Over the past 24 hours, the price of bitcoin has lost $ 400 amid a downturn in the stock market and an increase in sales by miners.

In the first half of June 24, BTC was trading around $9,650, but in less than a day its rate fell to $9,070, even reaching $8,992 for a short time.As a result of the collapse, traders began to massively liquidate long positions in futures contracts. On crypto derivatives exchange BitMEX alone, total sales reached $55 million.

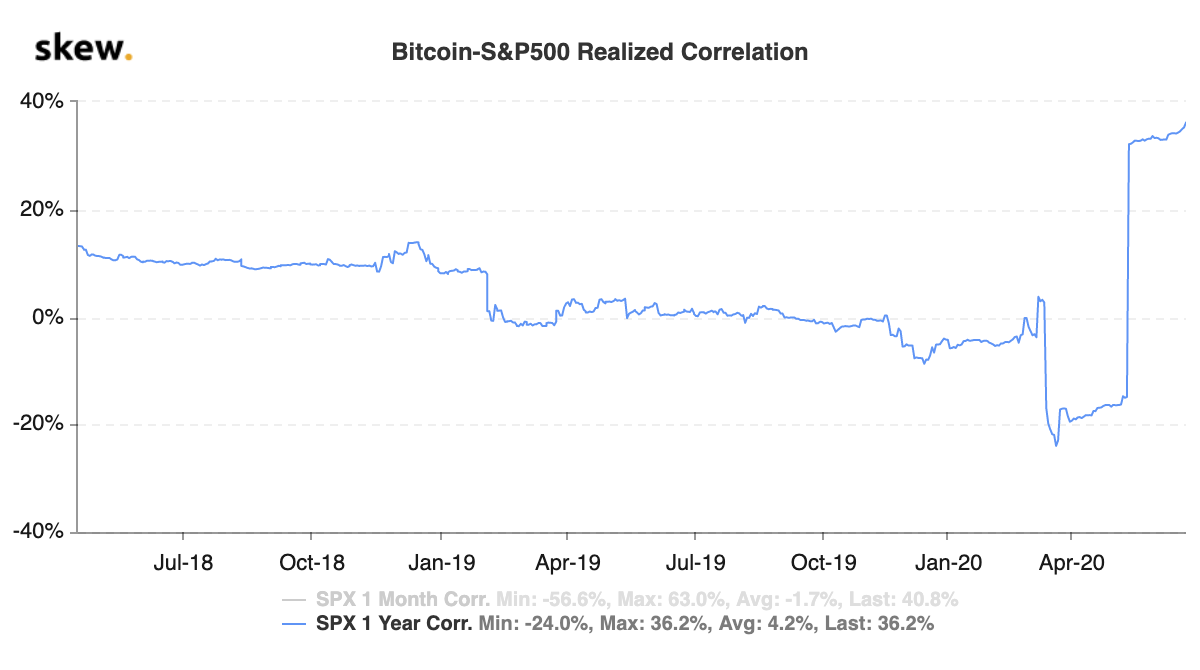

According to analysts, the decline is due to several factors at once, the main of which is the pressure from theIn recent months, experts have noted an increase in For example, the indicator of the dependence of the dynamics of the BTC rate on theof the S&P 500 index rose to almost 40%.

Another reason for the decline in prices is the influxcryptocurrencies on exchanges from miners who began to actively sell their stocks after the next adjustment of complexity. The peak of transfers occurred on June 24, when only Bitfinex from prospectors received 2650 BTC. In the short term, this put pressure on the market and caused an increase in volatility.

However, many traders are optimistic as June 26 expiresBitcoin options have a record $1 billion in expiry dates, and most of the contracts are in the $10,000-11,000 range.This factor should stimulate growthrate above $9900. However, bitcoin whales may also join the game, the number of which is gradually growingAnd last week it reached a record high.

At the time of publication, BTC is trading at $9218, having lost 3.67% over the past day.

</p>