Ethereum was the first smart contract platform, and since thencontinues to maintain a dominantmarket position. Despite the fact that competitors can boast of higher bandwidth, a scalable platform with a consensus algorithm, which is considered energy-efficient, their share is still much more modest.

As an example, delegated consensus algorithmProof-of-Stake, adopted by Tron and EOS, introduces the concept of super nodes called super representatives and block producers. This, critics say, is the core idea of blockchain, a technology that relies on dispersal of control and elements of centralization.

However, Ethereum plans to move away fromthis solution and provide scaling through sharding options and additional layers. The agreed-upon algorithm will be Proof-of-Stake, the same algorithm that Cardano uses.

The Serenity update, which is estimated to beready by 2023, will present us with a scalable and energy-efficient network suitable for many applications, including social networks, etc. Notably, there will be no centralization at all.

For the validator node to work, the user must enterstaking 32 ETH. That's about $ 6,000 at spot rates, and inUnlike other models requiring large sums, Ethereum will strengthen its leadership potential in the conclusion of smart contracts and will become attractive to investors.

At a rate of 32 ETH, the annual yield (subject to the operation of the node in the amount of 99%) will be 14%.

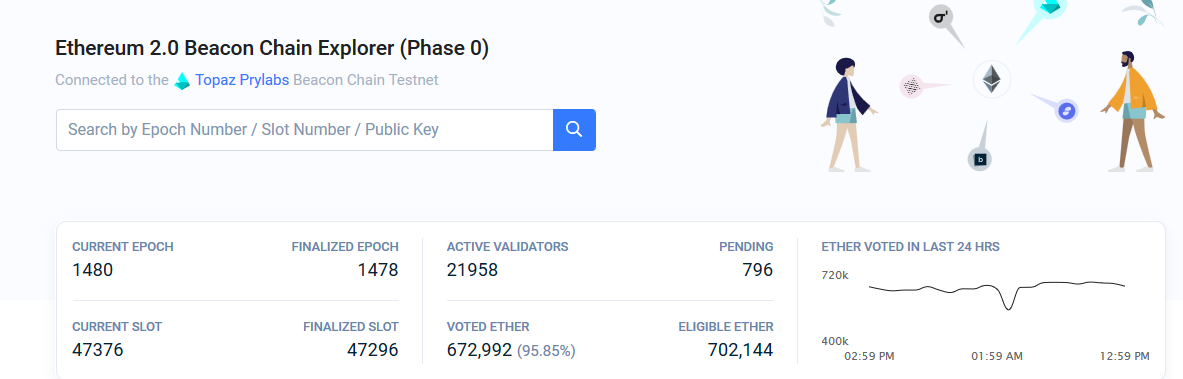

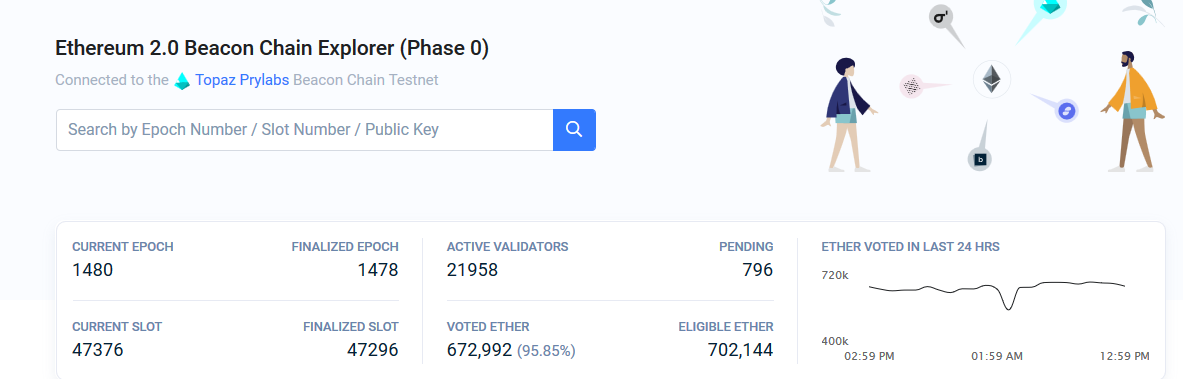

In this regard, it is not surprising that 9 days after the launch of the Ethereum 2.0 Topaz TestNet testnet, there were 21,958 active validators.

At this stage, Topaz's goal is to thoroughlytesting Phase 0 of the six phases of the Proof-of-Stake protocol that will underpin Serenity. Instead of investing in expensive equipment, the Proof-of-Stake model involves staking and receiving annual fees for checking transactions.

</p>Rate this publication