On the night of May 8, the price of Bitcoin (BTC) recovered to $10,000. Traders believe that Bitcoin is just starting to rally and mayreach $ 15,000 in the third quarter of this year, while the uptrend is fueled by a number of positive factors.

Historically, the $ 10,000 line has always acted likepsychological level for the price of bitcoin. A net break through such an important level in a short period of time may indicate a resumption of growth.

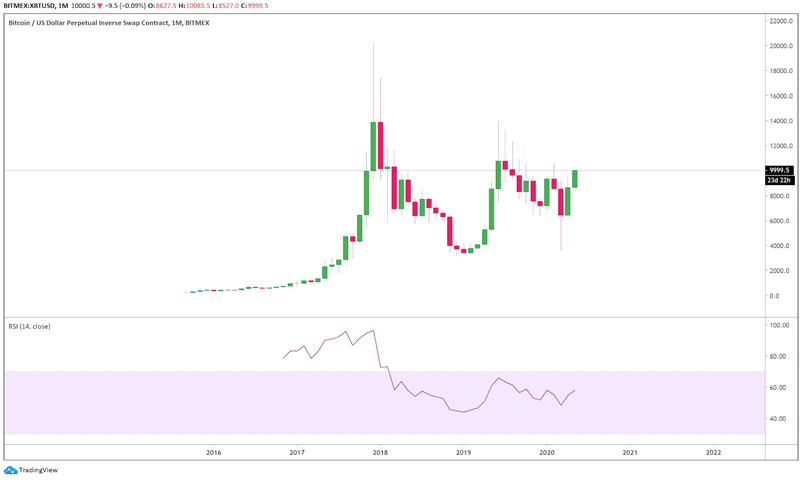

$ 14,000 is a range of strong resistance

Now, bitcoin has broken a multi-year cycle that dates back to December 2017. A further achievement of $ 10,500 would confirm the start of a new cycle, which may become the basis of a new strong rally.

In 2019, bitcoin rose to $ 14,000 on majorexchanges. In December 2017, both monthly candles closed at the same level; and this suggests that for the medium term, the resistance level of $ 14,000 remains key.

Bitcoin exceeds $ 10,500 to $ 11000 or its consolidation above $ 9,500 should lead to the fact that the main cryptocurrency, nevertheless, will test $ 14,000. Also, given the tendency to overvalue in the form of a long wick (“takeoff peak”), there is a chance of the coin growing up to $ 15,000.

The effect of halving on the price of bitcoin

Long awaitedBitcoin halving will happen on May 12in less than 4 days.

Historically, Bitcoin has grown in about 10-11 months by 1200% — 6000% after previous halvings.

Bitcoin also usually experiences gradual growth after halving, and analysts have every reason to believe that the main cryptocurrency will restore its historical maximum of $ 20,000.

In addition, Bitcoin's growth could be supported by bullish fundamentals such as rising usage and development activity.

High Institutional FOMO

The demand for bitcoins from retail investors before halving is growing. However, institutional investors are now investing in bitcoin as intensively as retail investors.

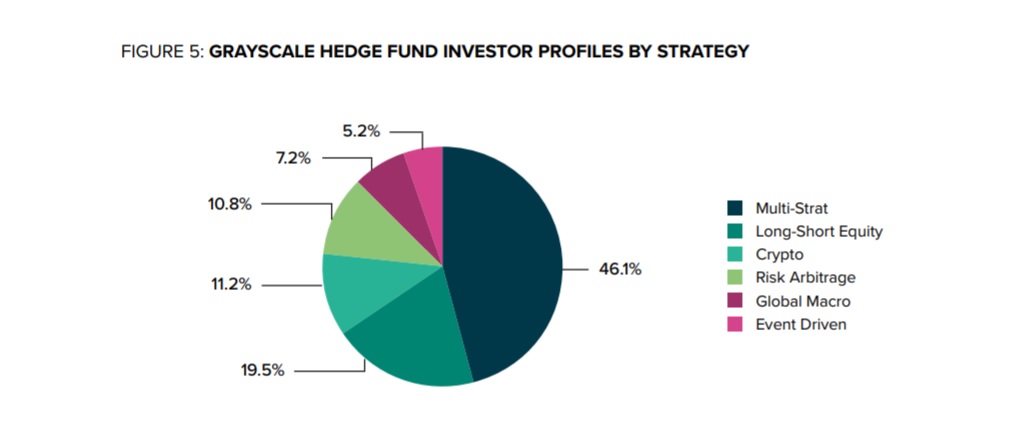

In its report for the 1st quarter, Grayscale reported that institutional investors purchased 88% of its products, and from January to March 2020, their contribution to the cryptocurrency market amounted to $ 443 million.

The Grayscale report says:

“88% of the inflow in this quarter came frominstitutional investors, most of whom were hedge funds. The terms of reference and strategies of these funds are generally ambiguous, since among them you can find funds such as Multi-Strat, Global Macro, Arbitrage, Long / Short Equity, Event-Driven and Crypto-focus. ”

Earlier, the founder of the financial group Tudor Investment billionaire Paul Tudor Jones explained why his company is interested in investing in bitcoins.

</p>Rate this publication