The growing popularity of the first cryptocurrency does not threaten the status of the precious metal, but it maynegatively affect the demand for it as a defensive asset, are confident in the American bank.

Bitcoin may reduce the demand for gold, but notwill replace it as a defensive asset, analysts at Goldman Sachs are sure. They stressed that, despite the growing popularity of bitcoin, they do not see it as a real threat to gold's status as a "safe haven," Bloomberg writes.

“Some investors are concerned that bitcoinwill replace gold as a defense against inflation. Although the popularity of the first cryptocurrency is growing, we do not see it as a real threat, ”Goldman Sachs said.

Bank analysts explained that investorsthe institutional level avoids working with the first cryptocurrency due to the lack of transparency. At the same time, speculative actions of retail investors make bitcoin an “overly risky asset”.

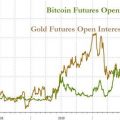

Bitcoin is being actively invested in 2020hedge funds, insurance and public companies. In December, One River Asset Management, together with billionaire Alan Howard, announced the acquisition of more than $ 600 million worth of cryptocurrency.The new fund, specially launched for investments in cryptocurrencies, plans to increase the volume of assets in bitcoins and ethers to $ 1 billion by the beginning of 2021.

News on the purchase of cryptocurrency by largeinvestors began to appear more often during the Bitcoin rally. On December 17, the value of an asset for the first time in history reached $ 23.8 thousand. On December 18, the price of a coin on the Binance exchange is $ 22.9 thousand.

Bitcoin hit its all-time high exactly three years after the coin's price first approached the $ 20K level.This record has been held since December 2017.

On March 12-13 of this year, the cryptocurrency survivedone of the largest crashes in its history - its price dropped by more than 50%, from $ 7.9 thousand to $ 3.8 thousand. However, on May 7, the value of BTC reached $ 10 thousand, and for 10 months the growth exceeded 520%.

</p></p>