Cryptocurrencies and their derivatives, decentralized finance (DeFi), are intended to make financialservices more efficient, transparent andglobally available. The latter is especially true for those who, for whatever reason, have limited access to the traditional banking system and live in countries with high inflation, currency restrictions and extremely expensive credit resources.

Public Blockchain Applications (dApps)gaining popularity and are increasingly competing with each other. As a result, the quality of services improves, and completely new products and services appear that compete with traditional counterparts.

Most Most Popular Decentralizedapplications built on the basis of Ethereum. The same platform surpasses competitors in the person of TRON and EOS in the total cost of transactions transmitted through dApps, as well as in the number of users.

However, despite the growing popularity and number ofThe undeniable advantages of DeFi over old-school financial services, the growth rate of the air price disappoints many crypto investors. ForkLog magazine tried to find out why the demand for Ethereum is not yet sufficient to send it to the “moon”, as happened several years ago during the ICO boom.

Unstoppable DeFi Growth

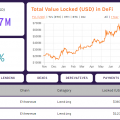

The decentralized finance sector continues to grow steadily. In particular, the cost of Ethereum, blocked on smart contracts of DeFi-applications, moves to the mark of $ 900 million:

Data: DeFi Pulse as of 01/30/2010

January 1, 2020, this figure was $ 667million, therefore, in less than a month, growth was almost 30%. For comparison, at the dawn of the development of DeFi in November 2018, the volume of blocked Ethereum was $ 189 million, that is, this figure was 4.6 times less than the current one.

The undisputed leader in this sector isMakerDAO project - it accounts for 57.66% of blocked airtime. In absolute terms, this is 2.5 million ETH or 2.28% of the total market supply of the second cryptocurrency by capitalization.

Given sector growth and popularityMakerDAO in particular, it can be assumed that the role of such services in the Ethereum ecosystem will continue to grow. In the future, this should push up the price of ether due to the steadily growing demand for it.

However, not everything in this area is so smooth, there arecertain risks. For example, researchers at Digital Assets Data concluded that 42% of MakerDAO's secured debt positions (CDPs) are stored in two wallets. Such a significant concentration of funds in whales clearly contradicts the concept of a decentralized autonomous organization.

Moreover, possible critical vulnerabilities incode can lead to theft of huge amounts of funds. For example, last November, the Maker Foundation prevented the potential theft of all ETH collateral worth more than $ 333 million. If an attacker took advantage of the vulnerability, all of this ether or a significant part of it would most likely be sold soon. This would negatively affect the cryptocurrency market as a whole.

The lion's share of financial DeFi applicationsare based on Ethereum. However, such dApps can be created on the basis of various networks. For example, analogues of MakerDAO based on the RSK bitcoin side chain are being developed, the DeFi Pulse service refers to the decentralized finance second-level protocol Lightning Network. Consequently, Blockstream's Liquid sidechain, as well as the decentralized Bisq exchange based on the blockchain of the first cryptocurrency, can also be attributed to DeFi.

However, the most rapidly growing activity onEthereum exchanges. For example, only during the third week of January the trading volume on such DEX increased by 50%. Among the popular non-custodian platforms are Uniswap, Idex, Kyber and the growing popularity of Oasis. The latter appeared in November last year along with a multi-security version of Dai stablecoin.

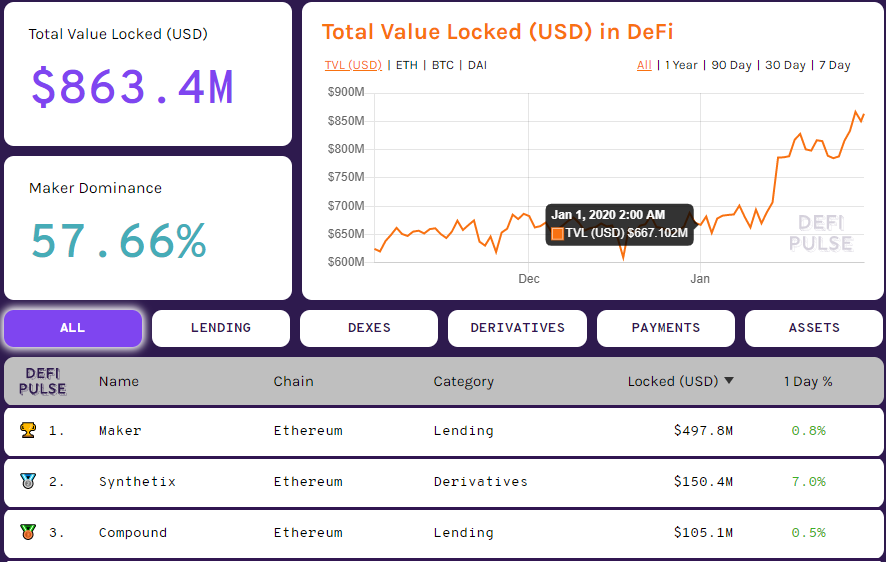

At the end of 2019, the total volume of DEX amounted to $ 2.36 billion. Approximately the same turnover is achieved per day on the OKEx or BitMEX crypto-derivative exchanges:

Data: skew as of 01/30/2020

Also for comparison, the daily trading volume on the ten spot exchanges included in the Bitwise rating is usually in the range of $ 600-800 million.

Thus, despite the rapid growth,DEX is still far from centralized trading floors. However, it is possible that the lag will decrease over time - the interface of decentralized exchanges becomes more user-friendly, the functionality of the platforms expands and problems with their liquidity are solved.

Ethereum price is not growing so fast

It would seem that the demand for ETH and therefore itsprice should rise after DeFi. However, the market price of ether today is the same as in May 2017, when the bubble of primary coin offerings was still gaining momentum.

TradingView Bitfinex ETH / USD weekly chart

Ethereum is currently 87% lowerthe historical maximum reached in January 2018 near the $ 1,400 mark. Moreover, nominations in BTC ETH price is now even lower than in March 2016.

According to CoinPaprika, since the beginning of 2019, Ethereum price recovery has been much slower than for BTC, BCH, BSV, LTC, EOS and BNB:

Many experts consider the volume of transactions as almost the main fundamental factor in the analysis of a particular cryptocurrency. At Ethereum, this figure has been falling rapidly since mid-July:

The largest on-chain activity in the Ethereum network took place at the turn of 2017-2018, in the midst of “ICO fever”. Data: etherscan

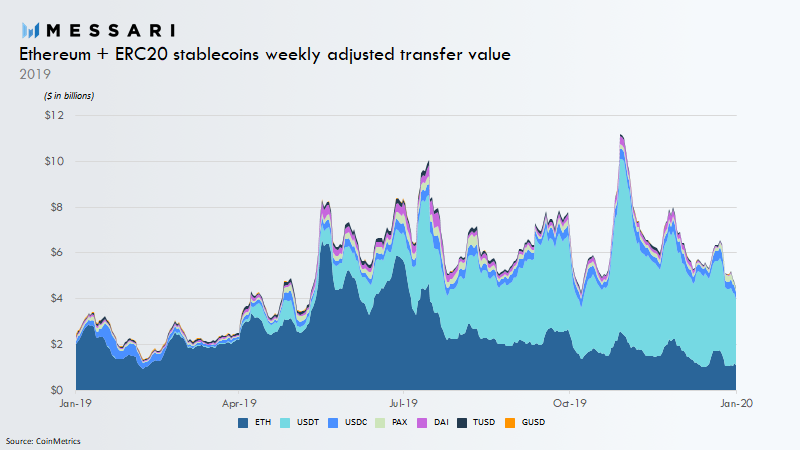

It is also noteworthy that since about mid-2019, most of the value on the Ethereum network has been transmitted through stablecoins, and not through its own ETH cryptocurrency.

Dynamics of volumes of transferred value in Ethereum and popular stablecoins of the ERC-20 standard

However, in 2019 the total costtransactions in decentralized applications based on the Ethereum blockchain reached $ 12.8 billion, exceeding similar indicators in the EOS networks ($ 6.1 billion) and TRON ($ 4.4 billion).

Ethereum continues to lead in the number of dApps deployed - as of early January, the network had 1,223 active decentralized applications, 668 of which were created in 2019.

Thus, despite the demand for ether in decentralized finance, its price increase does not outstrip the wider market, and on-chain activity leaves much to be desired.

Why is this happening?

Delphi Digital researchers Enil Lulla and Ian Liberman emphasize that despite the steady growth of DeFi, activity in this sector is still far from what was observed during the ICO boom.

“We need to take a step back to assess the scope of the decentralized finance sector relative to Ethereum, - experts share their thoughts. -The volume of ETH coins locked in DeFi is onlyrecently crossed the 3 million mark. Despite the fact that the annual increase in this indicator was about 1 million, this is less than 3% of the total supply of ether [109.5 million].”

Lulla and Lieberman note that locked invarious DeFi applications of 3 million ETH are nonsense compared to more than 16 million ETH collected by ICO projects from mid-2016 to early 2018. It is also worth considering that a few years ago, the ETH market supply was slightly less than now. Thus, the impact of the ICO boom on the price of Ethereum was really significant.

“It’s important to understand that we cannot compare apples with apples, since these 16 million coins were not simultaneously blocked, Delphi Digital experts continue. -Of the approximately 11.5 million ETH raised through the ICOat the end of 2017, only approximately 29% of tokens were listed on exchanges. It is safe to say that the bull market has been the main driver of the ETH price in 2017. However, it is these values that help quantify how much greater the impact of token sales on the price of Ether was compared to current DeFi, and why the impact of the latter is still relatively small.”

Experts are sure that the DeFi sector mainly involves people who are already familiar with the cryptocurrency market and would like to increase the profitability of their long-held Ethereum assets.

Among other things, the price of ether for a long timeexperienced pressure from large sellers in the face of ICO projects, in which significant coin reserves remained in storage. According to the Delphi Digital report, by February 2019, 60% of the total amount of these funds had already arrived on the exchanges, most likely for subsequent sale. A significant part also got to OTC-platforms, therefore it is difficult to estimate the exact number of coins sold by ICO-projects.

In general, Delphi Digital analysts believe that the price of Ethereum so far for the most part depends on speculative demand, and the impact of decentralized finance remains insignificant.

“In order for the DeFi sphere to have a more significant impact on the price of ETH, applications should begin to attract users who have not kept cryptocurrency for years”- summed up the experts.

***

DeFi continues to evolve - appearnew, interesting open source projects that solve a variety of problems. The competition between these projects is gradually becoming tougher, helping to expand the functionality of services and improve the user experience.

Despite the relatively high potential and pacegrowth of the DeFi sector, the degree of mass adoption of decentralized Ethereum applications so far leaves much to be desired. However, it is possible that the growing popularity of dApps on a global scale is only a matter of time. It is highly likely that the chronic inefficiency of traditional finance will continue to contribute to the development of the young cryptocurrency market segment.

Also probably a lot depends on the increaseEthereum’s performance and lower cost of operations on its network. However, developers are dealing with these issues, and the creator of Ethereum Vitalik Buterin is optimistic about the future - he is confident that the platform is stronger than ever. As far as he is right, time will tell.

Alexander Kondratyuk