Most cryptocurrencies are unevenly distributed among holders. Bitcoin has 2000 richest addressesown more than 40% of issued coins. This is only 0.01% of all addresses - an unprecedented concentration of capital in comparison with fiat.

On the Ethereum network, almost half of the money supplybelongs to 200 wallets, in lightcoin - 130. But even these numbers of PoW blockchains fade before the inequality in some PoS blockchains. For example, in EOS, a good half of the coins are contained in only 10 wallets.

Why did this happen and what to expect next? How will the popularization of exchange PoS stacking affect this inequality?

Power and wealth in PoW and PoS cryptocurrencies

Since ancient times, the concentration of power and wealthconnected to each other. Wealth allows wealthy people to hire workers (even power professions) for their needs. On the other hand, political power gives officials access to tax revenues, and sometimes money issues.

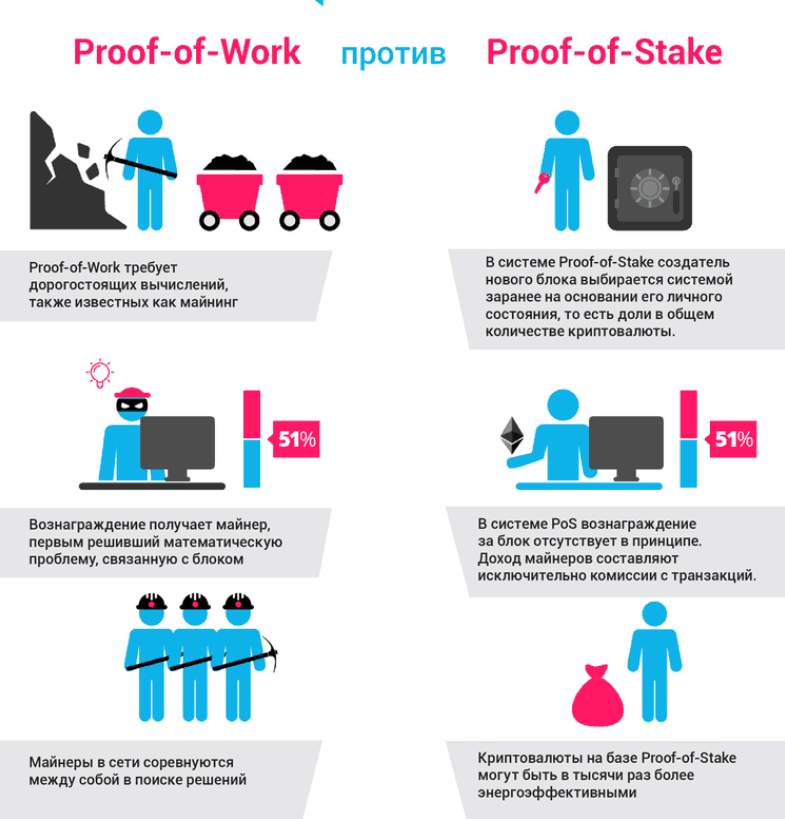

Among cryptocurrencies, there are two main approaches to the distribution of power and wealth over projects - PoW (Proof-of-Work) and PoS (Proof-of-Stake).

In PoW, power is vested in miners providingnetwork computing power. The more of them, the more votes the miner has in deciding on the development of the network and the higher the reward. If someone saved a lot of coins, but does not participate in mining, then he does not have votes to manage the network.

The situation is different in PoS. This principle is designed to correct the main disadvantage of PoW - a huge consumption of electricity. But the issue of power in it is solved in a very doubtful way: the number of votes is directly determined by the number of coins that the user temporarily “freezes” for taking / stacking - an analogue of a bank deposit, on which interest accumulates over time (usually higher than in banks).

So, in PoS, wealth simultaneously gives bothpower and income. This obviously helps centralize the system. The only decentralization issue where PoS protects the system better than PoW is a 51% attack.

If in PoW currency someone takes over 50%mining, it will receive the network for sole use and may deprive other miners of earnings, make double spending or completely freeze the network. Having received the result (quick money or discrediting the network), he can switch equipment to mining other coins as if nothing had happened. This is possible in PoS, but then the attacker himself will probably suffer: because of the discrediting of the network, the rates of his own coins that he used to attack will collapse.

PoS coins will become a trend in 2020

For a long time, PoS coins were in the shadow of PoW. Even now, the most popular EOS PoS coin takes only 8th place in the capitalization rating. Two more coins - Tezos and Cardano - occupy 10th and 11th places, respectively.

The masses only learned about the principle of PoS in 2017, when talk about the future transition of the ETH cryptocurrency from PoW to PoS intensified. However, to this day this transition is postponed.

The sharp popularization of PoS began at the end of 2019thanks to the advent of stacking services on large cryptocurrency exchanges. Today, more and more people prefer to keep coins not in personal wallets (often bulky and difficult to use), but on exchanges. And if before PoS-coins on exchanges could only be stored, now right there they can receive income in the form of interest from stacking.

The currency was especially famous for exchange stacking.Tezos, which combines smart contracts such as ETH and profitable PoS capabilities. If until October 2019, its rate followed in the general channel of BTC and other currencies, then since November it has risen sharply. In the 20s of October, the coin cost about $ 0.8, in early December - $ 1.5, and now - about $ 4. For four months, the coin went up five times and actually ignored the second cryptozyme of December 2019. The XTZ rate is growing so rapidly that it is likely to overtake EOS, or maybe some of the leading PoW coins.

For other PoS coins, outperforming PoW competitorsnot so obvious, but also noticeable. If the overall capitalization of the crypto market, after a recent failure, has so far returned to August levels, and the BTC rate only to September levels, then ADA, NEO, Cosmos, VetChain and a number of other PoS coins have already restored their July positions. EOS and Dash were also at July levels in mid-February, although they have now corrected to September levels.

Inequality among PoS Coin Holders

Generally, when comparing holder inequalitycoins, analysts pay attention to the number of wallets containing half of the existing money supply, as well as the number of richest wallets containing 1000, 10 000, 1 000 000 coins, etc.

The most known data for BTC: approximately 2,000 wallets contain 1,000 coins or more (at the current exchange rate more than $ 10). In total, they control about half of the entire money supply. Since 2012, the percentage of such wallets from the total number of accounts has not changed much and amounts to about 0.01%. The concentration of capital in the leading altcoins is even higher: approximately half of all ETH coins are in 200 wallets, and lightcoins are in 130.

But what do we find if we look at the dataPoS coins? The first coin, EOS, impresses with its degree of centralization. Since mid-2018, approximately half of them have been controlled by about 10 (!) Users, and the PoS algorithm has been modified so that 21 players have almost complete control over the network. The third coin, ADA, is slightly better: there 40% of the funds are concentrated in 39 wallets. In such blockchains, it is easy to expect a conspiracy of the largest holders, and no decentralization can be talked about.

We can say that in these currencies there is no 51% attack, not because the whales cannot commit it, but only because they do not want to.

Economic disadvantage of an attack of 51% forPoS currencies are their advantage and at the same time the Achilles heel: the community is less afraid of it and therefore looks through the fingers at inequality. But there is no full guarantee against such an attack: if a strong competitor wants to discredit a small promising coin for the sake of the success of his own business, he will not spare the money to buy her “controlling stake”, which is technically much easier with a small number of whales.

XTZ differs from EOS and ADA asidedecentralization: here, since 2018, 50% of coins have been distributed between no less than one hundred owners. This is one of the reasons why XTZ exchanges are especially willing to accept for stacking.

However, in the same 2018, David Floyd, that 50%all interest income is still given to about 10 holders, 8 of which are directly related to the project. But this could be due to the fact that not all holders figured out the mechanism for independently providing a “steak” for interest, and exchange-based stacking has not yet gained popularity.

Will cryptocurrency exchanges save PoS blockchains from centralization or strengthen it?

Exchange stacking services greatly contribute to the decentralization of PoS coins.

- Firstly, because a larger percentage of network participants are involved in stacking, depriving this privilege of the most advanced (in the first place, the team members themselves).

- Secondly, ceteris paribus, preferring coins that will bring fewer problems with regulators, as they are less prone to manipulation.

But exchange stacking is just starting to take root. It starts with “respectable” decentralized coins, but it is possible that for other popular PoS coins this is only a matter of time. In extreme cases, practically nothing will prevent the richest holders of EOS or ADA from sharing their funds between many wallets, simulating a decrease in centralization.

At the same time, the exchanges themselves will eventuallyConcentrate a growing percentage of PoS blockchain coins. And although these coins formally belong to many owners, technically the exchange can “lend” them for a while for the same manipulation of rates.

So, first down, centralizationDue to the actions of exchanges, PoS blockchains can begin to intensify again. But in any case, such a restraining factor as public and state rejection of overly explicit manipulations remains against this. The more “indecent” they are, the more actively users will begin to switch to more predictable blockchains.

</p>Rate this publication