The number of cryptocurrency addresses with coins purchased below the current price is growing rapidly in the wake of the bullishtrend and growth of the BTC rate.

However, not all cryptocurrencies are created equal.Rising prices also affect transaction costs. The rise in fees on the Bitcoin network is spurring the transition to SegWit. Almost two thirds of payments now use this format.

Most crypto investors are in the black

More than 92% of all Bitcoin holders (BTC) bought their coins at a price below the current one.

Some digital assets are outperforming Bitcoinby profitability. These are mostly coins launched after the 2017 crypto mania. LINK, VET, CRO and SNX attracted speculative interest in 2020 and, as a result, broke previous all-time highs.

According to IntoTheBlock, 95% of ChainLink and Crypto.com addresses are currently in the green zone. Meanwhile, 94% of VeChain holders acquired their assets at a lower price than today.

Finally, the vast majority of Synthetix Network Token holders are very happy with their investment, as the coin has appreciated by 2,320% in the last 12 months.

For any address with a positive balance, @intotheblock identifies avg price at which tokens were acquired, indicating if the address is at profit or loss.

Addresses at profit: $ BTC 92% $ ETH 77% $ LINK 95% $ BCH 90% $ LTC 55% $ ADA 57% $ CRO 95% $ VET 94% $ DASH 56% $ MKR 76% $ SNX 100% pic. twitter.com/XceYlTgsUu

- intotheblock (@intotheblock) August 17, 2020

At the other end of the spectrum, crypto assets are the mosthit hard during the 2018 bear market. For example, only 77% of Ethereum addresses are profitable. Things are even worse for Litecoin, Dash and Cardano. Here, only 55%, 56% and 57% of addresses are in plus, respectively.

Rising prices push traders towards SegWit

As mentioned earlier, bullish price action leads to higher transaction fees. Ethereum suffered the most in this regard. The growing interest in DeFi means more online activity.

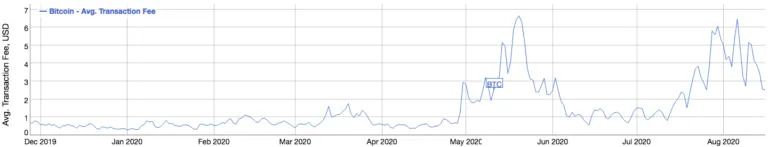

Bitcoin is no exception in this regard. According to BitInfoCharts, the average bitcoin transaction fee reached almost $ 6.50 in early August. Increasing prices not only makes each satoshi paid as commission more valuable, but also stimulates speculative interest.

The number of deals is growing, and they are all competing for a place in the block. Chart of the amount of commission on the bitcoin network:

While Ethereum awaits the long-awaited update, which is aimed at solving the scalability of the network, Bitcoin users are actively switching to SegWit technology.

SegWit, or Segregated Witness, was added innetwork in 2017 as a soft fork. This solution reduces the amount of transaction data that is stored on the blockchain. This actually increases the bandwidth of the network.

Since the launch of SegWit, an extra $ 500 million has been spent on commissions. Some netizens have already noticed this, so the popularity of SegWit is growing steadily.

Investor and entrepreneur Alistair Milne agreesWith this estimate, he refers to transactionfee.info data. The number of transactions using the scaling solution reached 65%, an all-time high.

#Bitcoin SegWit adoption continues to march higher

Higher fees give an incentive to switch to SegWit wallets

bad actors like @blockchain will eventually see their growth reverse and be forced to enable pic.twitter.com/PCdcPSTL8y- Alistair Milne (@alistairmilne) August 17, 2020

Milne argues that companies that do not useSegWit will eventually be “forced to turn it on”. Citing Blockchain.com as an example, he states that reluctance to shrink the block space occupied by a transaction could end badly for large users like cryptocurrency exchanges.

Who is promoting SegWit?

SegWit benefits the entire web. A decrease in demand for a place in a block leads to a decrease in network fees.

In fact, Milne recently promised a bonusin the amount of 0.1 BTC to whoever creates a bot that will post “When is SegWit?” in response to all tweets from companies not using this technology for their transactions.

0.1 BTC bounty for an open source bot / service that replies to every Blockchain dot com / BitPay / etc. tweet with «When SegWit?» … just give it permission to use your account and it does the rest

- Alistair Milne (@alistairmilne) August 13, 2020

Rate this publication