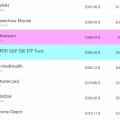

On August 5, the London hardfork took place, which launched a deflationary mechanism for Ethereum: the base fee forthe transaction burns out, and the miners get only the "tip" left from above and the reward for mining the block. About a third of newly released ETH falls under the destruction.

Image Source:coindesk.com

On average, about 2.5 ETH burns per minute, which withMaintaining the pace and current value of the altcoin leads to $ 1.5 billion of withdrawn funds by the end of the year, or 0.4% of the total capitalization. The deflationary mechanism is expected to drive up prices due to reduced supply. The network upgrade has already led to 13% growth, but by the end of the year Ethereum is predicted to be in the $ 4,000 - $ 5,000 range.

Image Source: Cryptocurrency ExchangeStormGain

Despite the Chinese storm, investments incryptocurrency projects are at their highs. So, in the first half of the year, global venture capital investments amounted to $ 288 billion, which is 95% more than the same period in 2020. The most interesting are projects related to NFT and DeFi services, which, in turn, are overwhelmingly built on Ethereum smart contracts. Because of this, the share among all cryptocurrencies has grown from 8% to 20% in a year and a half.

Image source: coin360.com

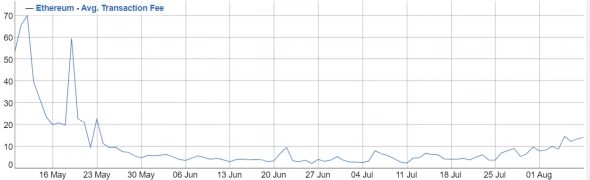

But not everything works as planned.In addition to the deflationary mechanism, the hard fork was intended to reduce the size of commissions by abandoning the auction model. Despite the relatively low "tip", the size of the total collection continued to grow.

Image source: bitinfocharts.com

High commissions make it difficult to attractinvestments and hold back interest in Ethereum, but everything will change dramatically with the transition to proof-of-stake, which is expected in December this year. The new algorithm will lead to the abandonment of mining, increase the speed of operations and reduce transaction costs. The long-awaited move approaching, coupled with a deflationary mechanism, could be a catalyst for Ethereum's growth for the rest of the year.

Analytical group StormGain