Coin Metrics analysts have released a report on the current situation in the Bitcoin market. Exactly a week ago, October 21, Bitcoin(BTC) rallied $ 1,000 in 24 hours, triggering a new bullish rally. Since then, its price has surpassed $ 13,000 and set new 2020 highs.

This situation will not surprise experienced bitcoin investors, as BTC is known for its volatility and has experienced many crazy price fluctuations in its history.

But this time it's different.We haven't seen anything like this in previous bull markets.growth rates that were observed after the BTC collapse in March. Fundamental on-chain metrics suggest that Bitcoin may be poised for its biggest breakout yet.

Bitcoin — digital gold

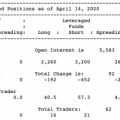

Throughout most of its history, BTChad a low correlation with both gold and the US dollar. But everything changed on March 12th. Amid panic over COVID-19, stocks around the world have collapsed. Cryptocurrency prices have collapsed along with the rest of the markets; BTC and ETH prices have dropped by about 50%. Since then, BTC's correlation with gold has approached all-time highs, while the correlation with the dollar has been at an all-time low.

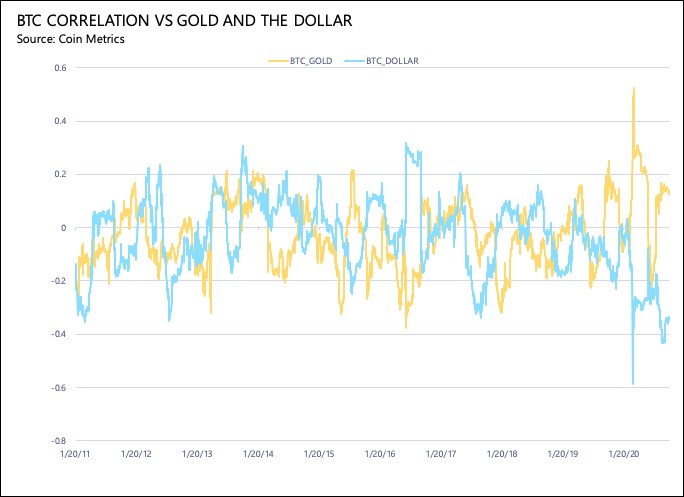

BTC is often referred to as "digital gold" and dataincreasingly confirm this statement. In the past few months, public companies such as MicroStrategy and Square have announced their investment in BTC as a reserve asset. In addition, on-chain metrics show that since March 12, the number of long-term holders of BTC (so-called "hodlers") has increased along with the price increase. This suggests that BTC is increasingly being used as a store of value.

As of October 25, about 62.5% of the total amount of bitcoins held at least 1 year, which is close to all-time highs. Historically, the percentage of dormant coins for at least 1 year peaked during periods when the price was at local lows.

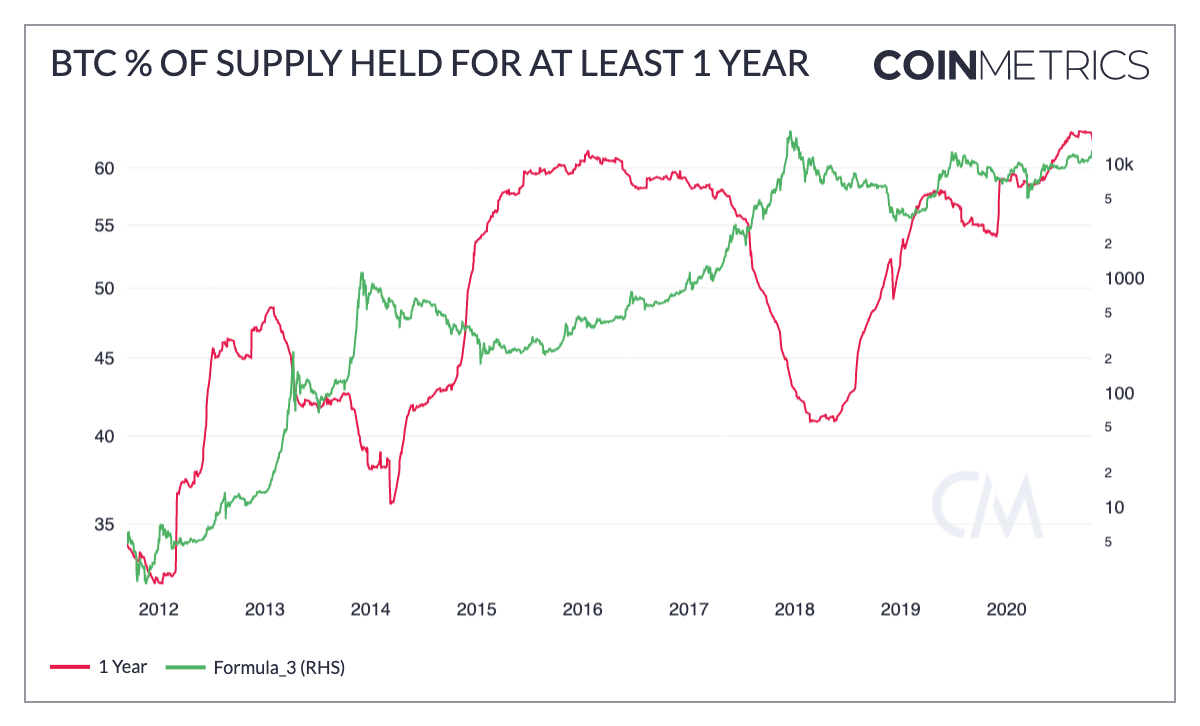

BTC activity is also at its lowestlevel since 2011. Activity is the average number of coin transfers over the last year. The decline in such activity suggests that BTC is more commonly used as a store of value rather than a medium of exchange.

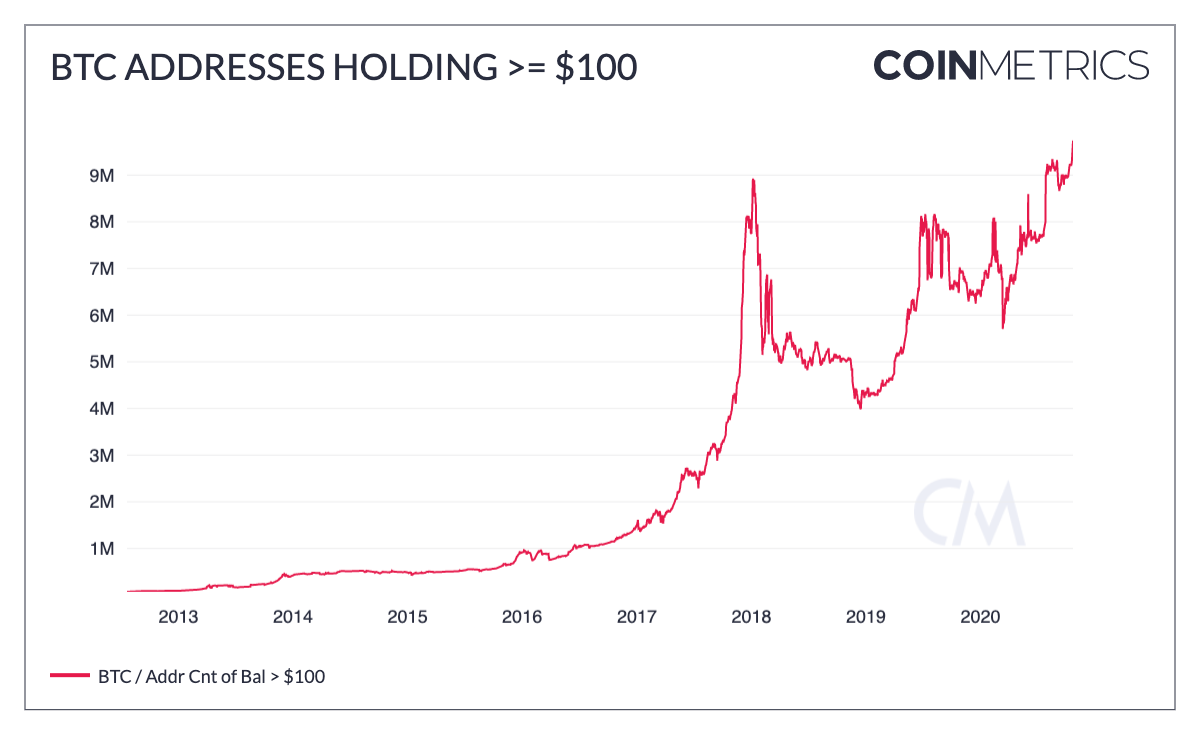

Increase in the number of BTC holders

It can also be assumed that the holders todaymore than ever. On October 22, the number of addresses that hold at least $ 100 worth of BTC reached a new high of 9.74 million. One individual or legal entity can control multiple addresses, so this is a rough estimate. But the trend suggests that the number of BTC holders is increasing, which is a positive signal for long-term BTC adoption.

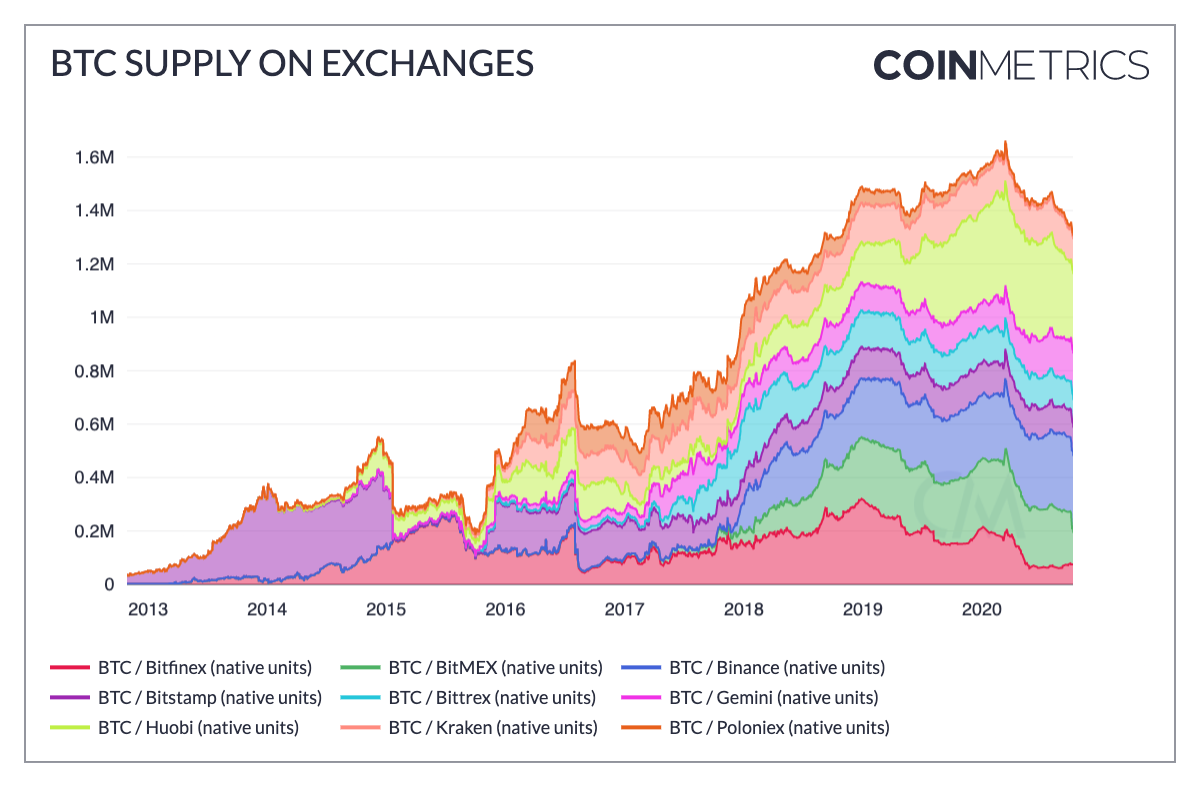

BTC is increasingly being withdrawn from cryptocurrency exchanges. This may indicate that more and more BTC holders want to store their coins on their own.

Reducing BTC supply on crypto exchanges

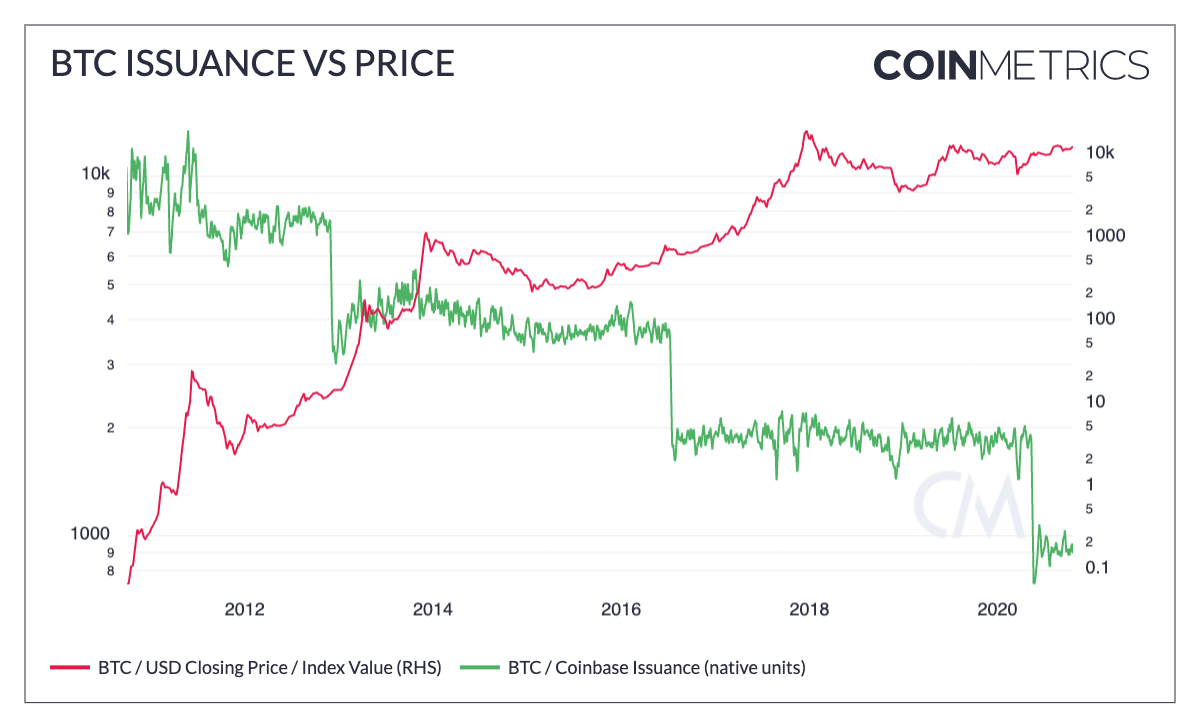

Third Bitcoin supply reduction (halving)happened on May 11, 2020. Historically, the price of BTC reached a local peak within 1.5 years after each previous halving. The rise in holders and the shrinking supply signals that BTC is ready to take off.

Rate this publication