Analysts at Goldman Sachs, one of the world's largest commercial banks, believe that the dominance of the dollar asthe world's reserve currency could be under threat.

The record high price of gold, known as the "currency of last resort", raises questions about the future of the world's reserve currency.

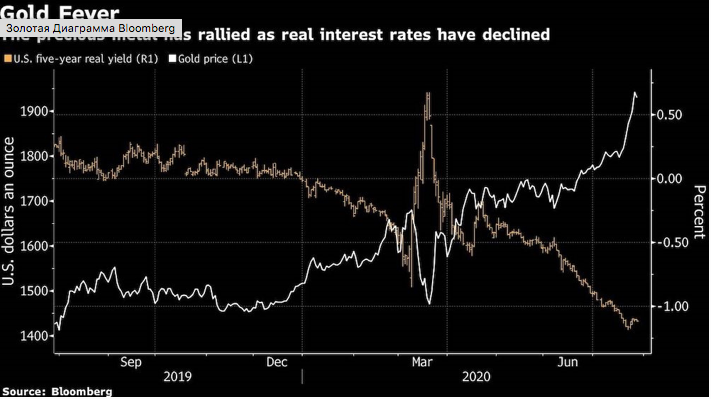

Gold that tends to risedemand amid economic uncertainty hit an unprecedented $ 1,943 an ounce this week, driven in part by record low interest rates, a downturn in the economy, and Federal Reserve monetary policy. The record rise in gold prices underlines growing concerns about the global economy. Goldman Sachs has already raised its 12-month gold price forecast from $ 2,000 to $ 2,300 an ounce.

Gold is a safe commodity because it is in limited quantities and is considered to have intrinsic value.

Back in the day, the idea of a "safe currency" gave the US financial system a huge advantage over the dollar's dominance in global financial markets for decades.

However, the growth of national debt, new steps by the Federal Reserve to expand its balance sheet, growing political and pandemic uncertainty, threaten the status of the US dollar.

Goldman Sachs isn't the only one bettingdoubt the dollar's place on the throne. Jim Reid, an analyst with German financial giant Deutsche Bank, said fiat money would become a passing fashion in the long-term history of money. In addition, gold outperforms stocks in the long run as a hedge against government money, Reid said.

Subscribe to ForkNews on Telegram