Grayscale Investments is the only American company that has received permission from the US Regulator (SEC) for OTCtrading in securities linked to real cryptocurrencies. The first shares of the OTC market were Bitcoin and Ethereum, Litecoin and the Bitcoin Cash fork were added to them on August 18th.

Grayscale Investments purchases cryptocurrency with funds from investors placed in a trust with the condition of freezing assets for a year.

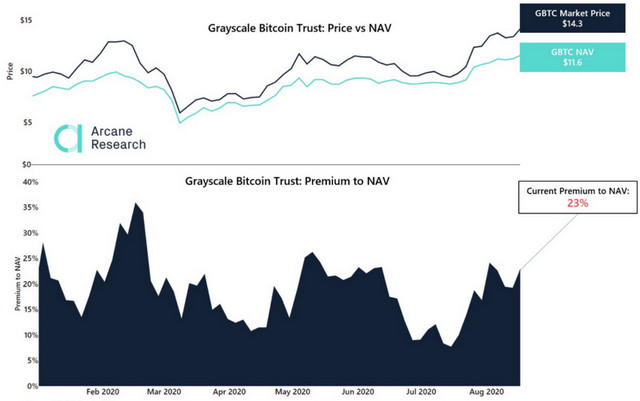

In return, depositors get the opportunity toadditional profit from the growth of shares issued in the amount of blocked assets, whose rate is determined by market demand. On the OTC exchange, securities are always quoted above the value of real cryptocurrencies.

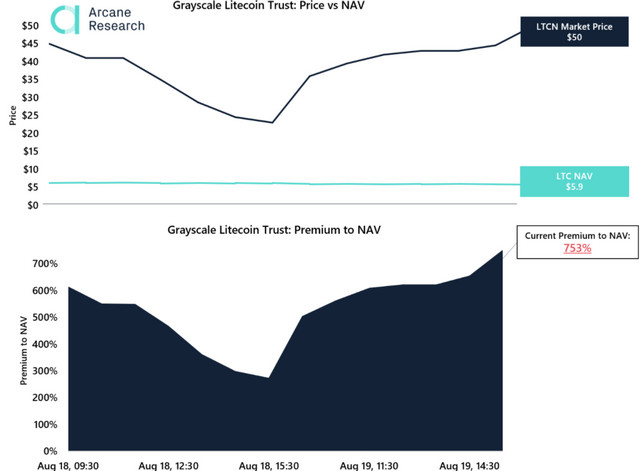

How profitable is this placement of funds,showed the issue of shares of Bitcoin Cash (ticker BCHG) and Litecoin (LTCN). For two days of trading, the demand for securities raised their rate above the value of real assets by 753% and 351%.

Such a “gap” from the real (spot) pricedigital currencies due to the limited supply of securities. The initial issue of BCHG shares was $29.2 million, LTCN – $19.5 million. The issue was determined by the low volume of investments in trusts tied to these cryptocurrencies and high demand for assets.

Grayscale Crypto Shares Diversify By Hedge Funds,like hot cakes, for American investment managers, this is the only legitimate opportunity to include crypto in a portfolio. For those funds that have direct access to cryptocurrencies, the purchase of shares guarantees compensation for losses in the event of a fall in value.

As you can see from the diagram below, compiled by analysts from Arcane Research, even at the time of the market fall, BCTG securities exceeded Bitcoin by 15%.