The Dow Theory has been around for almost 100 years and remains a pillar of technical analysis.This is probably the firstA technical tool that many crypto traders come across.

The Dow Theoryis a financial theory that states that a market is in an uptrend if one of its averages (e.g., industry or transportation) rises above a previous major high and is accompanied by a similar increase in another average.

Basics of Dow Theory

1. Everything is included in the price

"Price includes everything" – the market takes into account all factors that affect prices, such as economics, politics, and psychology, and reflectsthem in the price of the asset.

2.Three market trends

In any market, three trends must coexist: short-term, medium-term and long-term.

- Primary trend: The primary trend is usually a long-term trend, sometimes as long as 1 year. The primary trend influences other trends, so it is the most important trend for traders.

- Secondary Trend: A secondary trend is a correction of the main trend and its duration isIn a bull market, it moves down, and in a bear market, it moves up.

- Minor trend: also known as "short-term fluctuations", usually lasting from several hours to several weeks. This is a fall in a minor trend. During this time, the market “noise” is high and small price fluctuations affect market sentiment.

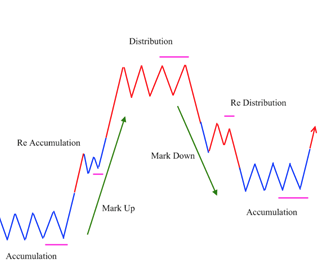

3.Major trends have three phases

- Accumulation Phase

This is the consolidation stage. The market is fluctuating and the old trend is almost over. This is often a good moment for traders to enter the market, but at the same time, the risks associated with it are higher.

- Absorption Stage

A phase of active public participation whenmarket participants have a confirmed direction and are actively buying. At this stage, the main trend usually occurs, the trend lasts the longest, prices rise, and the volatility is highest.

- Distribution Stage (Panic)

When signs of instability appear,traders start to close their positions. During this time, price may continue to stay in the same direction due to momentum, but it will eventually reverse.

In the first phase, the major players appear on the market, and in the second phase, the main traders (and the major players begin toIn times of panic, when there is no longer a large capital, the main market participants are hamsters (beginners).

In a bear market, the phases are reversed: the distribution phase, the public participation phase, and the despair phase.

4.Indexes must confirm each other

Signals that appear in one index aremust match or match signals of another index. If one index, such as the Dow Jones Industrial Average, confirms a new primary uptrend and another remains in the primary downtrend, traders should not assume that a new trend has begun.

5.Volume should confirm the trend

The Dow Theory posits that traders should follow the underlying trend to place orders and not worry about short-term fluctuations.

This affects the trading volumes. In a significant uptrend, the volume of transactions will increase as the price rises. Conversely, in a strong downtrend, trading volume will decrease as prices fall.

6.The trend persists until a clear reversal occurs

The Dow claims that the trend will continue to develop until there is a clear reversal signal.

When prices reach higher highs andhigher lows, an uptrend prevails. Conversely, when prices have lower highs and lower lows, there is a downward trend.

A trend breaks when an uptrend forms a lower low than the previous one, or when a downtrend forms a higher low than the previous one.

Subscribe to ForkNews on Telegram