So, at the end of the year the crypto market warmed up quite well. The old fox, Steve Wozniak, captured this moment subtly andentered the market with his project Efforce,offering to the general public its WOZX token. I put on his tip and make a small adjustment to my portfolio - I reduce the share of USDT and add this token to assets:

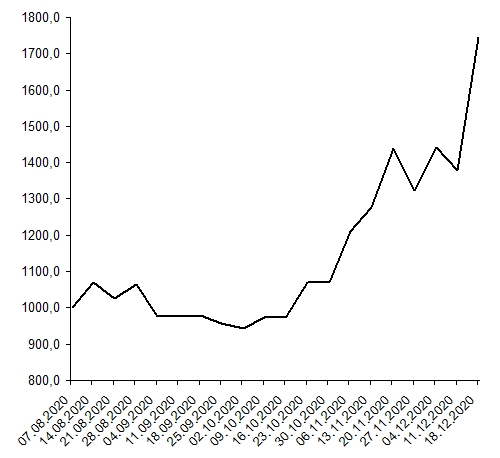

Markets have grown well this year, but aheadthe threat of new mutations in the crown looms, and old man Trump is in no hurry to admit defeat. Perhaps January will bring us the long-awaited correction, but in the meantime, we are enjoying the well-deserved 74.5% yield:

(Profitability of the public crypto portfolio August – December.)

</em>

As I thought, the crypto portfolio idea is greatworked. I bypassed Karpov in terms of profitability on the LPI, entering the conditional TOP-50 of the smartlab (as of December 17 of this year). Forgive Karpukh, but this time my foresight did not give you a single chance:

(My portfolio deservedly entered the TOP-50 Smartlab traders on the LPI in terms of its profitability.)

</em>

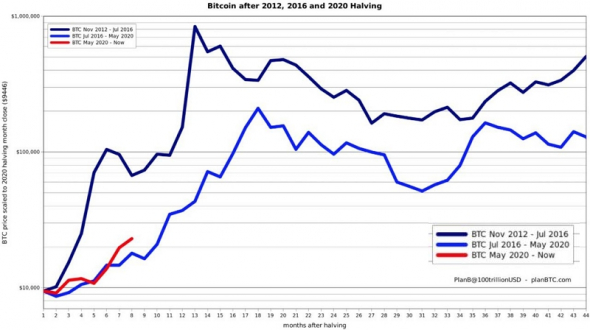

What's next?The UNI token reward for the so-called "liquidity mining" on Uniswop is over, so I moved this position to the Muniswop dex (they should also issue their token there). Bitcoin is still ahead of its last four-year cycle, I think it's time to slow down. Well, then - forward to new heights!

(Bitcoin dynamics after halving in 2012, 2016 and 2020. The horizontal axis shows the months since the halving of the block reward.)

_____

my blog/Yandex-zen/telegram

</em>