The third Bitcoin halving will take place on May 12, and in anticipation of this event, it’s time to compare the dynamics of the tokenbefore two previous halvings. As this comparison shows, there are not really many similarities.

Investors and speculators are in full swing preparing forthe upcoming halving, showing a record high interest in this topic, as evidenced by the rapid growth of search queries "bitcoin halving" in Google Trends. An equally curious question that interests many is how this important event for the industry will affect the course of the main digital currency in the current economic climate, which leaves much to be desired.

A few days ago we published a detailedanalysis of the impact of halving on the price of BTC in the current market situation, today we present to your attention a comparison of RSI and the dynamics of the moving average to determine upcoming rate fluctuations.

Well-known trader @TheCryptoDog conducted an interesting poll on Twitter, in which he invited users to share their opinions on how much the Bitcoin halving is priced into current prices.

Do you think the halving is priced in?

Be honest.

- The Crypto Dog? (@TheCryptoDog) April 22, 2020

Below we will examine the dynamics of bitcoin and compare it with previous halving to identify similarities and differences and determine how much the upcoming event is taken into account in current prices.

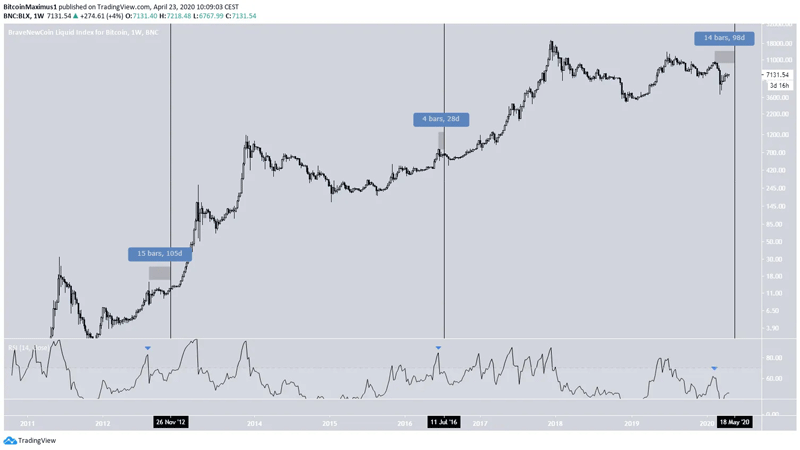

RSI: similarities and differences

The two previous halvings were held on November 26, 2012 and July 11, 2016.

In the first case, the maximum was noted 105 days before the halving. On that day, the weekly RSI hit the overbought zone and then plummeted.

A similar picture was observed before the secondhalving, but the peak was reached only 28 days before the event, and then RSI, and the price itself fell, but unlike the situation in 2012, the decline continued after the halving, and quotes were noted at the lows a few weeks after the event.

Now the recent high is at $ 10,504 on February 7th. If the halving takes place on May 12, as planned, this will mean that bitcoin reached the peak 98 days before the halving.

However, the current dynamics diverges from the previous one in several ways:

- Firstly, the aforementioned maximum was not accompanied by the rise of the RSI into the overbought zone.

- Secondly, bitcoin fell by more than 50% from the February maximum, which was not the case in the two previous cases.

And although such a small number of events does not allow reliable forecasts to be made, it should be noted that the behavior of Bitcoin and RSI itself is different from the dynamics before the two previous halvings.

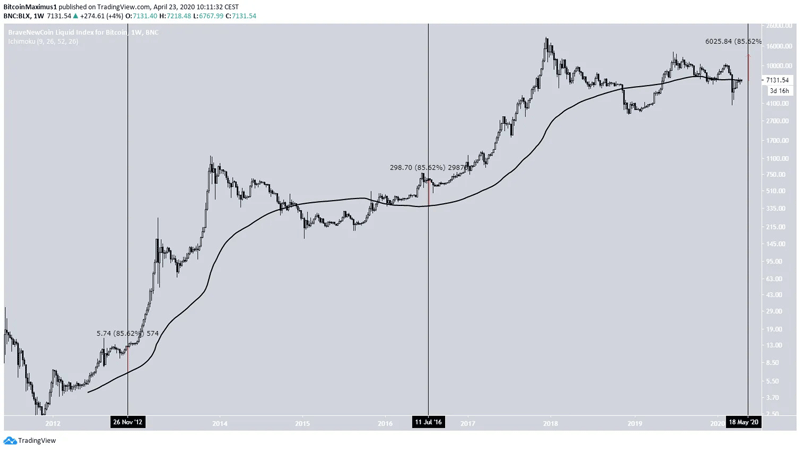

Comparison of the dynamics of the moving average

An interesting comparison gives participation in the analysis.100 week moving average. On the dates of the first two halvings, Bitcoin was 85% higher than this MA, while the current price is just on the moving average.

If the rise from MA by 85% is repeated, the pricewill be about $ 13,500 per day of halving. Such a scenario seems unlikely, especially given the short-term bearish technical signals. In other words, the rate is unlikely to rise above the $ 10,505 high noted in February before halving, but this will almost certainly happen immediately after halving.

Thus, the current dynamics of bitcoin andTechnical indicators are at odds with the signals that were observed before the second halving, and we expect the cryptocurrency to update highs above the $ 10,500 level after May 12.

</p>Rate this publication