A few days ago, the head of macroeconomic research at Fidelity Investment, Jurrien Timmermade a fuss, as if predicting that bitcoinwill cost $ 100 million by 2035. That would mean 72% of the profit annually for the next 14 years. That exceeds the rates on bank deposits by about 72%.

A few days later, a number of cryptocurrenciesnews agencies went even further by attributing to Timmer a prediction of $ 1 billion for Bitcoin by 2038. To be fair, both predictions were simply an extrapolation of the chart Timmer used in his presentation to clients, not his words. But this is a great time to wonder what exactly it will take for Bitcoin to reach such heights.

Fidelity Adds A Pair Of Zeros To Bitcoin Price

What is included in the bitcoin price?

The bitcoin rate to the dollar consists of two parts: how much bitcoin costs and how much the dollar costs. So let's figure it out step by step.

To begin with, what is the demand - "target market size"- for money. After all, most capital is not held in money at all, but in things like houses, cars, and investments. You probably have a lot of things that aren't money - chairs, for example, or a telephone. Because people have many goals in life, while money has a very specific goal: ensuring low-cost transactions in the future.

So what is their cost?

Today, people all over the world own money forthe amount of about $ 92.5 trillion. Roughly $ 80 trillion of all money is government-issued fiat, $ 12.5 trillion is alternative money, of which $ 11.5 trillion is gold and $ 1 trillion is bitcoin. I deliberately ignore altcoins as they are not significant stores of value, but more like casino chips.

Thus, the net demand for money is$ 92.5 trillion - 86% in fiat, 13% in gold and 1% in bitcoin. In other words, people have given up $ 92.5 trillion in real things in order to store that portion of their savings in something that they hope will protect their capital and can be cheaply and easily sold in the future.

Please note that the world's wealth is muchmore: perhaps $ 400 trillion. But most of it is invested in real estate or business, since you can live in the house, and the investments are profitable. Thus, only about 25% of human wealth is stored in money, which is about $ 12 thousand per person.

Real money supply M2. Central banks are working hard to push the price of bitcoin

Assessment of the future demand for money

Further refers to the perspective of at leastat least 14 next years. Without going into the realm of science fiction yet, I will assume that in 2035 or 2038, people will still live in homes and invest in businesses. So I will use the same ratio: 75% for real world objects and investments and 25% for money.

By the way, one could argue that hyperbitcoinizationincreases money holding because money no longer loses value and borrowing is no longer subsidized by central banks. However, it can also be argued that in a world with hard money, there is more real investment, since the time horizons are longer - more invested means less capital in money. In any case, now I assume that the same 25% of the capital will be in the money.

Further.In the future, there will likely be more people and the world will likely become richer - both are age-old trends. Both factors increase the amount of money people want to own. For the sake of simplicity, I will assume that the next 14 years of real demand for money will look the same as the previous 14 years.

USD 2.2 times more than 14 years ago(adjusted for price inflation), and 2.4 times more than 17 years ago. Thus, today's $ 92.5 trillion demand for money could organically grow to about $ 200 trillion in today's terms by 2035 and to about $ 220 trillion by 2038.

By the way, I am using the US dollar as a singlecurrency for the entire world, in part because it is easier to measure. And also on the basis of the logic that the US dollar has remained stable against other currencies for the past 14 or 17 years, so, apparently, they all grew at about the same rate. It should be borne in mind that the money supply in US dollars is only an assumption, even according to the data (PDF) of the Fed.

Weimar cabbage: worth its weight in gold.

How to get to $ 100 million?

You can notice the problem: if in 2035 the demand for money is $ 200 trillion and 20 million bitcoins are issued, this is a maximum of only $ 10 million per bitcoin. Not $ 100 million, and certainly not a billion.

Indeed, $ 100 million for BTC means a totalBitcoin's capitalization of $ 2,000 trillion, while 1 billion for BTC means a staggering $ 20,000 trillion for all bitcoins. So how can Bitcoin alone, as a form of money, be worth 10 or even 100 times more than all the money in the world?

It's simple: the dollar must collapse. This is the only way one of these scenarios can be realized.

The dollar's price could crash because there are too many of them being printed - a classic assumption. Or it may collapse simply because no one else wants to use it.

Historically, this usually happensa combination of two factors: as fiat loses value, people transfer their wealth to other things. Mises called this "an escape to real values." As a rule, this meant gold, houses, cars - anything that does not depreciate. In the future, it could very well be Bitcoin.

So how much does the dollar have to collapse for bitcoin's price to reach the $ 100 million or $ 1 billion valuation?

It depends on how many people are usingbitcoin. If fiat money continues to account for 86% of the demand for money in 2035, then an estimate of Bitcoin's capitalization of $ 2,000 trillion would mean that the total money supply will be at least $ 14,000 trillion. Seventy times more than our estimated $ 200 trillion demand for money. In other words, a dollar would be worth about 70 times less than it is today - $ 350 for a cup of coffee, $ 20 million for a regular home.

Oddly enough, for the dollar everything becomesmuch worse if no one is using bitcoin. For example, if only 1% of the demand for money in 2035 is Bitcoin, and that small 1% is worth $ 2,000 trillion, that means the total money supply is $ 200,000 trillion (!). This would mean a dollar collapse a thousandfold. $ 5,000 for a cup of coffee, $ 300 million for a house.

The time has come to outline the most auspiciousfiat scenario: If 95% of people in 2035 will use bitcoin, then this $ 2,000 trillion in bitcoin means only a slightly higher total demand for money - $ 2,100 trillion. In this case, this equality works with only tenfold depreciation of the dollar. So, $ 50 for a cup of coffee, $ 3 million for a house.

The key takeaway is that any scenariowith a bitcoin of one hundred million or a billion dollars is entirely dependent on the fall of the dollar. This means that these bitcoins will not be able to buy hundreds of Lamborghinis or small countries.

So what can you buy with it?If the price is much higher than a million dollars per bitcoin, it means that government money has crashed spectacularly. In this case, Bitcoin is likely to receive a very large share of the demand for money. Given how much superior bitcoin is to gold, I would assume that in these scenarios, almost 100% of the demand for money should come from bitcoin.

Just divide this real money demand into$ 200 trillion for 20 million BTC, and you get something like $ 10 million for bitcoin in 2035. Of course, you can supplement the calculation with parameters such as lost coins, speed, and so on, which could double this value. But, roughly, $ 10 million or $ 20 million in real terms is a ceiling, and anything beyond that is just an indirect way of saying fiat is going to crash.

Coffee for $ 15 thousand in 2035

Conclusion

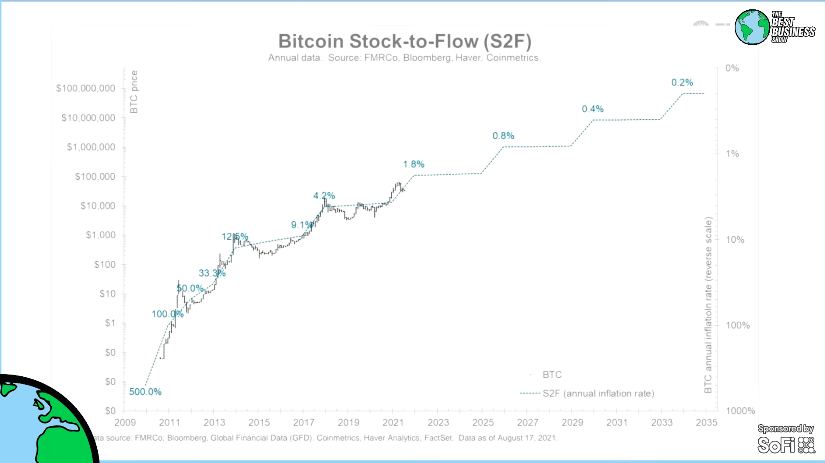

And the last one:The reason Timmer cited $ 100 million or $ 1 billion is primarily because of the astonishing accuracy of Plan B's Stock to Flow (S2F) model, calculated as the ratio of available supply to increase. This model was inspired by the discussion of scarcity in Saifiddin's book Ammus "The Bitcoin Standard".

Plan B provides no other justification forS2F models are purely statistical history. Nonetheless, the model has been "remarkably accurate" to this day, to the point that Fidelity's head of macroeconomic research uses it in presentations to clients.

It is gratifying to realize:if the S2F model remains valid for another 5 or 6 years - that is, if the price of bitcoin is still driven by its scarcity - it means that fiat has even less than ten years to pass the baton to bitcoin.

BitNewsdisclaim liability for anyinvestment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

</p>