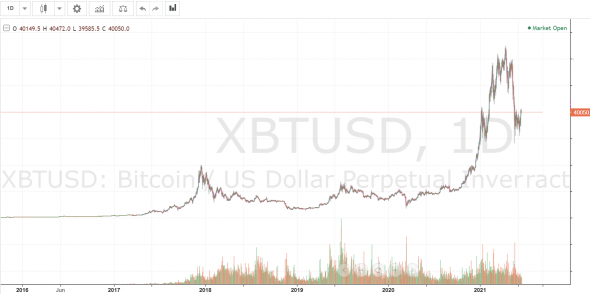

Until 2017, Bitcoin, like other cryptocurrencies, was of interest only to enthusiasts. These geeks live in their own worldthey had and still have a lot of their own gadgets that are not interesting to 99.9% of the rest of humanity.

ICO wave and klondike for professional traders.

The beginning of 2017 - until the beginning of 2018.

The situation changed at the beginning of 2017,when professional traders and scammers came to the crypto market, offering to participate in various types of ICOs, which were 99.99% fraudulent. This was very similar to the emergence in the early 90s of all kinds of investment companies whose sole purpose was to extract vouchers and money from the population. Adjusted for planetary scale.

On the other hand, the market has attractedprofessional traders. The market was phenomenally inefficient. In classical markets, inefficiencies had practically exhausted themselves by the year 2012, but here it was the Klondike.

Pretty soon everyone got tired of scammy ICOs.The prices for specialists who wrote white papers and issued slightly modified tokens became cosmic by the end of the ICO period. The greed was incredible. The teams of these swindlers were already asking for millions of dollars for conducting an ICO, when it was already obvious that the topic had dried up.

Professional traders also quickly ate all the significant inefficiencies by April-May 2018.

They lost interest in the crypt. The slightest negative led to the collapse of quotations. Bitcoin fell 6 times.

This continued until the end of 2020.

Then I wrote that the next wave will come with institutions.

The wave of institutions.

It began at the end of 2020 and lasted until May 2021.

Brokers and investment banks began to slowlycreate infrastructure for entering the crypto market. Bank of New York Mellon, large private investors like Elon Musk, pioneering crypto ETFs, Visa and Mastercard have begun partnering with companies offering crypto cards.

The market grew enchantingly until May.

And... interest began to fade, plus a blow from China.

What's next?

The greatest risk for cryptocurrency is if restrictions are introduced by US financial regulators. Along with the ban on crypto in China, this will stop the development of the industry for a long time.

If such a risk does not materialize, then it will be time for a relatively quiet expansion of the client base of institutional companies.

It is unlikely that we will see X's, the rate will rise fromexpanding penetration of applications into smartphones of a mass audience, which is still far from buying crypto through couriers with guns and security, strange, incomprehensible and scary crypto exchanges and exchangers for the average person.

The rate will begin to rise when banks and other financial institutions provide opportunities to become the owner of your favorite crypto coin in a couple of clicks. How Tinkov did it with shares.

Thus, the period of rapid growth is over,further growth will be of higher quality, with a wider coverage of the population, although this will most likely happen in two or three years. So much is needed so that institutions can offer their services to the population.

If fin.regulators will not unite and adopt regulations prohibiting or severely restricting the circulation of cryptocurrencies. After all, a wide coverage of the population is their fiefdom and a direct duty under the law. You won't be able to postpone further. Hopefully, everything will be limited to regulation, not a ban on cryptocurrencies.