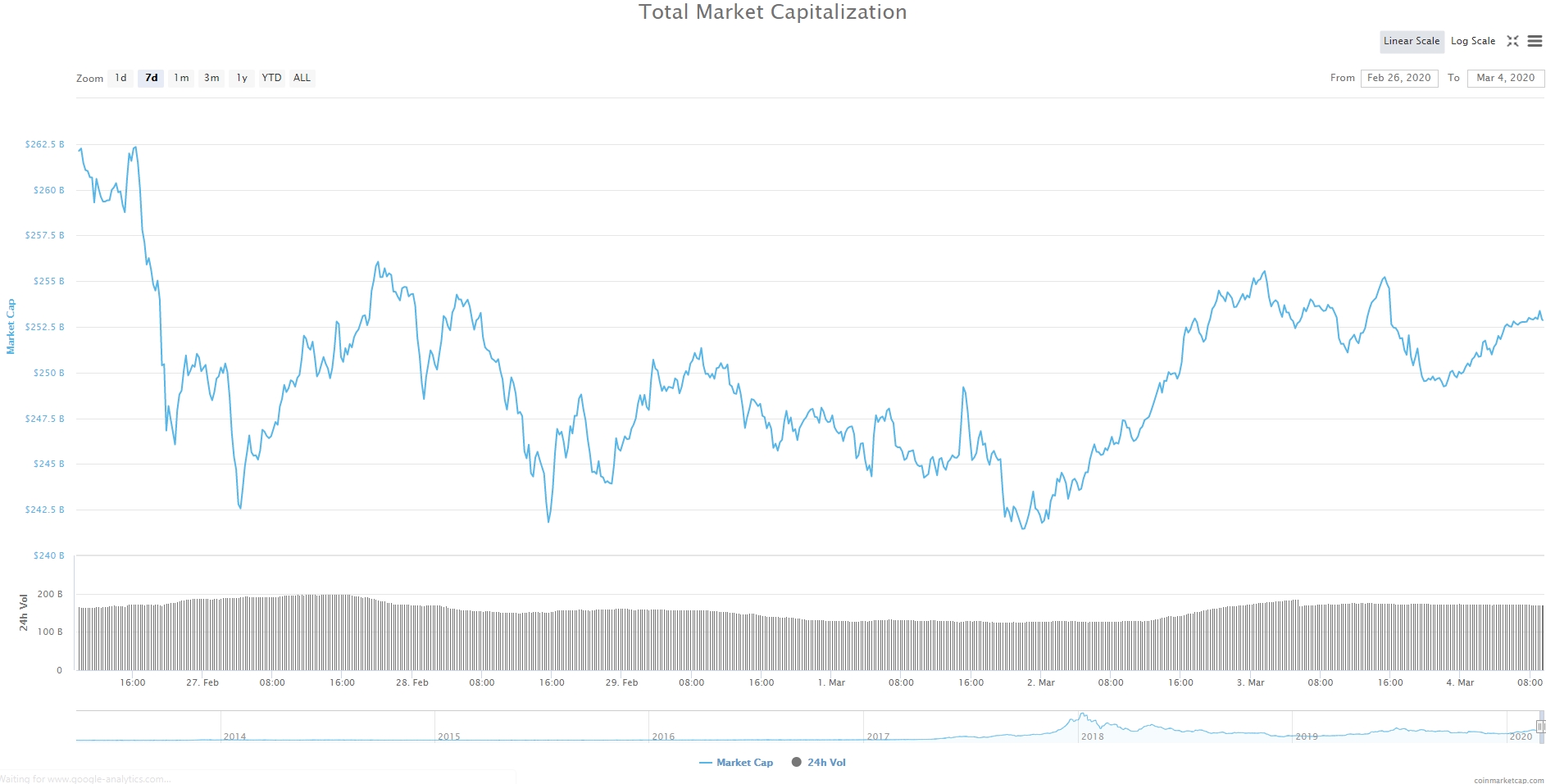

Quotes of most liquid cryptocurrencies rebounded from their minimums at the end of last weekvalues achieved in the lastcorrection. Volatility indicators have fallen markedly. The indicator of total market capitalization since Monday has grown by 2.4%, and its value at the moment is $ 252 billion.

</strong>

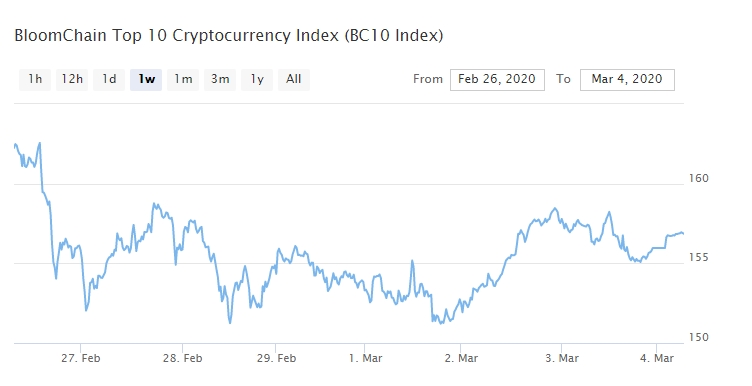

Our BC 10 Index indicator added 2.1% and thus its value is 156.9 points.

Bitcoin

The dynamics of the BTC to the US dollar (BTC / USD)

The price of BTC came up from a downward channel, andat the moment reached the resistance level in the region of $8950 per coin, after which a rollback occurred. Trading dynamics over the past week make it possible to identify price movements as a sideways trend in the range of $8,500-$9,000. From a technical point of view, in order to form a reversal pattern, quotes need to consolidate above the upper consolidation line. Meanwhile, experts have expressed their opinions regarding BTC.

Ethereum

ETH to USD exchange rate dynamics (ETH / USD)

A similar situation exists in ETH. Volatility decreased markedly, the emotions of the participants calmed down. The emerging pattern of the bearish triangle was broken and quotes went beyond the red line, showing that the forces of the "bears" in this phase of the market weakened.

Ripple

Dynamics of the XRP to the US dollar (XRP / USD)

XRP quotes move in the general market trend.The upper border of the triangle has shifted, which is why there is a possibility of a more prolonged sideways movement than initially expected. As noted earlier, if the green line is broken, the next support is located around $0.20. You can read more about what is happening with Ripple in our longread.

Bitcoin Cash

BCH to USD exchange rate dynamics (BCH / USD)

The price of BCH broke through the upper limit of consolidation andwent beyond the border of the downtrend indicated by the blue line. From a technical point of view, in the near future, the coin may have favorable conditions for moving up, however, the dynamics of BCH at the moment is highly dependent on general market sentiment.

Bitcoin SV

BCH to USD exchange rate dynamics (BCH / USD)

BCV shows positive dynamics on the basis oflast trading week. A short-term uptrend has formed, which has not been continued due to the more global downtrend passing in the vicinity, and by now the price has gone sideways.

World context