Investors began selling off digital assets late last week, exacerbating volatility and...led to a drop in the value of most coins.

Bitcoin falls to lowest point since mid-termJanuary 2020. The fall began on March 7, but the first cryptocurrency suffered the biggest losses the day before, when it fell in price from $8,750 to $8,200. Note that on March 5, BTC was trading above 9000, and the network hashrate exceeded 150 EH/s.

</p>On the night of Monday, March 9, the BTC rate dropped even lower and is now at $7,750. Bitcoin's market capitalization has dropped by more than 10% over the past 24 hours to $143.2 billion.

According to Mohit, a partner at Bitazu CapitalSorouta, such massive sales usually precede a long phase of asset consolidation. Traders now need to move on to wait-and-see tactics, since consolidation can last from several days to several weeks after bitcoin finds the bottom.

No point in knife catching $ btc

Massive OI-decimating moves are followed by days / weeks of consolidation once price finds a floor.

There’ll be plenty of time to position yourself.

Wait for it.

- Mohit Sorout? (@singhsoro) March 8, 2020

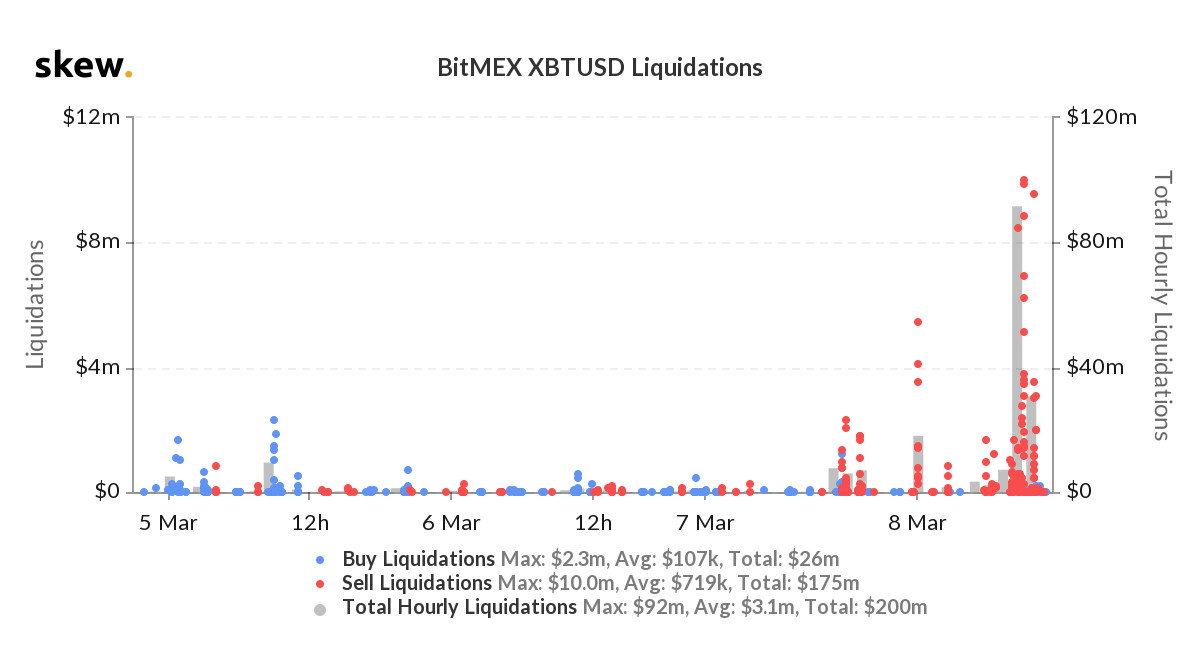

The fall led to the elimination of $ 185 million in longpositions on crypto-derivative exchanges, according to the data of the portal Datamish. According to Skew, on one BitMEX per hour, positions at $ 92 million were eliminated.

Altcoins also weaken at the beginning of the week. Of the first dozen cryptocurrencies, the most low-priced lightcoins and Tezos fell to $ 50 and $ 2.4, respectively (-16.5%). The second and third in terms of coin value, ether and XRP fell 13% to $ 199 and $ 0.205. The cryptocurrency market capitalization fell to $ 224.075 billion.

Other major cryptocurrencies have fallen even more. Ethereum, XRP, Bitcoin Cash, Bitcoin SV, Litecoin, EOS, Binance Coin - they all lost 12 to 16%.

Bitcoin fell a few hours beforeclosing a weekly candle, significantly reducing the likelihood of it remaining in the green zone. Technical analysts expect this close as a possible confirmation of the continuation of the bearish trend after a failure near the resistance of $ 9,200.

Even before this movement, Adaptive Fund analyst Nick Yaremchuk drew attention to the accumulation of liquidity in the region of $ 7,500 as an indicator of further consolidation around this level:

“I'm waiting for $ 8,000 - 8,500, $ 7,500 ideally. There are enough arguments for this from the point of view of technical analysis, despite the presence of external factors, such as high expectations from halving. Of course, there will be growth, Bitcoin is doomed to go higher, but this is a market, not a utopia. ”

Trader Kevin Swenson believes that the market is under the pressure of one “whale,” and recalls the recent move of 13,000 BTC from PlusToken crypto pyramid wallets.

“They crush the market with their sales. In fact, there is a huge whale that unloads after each upward movement. ”He writes.

Blogger Hsaka also draws attention to non-stop orders for $100,000 - $200,000 that are placed on the Bitfinex exchange within a few seconds of each other:

Finex has been unloading like a gatling gun today.

Non stop 100k market sells since the daily open. This screenshot is just of the past 5 mins. $ BTC pic.twitter.com/6pKkTD0b9o

- Hsaka (@HsakaTrades) March 8, 2020

At the end of December, the analytical firm Chainalysis estimated the balance of PlusToken wallets at 20,000 BTC.

</p> 5

/

5

(

1

voice

)