US congressmen Bill Foster and French Hill asked the Chairman of the Federal ReserveJerome Powell to consider releasingNational Digital Currency (CBDC) USA. At the same time, President of the Federal Reserve Bank of Philadelphia Patrick Harker announced the inevitability of a digital dollar.

What do parliamentarians offer, how do American regulators relate to the idea, how will the launch of the American CBDC affect the economy and the crypto market?

What is CBDC?

Digital currencies from central banks (CBDC) —this is a digital version of existing national fiat currencies, but without intermediaries in the form of commercial banks. CBDCs are issued and backed by the Central Bank and make the banking system simpler.

Commercial banks are now transferring fundsclients and work with each other through correspondent accounts of the Central Bank (therefore, for large transfers from different banks, you must pay such large commissions). CBDCs allow commercial banks and their customers to pay directly to each other, bypassing intermediaries.

Congressmen urge Fed to hurry up with digital currency issue

Congressmen Bill Foster and French Hill outlinedhis request in a letter dated September 30. They believe that the emergence of digital currencies marked a “watershed” in the evolution of money and payments. Congressmen expressed alarm that, according to the Bank for International Settlements (BIS), more than 40 countries are already developing their own CBDCs. In their opinion, this could undermine the primacy of the US dollar in the long term. Therefore, they are calling on the Fed to take on the project of developing a digital currency for the US dollar.

Foster and Hill believe that cryptocurrencies are noware used only for speculative purposes, but in the future they may take the place of fiat money. Congressmen fear that private crypto companies are becoming leaders in this area and could deprive the United States of part of its financial governance. A striking example is the Libra project from Facebook.

Congressmen also mention recent projects onlaunch of stablecoins from JPMorgan and Wells Fargo. This could lead to a loss of control over monetary policy, as well as a loss of ability to combat money laundering and terrorist financing. Foster and Hill suggested that a government-backed digital alternative to fiat currencies would prevent private companies from controlling the cryptocurrency microeconomy.

Congressmen Are Wondering WhyThe US central bank has not yet switched to digital currencies. They point to Christine Lagarde's comments where she made the case for a new digital currency. Foster and Hill asked Jerome Powell about whether the Fed is now considering developing a digital currency, what it plans to do if CBDCs take off, whether there are any legal and regulatory barriers to issuing a CBDC from the Fed, and what the potential risks and benefits might be.

Хилл и Фостер не единственные, кто призывает ФРС consider launching a CBDC. In June 2018, former Federal Deposit Insurance Corporation Chair Sheila Bair also recommended that the Fed consider creating a digital currency to avoid disruption by the private sector or another country. According to the expert, if the Fed does not address this issue, then banking will suffer, and the very existence of the Fed will be in jeopardy.

Fed is not going to issue digital currency

Fed officials confirmed that they receivedletter and plan to respond to it. Earlier in September, Jerome Powell said the Fed was closely monitoring CBDCs but was not yet considering implementing them. He noted that consumers already have many payment options and don't need another one, they "don't demand" cryptocurrency. Powell believes that CBDC carries too many risks - if the network is hacked, you can “create as many coins as you want.”

Speaking about Libra, the Fed chairman noted thatbecause of the scale of Facebook, stablecoin can quickly gain systemic significance, but the project must meet the highest regulatory and regulatory requirements, and therefore, its development “will not be a sprint”.

However, the Fed’s position does not mean that there will be no digital dollar in the near future.

“Hypothetical launch of US digital currencyabsolutely does not have to happen on behalf of the Fed. The fact is that the Fed “printing” the current dollar is a private organization from which the US government leases money for a fee. So if we are talking about the national digital currency, then it may well exist in parallel with the dollar issued by the Fed. ”- said Valery Petrov, vice president of RACIB.

A digital dollar is inevitable, but it should not be a pioneer

Congressmen are not alone in their concern aboutthat the US will fall behind in the CBDC race. On October 2, Philadelphia Federal Reserve Bank President Patrick Harker, speaking at a community banking conference in St. Louis, said that central banks, including the US Federal Reserve, will “inevitably” begin issuing digital currencies, possibly within the next five years. But as Harker stressed, the US should not be the first country to issue a national digital coin because the technology is still maturing and the US dollar remains the world's reserve currency.

The basis of the digital dollar, according to Harker,could become the FedNow platform - the American fast payment system that allows you to process and conduct settlements in real time. It should be launched in 2023-2024. Harker suggested that the Fed’s attempt to create a CBDC would likely follow the formal integration of the payment processor.

Harker admitted that his opinion represents the point of view of the minority in the Fed. But, despite this, some employees are still working on exploring the possibilities of CBDC release.

Why did they talk about CBDC more often?

Earlier, representatives of central banks announced theirnegative stance towards CBDC. However, Facebook's plans to create Libra have attracted the attention of officials and changed the rhetoric slightly. The European Central Bank (ECB) recently announced plans to create a common European CBDC to counter Libra.

In the summer, Agustin Carstens, head of the Bank of InternationalSettlement (BIS), said that central banks will soon be required to issue their own digital currencies. The BIS supports the developments of national central banks in this area.

CBDC Release May Happen Before They Expectmarket and society. At the same time, the BIS annual report states that currencies supported by technology giants can “quickly establish a dominant position” in global finance and pose a potential threat to competition, stability and social welfare.

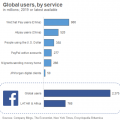

In recent months, among the main launch goalsCBDC is said to be preventing the growth of Libra. The entry of such a global project into the market—Facebook has two billion users—could significantly change the situation and deprive central banks of much of their control over the movement of funds.

At the same time, there are increasing calls forso that the world financial system moves away from the dollar. Thus, the head of the Central Bank of England, Mark Carney, believes that CBDCs can counter the destabilizing influence of the US dollar in international trade and its dominance in credit markets. The expert believes that the protectionist trade wars unleashed by the current Trump administration have led to increased levels of instability in global trade. Carney has proposed a number of possible replacements for the dollar, including the Chinese yuan, and most notably a digital currency backed by an international coalition of central banks.

According to IMF analysts, developed countries, inwho are reducing the use of cash, consider CBDC as an alternative to traditional payment methods, which reduces costs, increases the efficiency of monetary policy, and increases the competitiveness of the payment market. And for countries with developing financial systems, CBDC can become a means of improving the accessibility of financial services, their democratization and greater digitalization.

China launches its own digital currency

The creation of a national digital currency is being worked on by 40 Central Banks, but most of them are only exploring possible scenarios, fearing possible negative consequences from the launch of a CBDC.

China has moved on and appears to be pursuingown strategic goals. The country's National Bank is about to launch its national cryptocurrency. The regulator has not publicly commented on the timing, but according to rumors, this currency will launch at the end of this year or early next year. China's digital currency will be significantly different from the Bitcoin model, with the central bank controlling the money supply and monitoring transactions. Most likely, this will be a currency for interbank settlements, inaccessible to a private user.

Apparently, the country's authorities are hoping forinternational use of its CBDC is a direct challenge to the dominance of the dollar, a way to break out of US power, to become less dependent on them and their sanctions. This is an important geopolitical and strategic step of China.

If China's infrastructure project "Belt androad ”will succeed, digital and barrier-free currency will be able to facilitate international trade between more than 60 countries. China does not set a goal to overthrow the dollar, but it wants to give its allies an alternative, creating a system more independent from the USA, in which they would not have to use the dollar for their imports and exports.

Is the digital dollar the next chapter in cryptography?

Let's say the United States decides to issue a digitaldollar. What would it look like and what consequences could it lead to? Indeed, unlike other currencies, the dollar is the main reserve and settlement currency of the world economy.

The digital dollar will be different from the dollar bybank account, as it will use the same infrastructure as cryptocurrencies. People from developing countries will have direct access to the most important world currency without restrictions in the form of currency control, restrictions on transfers, import and export of currency. It seems logical that this will only strengthen the position of the dollar. However, everything is more complicated.

The digital dollar directly threatens the Fed, whichcontrols the money supply to modulate inflation and stimulate the economy. No central bank wants a currency to be something that it does not control.

In addition, it is necessary to take into account not the most favorable situation with the balance of payments and the US public debt, the servicing of which may soon become very problematic.

“This is happening against the background of the fact that more and morecountries abandon the dollar as a single reserve currency. Accordingly, in the case of the release of a new digital currency, it must be fundamentally ensured, otherwise its demand will be minimal, and the dollar will not be able to create competition. However, the United States has virtually no resources for such provision, which calls into question the prospects of the “digital dollar” in the foreign market. In addition, all the laws and regulations in the world are set to work with the ordinary dollar, and rebuilding this system for the new currency will require tremendous efforts. ”- clarified Valery Petrov.

The competition of the digital dollar with the traditional currency in the domestic market can only exacerbate the identified economic problems of the United States.

“So we can evaluate news aboutdiscussing the national digital currency as an intensification of attempts by American officials to break the national financial system from a dead end, but it is too early to expect global influence on the cryptocurrency market ”- added the expert.

CBDC - the future of the global financial system

The future of cryptocurrencies can greatly disappointfor many crypto enthusiasts and convinced libertarians, the revolution launched by Bitcoin almost 11 years ago is taking root. The central banks that crypto users hoped to abolish themselves are more and more inclined toward the idea of digitizing national currencies. How this will work specifically is not yet clear, but Libra and TON significantly accelerate the development of the industry.

CBDC is the future of the global financial system. This is the result of the gradual evolution of fiat payment systems. CBDCs do not have to be on the blockchain. But they have one of the main advantages of cryptocurrencies - the ability to pay each other directly without intermediaries, without their drawbacks in the form of volatility and lack of legal protection.

With widespread CBDC, private anddecentralized cryptocurrencies will not disappear. The former will compete with national currencies, while the latter will remain a means of hedging risks, a reserve asset and a means of settlement for those who prefer anonymity and confidentiality.

</p>