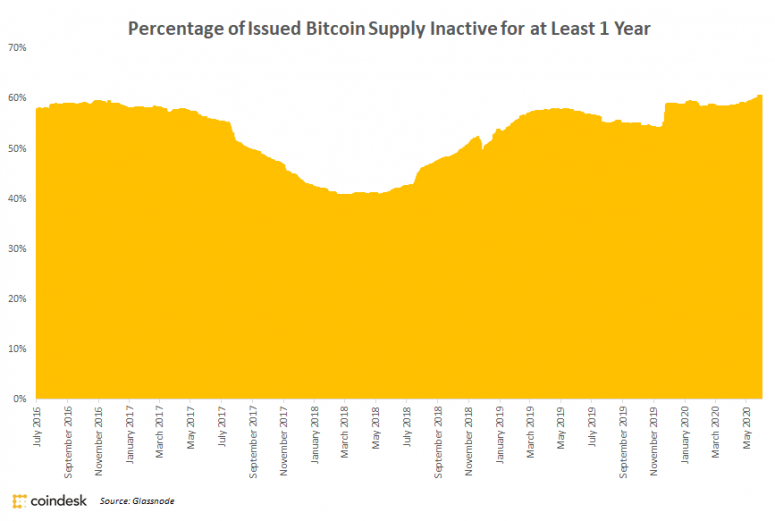

The share of inactive bitcoins has exceeded 60%. The largest increase in the number of inactive BTC since the beginning of the year has been observedamong coins purchased 10 years and 2-3 years ago.

According to Glassnode, 60.63% of all BTC have not moved in over a year. This data suggests consolidation of BTC ownership and that investors who bought the cryptocurrency at rock-bottom prices in 2018 have not yet begun to profit from their investments. It has been over four years since such a large percentage of the BTC in circulation has not moved in over a year.

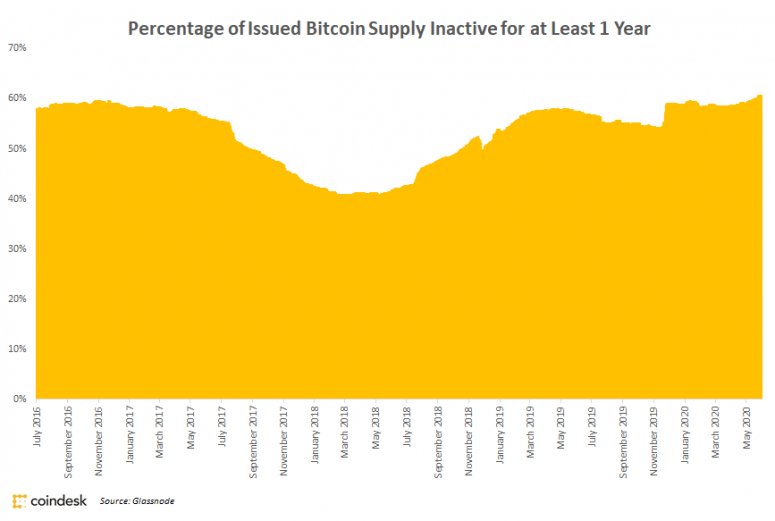

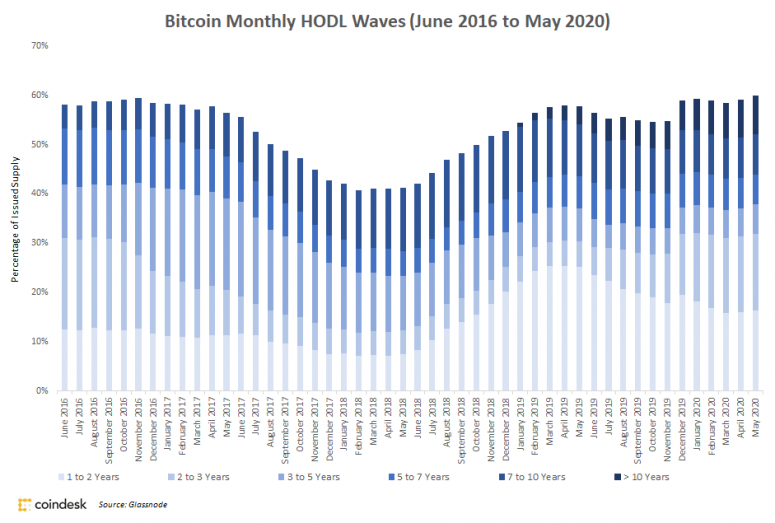

One of the methods for analyzing inactive bitcoinswas to group coins by the length of the period when BTC did not move. This data analysis, called HODL Waves, was first proposed by Unchained Capital in 2018 to demonstrate macroscopic changes in BTC ownership and use. It can also provide insight into investor sentiment.

Each wave — one day, one month, sixmonths, two years, five years, etc. — represents a period of time during which a certain percentage of the coins in circulation were not used in transactions, or in other words, were inactive.

The term HODL reflects investor behavior,who decide to hold BTC without the intention of using or selling these coins. Thus, each wave visualizes what percentage of BTC in circulation participated in the HODL strategy and for how long.

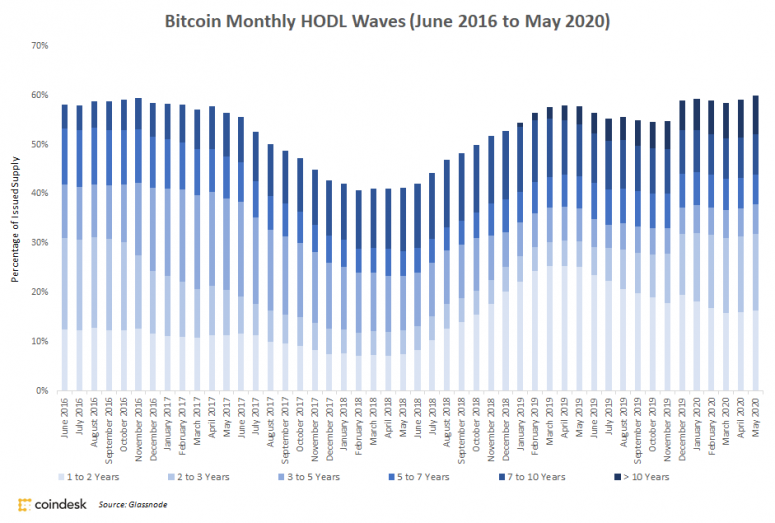

Percentage of BTC in circulation, inactive for one year or more. : Glassnode, CoinDesk Research.

Co-founder of Unchained Capital Dhruv Bansal(Dhruv Bansal) explained that the HODL Wave data indicates that investors who “bought bitcoin for between $ 6,000 and $ 3,000 in 2018 are still holding it, despite the huge growth since then and recent economic fluctuations."

Interestingly, two periods of storage durationBTC, in which the percentage of inactive bitcoins is highest, is 10 years and 2-3 years. The number of inactive BTC in these segments has grown to 31% and 26% since the beginning of the year, respectively. In 2020, during the storage period of 2-3 years, coins were purchased that were purchased at record high prices in 2017.

Bitcoin HODL Waves of one year or more (from June 2016 to May 2020), broken down by period. : Glassnode, CoinDesk Research.

However, not every BTC investor can intentionallyadhere to the HODL strategy. ARK Investment Management cryptocurrency analyst Yassine Elmandjra said that the growth of inactive BTC for two to three years, among other things, may be due to the fact that cryptocurrency owners “bought BTC at the peak and lost their Trezor wallet or forgot their username and Coinbase Password. "

Despite the extreme volatility of bitcoin inthe first quarter of 2020 and continued macroeconomic uncertainty, the growing number of inactive BTC confirms that cryptocurrency owners still believe in their investments. According to Bansal, “if you think the BTC price history is repeating, then market consolidation in the hands of confident investors in the future may be a sign of a bullish trend.”

</p></p>