Currently, there are more than 5,000 cryptocurrencies registered on the Coinmarketcap website. And although many of them are nothingOther than "shitcoins", some altcoins have ambitious plans and are developing truly innovative solutions. We invite you to familiarize yourself with one of these projects.

Tezos – is a platform for working withsmart contracts and decentralized applications. The project's program code is publicly available, so every user can take part in upgrading the system. Tezos is not based on the code of a pre-existing blockchain, meaning it is a unique network and not a fork.

The beta version of the Tezos blockchain was launched on July 12018, a year after the ICO, during which about $232 million was collected. It is worth noting that the project management team consists of only three people – Arthur and Kathleen Breitman and Ryan Jespersen. At the end of last year, the asset was included in the list of top 10 cryptocurrencies by market capitalization, and at the time of writing, it ranks 14th in the Coinmarketcap ranking.

Differences from other cryptocurrencies

The main difference between Tezos and other cryptocurrenciesthis system uses a protocol update process designed for the smooth evolution of the blockchain, instead of a hard fork. According to the creators, hard forks have extremely negatively affected networks such as Bitcoin and Ethereum, so they should be carried out exclusively in extreme cases.

Tezos network developers can offerAn update or feature that they would like to integrate into the network, and cryptocurrency holders can support the offer they like. It is worth noting that the developer receives an award if his proposal has been approved. This structure helps Tezos support and encourage independent developers.

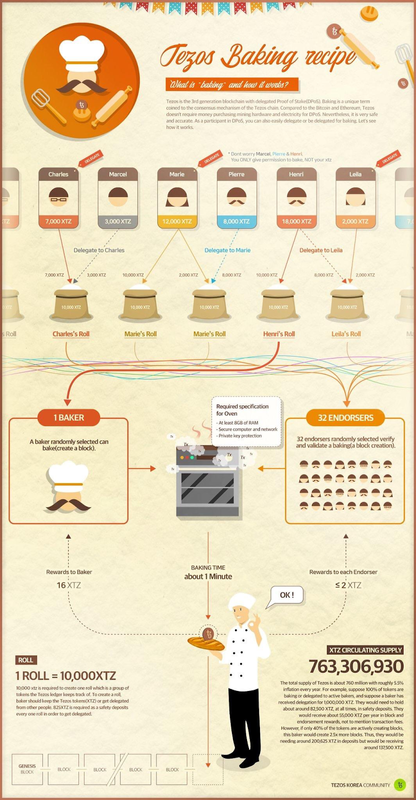

In addition, Tezos cryptocurrency is not mined, but“baked”. Using the DPoS (Delegated Proof of Stake) algorithm, each asset holder can participate in staking – creating new blocks. In order to bake blocks on the Tezos blockchain, the user must install a node on his PC and submit an application on the official website. For their work, bakers receive compensation in XTZ currency. In the Tezos whitepaper, the staking system is illustrated as follows:

Previously, Tezos representative ArthurB published an article in which he described the differences between baking and mining:

Bitcoin miners carry out complex computerthe calculations that must be made to create a new group of authenticated transactions (block) and add it to the distributed ledger. For Tezos, block creation is done by staking. Instead of gaining the right to create a block through calculation, bakers gain this right when the Tezos tokens they own (or are delegated to) are randomly selected to create a block. Baker learns of his right to bake blocks several weeks in advance. Then he must pay a security deposit, which is held for several weeks and then returned to him if no violations occur. This security bond is referred to in technical documentation as a “debenture.” In several other proof-of-stake systems, this deposit is a clearly defined single amount paid by the delegate. In Tezos, such collateral depends entirely on the number of blocks that the “bake” delegate.

To develop smart contracts on the networkuses the unique programming language Michelson. This language has a function of formal verification, which allows developers to verify the code of a smart contract before it is deployed on the blockchain. According to Tezos executives, this feature avoids critical errors in smart contracts, which can often lead to loss of user funds.

Where to buy XTZ

Currently trading with XTZ is supportedmost major exchanges, including Binance, Coinbase, Kraken, Bitfinex. It is worth noting that last year more than the number of well-known exchanges added support for Tezos staking. In addition, the asset staking began to be supported by the Ledger cryptocurrency wallet.

A brief overview of the Tezos price movement

By the end of 2019, the price of Tezos had recovered toarea around 1.40 USD and recorded the last local maximum in the outgoing year at 1.39 USD. At the beginning of 2020, the XTZ/USD pair recorded its first annual minimum at the support level of 1.21 USD, after which buyers briefly managed to restore the pair to the zone of the last local maximum. However, the XTZ price was unable to gain a foothold above the daily average price level EMA55. Yesterday's price decline in the cryptocurrency market pulled the Tezos price down to the support of 1.21 USD, but today the decline slowed down near the Point Of Control (1.23 USD) line of the Volume Profile indicator.