In a message published on GitHub, the creator of Ethereum shared his opinion on the amount of reward for minersafter the currency switches to PoS. According to Buterin, this amount should be higher than previously proposed.

Ethereum, like Bitcoin and Litecoin, operates onProof of Work algorithm, which requires the use of computing power to verify transactions. Users pay miners a fee to process transactions and also receive rewards for mining new coins. However, PoW has its drawbacks. The algorithm incentivizes the creation of huge mining pools, which increase competition for rewards and transaction fees, resulting in increased computing power that contributes to the network. The end result is a massive investment of resources in both power coverage and equipment.

Unlike the first algorithm, Proof of Stakeuses a reward system based on the number of coins owned by users. The more coins – in this case ETH – the more they contribute to the functionality of the network, for which they receive greater rewards.

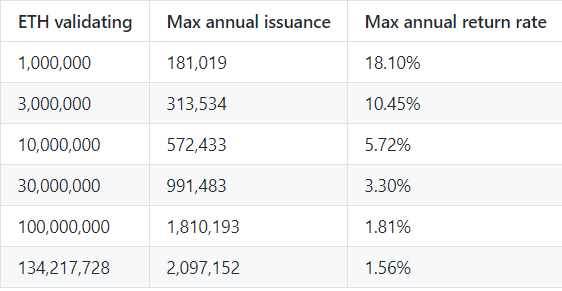

However, since Ethereum is inDuring the transition to the PoS algorithm, miners will be faced with a proposition such as the percentage of coins that must be awarded per stake. Buterin's proposal calls for the creation of 2,097,152 ETH per year, for a total supply of 134,217,728 ETH. The result will be an annual dividend of 1.56% for investors – The amount seems to be small, but it will also avoid excessive ETH inflation.

Buterin also offers a breakdown of the differentpayouts based on ETH rates. Compared to the previous value, 1 million Ether stakes will yield a return of 18.10%, and 10 million – net rates 5.72%.

Justin Drake, Ethereum researcher, responded inGitHub comments on its endorsement of Buterin's algorithm. Targeting 32 million Ether, which Drake called the ideal figure for maintaining network security, investors can expect a base return of 3.2%, with Ethereum annual inflation of around 1%, which is much lower than the average inflation in the United States, equal to 3.22%.