Starting from May 13, only around 900 BTC per day will be mined. Let’s see why this is important.

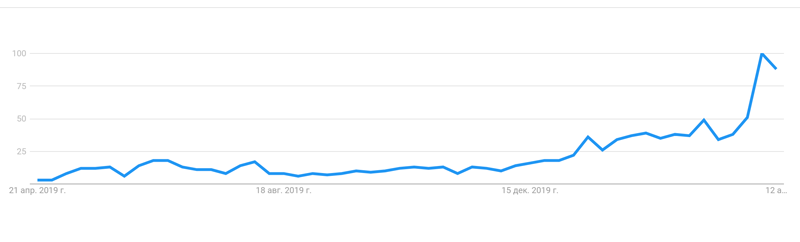

GoogleTrends shows growing interest in halvingBitcoin - a reduction in the reward for each mined block in the Bitcoin blockchain, which will take place in May. In less than a month, instead of 12.5, each block will be rewarded with only 6.25 bitcoins, and the total number of bitcoins mined will be about 900 such cryptocurrencies per day. The largest number of requests comes from five countries - Luxembourg, Latvia, Estonia, Switzerland and Lithuania.

These countries are by companies that have themare based, are not included in the top 10 in mining Bitcoin, which means that interest in bitcoin halving is investment in nature, that is, potential cryptocurrency investors expect that halving can lead to an increase in the price of this digital asset.

The same can be said for the request “Bitcoin halving 2020”, for which the leaders in the number of requests are residents of countries such as Nigeria, Venezuela, Austria, Portugal and the Czech Republic.

Bitcoin halving in history takes place for the third time. The previous halving took place in 2016 and attracted less attention than the upcoming event. What is the reason?

Dollar inflation will be higher than Bitcoin

Large-scale issue of money, started by the US Federal Reserve,led to the fact that an additional $ 8 trillion was launched into the financial system of the United States and the world, despite the fact that industrial production collapsed in the American economy by 5.4%, showing the deepest drop since January 1946.

BREAKING: U.S. industrial production plunges 5.4%, the worst drop since January 1946. Analysts had expected a drop of 3.5%. https://t.co/xVICT5pzYb pic.twitter.com/jlcKkIGeJY

- CNBC Now (@CNBCnow) April 15, 2020

The consensus forecast was that the fallwill be smaller - 3.5%. However, the number of manufactured goods in the US economy is falling, and the dollar mass is growing. It would still be fine if economies grew outside the United States, but the fact is that in the leading countries of the world there is also a recession. So, such a huge money supply looks, to put it mildly, inappropriate.

Of course, it's all about politics: US banks may begin to feel the need for additional capital. The market demonstrates pessimism of investors.

BREAKING: Bill Nygren thinks you should buy stocks pic.twitter.com/Nl9Sc83siV

- Rudy Havenstein goes brrrrrrr. (@RudyHavenstein) March 11, 2020

Every check that 70 million Americans receivein the amount of 1.2 thousand dollars, will be signed for the first time in history not by an employee of the US Treasury, but by the owner of the American White House. Thus, Donald Trump reminds voters of the November 2020 presidential elections in the United States, in which they need to understand who is worth voting for.

Previously, this did not happen in the United States, so that checkssigned by the president, who, naturally, represents not a neutral side, but has a party affiliation. But Trump rewrites the centuries-old traditions of American democracy, and not only that.

However, bitcoin goes its own way. Every 210 thousand blocks there is a halving of the reward, and Bitcoin inflation for the first time will fall below 2%, that is, 1.8%. This is a very important point: it is below the value of the consumer price index, which even before the large-scale issue of money was more than 2.2% in annual terms.

At the end of March, dollar inflation measuredin terms of money supply in the USA, it has already reached 6.7%. The US dollar is in a losing situation against Bitcoin. Exactly like gold: the growth rate of gold volumes, as Viktor Lee co-founder of DeFiToronto warned earlier, will be higher than the growth rate of bitcoins.

Next #bitcoin #halving is a significant milestone as bitcoin inflation rate will fall to 1.8%, similar to that of gold (i.e., new gold mined-to-inventory ratio)

— Victor «DeFi Toronto» Li (@CryptoEcon_Li) July 31, 2019

Unusual third halving?

A well-known cryptocurrency specialist, David Schwartz, believes that the effect of reducing the pace of bitcoin supply has not yet been reflected in the price of bitcoin before halving.

You’re saying the halving’s bullishaffect on supply is priced in but the bearish sell pressure after it isn’t? The reverse seems much more plausible to me, and yet still pretty implausible.

- David Schwartz (@JoelKatz) April 14, 2020

The current price, in fact, reflects the “bearish”cryptocurrency expectations in the short run after mid-May. And this is only with the realization of the most pessimistic scenario, because the previous halving showed the following picture.

One year before the first halving, the cost of bitcoinwas 2.5 dollars. After halving, she grew 5 times, amounting to 12 dollars. At the same time, the maximum growth of cryptocurrency in the period before the second halving was recorded at $ 1,200, having risen in price by ten times.

Bitcoin price one year before the second halvingwas 280 dollars. After halving, cryptocurrency grew 2.5 times ($ 2650). The historical maximum was fixed at $ 19,300. At the same time, growth was almost thirty times.

And before the first halving “bullish” run of the marketBitcoin began six months before halving, before the second - two months, but this time there is no price rally visible, although less than a month remains. It is exactly the same with the volume of trade: before the first halving, turnover grew on average by 50% two months before it, before the second - by 150% - per month, now, according to the results of March, the increase was 19.68%.

The “bearish” scenario is inscribed in the price of bitcoin right now

Reflection of the pessimistic scenario in the priceIt also shows that the ratio between bitcoin put options (to sell bitcoins at a fixed price after halving, on a certain date) and call options (to buy bitcoins at a fixed price after halving) weighs in favor of the first contracts and is 0.61. up from 0.42 recorded on March 24.

But this Bitcoin Put-to-Call indicator is stillremains less than 1, which means that there are fewer people willing to sell cryptocurrency after halving than to buy it. The situation with bitcoin futures indicates that, according to data from 11 trading platforms, including CME Group, investor interest in them is growing after a record decline in trading volume a month ago.

Bitcoin futures open interest is timidly rebounding one month after the historic 40% one day sell-off pic.twitter.com/rMXs75Nves

- skew (@skewdotcom) April 13, 2020

Bitcoin mining is on the rise

Bitcoin mining shows that the emergence ofAntminer with an indicator of 7 nanometers has led, according to the observation of PlanB, the author of the predictive concept of Stock-to-Flow, to the fact that blocks can be found faster than at an interval of 10 minutes, and this will lead to an adjustment in the difficulty of mining a given cryptocurrency.

Difficulty adjustment (DA) keeps blocks at 1every 10 minutes. Important because every block has new bitcoins (miner subsidy). Currently new mining hardware (7nm) hits the market and blocks are found faster than 1 every 10 min, DA will adjusts up to keep blocks at 1 every 10 min

- PlanB (@ 100trillionUSD) April 15, 2020

Indeed, in recent days there has been an increase in this indicator.

New Bitcoin mining difficulty: (+ 5.77%) #Bitcoin #Halving pic.twitter.com/ioAsZYzEYg

- Slytherin Crypto (@SlytherinCrypto) April 8, 2020

The bitcoin hash rate returned the lost positions and is now at around 130 exhash per second.

Mining specialist, BearBox employee, known on Twitter under the nickname Storms, believes that mining can not currently rely on a significant reduction in the cost of electricity.

What energy supply increase? The glut of oil that we can’t store anymore of?

In what ways does that lower electricity costs?

- Storms (@austorms) April 15, 2020

He also talked about the benefits of largemining companies that have access to various tools for hedging the risks of lowering the cost of bitcoin, as well as to lending against collateral in the form of digital assets extracted. Analysts believe that even more competition will unfold in the field of cryptocurrency mining, and the low price of bitcoin currently plays into the hands of those market participants who want to further increase their influence on it.

In my opinion, some miners want the absolute monopoly. So they could afford those prices for a little time while other miners would have to shut down.

- il Capo Of Crypto (@CryptoCapo_) April 3, 2020

Halving Bitcoin SV and Bitcoin Cash: calm dynamics

Bitcoin SV halved situation andBitcoin Cash leaves a positive impression. Bitcoin SV, which cost $ 111.2 on March 17, costs $ 199 on April 19. Bitcoin Cash has similar dynamics: on March 13, the altcoin was worth $ 147.2, and on April 19, its price was $ 236. After halving the price decreased but, insignificantly. It is too early to say whether there will be significant growth, but we can say for sure that the situation as in the case of Litecoin, which rolled downhill last year after halving, did not repeat.

However, some minersBitcoin SV and Bitcoin Cash have switched part of their capacities to mining bitcoins, but from the point of view of diversification, the majority of miners do not intend to completely abandon the production of these altcoins. And this already finds confirmation: there has been an increase in the Bitcoin Cash hash after a decrease in this indicator immediately after the halving.

The biggest event of this month with #crypto hasbeen the #Bitcoin Cash Halving where the amount of #BCH mined each block halved from 12.5 BCH to 6.25 BCH on April 9. /1@rogerkver @Bitcoin pic.twitter.com/dQsYfkwxAA

- 21Shares (@ 21Shares_) April 15, 2020

At the same time, analysts at 21Shares research company believe that even a temporary significant withdrawal of bitcoin miners from the mining industry of this cryptocurrency immediately after its halving is extremely unlikely.

Americans went to buy bitcoins

Bitcoin's upcoming halving affects moodsAmericans when they began to receive the first checks from the US federal government as financial support. Mike Dudas, the general manager of The Block, said that the funds for such assistance were transferred to them in bitcoins.

Square’s CashApp, which is managed by the head of Twitter’s social network, Jack Dorsey, has seen a flurry of applications for converting U.S. federal funds into bitcoins.

People are spending their stimulus checks right now @CashApp https://t.co/3dFaMQkvnO

- Dennis Parker⚡️ (@Xentagz) April 15, 2020

This fits in with the growing number of Bitcoin wallets with non-zero balances, as reported by The DaoMaker.

</p>The number of addresses with non-zero #BTC balance on it lately surpassed 2017 high.

29,448,686 addresses hodl some #Bitcoin now. # Blockchain #halving #satoshi pic.twitter.com/Ugq5ObK41P

- DAO Maker (@TheDaoMaker) April 15, 2020

5

/

5

(

1

voice

)