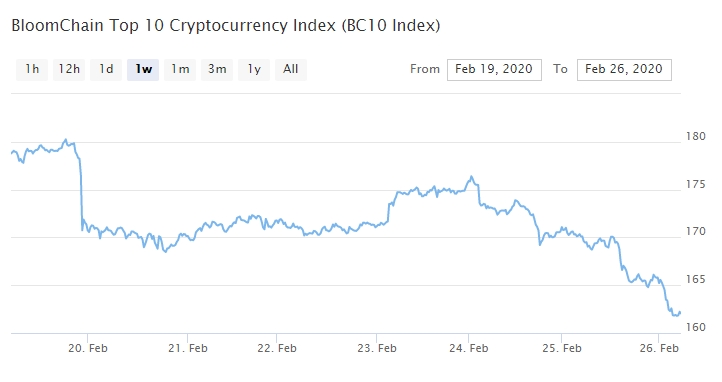

The cryptocurrency market is experiencing a decline. Perhaps this happened against the backdrop of criticism from Warren Buffett. INin most cases, everything is still happening within the frameworkcorrection, however, in a number of liquid instruments the trend has already become pronounced. Trading volumes have increased noticeably. The capitalization indicator has decreased by 7.7% since Monday, and its current value is $261 billion.

Our indicatorBC 10 Indexdecreased by 6.4% to a value of 162 points.

Bitcoin

</strong>

The exit from the converging formation occurred downward, inAs a result, the trend line, which originated in early January, was broken. This dynamics finally convinced market participants of a change in trend, after which sales followed, as a result of which the coin’s quotes entered the oversold zone. At the moment, the price is in the $9,150 support area, so the likelihood of a rebound is increasing. In case of a breakdown of the level, the next support is located in the area of $8600.

Ethereum

</strong>

ETH quotes have also come under pressure fromside sellers. Currently, the “bears” are trying to push support down, but due to local oversold, the likelihood of a rebound here also increases. In addition, a trend line passes nearby, which has not yet been broken, so the side scenario remains the most likely scenario.

Ripple

</strong>

The XRP price broke through the $0.264 level, confirmingformation of a reversal figure. In recent hours, the downward movement has accelerated, and volumes have increased noticeably. There is also some oversold at the moment, so from a technical point of view, the likelihood of a technical rebound increases. Meanwhile, the amount of Ripple’s investment in MoneyGram became known.

Bitcoin Cash

</strong>

As expected, the previous bounce worepurely technical in nature and under the influence of sales from the "bears" in the entire market, the decrease affected BCH. After the local oversold leaves, there is a high probability of a continued downward trend. In this case, the reduction target is located in the region of $ 315 per coin.

Litecoin

</strong>

In LTC, increased volatility persists. Compared to the other instruments under consideration, the movements here are more amplitude. Currently, the price is close to support, but in case of passing the level of $ 66 per coin, the downward trend may accelerate. In the meantime, everything looks like an ongoing sideways after the growth phase.

World context

Russia

Disclaimer Neither completely nor in any partdoes not constitute an offer to buy, sell or make any transactions or investments in relation to the currencies and assets mentioned in this review, and does not constitute a recommendation to make any investment decisions. The information used in preparing this review was obtained from publicly available and believed to be reliable sources. <em>BloomChain</em><em> has the right, at its own discretion, without any notice, to change and/or supplement this review and the recommendations contained therein. This review may not be reproduced, published or distributed in whole or in part, nor may it be referenced or quoted from without the prior written permission of </em><em>BloomChain</em>< em>. </em><em>BloomChain</em><em> is not responsible for any adverse consequences, including losses, resulting from the use of the information contained in this review or as a result of investment decisions made on the basis of this information.</em>