If you have been following the cryptocurrency market, and perhaps even traded spot and futures, thenat some point you will definitely think aboutmargin trading with leverage. Margin trading is not just an interactive experience. She can become a stable source of income. Of course, with a thoughtful and strategically correct approach.

Cryptocurrency margin trading requires experienceand knowledge of how markets work. The largest cryptocurrency exchange Binance offers traders the best conditions for margin trading, and today we will tell you how this prospect may be of interest to you.

What is margin trading?

Combining elements of spot and futures trading,margin trading allows investors to trade cryptocurrencies with leverage. Like spot trading (buying or selling an asset directly), margin trading involves the immediate exchange of cryptoassets. The difference lies in the access to leverage, which increases the value of transactions by 2-10 times (as in the case of futures contracts).

In addition to two main differences, marginaltrade has other features. Thus, when using leveraged capital, traders must provide collateral (or margin) in order to select the desired leverage for trading (2x, 10x, etc.).

In the process of margin trading, traders shouldclosely monitor changes in the market, especially when working with cryptocurrencies, as they are often threatened by margin calls. A margin call occurs when a trade loses and can cause large losses to the trader, proportional to the size of the leverage ratio. In such cases, the exchange applies a margin call, inviting the trader to cut the position or add collateral.

To avoid liquidating a position, a trader canreduce the nominal amount of the position, in turn, reduce its leverage. The trader can also add margin to the trade to confirm that there is sufficient funds to manage it further.

Margin trading is applied in severalcases. One of the most common is hedging a portfolio or other asset. Hedging involves opening new positions, the correlation of which with existing ones is negative. Investors and traders hedge portfolios to hedge against potential losses.

Although margin trading canbring large profits, it requires a robust strategy including, for example, using stop-limit orders. Otherwise, even minor market movements can be extremely costly for the trader. And the scale of potential losses when using leverage can be similar to the size of the potential profit.

TOP 3 reasons to try margin trading

- Non-standard trading pairs.Margin trading offers access tonon-standard trading pairs. This applies to two cryptocurrencies in a pair (for example, BTC and ETH). Instead of buying or selling currencies themselves, a trader speculates on their relative performance. Binance allows trading with up to 10X leverage. Remember: the higher the price volatility of an asset, the less liquidity it has in the market. This can be explained by the low reliability of the asset, which negatively affects the number of transactions on the market.

- Provision with multi-assets.A unique feature of margin trading isthe ability to use multiple assets as collateral to access leverage. On Binance you can do this in cross margin mode. Investors can use more than just BTC for BTC margin trading. They can also combine BTC and ETH, BUSD, USDT and other assets to determine the face value of the collateral. Using multiple assets as collateral allows traders to be more flexible when opening trades.

- Arbitration... Margin trading opens up to tradersaccess to the benefits of arbitrage subject to the volatility of futures pairs funding rates. So, for example, if the BTC / USDT perpetual funding rate is negative, you can open two margin trades at the same time - BTC / USDT short and long BTC / USDT perpetual futures - for a low risk profit. In this case, the trader's results do not necessarily depend on the prices of the underlying assets, they will be more influenced by the movements of the markets. Since trades are placed in opposite directions, this reduces the risk for the trader regardless of market trends.

How do I open a margin account on Binance? Step-by-step instruction.

Do not start margin trading on Binanceconstitutes labor. Register an account on the official website of the exchange https://binance.com. After registering, do not forget to enable two-factor authentication (2FA), this will significantly increase the security of your account.

Then you can start margin trading, we will analyze the process step by step:

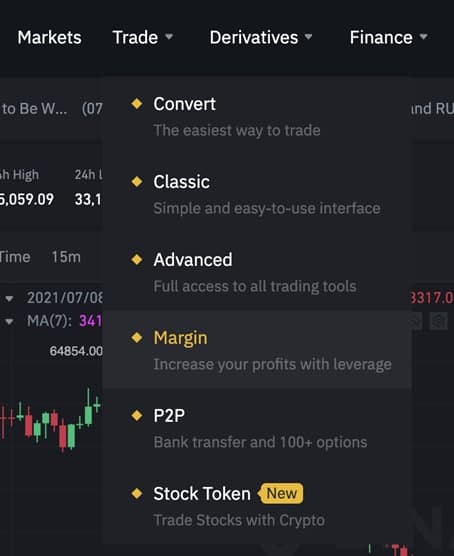

- Select the "Trade" section from the drop-down menu at the top of the screen. Then select the "Margin" section.

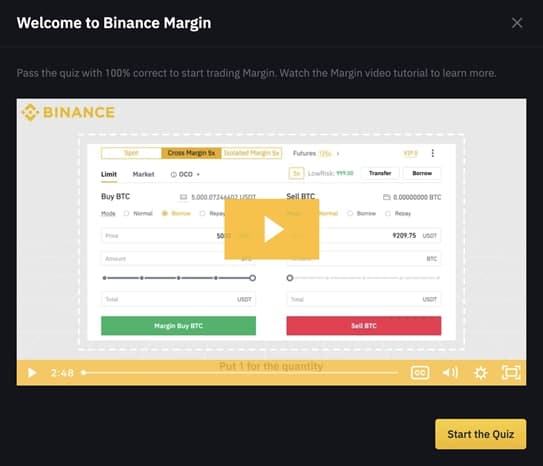

- Please note that you will have to take a short test before trading. All users must achieve a 100% passing score before starting margin trading.

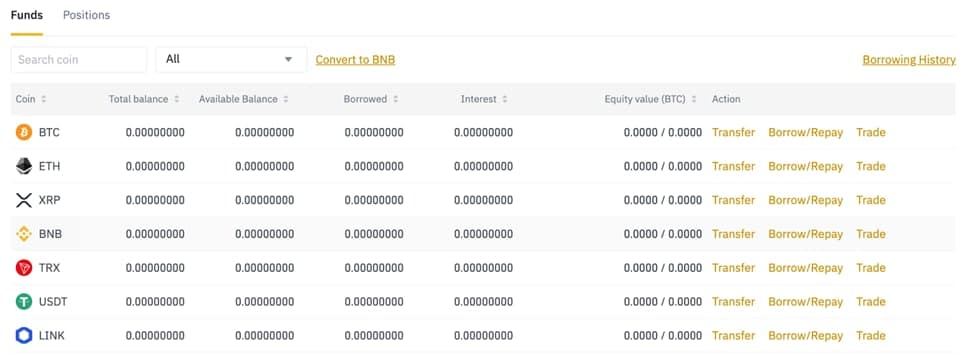

- You will then be able to transfer funds to yournew margin wallet. For example, you can transfer BTC, ETH and BNB from an exchange wallet to a margin wallet. These funds will act as collateral for any borrowed funds involved in margin trades and will determine the size of the loan (3x, 5x, 10x, etc.).

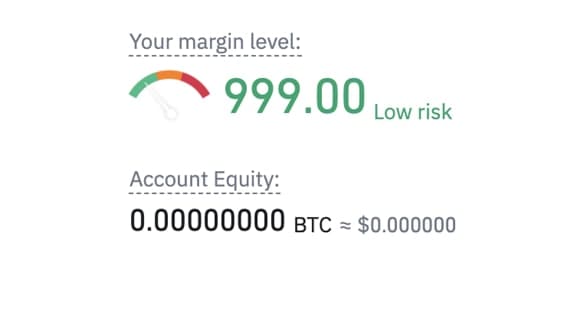

- Click “Borrow/Repay”, enter the amount,you want to borrow, check the hourly interest rate and click “Confirm loan”. The funds will be credited to your margin account (available under your balance/margin button). The balance menu provides a margin level scale that shows your risk vs. borrowed balance, the collateral you hold, and the market value. The margin level is calculated as follows: margin level = total asset value / (total amount borrowed + total accrued interest).

- If the margin level decreases, you should increasethe amount of collateral or reduce the size of the loan. If the margin level reaches 1.1, the position will be automatically liquidated. In other words, Binance will sell assets at market price to repay the loan.

For detailed instructions on margin trading on the crypto exchange, see our article “Guide to margin trading on Binance”.

Conclusion

Margin trading opens up opportunities for traders that are not available in other types of trading. Targeted and thoughtful margin trading can be fun and rewarding.

As we said, margin tradingsuitable for those users who already have trading experience. In addition, you need to be aware of the risks associated with margin trading. Useful tools such as stop orders should be used whenever possible.

All the margin trading options described above are available on the Binance crypto exchange: https://binance.com.

Especially for beginners, we have prepared detailed guides:

- How to buy Bitcoin on a crypto exchange for rubles?

- Cryptocurrency margin trading on the Binance exchange.

5

/

5

(

1

voice

)