The total crypto market capitalization index, which started the week at just over 2T USD, showedalmost “perfect” linear growth, reachingby the end of the week the value was 2.355T USD (an increase of 16.3%). It is obvious that with similar market dynamics, the previous ATH (2.474T) will be reached and exceeded in the near future.

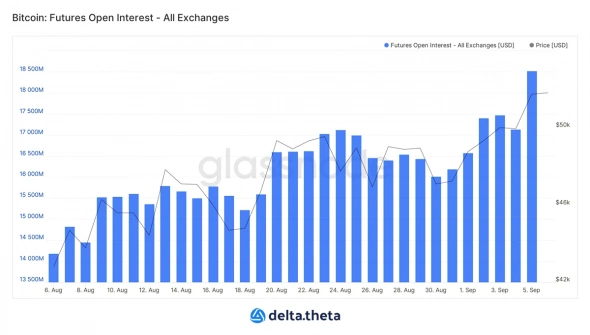

By the end of the week, BTC increased by more than 11% (50,850 at the end of the week) and finally “broke through” the resistance level of 50,000. At the time of publication, the main cryptocurrency is already trading above 51,000.

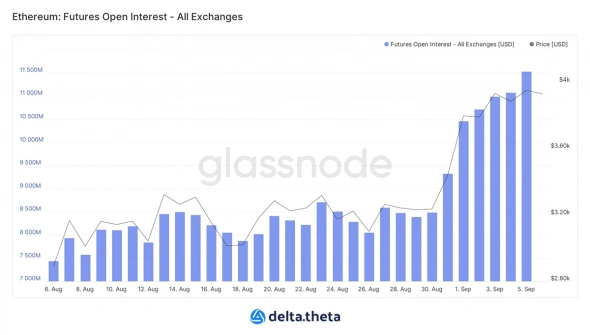

The ETH price movement was more amplitude, and according toAt the end of the week, growth amounted to an impressive 23.9% (from 3218 to 3970). At the moment, the price tested the resistance level of 4000 for the first time since May, but then corrected.

Analyzing the movement of financial flowscryptocurrencies between exchanges, smart contracts and users, we can see that as the BTC price exceeded 50,000, there was a shift in the BTC balance on exchanges towards withdrawal. Then the balance again found itself in the neutral zone (perhaps there was a slight liquidation of the positions of short-term holders).

Perhaps for similar reasons, the ETH balance returned to the neutral zone (however, then it again shifted towards the withdrawal of funds).

A sharp increase in open interest in futuresBTC and ETH last week were quite expected against the backdrop of a corresponding change in asset prices. In the case of BTC, the trading volume is not far from its ATH, and an additional factor predetermining further growth is that in the speculative volume of BTC, an extremely small share is occupied by coins purchased less than 1 month ago (market participants are determined to hold further). In the case of ETH, this is the ongoing NFT and DeFi boom, as well as growing interest in the second cryptocurrency from institutional investors.

Among the main news of the past week are the following:

The SEC began to study other DeFi segments,besides Uniswap. According to inside information, SEC officials are conducting a massive investigation into a number of DeFi platforms. It is not known for certain whether this investigation will lead to any action against Uniswap and other platforms. The Ripple case shows that such pressure can and should be fought.

Through the efforts of entrepreneur Ricardo Salinas Pliego,There are private attempts to accept Bitcoin in Mexico. He tweeted that his company Grupo Elektra plans to integrate Layer 2 Bitcoin solution into its payment system. Despite this, Mexican financial authorities remain opposed to crypto-assets, doing their best to prevent such initiatives.

Vast Bank clients will be the first in the US to buy andstore cryptocurrency in insured accounts. Among the assets available will be Bitcoin, Ethereum, Cardano (ADA), Filecoin (FIL), Litecoin (LTC), Orchid (OXT) and Algorand (ALGO). Funds up to 250,000 USD will be insured by a policy provided by Coinbase.

The other day, the Houston Bitcoin Meetup took place, as part ofwhich miners and representatives of Texas oil and gas companies discussed mutually beneficial cooperation. Texas, with its deregulated energy system, large hydrocarbon reserves and positive attitude of the authorities towards the crypto industry, has every chance of becoming the “capital of bitcoin”. It was around this topic that the main discussions were focused.

According to the September issue of the Bloomberg reportCrypto Outlook, BTC will reach $100,000 and ETH will reach $5,000. The report says that now, after the correction, the cryptocurrency market is expected to “move forward and upward.” This is not the first time such a Bitcoin price forecast has been made. Crypto enthusiasts and experts have made some seemingly bold predictions, with some even suggesting that a $1 million price tag could be possible.

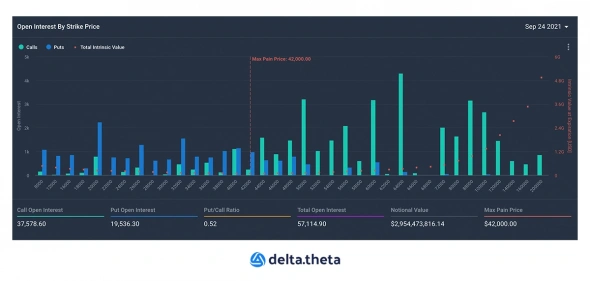

Options market volume has increased for the seventh week in a row.The size of open interest for transactions with an execution date at the end of the third quarter—September 24—increased by 5.8% and amounted to 57,114 BTC. Call options traded two and a half times more than put options. Most of the interest was concentrated at the 60,000 mark for call options.

By the size of open interest of options withexecution in December increased by 5% and amounted to 50,474 BTC. The increase in interest was evenly distributed between the main levels - 48,000-50,000, 60,000-64,000 and a wide range of 100,000 - 200,000. For put options, respectively, these are the marks of 40,000, 32,000, 20,000-24,000.

Volume of total interest for all execution datesincreased by 6.2% and amounted to 166,173 BTC. The increase was split equally between call and put options. The main increase in interest for call options occurred at 60,000 and 80,000, and for put options - at 30,000 and 50,000. The increase in demand for put options may be due to the participation of professional traders and corporate market participants who hedge their positions on the spot market .

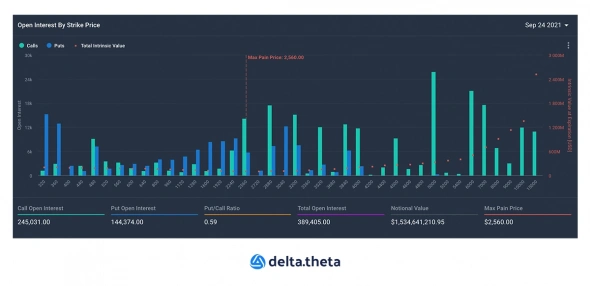

Open Interest Volume for Date Optionsexecution on September 24 increased by 19.9% and amounted to 389,405 ETH. Call options were traded 30% more than put options. For call options, the main increase in market activity was noted at the levels of 4,000.6,000 and 7,000. For put options, 3,000, 3,200 and 3,800 were most in demand.

Options with a strike date of December 31 are notwere very popular, trading increased by 2.5%, the total volume of open interest is at 442,005 ETH. Probably the main activity for this date will start after the end of the third quarter.

In the general market, the level of interest increased by 8.9% and amounted to 1 304 971 ETH. The largest share of the gain was at the levels 4,000, 6,000 - 8,000 for call options and 3,200 for put options.

</p>