By the end of 2022, Ethereum is doing worse than Bitcoin: over 12 months, the fall was 69% versus 64%, respectively.The long-awaited transition to PoS only added new difficulties, promising a difficult year for cryptocurrencies in 2023.

Image Source: Cryptocurrency ExchangeStormGain

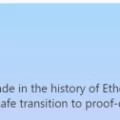

On the technical side, the merger passedflawlessly, and a key achievement was a 99.9% reduction in network energy consumption. The “heart pulse” has normalized: now it takes exactly 12 seconds to create a block.

Image Source:glassnode.com

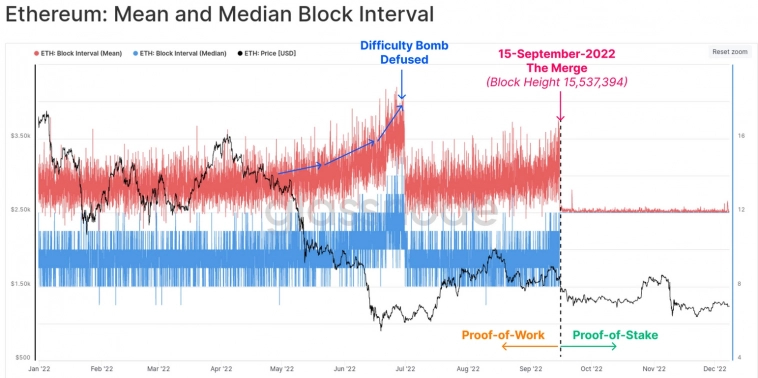

A controversial achievement can be considered an increase in the number of validators by 13.3% or 57 thousand people.

Image Source:glassnode.com

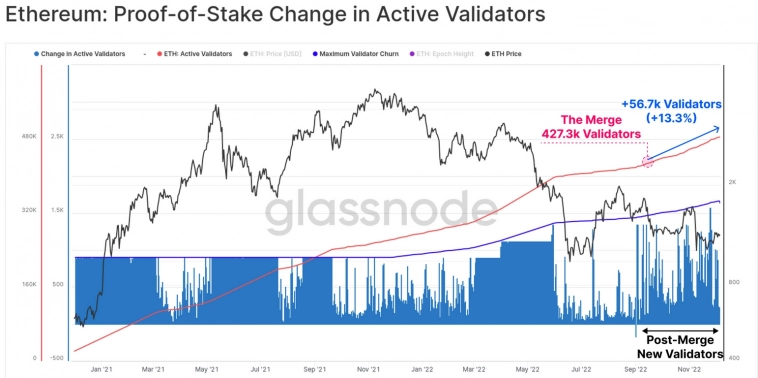

This indicator usually indicates an increasenetwork decentralization. The opposite happened with Ethereum due to a significant entry threshold of 32 ETH (~$38K) for self-deploying a node. As a result, investors incurred money to aggregators represented by Lido Finance and the largest crypto exchanges.

Now Lido, along with Coinbase, Kraken and Binance, has a 57% market share, while the US share in the global standings has reached 56%. For cryptocurrencies, these are extremely alarming bells.

Image Source:etherscan.io

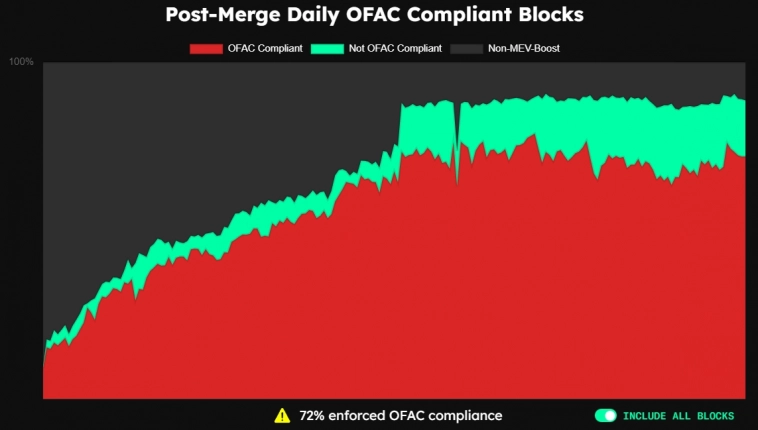

Due to the dominance of the United States in the formation of transactionsFinancial regulators have already announced the need for more careful oversight of the network. The presence of such large participants makes it easier to control and impose the rules of the game. Thus, the crypto industry this year faced a precedent in the form of blocking the Tornado Cash mixer by a division of the OFAC Ministry of Finance. The level of censorship in Ethereum has reached 72%.

Image Source:evwatch.info

However, things can take an even sadderturnover if SEC Chairman Gary Gensler achieves recognition of Ethereum as a security. The corresponding statement was made on the day of the transition to PoS, since staking provided users with the opportunity to receive passive income.

This list of challenges is not over yet.The deposit contract to attract validators was launched at the end of 2020 and currently contains 15.7 million ETH for $19 billion, or 13% of the entire capitalization of the network. A number of investors have deposited coins at a higher price, but cannot return them due to the current lock.

The restriction will be lifted by the Shanghai hard fork,which will take place tentatively in March 2023. The release of a large mass of coins and the disappointment of some investors with negative dynamics can lead to a sell-off of ETH and a new round of decline.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)