It's impossible to beat the market, and dollar cost averaging (DCA) has the highest ratioprofitability and effort between different strategiesaccumulation. This article is from Nick Bhatia and Joe Consorti of The Bitcoin Layer. Enjoy today's post on a simple but necessary question - to determine or not to determine the ideal entry time?

“Time spent in the market is more important than determinationthe exact moment of entering the market» is an aphorism we've heard before, a warning against trying to pinpoint the timing of market bottoms in search of cheaper asset costs.

The wisdom of most investors is alwayswas to invest when the market is scared, reinvest dividends, and avoid trying to accurately calculate market highs and lows. After all, 80% of day traders quit after just two years, which is a testament to the difficulty of fighting the market.

It's not easy to exceed expectations by timingreaching lows in stocks. In bitcoin, things are not so simple either. Even with many unique tools such as on-chain analytics that allow investors to observe buying behavior and market cycles in detail, most investors do not have the time or market discipline to monitor the markets, especially bitcoin. Choosing the perfect time to enter the market requires not only intense discipline, but also the study of prices and behavioral economics.

What the average investor should be doing is averaging out the dollar value of a bitcoin.

Stay Humble and Accumulate Satoshi

In today's article, we'll look at why this is a best practice.

Choosing the perfect time to enter the market (not worth the effort)

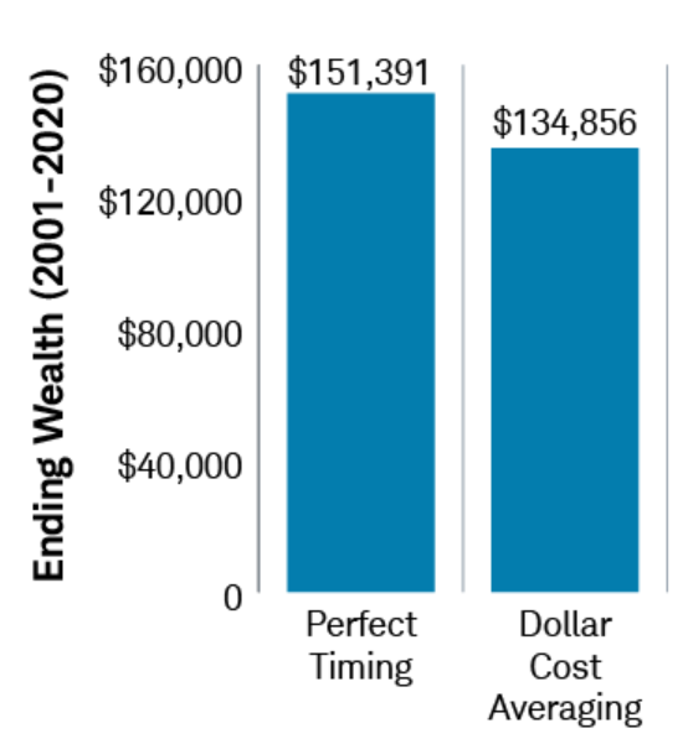

Let's start with Charles Schwab's 2021 study, which aimed to determine the best investing style in two decades.

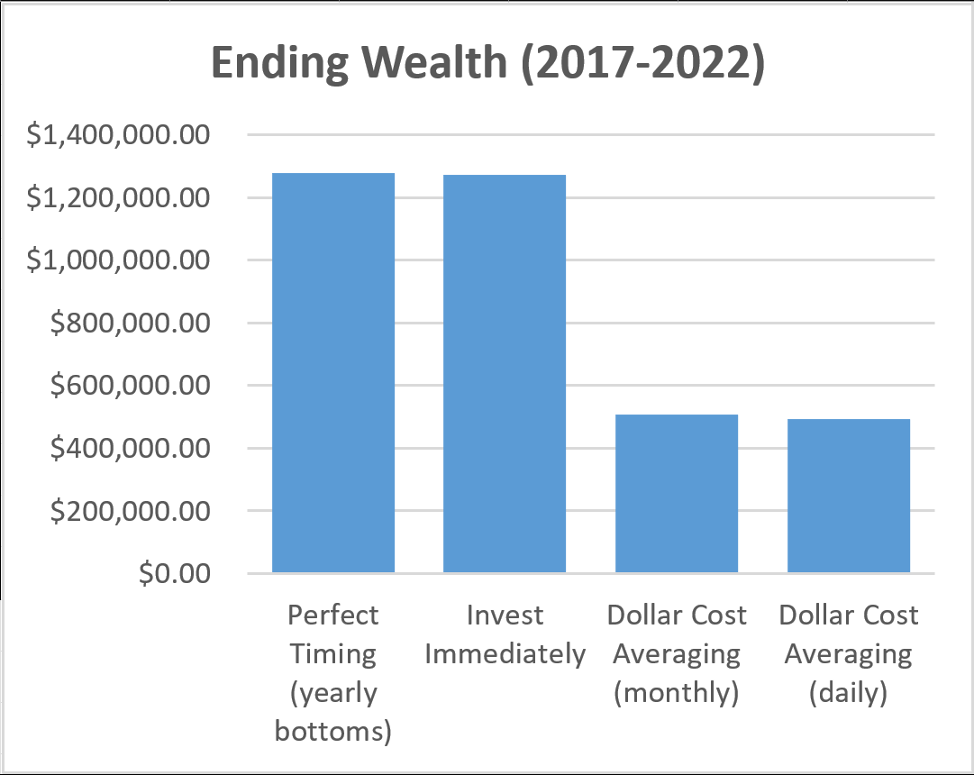

The study looked at different investing styles, namely “Perfect Timing” and “DCA,” and compared the returns of the S&P 500 over two decades.

As expected, investment at the bottom of each year(ideal timing strategy) brought the highest returns. Although, surprisingly, not much. The yield difference between ideal time and DCA was only 10.9%.

Even now, dollar cost averaging seems to be the best investment style given that its reward-to-effort ratio is much higher than ideal time.

One aspect that was not taken into account instudy, there was a possibility of accurately determining the time of the market bottom. This was not taken into account, since the chances are practically equal to zero. More precisely, the probability of choosing the perfect day to time the market for thirty consecutive years is (1/253)^30, or one in 1240, followed by 69 more zeros.

Since Bitcoin is in relativelyin its infancy, and its comparatively low liquidity making it even more volatile than the S&P 500, it's safe to say that these already impossible odds are becoming even more impossible.

This data suggests that the return on applying DCA to bitcoin will exceed the return on ideal time multiplied by the probability of ideal time.

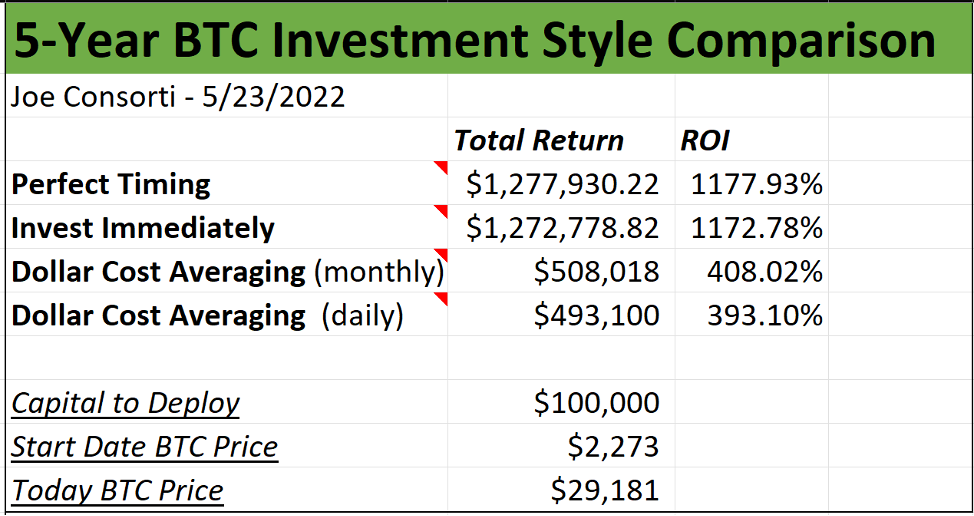

Let's do some basic calculations toconfirm this assumption. We're going to replicate Charles Schwab's research with Bitcoin, adding a few more investment styles to drive our point home. Here are the parameters:

- $100 thousand in cash,

- five-year time horizon (start date 05/23/2017).

Comparison of BTC investment styles over a 5-year time horizon

As expected, the perfect timing strategy generated the most profit, outperforming both the monthly and daily DCA by over 600% ROI.

To confirm the above assumption, a ~600% higher return can be seen by accurately timing the bottom, but this is even remotely unlikely.

In second place is the immediate investment strategy, which bought and held $100,000 worth of BTC. And it lags behind the ideal time strategy by only 5.15%.

Here is the visualization.

From left to right: perfect timing, immediate investment, DCA (monthly), DCA (daily)

You could buy bitcoin, be in a comafor five years and earn almost as much as someone who timed the yearly lows perfectly. Further proof that frantically updating charts, monitoring every cyclical on-chain indicator, and flawlessly catching every wick of surrender is too much effort for a mere 5.15% alpha compared to going all-in on bitcoin and waiting. . Again, what we are looking for is the highest reward to effort ratio.

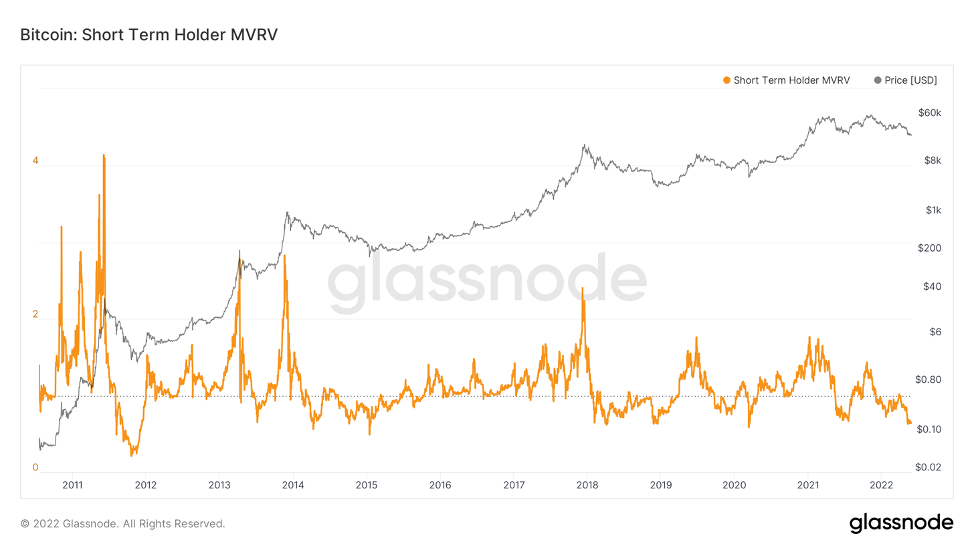

The disadvantage is that the immediateinvesting in a lump sum is far more risky than most investors can bear. Instead, retail investors are more likely to buy closer to the highs. Retail investors tend to buy during a bull market, as evidenced by on-chain metrics such as Short-Term Holder Market Value to Realized Value (STH-MVRV).

MVRV short term holder

Short-term holders classifiedmuch like coins held for less than 155 days directly represent retail investors. As the MVRV (Market Value to Realized Value Ratio) among these coins is increasing, it indicates that the coins are being bought ahead of a rise. Conversely, retail investors sell during a downturn, and this rate decreases as prices fall.

Retail investors, the majority of BTC holders,buy for weakness and sell for strength; Simply put, they are not very good at calculating the highs and lows of Bitcoin. Buy high, sell low seems to be the prevailing wisdom of most market participants; and that's okay, because not everyone is a skilled super-trader.

There is another way to beat spot buying that doesn't exceed an investor's average risk tolerance and doesn't require undue effort.

Dollar value averaging

This investment method involves buyinga small amount of BTC, regardless of price, at regular intervals. By spreading your purchases over time, you buy at the average prices of any interval during which you invest, reducing your overall cost. In short, it reduces risk while reducing cost compared to random spot purchases.

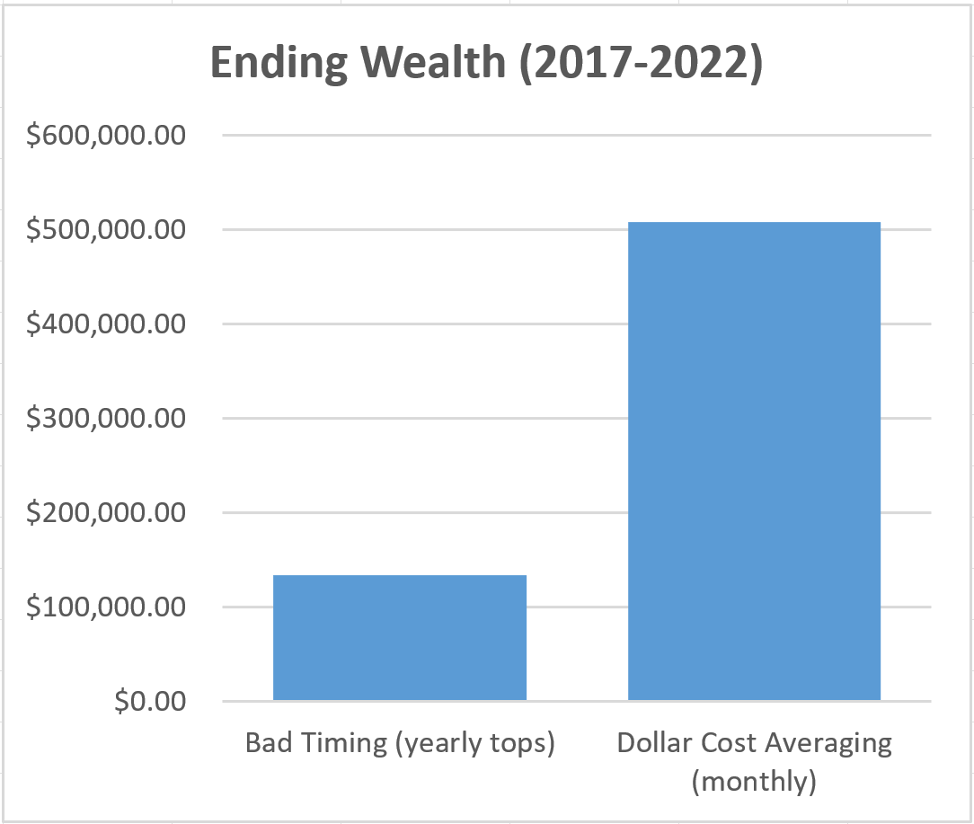

As we have already discussed, market participants buy,when the price is rapidly approaching the top of the cycle. Well, dollar cost averaging outperforms this common “buy the highs” style of investing by about 405%.

From left to right: poor definition of ideal time, DCA (monthly)

For everyone reading this article: don't be a hero.Not only is it easier to create a buying plan using DCA than it is to fight the market, but you will also get more than four times the return over a fairly long period of time. Based on this data, we humbly present our own timeless investing adage: “buying at regular intervals is better than waiting for the perfect time to enter the market”, although it initially sounds different.

For those who want to invest a certain partof your bi-weekly Bitcoin income, most platforms integrate a scheduled DCA feature directly into their user interface. This ability to set it and forget it without worrying about the intraday price is what makes the DCA strategy so attractive. This is the most practical method of accumulating BTC for most investors and the highest reward-to-effort ratio of any investment method. The perfect time to buy just isn't worth the effort. Accumulate satoshis wisely by using dollar-cost averaging, and you won't experience price fluctuations as you try (and most likely fail) to time your purchases perfectly.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>