. :TradingView

The three-hour chart shows a clear structuredowntrend, against the background of which only the pump of the Musk name stands out sharply. This downward structure formed after peaking around $42K.

The local downtrend forms smaller highs and smaller lows - all this can be seen on the chart. Therefore, there is a significant probability that this trend will continue.

If BTC can overcome the $35 thousand barrier., then the resistance zone at $38K should not pose much of a problem for the bulls. The next significant resistance zone will likely be around $40.5K.

On the other hand, if the price of Bitcoin failsbreak through $35 thousand, then a retest of the $30 thousand level will be on the agenda. And given that it has already been tested several times after the formation of the last peak, there is a significant probability that this level will not survive the next retest. And in this case, the correction may continue to $25-26 thousand.

The 21-week MA is currently at $21K.

BTC/USD, 1-week chart. :TradingView

Again, the only indicator behind whichit makes sense to observe in case of further correction, in my opinion, is the 21-week moving average (MA). Throughout the previous bull market, it provided sustained support to the price of bitcoin.

However, if the market continues to correct, thenA retest of the 2017 peak is still unlikely. In other words, absolutely everyone will buy at this level, even their mothers and grandmothers, which means that the market is unlikely to present such an opportunity to anyone.

That being said, there is still a possibility of a correction to $24-26k and, along with a test of the 21-week MA support, this would close the CME gap.

However, the direction of further momentum now depends on whether Bitcoin can gain a foothold above $35K.

Bullish scenario for bitcoin

XBT/USD, 4-hour chart. :TradingView

This detailed chart and scenario shows that the critical resistance for Bitcoin is the $35K zone, which if broken would open it up to new all-time highs.

In the area of $38 thousand.There may be some short-term consolidation. But since the price has already tested this level once, it will most likely encounter real resistance at $40.5 thousand. Therefore, if the BTC price breaks through the $35 thousand area, then I would expect the momentum to continue to $40.5 thousand.

Bearish scenario for bitcoin

XBT/USD, 4-hour chart. :TradingView

The bearish scenario is also quite simple: the $35k level is held as resistance, followed by further declines.

The first visible support is the $32k area., which has been tested many times and is likely to be lost. The next support level is in the area of $29–30 thousand. It has also been tested several times.

One more test and breakout of this level will open the wayto $25K. This would correspond to the closing of the gap in CME futures and a test of the 21-week MA. Meanwhile, each previous support level is tested and confirmed as resistance, and the correction continues to set new smaller highs and smaller lows.

The article does not contain investment recommendations,all opinions expressed are solely the personal opinion of the author. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>