Financial fraud with cryptocurrencies is one of the key allegations against Sam Bankman-Fried (SBF). According to the NYT, the former head of FTX lednegotiations with startup developers to offer listing of new coins on their platform on mutually beneficial terms. On the days of the listing, SBF ran an active advertising campaign, and Alameda was engaged in "pumping" the price as part of the pump and dump strategy ("pump and dump").

By attracting the masses and creatingartificial growth Alameda threw off the stocks of coins received from the developers, increasing profits. The coins under the SBF's custody were nicknamed "Samcoins" by the media, that is, Sam's coins. Basically, they include low-liquid instruments, for example: Maps, Oxygen or Bonfida. Among the latest big names is Serum, a joint project between Solana and FTX to launch a decentralized exchange. The most painful for the community on the list is Solana.

With the collapse of the crypto-exchange, close relationships went sideways for Solana: in a week, the cryptocurrency “lost” by more than half.

Image Source: Cryptocurrency ExchangeStormGain

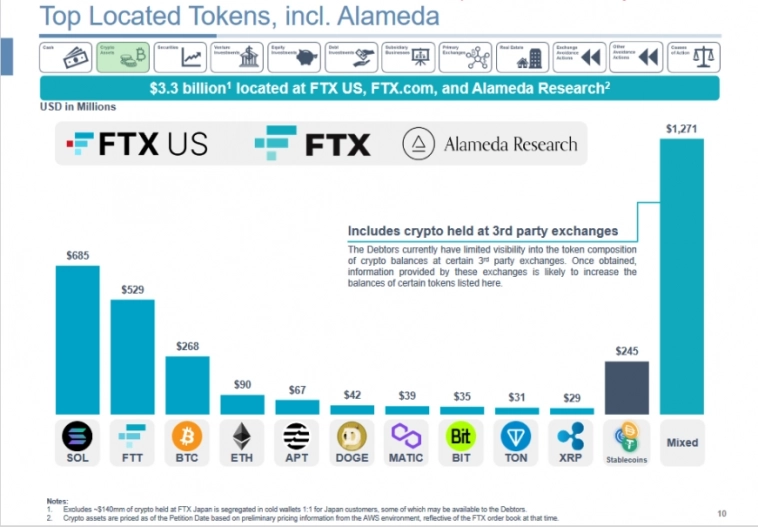

It is currently unknown to what extentthe developers of Solana and FTX collaborated, since price manipulation could be an initiative of the SBF itself. Notably, according to the results of the calculations of the liquidation commission, SOL ranked first in balances with a total amount of $ 685 million - almost three times more than BTC or stablecoins.

Image source: twitter.com/adamscochran

The coin count is not over yet, as it is necessaryto bring together the assets of all the companies of the “crypto empire” (of which there are about a hundred), and some of the reserves are still placed on third-party exchanges. According to preliminary estimates of the commission, a total of $5.5 billion worth of assets were identified, of which cryptocurrencies account for $3.5 billion. The total debt of the SBF is estimated at $8.8 billion.

For Solana holders, the news is depressing,because at the end of the judicial debate, the liquidation commission will start selling coins to cover the damage to investors. The dumping of stocks will likely lead to a decrease in the value of the cryptocurrency.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)