Why and what are the reasons for this growth?on the balance of supply and demandBitcoin is conducted by Alexander Yanyuk, financial expert at CEX.IO Broker.

4–BTC/USD hourly chart from the platformbroker.cex.io

The second half of July was successful forinvestors in the digital asset market. Starting on July 20, Bitcoin is up 25% for the rest of the month. And all this happened under the expiration date of futures on the CME Chicago exchange. It is also worth noting that the exchange set an absolute record for a daily trading volume of $ 1.3 billion, as well as a maximum open interest volume of $ 724 million. These figures exceed the average by 350%.

The derivatives market has been very strong latelyhas grown in terms of volumes. And this is not surprising - the spot market is very small for the whole world, because the amount of bitcoin is limited, and there can be an unlimited number of various derivatives (options, settlement futures). Taking into account halving, at the moment, according to various analytical agencies, bitcoin is mined in the world twice less than the volume of demand for coins. Therefore, derivatives are becoming more and more attractive. Plus, they are traded on regulated exchanges, which allows institutions to participate in digital asset trading.

When analyzing liquidity flows and balance onthe cryptocurrency market, of course, should first look at the spot market and only then at the derivatives. But don't think that the derivatives market does not affect Bitcoin's pricing.

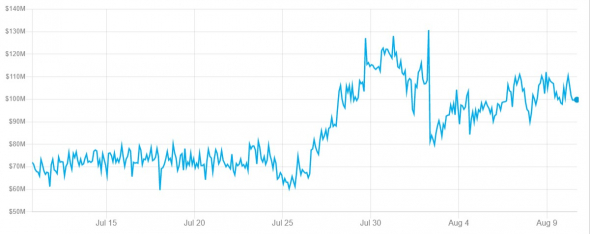

Over the past month, the average daily volume of the entire crypto market has grown from $ 50 billion to $ 125 billion, according to coinmarketcap. Of these, bitcoin accounts for about 28 billion.

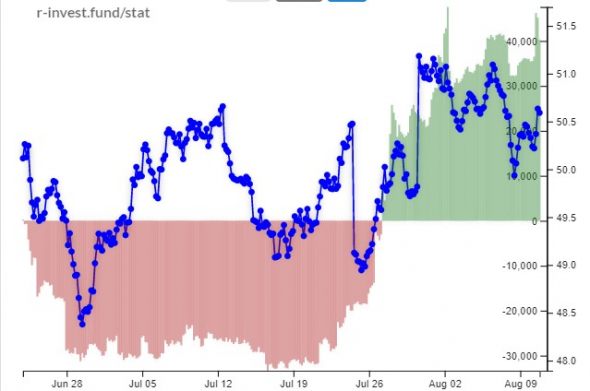

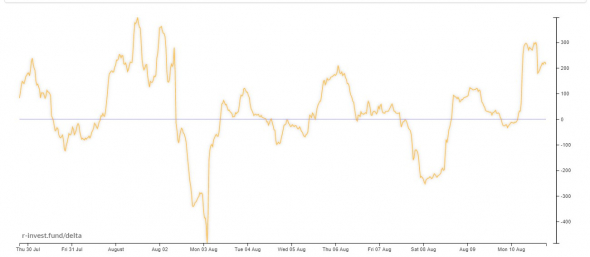

Cumulative delta by volume in the bitcoin spot market

If we look at the cumulative delta in volume, thenBefore July 26, bitcoin was sold more on the spot market than it was bought. But already from July 20, the volume of purchases began to grow, and the delta began to go into the green area. That is, the current rally took place on active buying market. Prior to that, the price was kept by the limit above the level of 9 thousand and the larger participants were gaining a position. And when the position was already collected, the buy market was “turned on”.

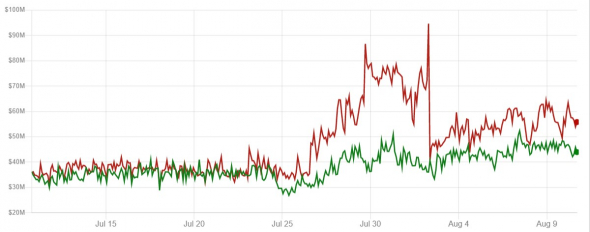

The volume of limits in the order book increased from $ 70 million to $ 120 million. This indicates the growing interest of professional participants in current prices. Because retail investors mainly use market orders.

Total volume of limit orders in order books

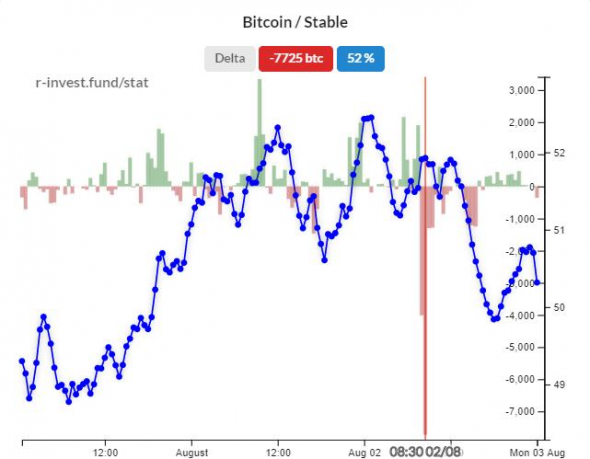

At the beginning of the month (2.08) the first major profit taking occurred. More than 13 thousand bitcoins were sold on the market. The price reacted with a 12% drop. The volume of limit orders fell to average. The euphoria was stopped. Now there is organic growth driven by increased demand.

Profit taking 2.08(in 5 minutesutsold 7725 BTC on the market)

We, at broker.cex.io, we believe that the market selling was initiated by the participants who held limit orders in the order book. (green is bid, red is ask). We see that limit sellers used the rising market to unload their positions because the number of limit sell orders was growing faster than the number of buy orders. And of course, if there are too many limit sellers, then the demand market cannot overcome the resistance and dries up.

Dynamics of changes in the volumes of limit demand (green) and supply (red)

I count on the flat movement of bitcoinuntil the end of the month, because at the end of the month there are expiration of futures on the CME exchange and also the expiration of options on the deribit exchange with an open interest of 43 thousand BTC. Analyzing now the supply and demand of market participants, as well as limit players, we can come to the conclusion that the market has found a balance at the current levels, although the asset is a little overbought.

Aggregated Difference Between Market Buys and Sells

Until new imbalances appear on the market,count on trend movement. Because a trend needs energy, it needs fuel, and it appears only when the activity of the market or limit market participants increases. Now the accumulation of limit orders is located at prices 10270 and 12060. Therefore, count on this range as a trading corridor.

Broker CEX.IO was launched for testing in a closed beta format on April 1, 2019 under the abbreviated beta name CEXBro, and has been open to customers since the end of January 2020. The purpose of the project is to provide traders and investors in the cryptocurrency market with access to professional and reliable financial instruments, including margin trading and derivatives.