The Binance USD (BUSD) stablecoin, developed by the Binance cryptocurrency exchange, was not fully backed by dollarsmeasure.

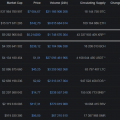

Jonathan Reiter, co-founder of the analytics company ChainArgos, found that from 2020 to 2021, Binance often did not back up the exchange rate of coins with fiat currency in an insufficient amount.

In at least three cases, the difference betweenthe declared and actual value of the reserves that ensure the stability of the BUSD price exceeded $ 1 billion. Representatives of the exchange admitted their mistakes and did not dispute the results of the Reuters study.

The collateral asset management process involved many teams and was not always executed flawlessly, which may have led to operational delays in the past.

Recently this process has been significantlyenhanced with enhanced checks to ensure that stablecoins are backed by dollars at a 1:1 ratio. However, data discrepancies have never prevented the BUSD exchange, a Binance spokesperson said.

According to the rules, whenever a user buys BUSD, Binance purchases BUSD from Paxos and issues new stablecoins on the BNB Chain or Ethereum (ETH) blockchain.

However, according to Jonathan, the trading platformdid not always follow this procedure. In some cases, the exchange created tokens and did not transfer funds to Paxos, so the stablecoin exchange rate was not 100% backed by dollars.

News and notes about cryptocurrency and traditional financial markets, politics and technologies in Telegram.