Analysts from BitMEX Research, the research division of the BitMEX crypto derivatives exchange,published a detailed overview of Ethereum 2.0, which is scheduled to launch in July 2020.

How will Ethereum 2.0 differ from the current blockchain?

Analysts noted that the launch of a new blockchainEthereum may not be as important an event as many people think, because at the initial stage Ethereum 2.0 will essentially work as a test network for the new Proof-of-Stake system. Most of the economic activity and smart contracts will remain in the "old" Ethereum network, which will operate in parallel with Ethereum 2.0. There will be a one-way bridge over which ETH1 can be converted to ETH2 (without the possibility of reverse translation).

This transition is risky, very difficultand long. According to BitMEX analysts, the main motive for this transition was scalability. The Ethereum network has managed to become popular and today processes relatively large volumes of transactions. In order to continue growth, node operators will be forced to work on large computers, which can lead to increased centralization, and this, in turn, can adversely affect the censorship of the system and, ultimately, support for such a network will become meaningless.

Bitcoin uses the Lightning Network to solve the scaling problem, while Bitcoin Cash pretends that there is no problem. Ethereum chose a solution called sharding.

The main problem is that shardingimplies a significant change in the economic model of ethereum. If in the understanding of many users ethereum is a “world computer” that cannot be stopped, then the implementation of sharding may not meet their expectations, since ethereum will be divided into several shards / segments (several computers). If the smart contract on shard 1 wants to interact with the contract on shard 2, this can cause significant difficulties due to the need to coordinate actions between shards.

So between sharding and concepta planetary computer has little in common. It can even be argued that ethereum and sharding are opposite concepts. On the other hand, using sharding, Ethereum can occupy several niches with different categories of users who are interested in different types of applications. In such a world, separation can make sense and increase the flexibility of the network to work with different groups of users who use the same basic ethereum token.

The fact that sharding representsa fundamental change in the functioning of ethereum explains why this transition is so complex. Existing smart contracts cannot simply be moved to another network. A new network must be created, and on its basis, smart contracts must be created again. The transition will be a painful long-term process. At the initial stages, Ethereum 2.0 will exist as a parallel system along with Ethereum 1.0, and at some point in the future the two systems will be merged into one.

Three phases of transition to Ethereum 2.0

The transition to Ethereum 2.0 will take place in three stages:

Phase 0. Beacon chain

This phase will be launched in July 2020. In the past, its launch was delayed, but now, it seems, it will still take place. This stage will only be aimed at checking the Proof-of-Stake system (and not anything else), so this network can be considered more like a test network, although it will use real ETH.

There are various aspects of the system.Proof-of-Stake, which should function properly, for example: managing a set of stakers; management of funds of stakers; random number generator that helps to choose block manufacturers; voting of stakers for the block; remuneration and fines for staking.

Phase 1. Shards:

Initially, a network with 64 shards will be deployed. At this point, the network will still be largely experimental. While the zero phase is aimed at testing the work of Proof-of-Stake without any other economic activity, the first phase is aimed at testing the basic sharding model.

During this stage, 65 "mini-blockchains" will work in parallel - the Beacon chain from the zero phase and 64 new shards. There will be two-way communication between the Beacon chain and 64 shards.

Phase 2. State execution

It is expected that at this stage the network willsignificant economic activity (and not just staking) and smart contracts. Shards will no longer be basic data containers and will serve as Ethereum 1.0.

The specifications for this stage are not yet completed, and, according to BitMEX analysts, much work needs to be done to get the network ready for this phase.

One way bridge

When Ethereum 2 starts.0, two networks will work in parallel: Eth1 and Eth2. Users will be able to convert ETH1 to ETH2, but without the possibility of reverse conversion. Therefore, theoretically, ETH2 should be traded at a price less than or equal to the price of ETH1. However, in the early stages of the transition, it is unlikely that ETH2 will generally be priced or supported by crypto exchanges, as it will only be used for staking.

To convert ETH1 to ETH2 will usedeposit agreement on Ethereum 1.0. This contract essentially destroys ETH1 coins. Coins are burned forever, although theoretically it will be possible to restore them in Ethereum 1.0 through changes in the protocol through a hard fork. Coins transferred to Eth2 automatically fall into the Proof-of-Stake validator pool.

According to Ethereum 2.0 specifications, each validator requires 32 ETH.If more than 32 ETH are sent to the contract, thenthe staker will not receive rewards from these additional coins, and if less than 32 ETH is sent, the staker will not be activated. Therefore, to convert ETH to Ethereum 2.0, you need to do it in batches of 32 coins. Each batch of 32 ETH can be a separate staker.

Ethereum 2.0 Stake Remuneration Calculator after upgrading to Proof-of-Stake.

Coin issue

As mentioned above, will simultaneouslythere are two parallel systems. Ethereum will continue to work on Proof-of-Work, while Ethereum 2.0 will run on the new Proof-of-Stake system. During this period, both miners and stakeholders need incentives to support the network, so the level of inflation in ethereum will increase (at least temporarily) until the two systems eventually merge. This may be considered a flaw or a price worth paying to ensure a successful upgrade to Ethereum 2.0.

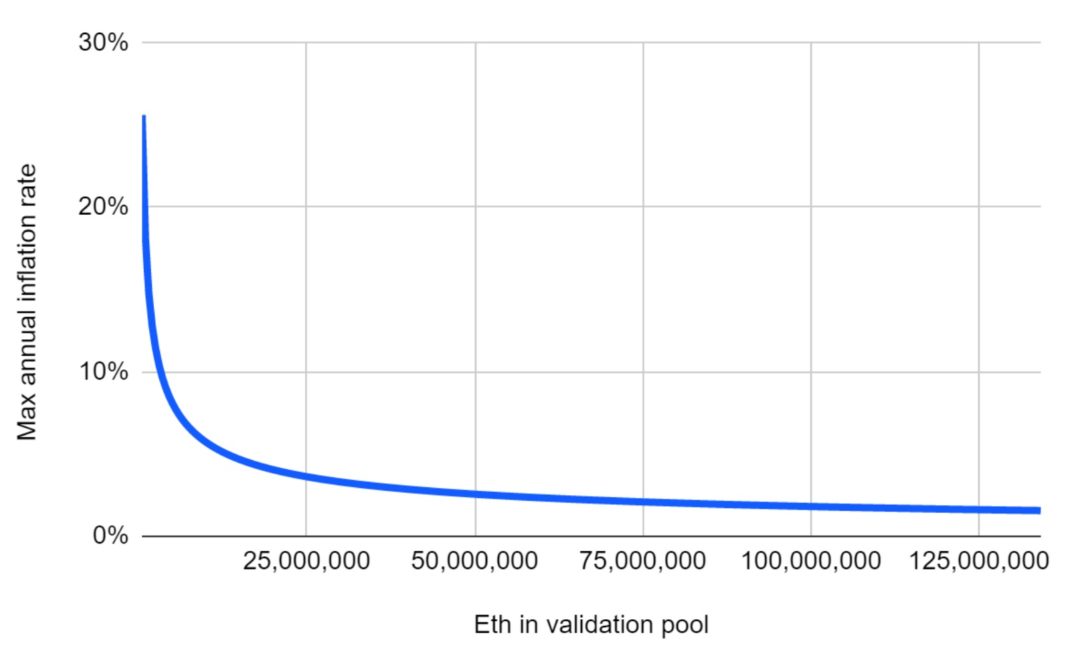

As for the Eth2 inflation chart, the emission level will depend on the amount of ETH that is participating in the stake. The annual release schedule will be based on the following algorithm:

Where Eth2 is the amount of ETH that participates in the pool of PoS validators. These numbers appear to be based on these calculations made by Vitalik Buterin.

The essence of the above formula is that investment income will decrease with an increase in the number of stakers.

The basis for such inflation are incentives. At the initial stages, rewards should be an incentive for moving coins to Ethereum 2.0; as the number of coins increases, the incentive will be less and less. This should ensure the movement of a sufficient number of coins, and at the same time, the issue should not become too high.

Some may pay attention to how such emissions do not fit very well with Ethereum’s initial plans for “constant linear inflation”.

«Continuous linear growth modelsupply reduces the risk of what some consider to be an excessive concentration of wealth in Bitcoin, and gives people in the present and future a real opportunity to acquire the coins, while preventing Ether from depreciating as the "supply growth" percentage still tends to zero over time. 187;.― Ethereum Whitepaper

There are potential factors that can mitigate the potential impact of high inflation:

- It is expected that at the first stage of the commission in the networkwill consist of two elements: the base commission, at which the coins are burned, and the prize, which is awarded to the steakers. These burnt coins can lower inflation.

- If the stakeholders do not participate in the validation process (for example, if the nodes fail), the remuneration for staking will decrease.

- If the validators behave in bad faith, the system can fine them, and these coins will also be burned.

The above mechanisms may result in burning.a large amount of ether, which can reduce inflation, but it is difficult to predict the significance of these factors, so there is considerable uncertainty regarding the issue of coins.

Blockchain Association

According to BitMEX analysts, combining Eth1 andEth2 back to one system can take several years. In the future, Eth1 should become one of the shards inside Eth2. Then it will be possible to move the ether between shards in both directions, and then two coins will merge into one. It is planned that most of the economic activity in Eth1 will continue inside the shard Eth2.

The next step could be a merger of systemsconsensus. Shard Eth1 will be able to gradually switch to Proof-of-Stake. Proof-of-Work will continue to work, but after a given number of blocks (for example, every 100 blocks), consensus can be determined by the Proof-of-Stake system.

In the end, confirmation through Proof-of-Work can be completely discontinued. This would give ethereum users and investors more confidence in the inflation schedule.

Output

The ethereum community loves to experiment withnew and sophisticated systems, be it DAO, ICO, Maker and now DeFi. Some members of the community expressed concern that Ethereum technology has been around for five years, it is lagging behind and something new is needed.

Ethereum 2.0 was the answer for a community that is always open to new ideas, so BitMEX analysts predict that a significant amount of funds will go to Ethereum 2.0 to receive rewards for staking (possibly billions of dollars).

“Many ask us how the launch will affectEthereum 2.0 for the price. Of course, in the short term, a significant amount of ETH can be blocked inside the Beacon chain, which is invested to receive block rewards. This may limit the supply of ETH in the market and raise the price; ETH, on the other hand, can be invested from other smart contracts. However, the real question is whether Ethereum 2.0 will have long-term value, and for this it is necessary not only to limit supply, but also to create sustainable demand ”- analysts write.

For the success of the Ethereum network 2.0 Proof-of-Stake and sharding should attract economically significant components of the Ethereum 1.0 ecosystem. Ethereum 2.0 is an incredibly ambitious project, and analysts believe it is unlikely that everything will go exactly as planned and without serious disruptions.

“However, despite all the potential problems, Ethereum 2.0 is worth a try, because if it succeeds, the potential reward will be very significant.”- analysts conclude.

5

/

5

(

1

voice

)