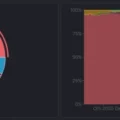

A key indicator of the reliability of first-level blockchains is decentralization. Among networks withsupport for smart contracts Solana is inferioronly Ethereum, while the transaction fee costs a penny, and the average network speed often exceeds 3 thousand operations per second. According to Unstoppable Finance, the number of validators and the Nakamoto ratio of the network is higher than that of classmates.

Image source: cointelegraph.com

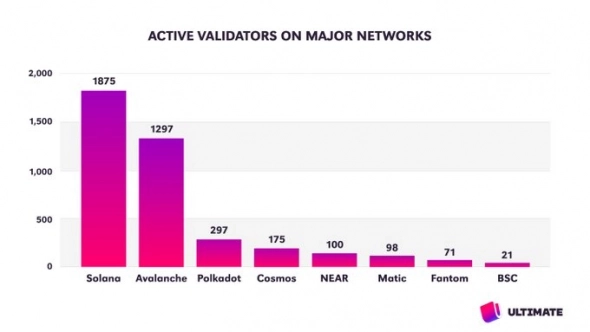

If things were so rosy, Solana wouldn't be trading 86% below its record right now.

Image Source: Cryptocurrency ExchangeStormGain

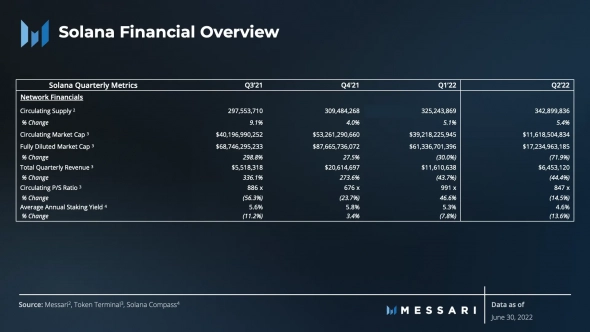

Fly in the ointment are frequent failures, delaystransactions and network shutdown. On average, Solana loses one day of work per month. In the second quarter of 2022, this led to a decrease in the average number of transactions per day by 17.6%, and revenue by 44.4%.

Image source: messari.io

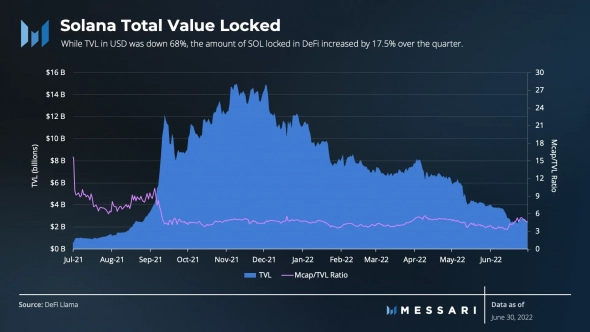

The crisis also contributed to the drop in indicators,engulfed the cryptocurrency market. However, with a loss of 68% of the volume of blocked funds in the DeFi sector, Solana showed a growth in the number of blocked coins by 17.5% in the reporting quarter.

Image source: messari.io

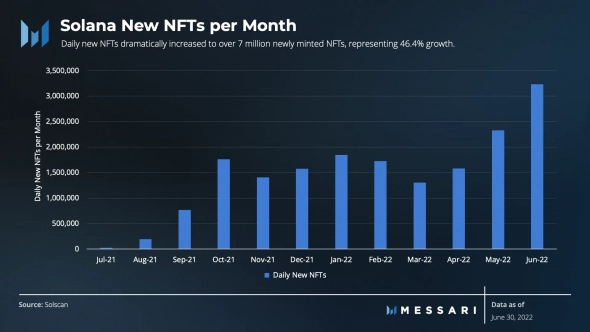

Solana feels best in the sectorNFT, where he continues to set records. Minting of new tokens on the network jumped to more than 7 million per day with a 46.4% increase. In terms of secondary NFT sales, the network ranks second after Ethereum. Recently, Instagram (banned in the Russian Federation) added support for NFT, and in the near future, the addition of a Phantom wallet based on Solana is expected.

Image source: messari.io

Despite the general decline in the cryptocurrency market,the average number of validators in the second quarter increased by 19.4% to 1875. The Nakamoto ratio rose to 27, while during 2021 it did not exceed 20. The increase in network scalability should have a beneficial effect on its sustainability.

The developers also did not sit idly by:at the end of May, the QUIC function was launched, which allowed the network to stabilize by the end of the quarter. And with update 1.11, a fee prioritization mechanism will appear, which will allow users to increase the fee within a single application (and not the entire network, as in Ethereum) to speed up the transaction.

Now the cryptocurrency market is under pressure asnegative macroeconomic environment, as well as a series of crashes of crypto projects. However, Solana retains a high potential, and in a number of parameters it already outperforms its closest competitors.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)