The main disadvantage of traditional money is that it needs to be trusted—we have to believe inthe honesty of central banks, but the story is full of examples where banks undermined that trust by devaluing fiat money.

Satoshi Nakamoto

Amid ongoing world war with COVID-19for many investors, questions about the medium and long-term consequences of government intervention in the economy through monetary and fiscal policies have become relevant again.

Desperate to mitigatearising cyclically and, consequently, the inevitable crisis, the central banks of developed countries resort to such exotic measures as quantitative easing (QE) and “helicopter money”. However, the effect of these measures can be compared with the action of paracetamol or aspirin in severe illness - if relief comes, then short-term, and the disease itself does not disappear.

ForkLog Magazine Offers Readersan article about the direction the global economy is moving and why, in our opinion, the popularity of bitcoin will grow over time both among experienced investors and among many ordinary users.

Fragile world economy

The beginning of 2020 was marked by globalflight to the US dollar. Investors came both from relatively risky financial instruments such as stocks, and from traditionally defensive assets, the brightest representative of which is gold.

Widespread panic due to the coronavirus pandemicBitcoin also affected - on March 12-13, the first cryptocurrency collapsed to the accompaniment of a fall in world indices and commodities, the demand for which fell significantly due to the global lockdown.

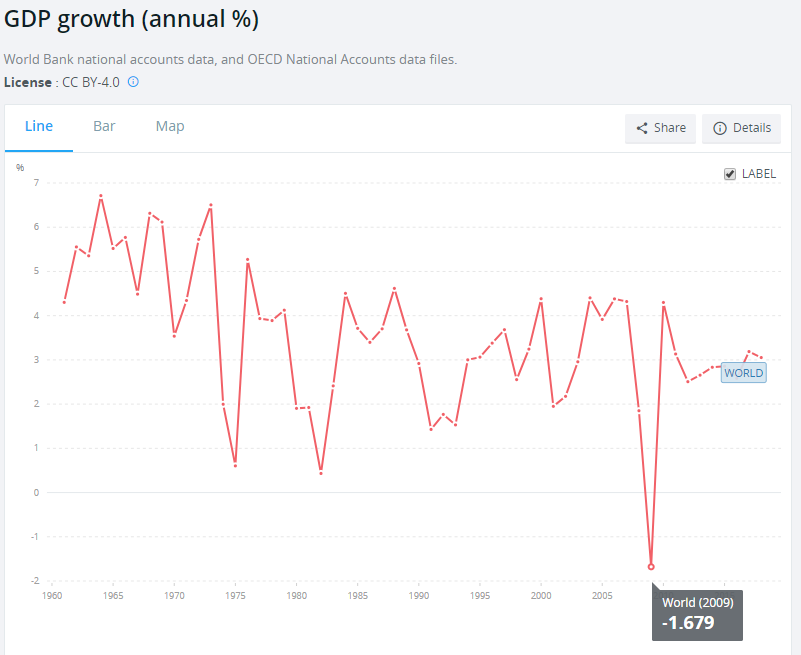

To date, few doubtthat the global crisis has already begun and the worst may be yet to come. In particular, the April IMF report says that in 2020 a sharp decline in the global economy by 3% is forecasted. This is much more than during the financial crisis of 2008-2009. No less pessimistic forecast for the European Commission - in Spain, Italy and Greece, GDP is expected to fall by more than 9%.

In 2009, the fall in world GDP was 1.68%. Data: World Bank.

Thus, there is every reason to believe thatthe current crisis, triggered by the COVID-19 pandemic, will be more difficult for the global economy than the previous one. Consequently, recovery from the effects of a recession can be dragged out.

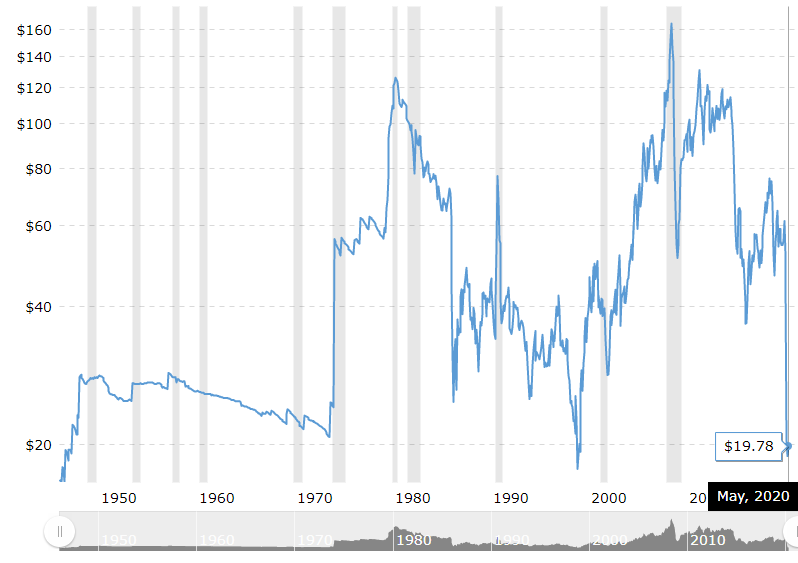

Currently under the greatest blow putcompanies with a large debt burden and a small margin of financial strength - many of them faced the threat of bankruptcy due to extremely low revenue. In particular, the fall of oil to the level of 20 years ago dealt a crushing blow to the industry, where there are many American companies.

The price of West Texas Intermediate (WTI) is now at the end of the last millennium. Data: Macrotrends

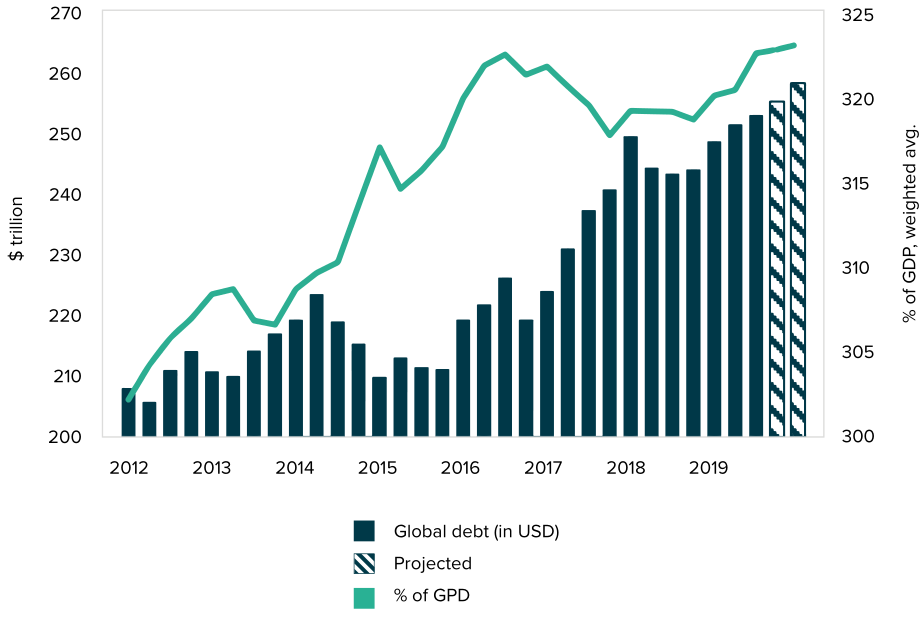

“A further decrease in revenue for companies in most industries, high unemployment rates and historically low oil prices may cause a deflationary spiral with a global debt of $ 255 trillion.", Says a recent Grayscale Investments report called Bitcoin’s Quantitative Tightening.

It is worth noting that global debt has already reached a record 322% in relation to global GDP:

Data: Global Debt Monitor

Trying to somehow influence the currentsituation and prevent further collapse of asset prices, bankruptcies and layoffs, the central banks of many countries aggressively intervene in the market. In conditions of extremely low interest rates, these efforts are often in vain, which only emphasizes the thesis of the fragility of the interconnected financial system in times of global upheaval.

Against the background of the March collapse of world indicesThe Federal Reserve System (FRS) has cut its key rate to almost zero. It was also decided to repurchase treasury bonds and other debt instruments"In necessary quantities".

Soon after, the U.S. Congress passeda bill to inject $ 2 trillion to support large and small businesses, which also includes direct payments to individuals and families, unemployment assistance and loans for companies in a difficult situation. $ 25 billion of this aid package was allocated to support passenger airlines.

Grayscale Investments experts call the intensity and scale of US government intervention in the economy unprecedented:

“During the first quantitative easing, withNovember 2010 to March 2010 (that is, over 16 months) the Fed added $ 1.5 trillion to its balance sheet. For comparison, by now the Federal Reserve has printed $ 2 trillion for two months. So far, this may not particularly affect purchasing power, but inflation is accelerating. ”

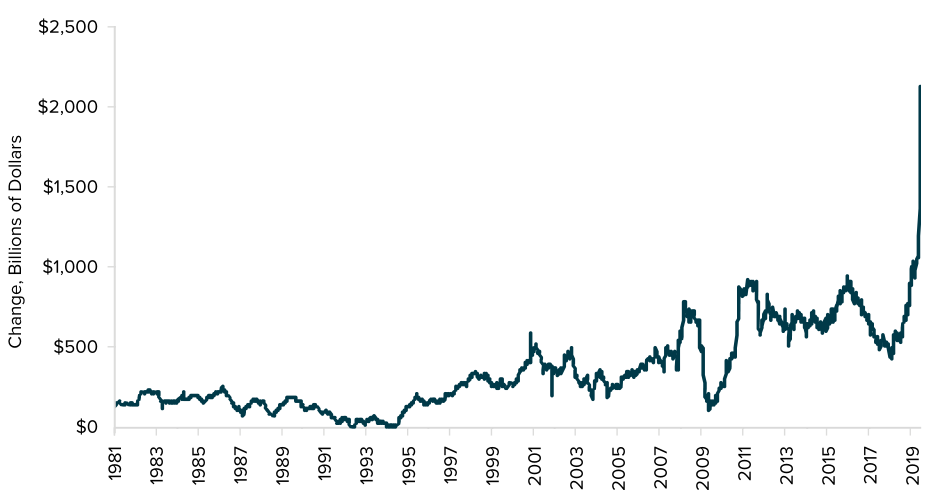

The actions of the American regulator directly affect the M2 monetary aggregate, including cash, demand deposits, checks, as well as time deposits and some highly liquid assets.

The graph below illustrates the ascent of M2 to unprecedented heights:

Source: St. Louis Federal Reserve Bank, Grayscale Report

“QE cannot be undone without causing deflation, forthe fight against which this measure was intended. Just as QE increases the price of assets by creating money, any decrease in monetary supply means a fall in the prices of these assets. Although the printing of money by central banks is designed to give an impetus to the global economy, this cannot continue continuously without negative consequences for fiat currencies, for which these regulators are responsible. We have witnessed numerous examples of currency depreciation and subsequent hyperinflation, both in the US and abroad: the Confederate dollar and much later examples - the Argentine peso, the Venezuelan bolivar and the Zimbabwean dollar. ”, - Grayscale analysts shared their thoughts.

According to experts, monetary and fiscal stimulus measures are unprecedented. At the same time, governments are unlikely to abandon their application in the foreseeable future.

“Given that global debt is $ 255 trillion, or 322% of global GDP, such an adaptive policy is unlikely to ever be reversed.”, - emphasized in Grayscale.

Investment Opportunities During Economic Uncertainty

Fiat currencies. Investors often go fiat during periodsuncertainties. However, national currencies are at risk of devaluation due to the intensive printing of money by central banks. The exception may be the US dollar, which is the world's reserve currency.

However, as already mentioned, the Fed is conductingaggressive monetary policy to combat the risks of deflation and revitalize business activity. At the same time, the regulator risks going far beyond its goal by depreciating the dollar and breaking its faith in the monetary system.

Government bonds.These instruments have long been perceivedamong investors as a kind of “safe haven”. However, in the current situation with negative interest rates and active expansion of the money supply, even these instruments are losing their former significance.

Real yield, representing nominal yield minus inflation, has become negative for the first time since 2013. The assets of bondholders depreciate over time.

Moreover, in modern conditions, as measuresstimulating the economy can be expected to expand the supply of treasury bonds. The latter, therefore, can hardly be perceived as tools to protect against the intervention of central banks in the operation of the market mechanism.

Gold and Bitcoin.For thousands of years, gold has been valued becauseits corrosion-resistant properties and scarcity. However, the zeitgeist demands money that is digital, portable and at the same time accessible to everyone, while also providing a long-term store of value.

Bitcoin and gold are fundamentally similar - both assets are scarce and hard to mine. There are significant differences between them, one of which was clearly manifested in the midst of the coronavirus pandemic.

Several gold mining enterprises inthe Swiss canton of Ticino was forced to close for two weeks due to measures by local authorities to combat COVID-19. Thus, the main source of gold bullion supplies was shut off right at the height of the hype among investors who preferred a traditional physical safe haven asset.

"The gold market in New York is faced withan unprecedented contraction of supply due to the fact that the pandemic blocks the physical asset trade routes. This happened at a time when investors realized they would accumulate this metal as a refuge. ”Writes the Los Angeles Times.

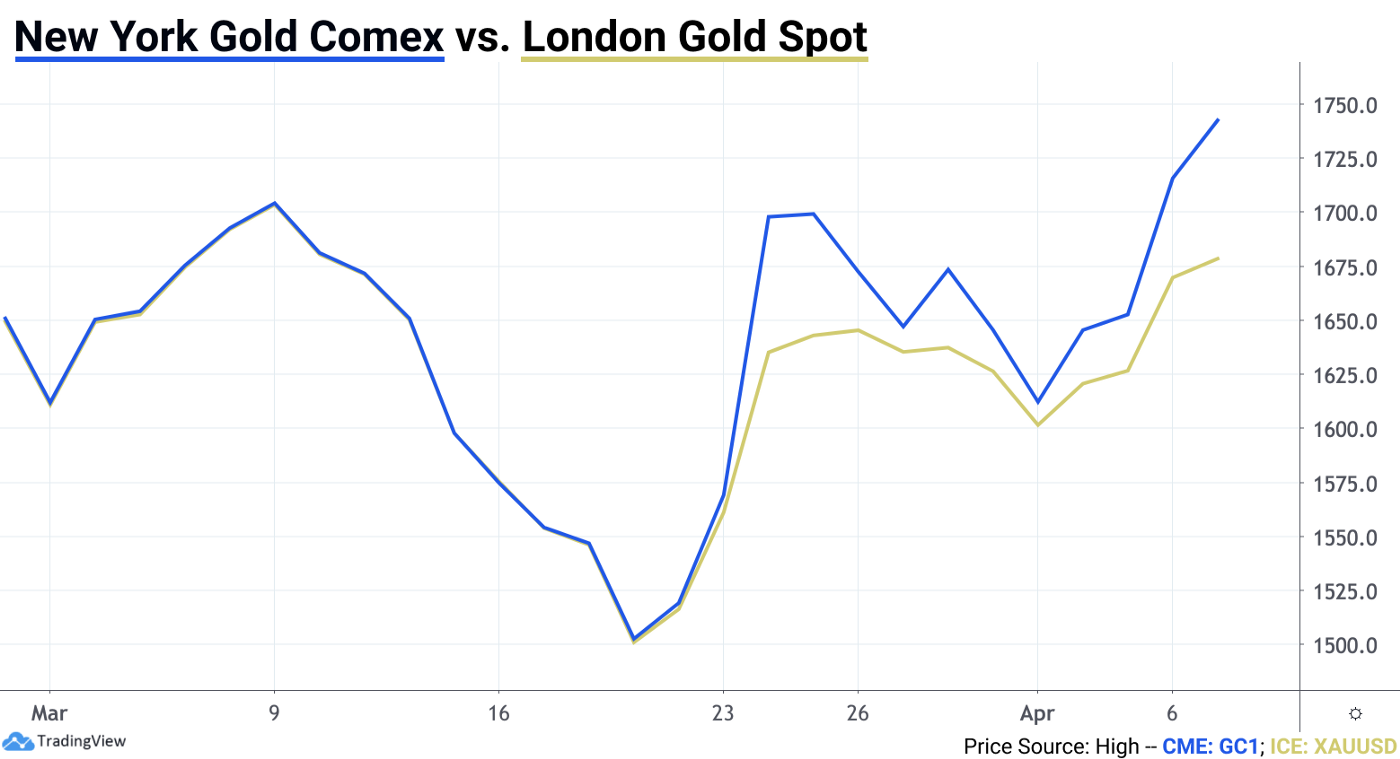

The situation with supply chains could not but affect the financial markets, including derivatives, and the market value of the precious metal.

“Premium relative to spot gold price onCOMEX's New York Stock Exchange, a member of the CME Group, has risen sharply again on Tuesday, April 7, due to the fact that supply routes remain partially blocked. At the same time, banks and brokers restrict trade because of fears of further growth in the price gap ”- Reuters reports.

Gold prices at Comex and the London Metal Exchange

And while the price of gold "lives its own life" because ofinterruptions in production and supply, bitcoin is running smoothly, the activity of miners supporting the network is growing. In anticipation of the next halving, designed to make BTC even scarcer, the digital gold hash has updated its historical record. This indicates the confidence of miners in the long-term prospects of the first cryptocurrency, as well as the fact that interruptions in the supply chains of equipment from China are left behind.

It is possible that the hashrate of the first cryptocurrencyit will sink somewhat immediately after the upcoming halving, which will take place on approximately May 12. This can happen due to the fact that due to the halving of the block rewards, relatively inefficient and energy-intensive devices for mining bitcoin will become unprofitable. So, provided that there is a slight increase, flat or a decrease in the price of BTC, Antminer S9s will most likely turn off massively, which still generate almost a quarter of the total computing power of the network.

Nevertheless, historical data indicate that in the long run, hashrate is growing, despite halving, price volatility and other factors.

Some time after halving in 2016, the price and hashrate “took off”. Source: glassnode.

In the short term, the price may fallthe first cryptocurrency, closely correlated with a hashrate. This is exactly what happened on the eve of the second halving in history, but market value then recovered very quickly.

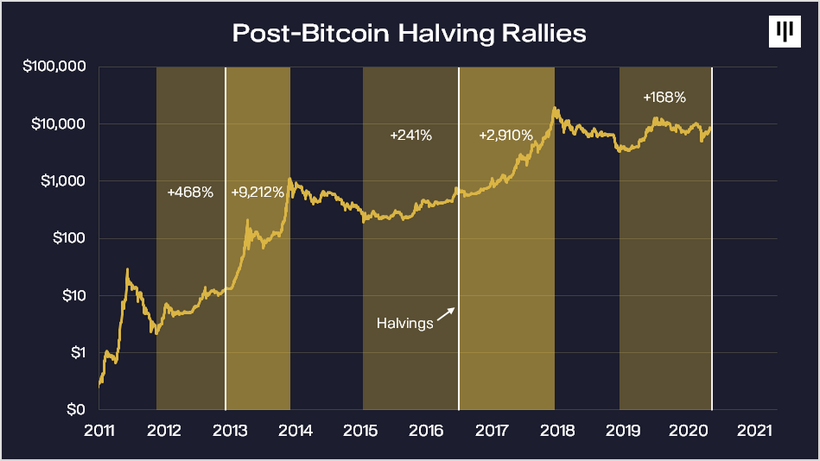

According to the head of the cryptocurrency hedge fundDan Morhead's Pantera Capital, historically the leading cryptocurrency price bottomed 459 days before the event, and the subsequent rally lasted an average of 446 days.

BTC price dynamics before and after halving block rewards.

“If history repeats itself, bitcoin will peak in August 2021”- said Morehead.

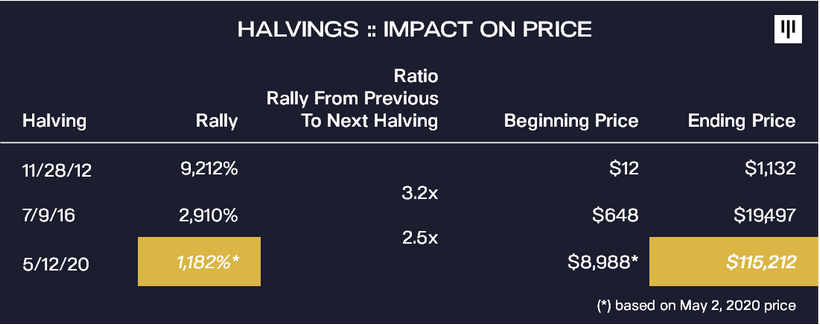

The head of Pantera Capital also examined the impact.each decrease in BTC emissions as a result of halving the block reward. After the second halving, the supply of coins fell exactly three times, having exactly the same effect on the price.

The expected reduction in supply will be 40% more than in 2016, Morehead emphasized.

“If the ratio persists, this will mean that the price impulse will increase by about 40% - bitcoin will reach a maximum of $ 115,212”- he believes.

The effect of halving on the price of BTC and Morhead's forecasted next peak at around $ 115,000.

S&P 500 and Bitcoin

Return on investment in Bitcoin compared totraditional assets is quite high. For example, as of April 29, the profitability indicator since the beginning of the year for Bitcoin was +20%, gold — +12%, and S&P 500 - — 8%.

Dynamics of profitability of investments in Bitcoin, gold and the S&P 500 index since the beginning of the year

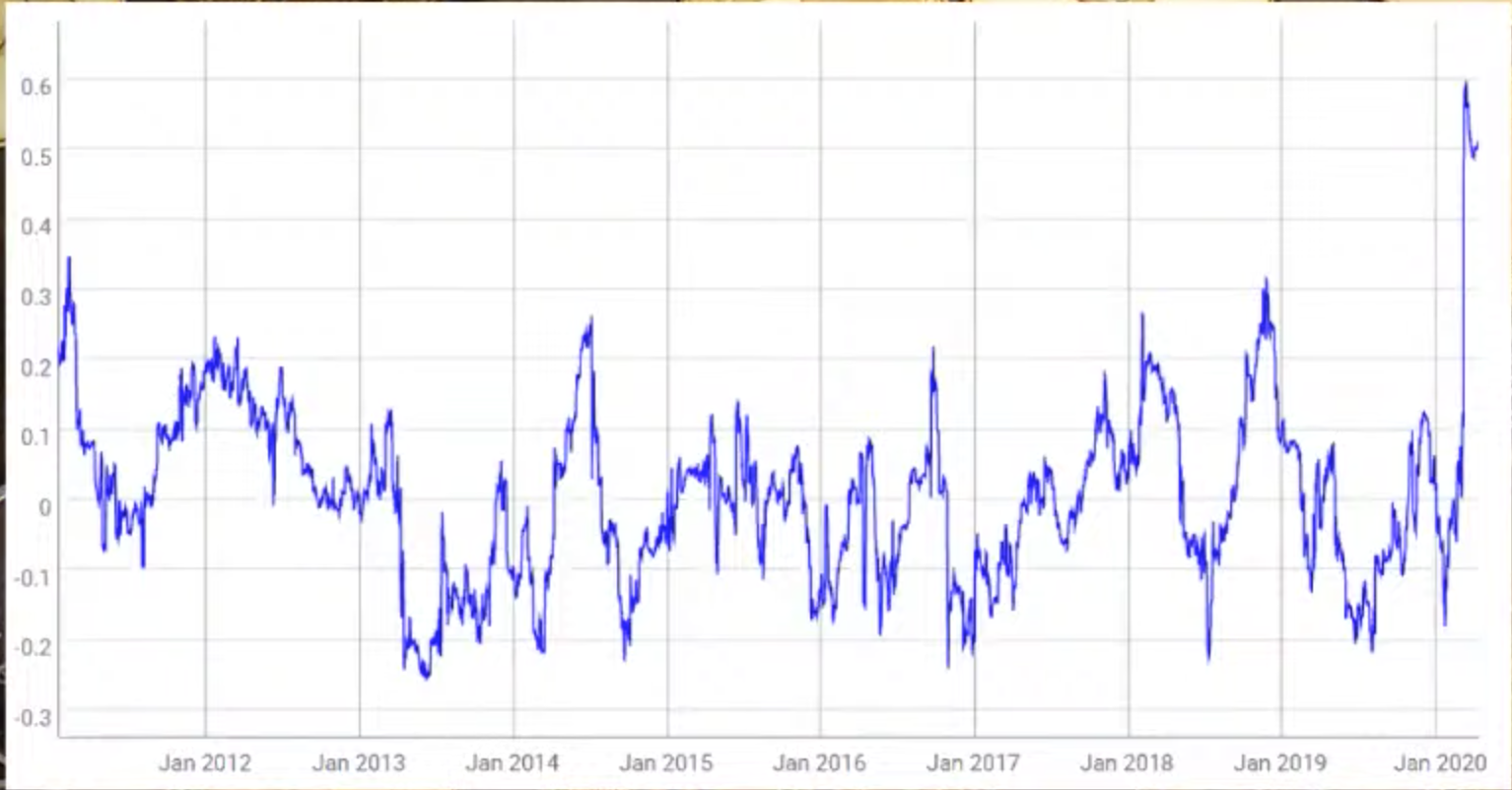

Thus, so far the first cryptocurrencymuch more attractive than traditional assets, whose prices sagged significantly in relation to their peak marks. On the other hand, bitcoin is now more than ever closely correlated with the "barometer of the American economy."

The correlation between BTC and the S&P 500 has reached its maximum. Data: CoinMetrics

This has not always been so - since itsThe appearance of the first cryptocurrency mainly correlated very weakly with the American stock market. Considering also the impressive price dynamics for all this time, Bitcoin would be by no means an asset in diversified investor portfolios.

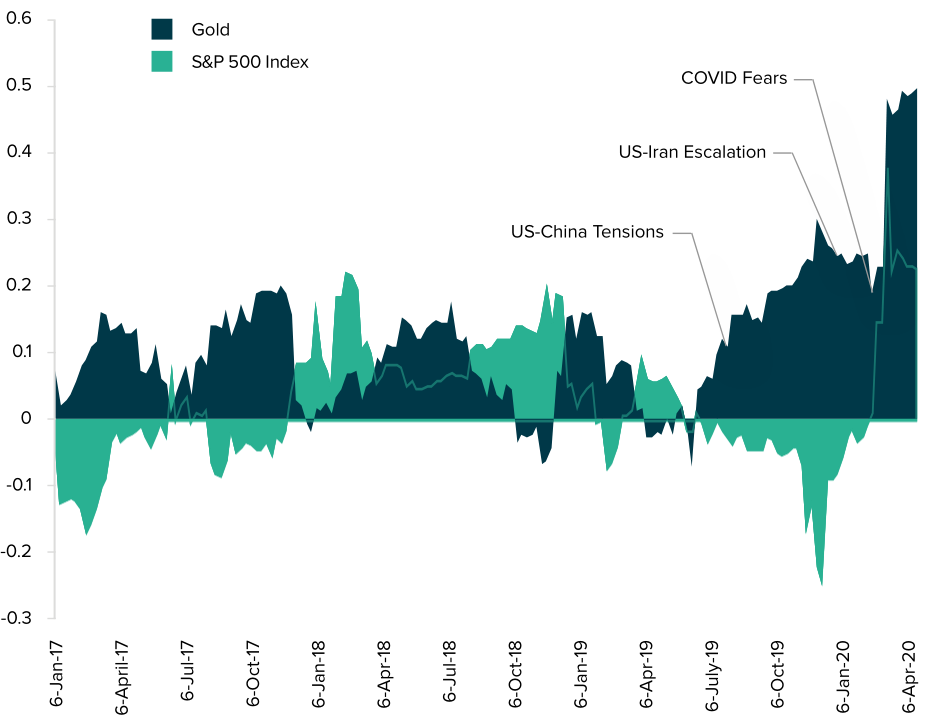

According to observations by VanEck experts, bitcoin is increasingly correlated with gold amid the crisis, triggered by the COVID-19 pandemic. This strengthens the status of cryptocurrency as a safe haven asset.

Historically, the correlation of bitcoin with goldquite high and at the same time increases significantly during periods of turbulence in the global market. This may be an argument in favor of the thesis about the protective properties of BTC. Source: Grayscale.

In terms of investment attractiveness of bitcoin, VanEck analysts noted that adding a digital asset to a portfolio with 60% of shares and 40% of bonds can significantly reduce its volatility.

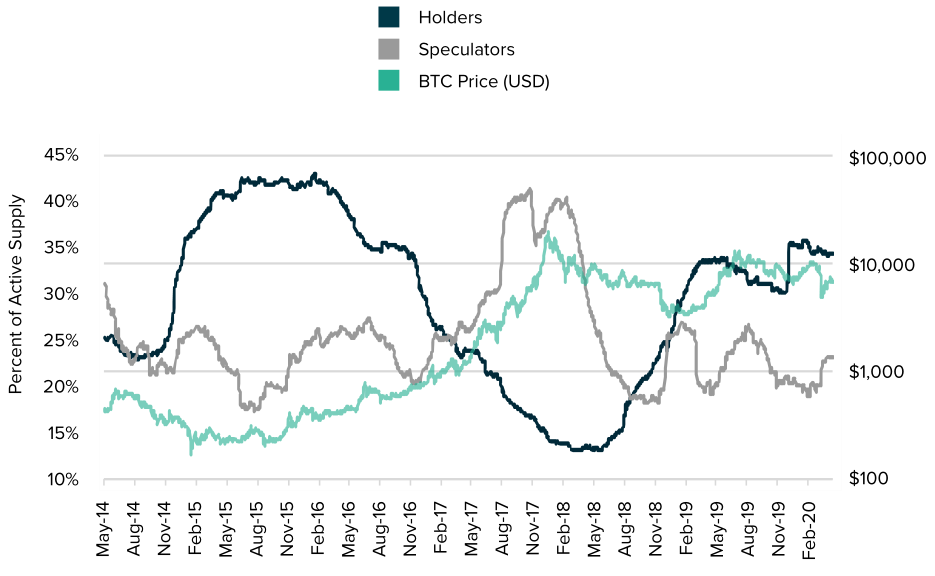

The following graph shows that over time, bitcoin is increasingly concentrated in the so-called hodlers - major market participants:

Source: Grayscale.

Small players - speculators - tend to be massivelyget rid of "digital belongings" against the backdrop of a bear market. This is evidenced by a significant decrease in the share of these market participants in the total active supply of bitcoin in 2018.

Most large and, most likely, experienced market participants are confident in the long-term prospects of digital gold and are not at all inclined to sell cryptocurrency at a loss.

findings

Bitcoin is a censorship-resistant assetshowing high profitability compared to many traditional financial instruments. The first cryptocurrency can serve as a good tool to diversify the medium and long-term investment portfolio.

Bitcoin has some similarities with gold -the latter is also in short supply; its volatile price is mainly rising. However, the BTC offer is even more limited, and the stability of its network and coin mining does not depend on the decisions of the authorities, the pace of epidemics and other significant factors for the traditional economy.

Make a wallet and have bitcoineach, the threshold for entering the cryptocurrency market is low. Digital gold also has obvious advantages by criteria such as portability, divisibility, simplicity and low cost of transactions.

It is highly likely that in conditionsUnprecedented and widespread easing of monetary policy, ultra-low rates and the fall in the attractiveness of traditional financial instruments, the demand for bitcoin will grow. Consequently, its price will increase, especially considering the limited offer of cryptocurrency and a sharp reduction in the rate of emission due to the halving.

Since miners will receive twicefewer coins per block mined, they will become a less significant source of sales pressure. In addition, the development of the derivatives market, including on the basis of improved hashrate calculation methods, will allow market participants to more effectively hedge risks. It can also reduce the pressure on the price from the side of miners and increase the imbalance between demand and decreasing supply leading to an increase in BTC prices.

Bitcoin stands out sharply from traditionalassets by the fact that populist governments that are struggling to tighten the economic cycle to the detriment of the national currency and the welfare of millions of people cannot influence it. The first cryptocurrency cannot be influenced by the de facto central banks controlled by governments.

This means that BTC cannot be devalued.voluntary increase in supply through QE. On the contrary, periodic halving inevitably reduces the inflation of digital gold, making it scarcer and more expensive, given constant or growing demand.

The situation in the global economy actualizesthe thesis that non-sovereign money in digital form can be an attractive means of exchange and preservation of value, as well as a hedge from the far-reaching consequences of the central banks' policy of rampant printing of money.

Alexander Kondratyuk