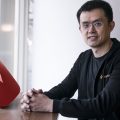

Changpeng Zhao shared his insights about DeFi, Ethereum 2.0, and answered the question – will DeFi stay with us or will itanother bubble?

The head of the Binance exchange has long been interested in the DeFi industry. Over the past few months alone, the exchange has listed more than fifteen DeFi tokens.

Changpeng Zhao recently gave an interview toCointelegraph, during which he talked about what DeFi really is, why this sector is so in demand and what he expects from DeFi in the future. We have prepared a complete translation of the interview for our readers.

Q: Explain what DeFi really means.

Changpeng Zhao:There are several interpretations of DeFi.Initially, this word meant any decentralized financial service. The term originally referred more to decentralized lenders or lending platforms.

At the beginning of this year people started blockingcoins in the liquidity pool. These coins were used by an automated market maker who provided liquidity. Thus, users received a reduction in the spread and a more favorable price when trading.

This type of DeFi has gained enormous popularity. Competition continues to intensify as people compete for the highest percentage of income from providing liquidity.

Q: Why is DeFi gaining popularity so quickly?

Changpeng Zhao:To be honest, the popularity of this industry beganrecruit back in the last year or at the beginning of this. The advantage of an automated market maker is that it is extremely transparent. If a user loses money, he knows exactly why he lost it. There is no cheating on such platforms.

Q: How is Binance involved in the DeFi industry?

Changpeng Zhao:Some believe that DeFi projects cancompete with centralized exchanges and take away liquidity from them. However, we still want to drive innovation. Therefore, Binance has been listing DeFi tokens quite aggressively lately.

We have a lot to learn from the DeFi model, and wewe plan to introduce it into a centralized financial space. Our own liquidity exchange product is currently available on Binance. We also recently launched a product called Binance Pool, which unlocks BNB token staking and rewards.

In addition, we have been working on Binance Smart for a year nowChain– smart contract compatible with Ethereum. It is 100% compatible with Ethereum in functionality, but surpasses it in speed, which reduces the cost of gas and the load on the network. And this is important, considering how much DeFi products slow down the network.

Binance Smart Chain will also allow the launchown DeFi products with incredible ease. You just take the Ethereum smart contract, copy and paste. We also recently launched a $ 100 million fund to support the development of DeFi.

Q: What are your thoughts on Ethereum 2.0?

Changpeng Zhao:I have high hopes for Ethereum 2.0.I underestimated Vitalik when he told me about his project in 2015. I told him – “You overestimate your strength.” To my surprise, I was proven wrong. He provided us with working Ethereum. I think that Vitalik's team and his community can solve really strong technical problems.

However, I think Ethereum 2.0 is incredibly difficult to implement. Ethereum 1.0 has proven that it can do everything, while it does nothing well. For example, it doesn't have high bandwidth. When you're trying to release a product to the masses, you need scalability and bandwidth. Ethereum cannot provide this.

I have high hopes for Ethereum 2.0, but I think we'll have to wait with its release. First they have to switch mining to PoS, which is already a big change. If they do it this year, it will already be a good result.

Q: So the DeFi industry isn't going anywhere like the ICO boom we experienced in 2017?

Changpeng Zhao:If you look specifically at ICOs, it can be called a boom. But if you look at the concept of fundraising on the blockchain, this concept is still present. Yes, there are bubbles, but the basic concept of blockchain fundraising remains.

And although most ICO projects turned out to beunsuccessful, there were a couple of extremely successful ones. For example, Binance. We held an ICO and then built a pretty strong company. I think the situation is similar in DeFi.

I see a lot of bubbles in the DeFi space.Many of these projects last no more than two weeks. However, the core concept of an automated market maker and staking coins for liquidity will remain with us.

Subscribe to ForkNews on Telegram

Based on materialscointelegraph.com