The US Federal Deposit Insurance Corporation (FDIC) is investigating Voyager Digital. According to the agency,a cryptocurrency broker deceived users by claiming that their assets are protected by the department's program, reports Bloomberg.

On July 5, Voyager Digital filed for bankruptcy in a New York court. The company's estimated liabilities range from $1 billion to $10 billion with about 100,000 customers.

Similar petition under Chapter11 of the US Bankruptcy Code was filed by subsidiaries - Voyager Digital Holdings Inc and Voyager Digital LLC. The company expects that the financial restructuring process will "maximize value for all stakeholders."

Voyager has about $1.3 billion on the platform,more than $350 million in an account with Metropolitan Commercial Bank and over $650 million in claims against Three Arrows Capital. In addition, the company “has ~$110 million in cash and its own cryptocurrency assets.”

The broker said that the assets of its clients fall under the FDIC deposit insurance program through cooperation with the Metropolitan Commercial Bank.

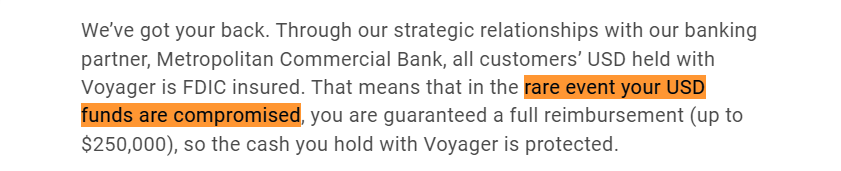

"This means that on rare occasions when ourdollar reserves are compromised, you are guaranteed a full refund (up to $250,000), so the cash in Voyager accounts is protected,” the company said in a release dated December 18, 2019.

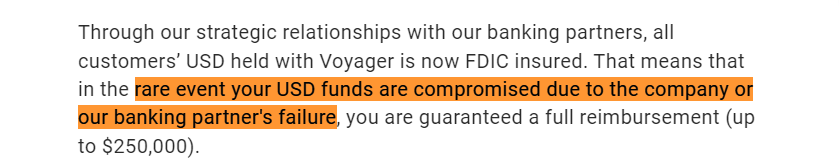

However, this is a modified statement. According to the Wayback Machine, the original wording read as follows:

“[…]in the rare event that our dollar reserves are compromised due to an error by the company or our banking partner […].”

Voyager's original statement.

Edited Voyager statement.

The Metropolitan Commercial Bank website says,that the bank maintains an "omnibus account dedicated to Voyager customers". The assets in this account are insured by the FDIC, but coverage is available "solely for bankruptcy protection" of the lending institution:

“FDIC insurance does not protect against the collapse of Voyager, the actions or omissions of the company or its employees, or losses associated with the decline in the quotes of cryptocurrencies or other assets.”

Speaking to Bloomberg, an FDIC spokespersonemphasized that Metropolitan Commercial Bank is insured by the agency, but Voyager Digital is not. According to him, the department's program does not protect broker clients from default, bankruptcy or blocking of funds.

Previously, Alameda Research provided a cryptocurrency broker with a loan of 200 million USDC and opened a revolving line of credit for 15,000 BTC.

Recall that the head of Binance, Changpeng Zhao, criticized the deal and said that he “would never have agreed to such an agreement.”

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.