06/30/2020

Alex Kondratyuk

Over the past few weeksThe decentralized finance (DeFi) market landscape has changed dramatically. The Compound landing project, which has long held the second place in the DeFi Pulse rating, suddenly broke into the lead.

Thanks to the hype surrounding the distribution of tokensCompound is now ahead of the Maker DAO by the amount of ETH coins blocked on smart contracts. Recently, the capitalization of the DeFi segment has grown significantly, as has the trading volume of decentralized exchanges (DEX).

ForkLog Magazine understood the reasons behind the resounding success of Compound and the rise of the decentralized finance market as a whole.

Background COMP

Compound was founded in 2018. It operates on the basis of Ethereum and is a money market protocol where interest rates are formed algorithmically based on the ratio of supply and demand.

In 2019, a startup from San Francisco raised $ 25million in the Serie A funding round led by Andreessen Horowitz. Also in the round were Bain Capital Ventures, Polychain Capital and Paradigm.

Even in the early stages of the project life cyclefounder Robert Leshner announced his intention to gradually “decentralize” the protocol, depriving Compound Labs developers of administrative privileges in favor of the community. According to him, the community could change the list of supported coins, influence risk parameters, interest rate curves, etc.

April 16, 2020 management issues atCompound has moved from administrators to holders of COMP tokens. The latter are designed to encourage community participation in the project, acting as a voting mechanism. Therefore, anyone who has a good idea has the opportunity to organize support for changing the protocol.

In total, Compound Labs issued 10 million COMP coins. 55.71% of them are to be distributed among the project team members, founders, investors and partners. The remaining 42.29% will go to users within four years. The pace of the so-called "liquidity mining" will be 2880 COMP coins per day.

Half of the assets will be distributed amongsuppliers of offers on the Compound service, the remaining 50% are among borrowers. The dynamics of coin accrual is dependent on market interest rates. For example, if USDT has the highest rates, then those who deposit and take loans in the Tether stablecoin will receive more COMP tokens.

DeFi landscape changes

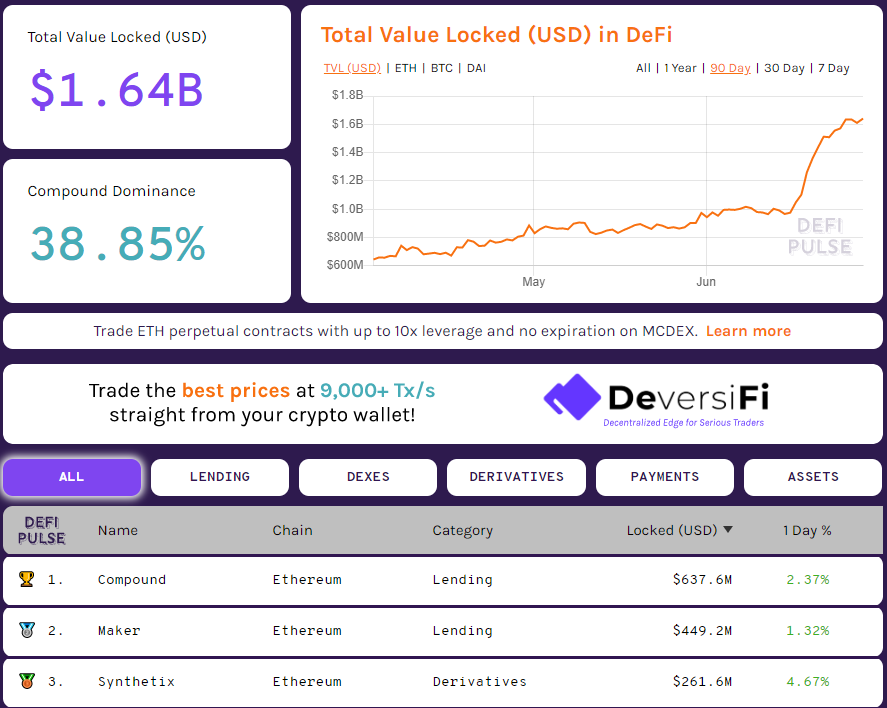

In early June, the cost of blocked fundson smart contracts, DeFi applications were approaching $ 1 billion. Until recently, the MakerDAO project dominated this segment, occupying about 55% of the market. Behind him by a large margin followed the platform of synthetic assets Synthetix and Compound.

In the second half of June, the alignment of forces insegment has changed dramatically. As of June 29, Compound leads the DeFi Pulse ranking. The cost of ETH blocked in this application exceeds $ 600 million.

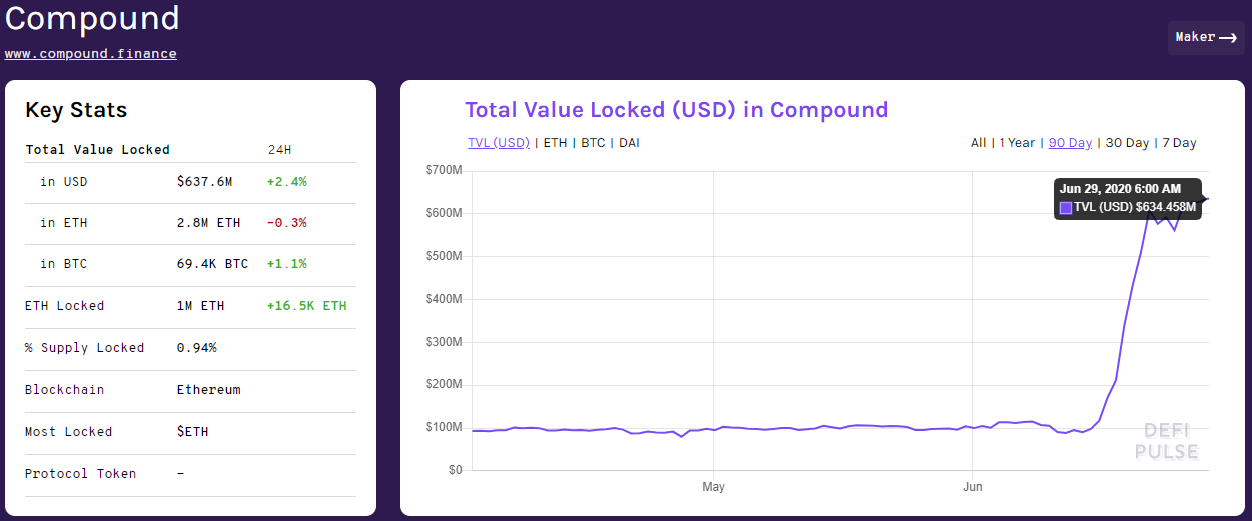

Compound’s massive cash flow started afterstart distribution of tokens COMP. The chart shows a sharp increase in the cost of ETH, which was blocked in the DeFi ecosystem, that began on June 16. We can also note a significant lag behind Maker from the newly minted leader, whose dominance index is 38.85%.

As early as June 15, the volume of assets blocked at Compound was about $ 98 million. Now this figure exceeds $ 600 million. Data: DeFi Pulse

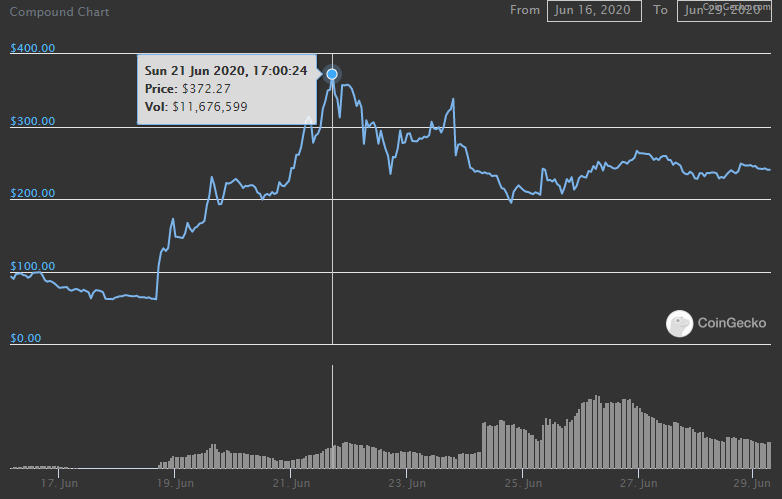

The price of COMP, according to CoinGecko, soared from $ 92 (June 16) to $ 372 (June 21). Subsequently, the token quotes were adjusted to $ 240.

A sharp rise in the market value of COMP, the emergence ofcoins on various trading floors (first of all, on Uniswap and Coinbase Pro) and applications positively influenced the market capitalization of the DeFi market and the turnover of decentralized exchanges (DEX).

Many market participants are likely to haveA reasonable question: why is the rise of the DeFi market and the increase in trading volumes on DEX still not particularly reflected in the price of Ethereum? According to Zerion co-founder Vadim Koleoshkin, this is not surprising, since trading volumes on decentralized exchanges are still much less than on “charged” exchanges. liquidity on sites like Bitfinex or Coinbase Pro.

"Also, a large number of Ethereum are still nottransferred from ICO wallets or stored in custody services by institutional players. DeFi currently has less than 3% of the total airtime, ”he said.

However, Koleoshkin is sure that gradually capital from centralized services will migrate to decentralized applications and to DEX.

“I think the opportunity to earn and convenienceUses will be the main drivers of DeFi growth in the near future. Thus, the price of Ethereum will be more dependent on the demand for it in the decentralized finance ecosystem. ”

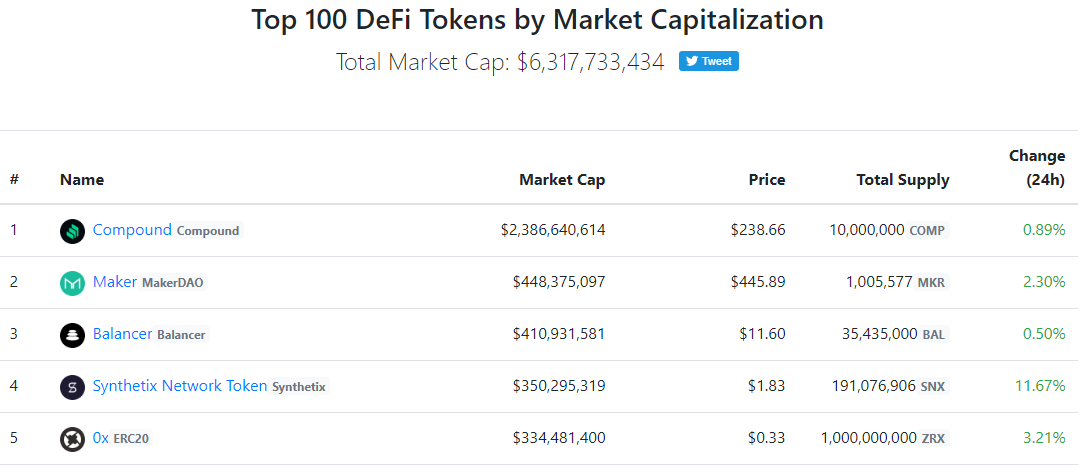

According to the DeFi Market Cap, the total value of DeFi tokens exceeds $ 6 billion, as of June 29. Back in early June, this figure was at around $ 2.1 billion.

The Compound Project Management Token (COMP) leads the way with the Maker DAO (MKR). The market capitalization of the first “DeFi sphere unicorn” exceeds $ 2.3 billion.

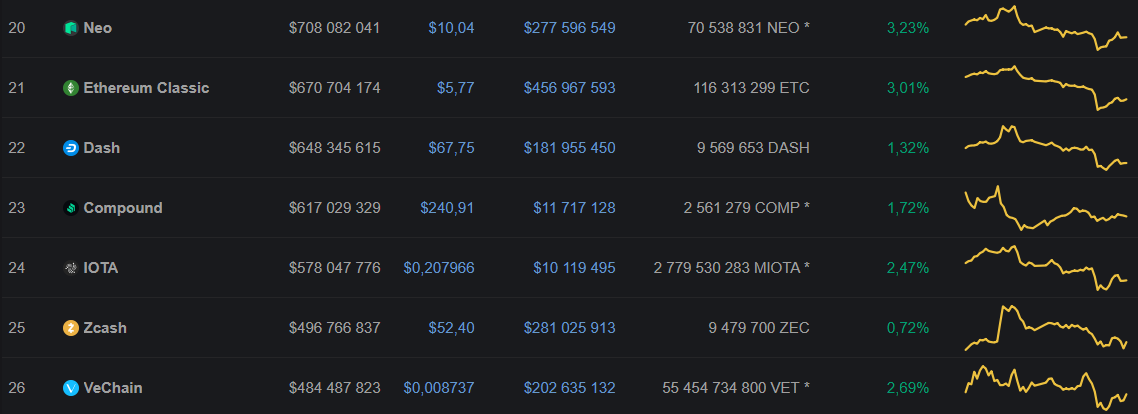

In the CoinMarketCap rating, the COMP coin takes 23rd place as of June 29th.

In less than a week, the Compound token has almost grown to the capitalization of coins such as Neo, Ethereum Classic, and Dash, and is already ahead of IOTA, Zcash, and VeChain.

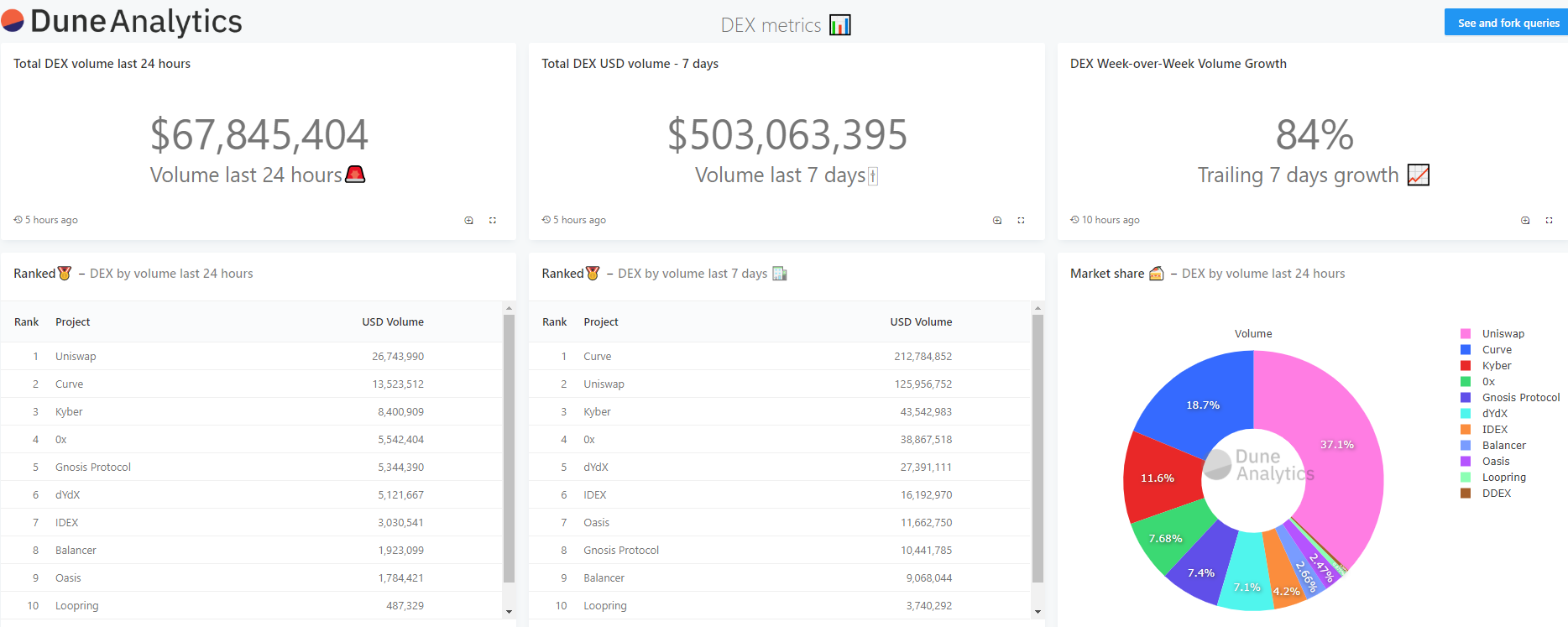

Largely thanks to the hype around COMP, trading volumes on DEX grew by more than 80% in just seven days. Uniswap has further strengthened its position in the segment.

In the non-custodian platform sector, the Uniswap exchange dominates. Data: Dune Analytics.

Probably inspired by the success of Compound, histhe coin was launched by Balancer's automated market-making protocol. The token on the first day of trading showed significant growth, jumping from $ 7 to $ 22. Thanks to this, the project was on the second line of the DeFi Market Cap rating.

Currently, according to DeFi Pulse, Balancer is in 4th place in terms of the cost of blocked ETH, behind the new leader Compound, MakerDAO and Synthetix.

Soon there was news that an unknown hacker managed to withdraw $ 500,000 in altcoins from the pool of the Balancer Labs DeFi project, using the vulnerability of a smart contract.

The “fashion” for control tokens has not only changed the balance of power in the DeFi segment. but it has also become one of the reasons for the growth of the Ethereum median commission to a maximum in almost two years.

According to Koleoshkin, many companies are really preparing to launch their tokens. However, the hype around the coins is unlikely to be comparable to what happened during the “ICO fever” in 2017-2018.

“Unlike the wave of ICOs, projects are likely tothey will need to show what they did before raising money. At the moment, this can be compared to raising funds from a round of venture financing.

A big plus for these projects will be thatthe infrastructure for trading and use is already ready. You don't need to pay big money for listing on exchanges - you just need to create a Balancer or Uniswap pool for a token, ”the co-founder of Zerion shared his thoughts.

According to him, the development of the decentralized finance market is proceeding rapidly:

“Over the past two years, DeFi has gone fromconcepts and the first working examples of smart contracts to one of the industry's most talked about trends and billions of dollars of capital, every day turning around in the open market. If a year ago it was used only by enthusiasts who were interested in the very concept of programmable finance, now thousands of people from all over the world manage their capital and savings using new services. ”

The expert emphasized that much remains to be done in the area of decentralized finance. The main upcoming challenge is the launch of the second version of Ethereum.

“The industry is waiting for a big migration, I would evensaid the evolution from DeFi to DeFi 2.0. ETH 2.0 will open up new opportunities for developers, but there will be many restrictions. Projects will need to take all the experience gained and re-create their products in new conditions. I think DeFi and DeFi 2.0 will exist side by side, as bitcoin and Ethereum exist now, and the transition will take years, "Koleoshkin concluded.

Controversial Coinbase Effect

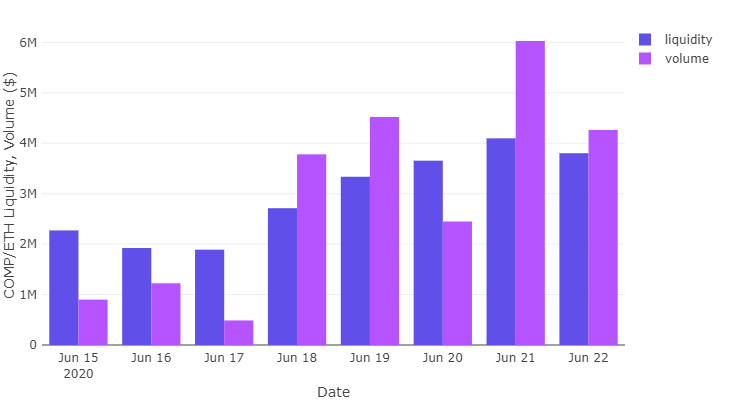

On June 15, COMP debuted with Ethereum onleading non-custodian exchange Uniswap (v2). 25,000 COMP and 2,000 ETH were deposited in the platform pool. The price of the token initially was approximately $ 18.50 or 0.08 ETH, but in just three days it reached $ 145 and continued to grow amid news of the upcoming June 22 listing on Coinbase.

Dynamics of trading volumes and liquidity of the COMP / ETH pair on the Uniswap exchange. Data: Dune Analytics.

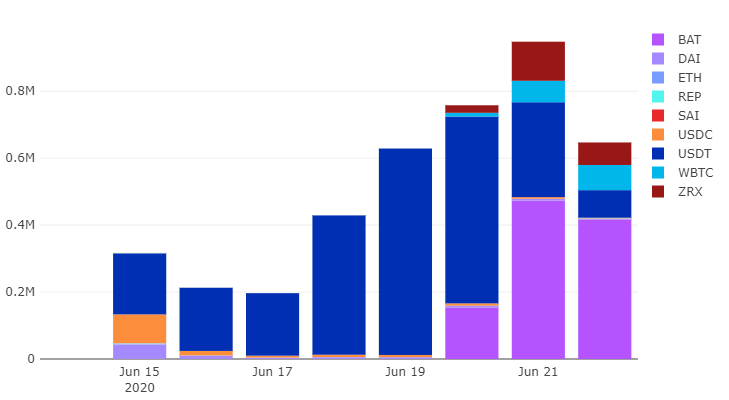

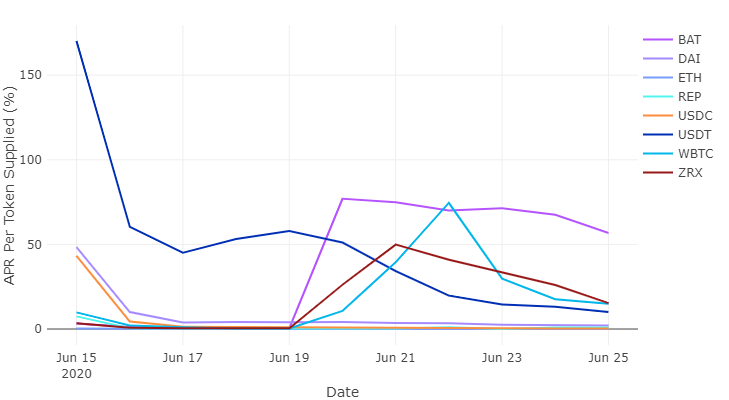

The following chart shows that at first most of the COMP coins were distributed among users of the Tether USDT stablecoin, and then among Dai holders.

Excessive lateral bias at firstUSDT was likely driven by much higher deposit and lending rates compared to other popular DeFi market assets. As already mentioned, the dynamics of the COMP distribution directly depends on interest rates.

Dynamics of changes in annual interest rates forvarious DeFi tokens for the period from 15 to 25 June. The initially superhigh reading for USDT has dropped significantly, but remains at double-digit levels.

One reason for the subsequent declinepopularity and, therefore, the rate on USDT could be an approved proposal by COMP holders to redirect 10% of the interest income generated by this stablecoin to the reserve fund.

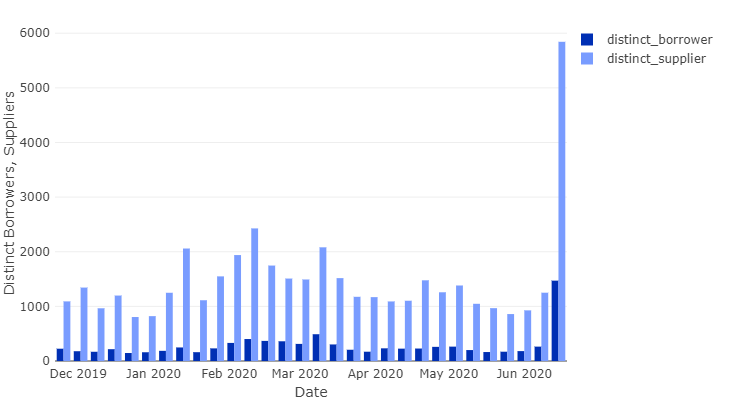

The revival of activity in the DeFi market was reflected in the number of its participants. The number of liquidity providers on the Compound service jumped by 200%, the number of borrowers by 238%.

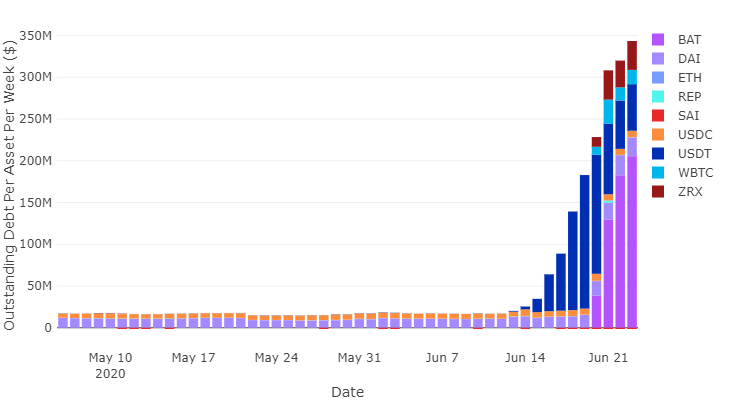

Compound's total outstanding debt since June 15 has grown by 470%, to $ 137 million. USDT accounts for over 80% of this indicator.

The demand for loans in USDT rose sharply in the second half of June.

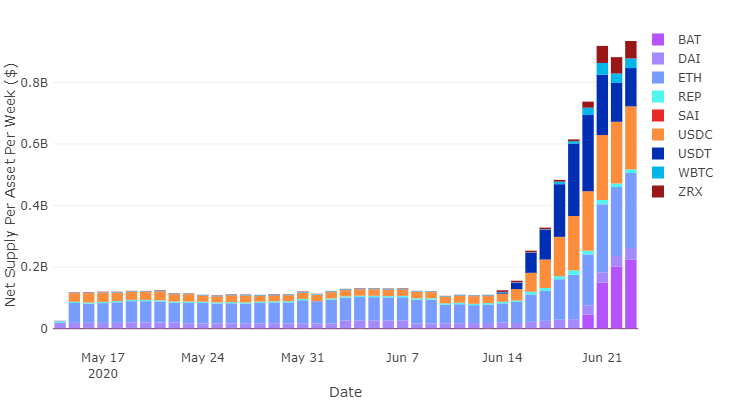

The volume of liquidity supply has grown along a similar trajectory:

Note that the shares of USDT, USDC and ETH in depositsusers are comparable among themselves - 35%, 26% and 28% respectively. Such a uniform distribution in this case is due to several factors: the USDT rate is the most attractive, ETH is the most popular asset among DeFi platforms. In turn, USDC stablecoin may be the preferred security for risk-averse investors. So, by borrowing USDT against USDC security you can avoid the risk of liquidation.

It is possible that one of the token growth driversCompound could serve as the so-called “Coinbase effect”. The fact that the “hot” asset will appear on the leading American stock exchange became known almost immediately after the issue of COMP.

On June 23, immediately after the start of the token trading on Coinbase, a serious and unexpected dump price occurred for many.

Coinbase COMP / USD chart by TradingView. Data as of June 29, 2020.

COMP trades opened above $ 400, but soon the price was below $ 200. As of June 29, the coin is trading at $ 240.

Galois Capital experts suggested that one of the early investors could take advantage of the hype around COMP, which was growing rapidly in anticipation of the listing on Coinbase.

Analysts recorded 25 translations for 2000 COMPon exchange wallets against the background of the opening of trading. The company does not exclude that Bain Capital or Coinbase Ventures could be behind them. Coins could be transferred for subsequent sale at a relatively high price.

Messari experts are sure that the effect of listingCoinbase Pro's digital assets are significantly overrated. The company claims that the listing news on the exchange does not significantly affect the general market trends of the selected cryptocurrencies.

According to observations by CoinMetrics researchers,many assets exhibit negative changes in market value within ten days of listing. Only a few coins rise in price by more than 5% over this period. The average effect is estimated by analysts at + 4% to the price.

Will COMP Hold Leadership?

The rapid rise of COMP is still presentedone of the brightest episodes of the still short history of decentralized finance. The success of the experiment is confirmed by the rapid growth of unique users, the dynamics of outstanding debt, interest rates and other key metrics.

The sharp increase in the capitalization of COMP, which in a short time exceeded the indicator of the Maker DAO project by almost five times, is also impressive. The latter, until recently, reigned supreme in the DeFi market.

It’s difficult to outline future medium- andlong-term prospects of Compound. For the further development of the project, not only the growth of outstanding debt is required, but also a more or less equitable distribution of COMP. The decentralized nature of project management, potentially reducing regulatory and other risks, depends on the last factor.

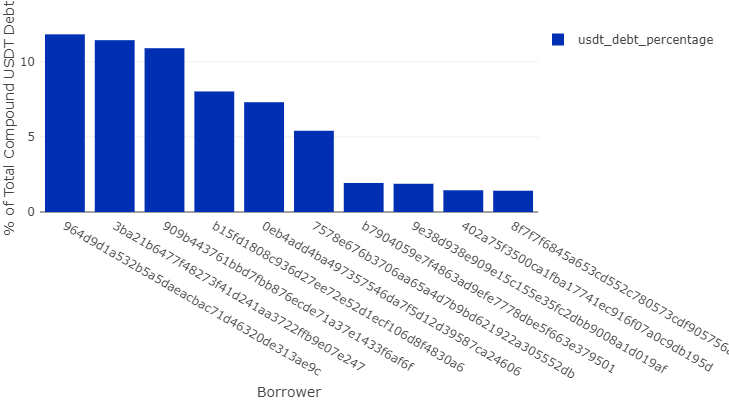

The even distribution of “digital wealth” has never been an industry strength. Compound is no exception: the top 10 borrowers in the USDT market account for more than 60% of the debt in this stablecoin.

The share of the largest borrowers in the total amount of USDT debt on the Compound service.

It can be assumed that competition between the protocols will increase, as Curve, Ren, Synthetix, Balancer, FutureSwap and other DeFi-projects implement similar Compound initiatives.

This means liquidity will flow smoothlyflow between different protocols, affecting interest rates. Consequently, the effect of the huge funds spent by Compound on customer acquisition may soon be offset by arbitrage operations.

Liquidity inflow to the protocol to a large extentDepends on the market value of the COMP token. The higher the price of a coin, the more profitable it is for a user to interact with Compound, and vice versa. In other words, a change in market value is reflected in interest rates and the attractiveness of the service as a whole.

Nevertheless, the distribution of COMP tokens is a striking, exciting experiment. It can serve as a sort of standard for the distribution of DeFi governance tokens.

The successful implementation of such programs by various projects can attract funds from participants in the traditional market that are unfamiliar with cryptocurrencies, who are "tired" of low interest rates.

Alexander Kondratyuk