Competition in decentralized finance (DeFi) among smart contract-enabled blockchains continuesgrow.Ethereum has already lost over 40% of its market share since January 2021, giving way to cheaper and faster solutions. And now Avalanche is forced to give all the best in order to maintain interest in the network.

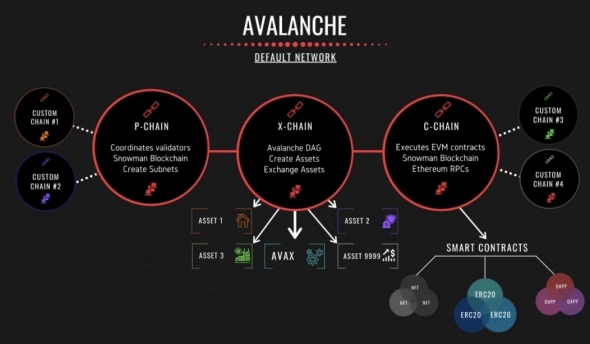

Avalanche, like most other competitorsEthereum is based on the Proof of Stake (PoS) protocol, but with its own distinctive features. For example, their own subnets are used to increase speed: X-Chain manages assets, C-Chain is responsible for smart contracts, and P-Chain coordinates validators. As a result, according to the developers, Avalanche has the highest transaction completion speed - less than 2 seconds.

Image Source:cointelegraph.com

However, one speed was not enough,to demonstrate the steady growth of blockchain usage. In DeFi, the amount of funds blocked (TVL) shows a negative trend: the peak in December 2021 was $13.7 billion, while now it is only $10.6 billion. In comparison, during the same time, TVL in Terra grew by 50% to $30. 7 billion. A similar situation is observed in decentralized applications, where the number of active network addresses decreased by 16% in March.

Image Source:defillama.com

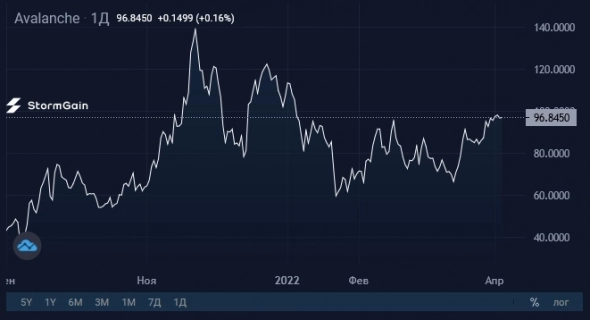

Demand reduction for solutions from Avalanche ledto the decline of the domestic AVAX coin. It is trading at a 33% discount from its November 2021 high. For comparison, the LUNA coin of the aforementioned Terra blockchain updated historical records in March and April.

Image Source: Cryptocurrency ExchangeStormGain

To reverse negative trends, the Avalanche fundlast month announced the launch of the Avalanche Multiverse investment program, which will provide $290 million to incentivize blockchain game and application developers. In addition, part of the funds will go to the creation of a Defi Kingdom subnet with an integrated KYC (know your customer) policy. According to the company, this will increase interest from institutional investors. Valkyrie Investments shares the same sentiment, calling the Avalanche KYC subnet “a big step towards institutional adoption.”

Do you think that the allocation of grants for the development of new applications on Avalanche will lead to an increase in the popularity of the network and its coin? Let us know about it in the comments!

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)