Summing up the week, we remember the anniversary Bitcoin Pizza Day, the movements of early bitcoins and newlegislative initiatives in the Russian Federation and Ukraine.

Bitcoin price

According to the results of the last seven days, the first cryptocurrency sank by more than 4% and by the end of the week continues to show a downward trend, dropping below $ 9,000.

The total market capitalization fell by almost 2% over these seven days — up to $251 billion. The dominance index is 65%.

The second Ethereum cryptocurrency in terms of capitalization this week was up 1.5%, trading at $ 203 at the time of publication.

In the Bitcoin network, record commissions were recorded

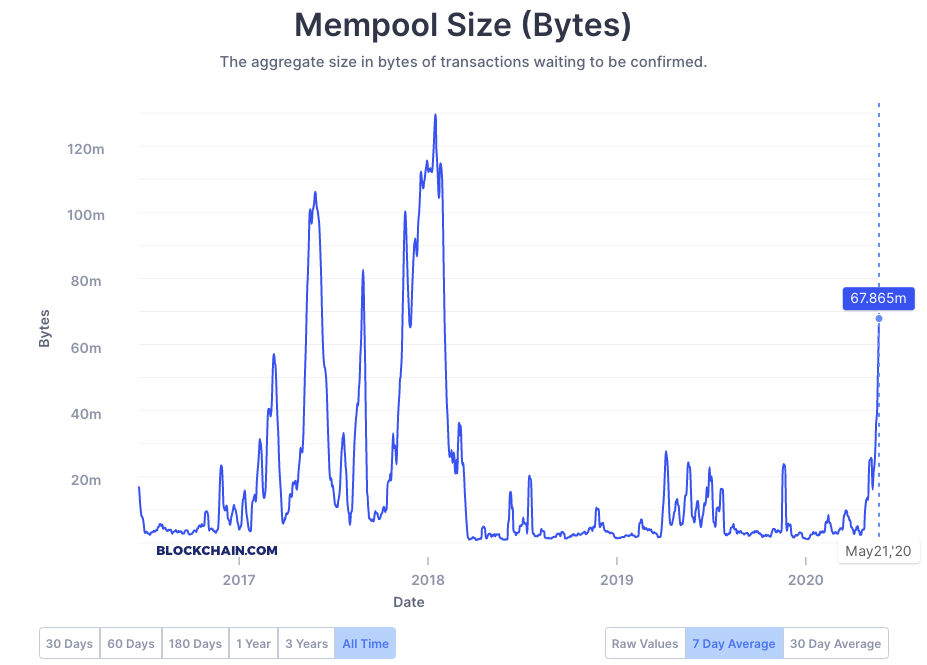

On Thursday, May 21, the price of Bitcoin was already falling$8800 area - to the price levels recorded immediately after the halving. However, what was more remarkable was the sudden increase in the size of the mempool — the total volume of unconfirmed transactions.

At a certain point, this indicator returned to the state at the beginning of 2018, when the average 7-day mempool size reached 68 MB.

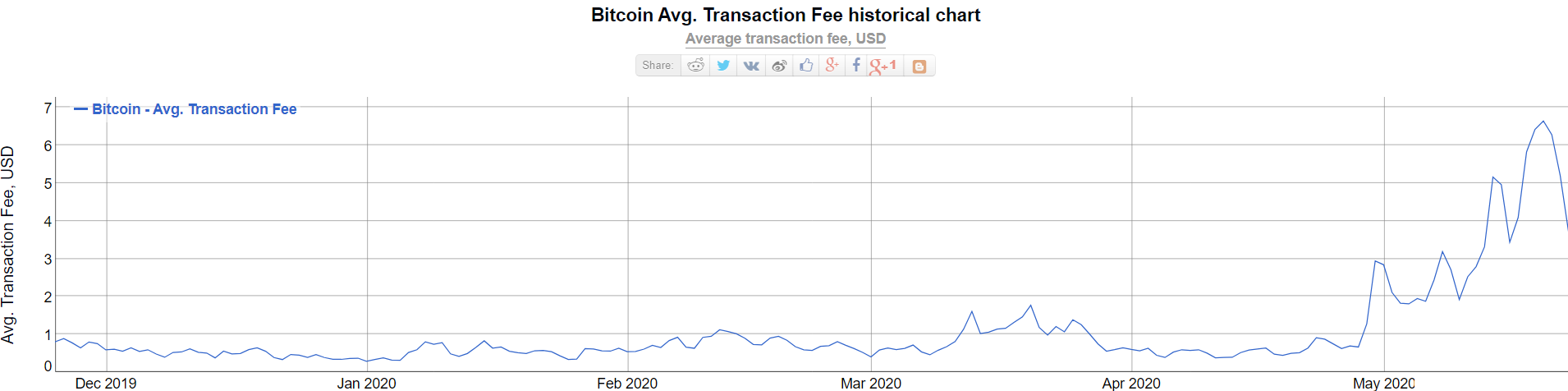

The average transaction processing fee has also increased. On May 20, it exceeded $6.6 — record level in 2020. By the end of the week, this figure dropped to $3.7.

Bitcoin hash continued to decline

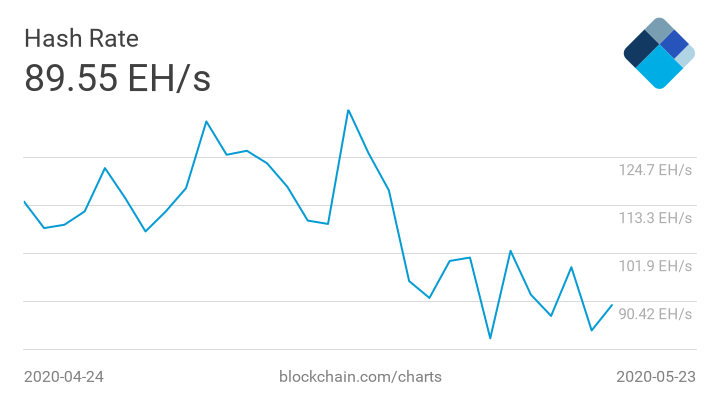

Hashrate continued to fall after the third halving. As of Saturday, May 23, the indicator was 89.55 EH / s.

This week, it became known that the authorities in the Chinese province of Sichuan issued a notice demanding "an orderly cessation of mining activity."

In rich in hydropower SichuanAlmost 10% of the global bitcoin hash is generated. If earlier in this province mining was encouraged, which can absorb excess electricity, now the situation has changed dramatically.

Primitive Ventures Partner Dovi WangShe emphasized that local authorities cannot ban mining, as this runs counter to national energy interests. According to her, usually such statements signal only a desire to raise taxes.

</p>Even if the order does not enter into force, it is likely that miners will lose access to cheap electricity due to a shortage of hydroelectric power.

Bitcoins from 2009 set in motion

One of the most discussed topics of the week wassudden movement of 50 bitcoins that have been lying motionless for 11 years. Coins were received as a reward for block # 3654 of February 9, 2009, when the first cryptocurrency network was only a month old.

Bitcoins that may belong to Satoshi Nakamoto

Mining at that time was carried out by 3-4 people. One of them was the creator of the first cryptocurrency Satoshi Nakamoto.

Excluding block rewards, only 97 transactions took place on the bitcoin network at that time.

The transaction from wallet 17XiVVooLcdCUCMf9s4t4jTExacxwFS5uh was divided into two amounts - 40 BTC and 10 BTC. The latter, according to Chainalysis, went to the mixer.

It is not known for certain who was behind the movement of these coins, but many experts doubt that they are related to Satoshi.

Immediately after the transfer of coins became known, the rate began to decline.

</p>Later it also became clear that the address on whichthese coins were stored, listed in court documents in a lawsuit against the self-proclaimed Bitcoin creator Craig Wright, which only added to the events of intrigue.

Community celebrates anniversary Bitcoin Pizza Day

On May 22, the Bitcoin community celebrated its anniversaryPizzas. Ten years ago, on May 22, 2010, programmer Laszlo Heinitz made his name in Bitcoin history by paying for the delivery of two Papa Johns pizzas’ cryptocurrency. The order cost him 10,000 BTC.

Heinitz himself later stated that he did not regret the potentially lost millions - it was enough that he had contributed and entered the history of bitcoin.

This day, the community traditionally celebrates the purchase of pizza and philosophical thoughts about the corruption of life and that not everything in this world is measured in money.

ForLog collected the brightest moments of the holiday, and also summed up the results of the competition for the most accurate forecast of Bitcoin prices for Bitcoin Pizza Day!

Pizza for bitcoins and memes: how the community celebrated Bitcoin Pizza Day

Uniswap v2 protocol launched on Ethereum core network

The team behind the development of the Uniswap DeFi protocol has completed testing the second version of the decentralized platform and announced its launch on the Ethereum core network.

Among the new features of Uniswap v2:

- the ability to exchange any Ethereum-standard ERC-20 tokens among themselves;

- instant swaps, providing for the possibility of withdrawing “as many coins as you like” for, for example, arbitrage and margin trading operations;

- improved quotes control thanks to oracle support.

- An updated version of the decentralized platform has already passed an audit and formal verification.

The trading volume at Uniswap in the first quarter of 2020 increased by 225% compared with the figures for the last three months of the previous year.

In Russia, introduced bills to regulate the bitcoin industry

After another revision, Russian lawmakerspresented a new package of documents on the regulation of digital currencies in Russia. It includes not only the draft federal law On Digital Financial Assets, but also a number of documents amending the Code of Administrative Offenses and the Criminal Code.

The new version of the law assumes thatfor organizing the illegal circulation of digital currencies and making transactions with them, or for participating in the issue of digital rights or assets using technical means or sites registered in the Russian Federation, individuals face a fine of 50 to 500 thousand rubles, legal entities - up to 2 million rubles.

For violation of the rules for transactions with digitalassets that are used as a means of payment, the fine for individuals will be from 20 to 200 thousand rubles, for legal entities - from 100 thousand to 1 million. In addition, assets can be confiscated.

For the same actions may face criminalliability if major damage was caused to “citizens, organizations or the state”. In the case of particularly large damage or income in an especially large amount, the punishment shall be up to 7 years in prison with a fine of up to 1 million rubles or in the amount of income for 5 years.

If the damage is not too large, either imprisonment of up to 4 years and a fine of up to 500 thousand rubles, or a fine of up to 1 million, or in the amount of income for two years, is provided.

Criminal liability is also threatening for the purchase of digital currencies for cash or through the transfer of funds to accounts in Russian banks.

A similar idea was offered earlier, but there wasdiscarded. What caused its second reincarnation, we still have to find out, but experts interviewed by ForkLog are convinced that the proposed draft laws on the regulation of digital assets in Russia in the current version will not only not solve the problem of shadow turnover of cryptocurrencies, but also will kill the rudiments of legal bitcoin business in the country.

In Ukraine, introduced the bill "On virtual assets"

Meanwhile, the Ministry of Digital TransformationUkraine introduced the bill on virtual assets for public discussion. In the document, virtual assets are defined as property and are divided into two categories - crypto assets and secured tokens. Separately, the bill spelled out "financially stable stablecoin." It can be secured by money and / or financial instruments.

Ownership of a virtual asset,According to the document, it is determined by the presence of a private key. Service providers must also register with the Ministry of Digital Development, which is established by the bill as a regulator of the turnover of virtual assets. This category includes companies providing custodial and virtual asset exchange services, as well as exchanges.

Previously, the concept of service providers related totransfers, exchange and storage of virtual assets, were introduced as part of the bill on the implementation of FATF standards to combat money laundering and terrorist financing.

The discussion of the draft law will last until June 5, but the community has already had a number of questions to the document to the document.

Some answers, convincing decisionwhich we leave to readers, the author of the bill, the head of the Blockchain4Ukraine inter-factional association (MFI) Alexei Zhmerenetsky, and the head of the Blockchain4Ukraine adviser group Konstantin Yarmolenko tried to give.

Ukraine will legalize Bitcoin: what will the bill «On Virtual Assets» change? for cryptocurrency owners

A lawsuit has been filed against Brock Pierce, Dan Larimer and Block.one

Block is behind the EOS project.one is again embroiled in a legal battle. This time, a class action lawsuit was filed against her, accusing the company that the EOS ICO was accompanied by misleading statements.

In addition to the company itself, in a lawsuit that is filed byCrypto Assets Opportunity Fund LLC and Johnny Hong are featured by its CEO Brendan Bloomer, CTO Daniel Larimer, former Block.one partner Ian Grigg, and former Brock Pierce project adviser.

The lawsuit says that Block.one stimulated an increase in the price of EOS through “aggressive” marketing to American investors, stating, among other things, that the EOS blockchain will surpass other existing blockchains, and calling the project “Ethereum on Steroids”.

At the same time, EOS failed to surpasscompeting blockchains, and the company itself did not disclose significant internal disagreements and could not ensure sufficient decentralization. The lawsuit provides several examples of how Pierce, Bloomer, Larimer and Grigg made statements that did not reflect the true state of the EOS blockchain.

Atari and Litecoin Foundation enter into partnership

Legendary video game maker Atari andNon-profit organization Litecoin Foundation entered into a partnership this week, which aims to create a bridge between the entertainment ecosystem and the seventh cryptocurrency in terms of capitalization.

It is reported that LTC holders will be able topurchases of the Atari internal token, which will be used to manage purchases and track digital assets in the ecosystem, as well as to make payments at Atari casinos. In the future, it is supposed to use LTC directly.

Also, the Litecoin community will be given the opportunity to purchase at a discount the VCS Atari game console planned for release.

Forklog live

How the trading of bitcoin and others has changedcryptocurrencies with the advent of institutional? Is it worth trading centralized altcoins? And finally, to whom do the 50 bitcoins mined in 2009 belong to the movement?

A trader told our publication about thisVladimir Cohen:

In addition, at the beginning of the week, our resident became a guest on the ForkLog broadcastTone Weiss: