Transaction fees and the bandwidth of the Bitcoin network are often talked aboutboth positive ornegative catalysts for BTC value —depending on whom and when to ask. Fee volatility has led to the development of polarizing narratives that characterize fees as both too high and too low.

For Bitcoin users transaction feesare not always predictable costs, but there is also an advantage: receiving final settlement 24/7 in a global digital and highly liquid asset. Historically, Bitcoin transaction fees represent a very small portion of miners' income compared to issuing new BTC to the ledger, but in the long run, these fees may become the main source of income for miners.

This report from Blockware Intelligence describes:

- Who pays transaction fees and how they are set

- Why High Network Congestion Fees Are Transient

- How Dynamic Fee Rates Help Bitcoin Users Bypass Unreliable Miners

Navigation:

- How transaction fees work

- Network congestion and scaling

- Bitcoin Scaling Cycle

- Finality of the settlement

- Finality, not "security"

- Unreliable miners

- Anti-fragile Bitcoin

- Attack paradox

- Market Feedback Cycle

- Waiting for attackers

- Conclusion

How transaction fees work

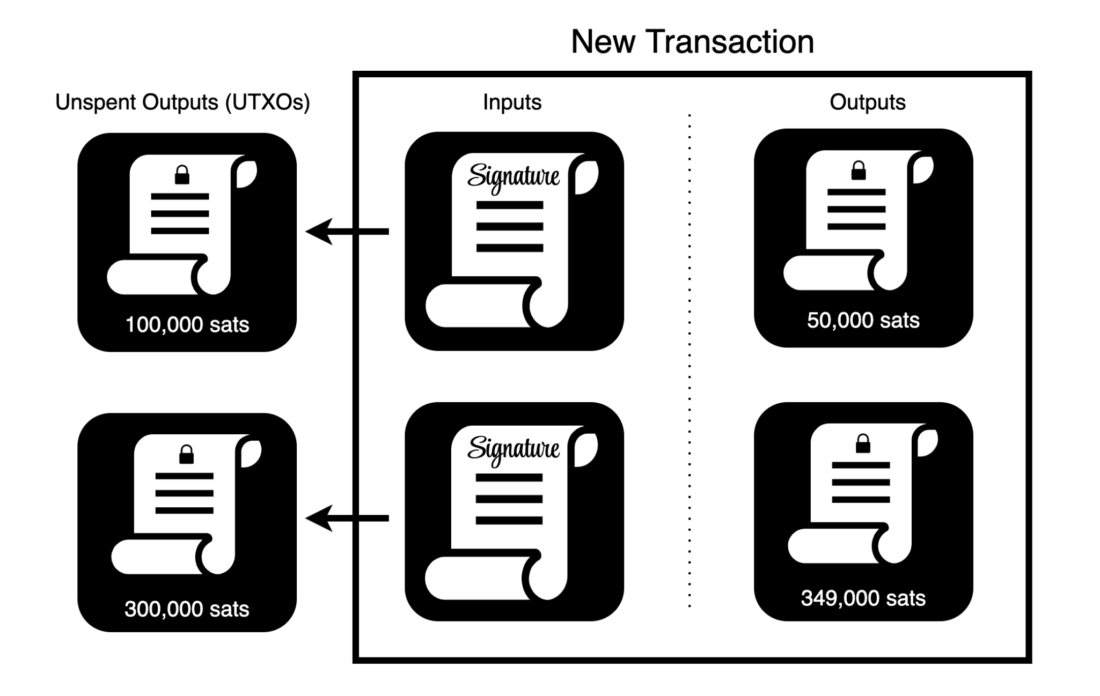

When your wallet creates a new transaction, itunlocks more BTC on its inputs than it locks on its outputs. The difference between these totals is the transaction fee offered to the first miner to include a transaction in a block. In the example diagram below, 400,000 satoshis unlocked from existing unspent outputs (UTXO) minus 399,000 satoshis locked in new outputs results in 1000 satoshis in transaction fees received by miners.

The number of inputs and outputs in a transaction canvary greatly depending on the wallet and transaction type. Transactions from exchange wallets typically have dozens and even hundreds of outputs - withdrawal requests made by clients in ~10 minutes. The size of the inputs and outputs varies depending on the type of "script", or smart contract, used to lock and unlock the Satoshi.

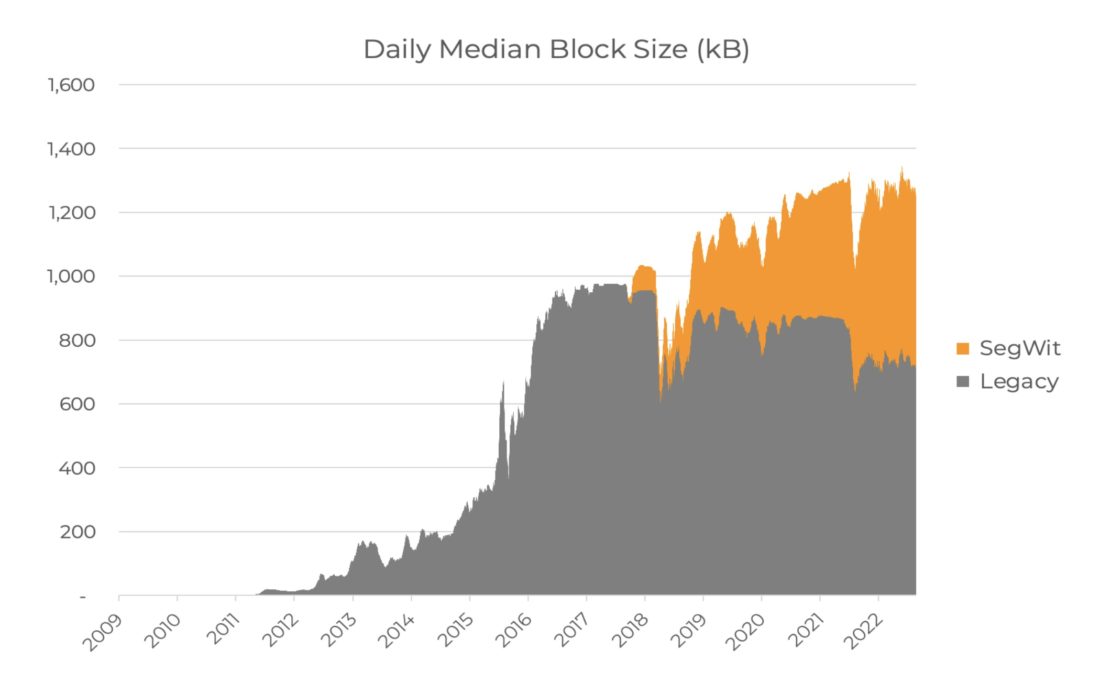

To the cost of synchronization and usenetwork node remained reasonable, in 2010 Satoshi Nakamoto added a 1 megabyte block size limit to the Bitcoin node software consensus rules. This limit means that nodes automatically reject blocks offered by miners if their size exceeds the set limit. In 2017, with the activation of SegWit, the 1MB block size limit was replaced by a block weight limit of 4 million weight-units (WU, from weight-units), nearly doubling the available block space supply at the limit.

Daily median block size (KB)

Block space scarcity means that the transaction fee is divided by the amount of data it uses to calculate the fee rate in Satoshi per «virtual» byte (sat/vB).

A normal transaction has two inputs and two outputs,occupying about 210 vB. Currently, the lowest market fee rate is 1 Sat/vB, so given the BTC exchange rate at the time of writing, sending a typical bitcoin transaction often costs as little as $0.05, or five cents. A transaction can move BTC worth billions of dollars, but the fee for it will be the same as for any other transaction with an equal amount of data, since the size of the fee is proportional to the use of block space, and not the amounts transferred.

The sender's wallet creates the transaction,uses the private keys to cryptographicly sign it and broadcasts the transaction to the Bitcoin network of nodes. Each node uses the protocol's consensus rules to independently verify the transactions it receives. If the transaction is valid, the node updates its view of the queue of transactions waiting to be included in the block. This transaction queue is called a mempool, short formemory pool.

When a mining pool wants to create a block formining, he must first choose which transactions he will include in this block. A rational miner will sequence transactions in such a way as to maximize fee income, so usually blocks include the first 1 million vB transactions with the highest fee rate in sat./vB. Senders can compete for the right to be at the top of the stack by paying a higher fee to get their transaction included in the block before the rest.

The demand in the block space market is provided by various types of consumers, including (but not limited to):

- short-term traders moving capital to or from the exchange;

- point of sale and e-commerce;

- private p2p transfers to friends or family, money transfers;

- long-term hodlers that move BTC to cold storage.

Block space clause has zerolower threshold: it is not uncommon for miners to rationally propose a valid empty block because they started hashing an empty block as soon as they saw the new valid block header; they can't add transactions to it yet because they don't know which transactions were already included in the previous block.

When a mining pool includes a transaction in a block, it takes the fee from that transaction and adds it to the output of a special transaction calledcoinbase. Coinbase transaction is created by the mining poolto pay yourself a block reward, which consists of transaction fees and a block subsidy - the amount of new BTC that, according to the rules laid down in the node software, can be transferred to the public ledger through miner rewards. The network subsidy is the only way new BTC can be added to the ledger, and the amount of subsidy per block is halved at about four year intervals. The mining pool distributes the received reward among the participants in proportion to their hashrate.

Network congestion and scaling

The first part of this report focuses on Bitcoin scalability and BTC transaction fees, while the second part looks at the potential user response to the decline in transaction settlement reliability.

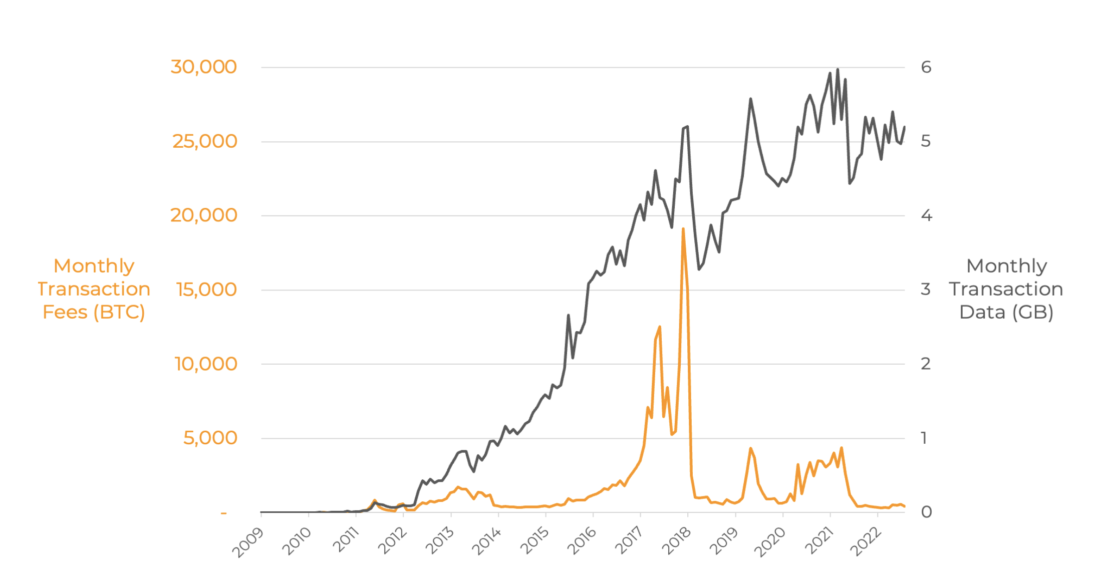

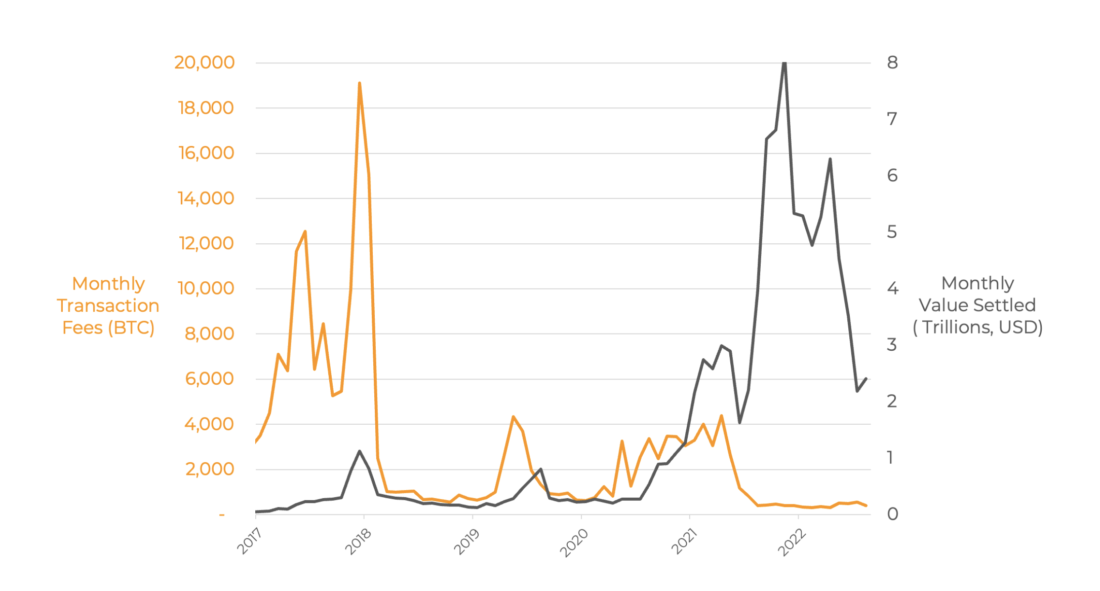

If we look at the commission history fortransactions, they skyrocketed during the 2017 and 2020-2021 bull markets when the demand for transactions exceeded the block size limit. Fees have remained very low since mid-2021 while the network continues to process over 5 GB of transactions per month.

Monthly transaction fees (in BTC) (orange) and monthly transaction data (GB) (black)

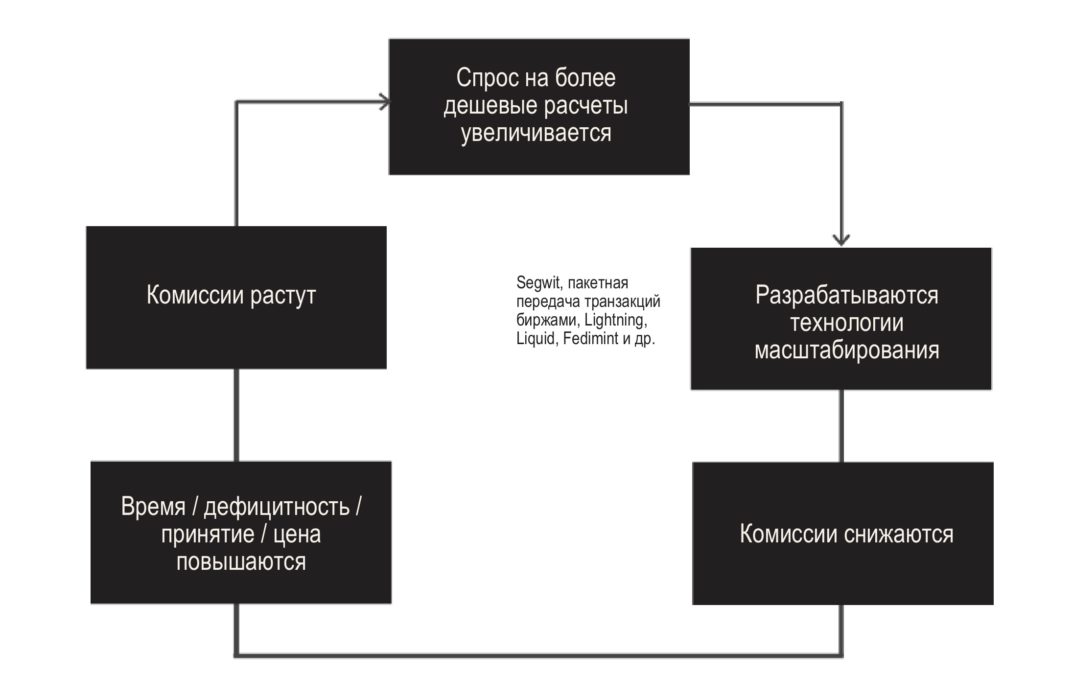

Bitcoin Scaling Cycle

The development of Bitcoin scaling solutions is notcoincides perfectly with the waves of new adoption, so Bitcoin is likely to continue experiencing periodic spikes in fees, as it did in 2013, 2017 and 2020. High fees create an incentive to use block space more efficiently by introducing new scaling technologies. These new solutions increase the overall throughput for Bitcoin settlements without significantly increasing the cost of running a Bitcoin node. The low cost of maintaining nodes allows users to independently run transaction and block validation software that implements their consensus rules without having to trust third parties. The low cost of self-verification of the system ensures the decentralization of Bitcoin.

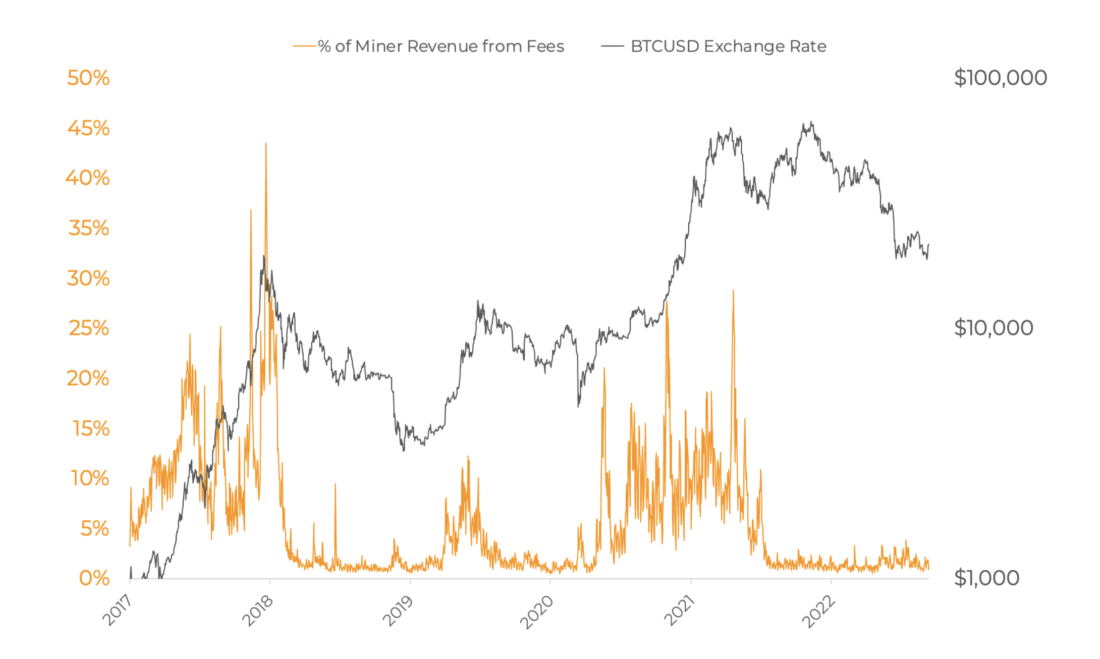

Bitcoin will continue to go through cyclesscaling. As more and more people start using Bitcoin and own their own private keys, they are all competing for a limited space of blocks delivered to the network at intervals of about 10 minutes. With strong adoption spikes, the share of fees in the total reward to miners increases dramatically compared to the subsidy they receive per block.

The share of commissions in the total income of miners (%) (orange) and the BTCUSD rate (black)

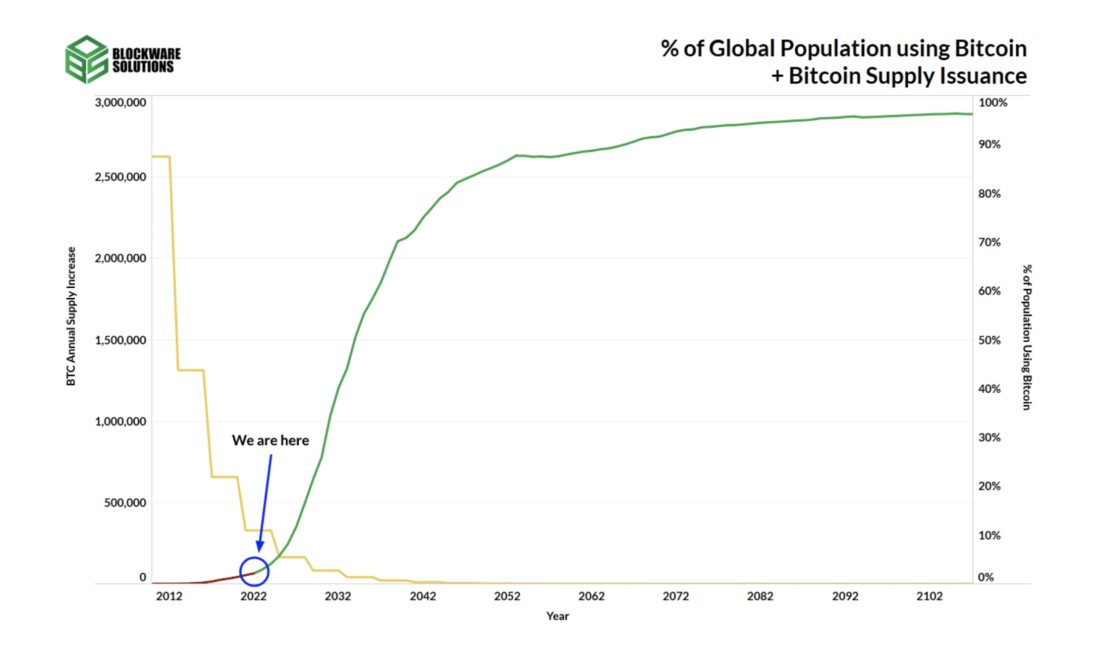

Interestingly, the level of adoption of Bitcoin in the worldstill constitutes only a small fraction of the total world population. Bitcoin has yet to get many more people on board, and all of them will presumably compete to add their transactions to Bitcoin's limited block space.

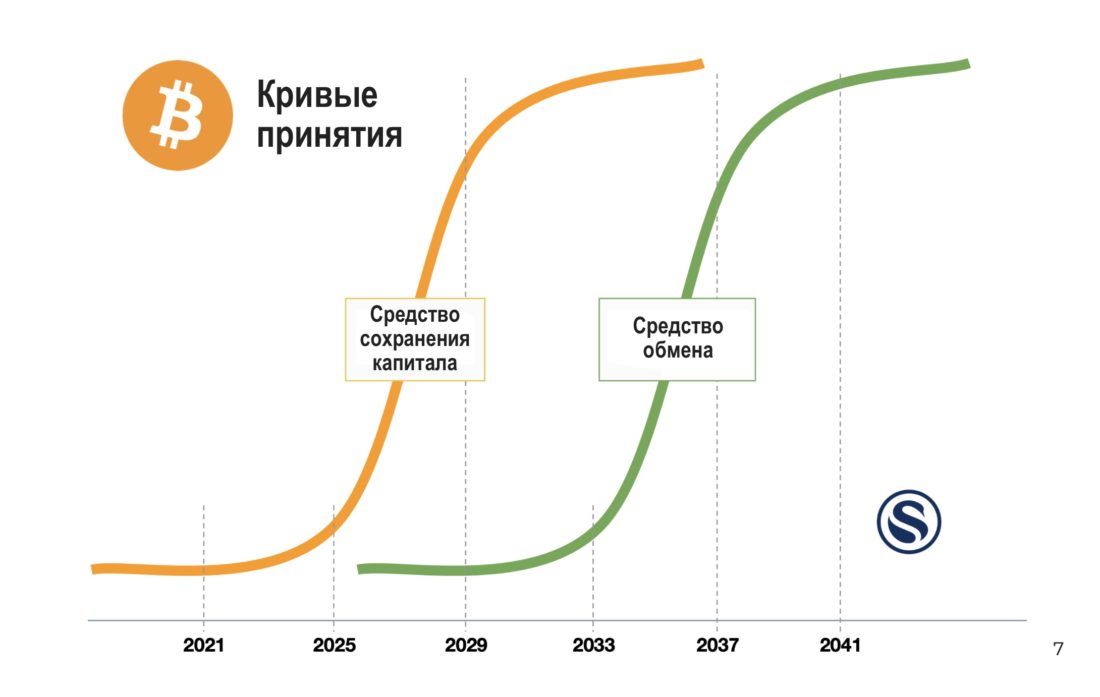

% of world population using (green graph) and bitcoin issuance graph (yellow)

Based on Blockware's recent data-driven estimateGlassnode, about 32 million entities store capital on the Bitcoin blockchain. Almost all of them use BTC as a store of wealth, not as a medium of exchange. What happens when 7 billion subjects use it as a store of value? This implies an increase in the number of network entities competing for the same amount of block space by a factor of 218.75.

Beyond billions of potential futuresFor Bitcoin users who are interested in keeping a significant share of their capital in it, it is possible that one day Bitcoin itself will also be used as a payment instrument or medium of exchange. This will be a period when network bandwidth will be put to a real test of strength, and transaction fees are likely to skyrocket. For everyday expenses, users can use second and third layer scaling solutions to save on fees.

Bitcoin users can go from 1-5transactions per year to 1-5+ transactions per day as more people use Bitcoin as a medium of exchange. If 7 billion people use Bitcoin as a medium of exchange, then the network capacity would need to increase by 79,843.75 times, rather than 218.75 times when used as a store of value.

As already mentioned, this need foran increase in throughput can stimulate the introduction of scaling solutions of the second and third levels (Lightning, Fedimint, etc.). However, all these scaling solutions are still tied to the first layer (like opening and closing transactions and lightning channel rebalancing), and they will always rely on the Bitcoin blockchain for security and unlimited access. High-volume transactions to and from a cold wallet are also likely to be carried out at the first, basic level to keep uncertainty to a minimum.

Temporarily increased fees for on-chain transactions,will apparently motivate the development of new scaling solutions, many of which we currently do not know and cannot predict. However, for throughput to increase by a factor of 79,843.75 over the next ~20 years, periods of high on-chain fees will likely occur with each wave of adoption. With each halving of the block subsidy, the importance of transaction fees in miners' income will increase. If we take 350–3500 BTC as the range of monthly miner income from transaction fees, we expect fees to become a more significant source of income than the block subsidy between 2032 and 2048.

Settlement finality

During periods of low fees, Bitcoin skeptics attackedconcern that this could undermine the finality, or “security,” of Bitcoin transactions. This statement is surprising since settlements in Bitcoin are generally viewed as irreversible. Even with very low fees, Bitcoin provides reliable settlement for trillions of dollars of transactions each month without the need for trusted third parties.

Monthly transaction fee volume (in BTC) (orange) and monthly transaction volume (in trillion $) (black)

Bitcoin opponents, however, argue that "ifNow, when the blocks are subsidized by the network (that is, in the presence of monetary inflation), it can work well in its volumes, but after the end of the subsidy, the network will become «unsafe» due to little incentive for mining." Bitcoiners mostly respond to this with something like “fees will [eventually] be a significant portion of the block reward” or “we'll deal with that later when and if it becomes an issue.”

In the next part of the article, we want to present a different approach to this topic, and it is important to take into account both Bitcoin users and miners.

Finality, not "security"

The security and consensus rules of Bitcoin are determined by the storage of private keys and the nodes of the network, respectively.

No matter how big or smallnetwork hashrate, miners cannot force your node to agree to the existence of more than 21 million BTC, exceeding the block size, creating a valid new transaction that steals your BTC, or changing other fundamental rules of consensus.

That's why «war» around sizeblocks in 2015–2017 had such a meaning. She confirmed that the core rules of Bitcoin consensus can remain unchanged, enforced by individual users (node operators) and not by large companies, exchanges, miners, developers or any government.

Bitcoin is the Schelling point on the existingset of rules of consensus. The first one was set by Satoshi Nakamoto with his initial release in 2009. Changes can happen, but users need to agree with them. Users of node software have agreed that they prefer cautious changes that do not result in significant increases in memory, processing power, or bandwidth over the long term. The result is decentralization—where anyone can run free and open source software—a full node—that verifies and validates the entire ledger history, including their own transactions, at little cost.

To ensure maximum safety anddecentralization must be avoided in a forced or «automatic» software updates, so new versions of software must compete with older ones by proving - while maintaining backward compatibility - that they are either more useful or necessary for the survival of the system.

Unreliable miners

After all, miners can do exactly one thing: propose blocks, which nodes (setting consensus rules) verify, accept, and update the state of the ledger with.

Because miners can't change the rulesconsensus, malicious or untrustworthy miners can only censor specific transactions that they do not want to include in their blocks. They can get creative with this, but all possible attack vectors stem only from the ability to censor transactions on the longest branch of the proof-of-work blockchain.

The cost of accumulating hashrate for an attack - howbuilding hostings, manufacturing ASICs, or buying electricity are irrelevant to attackers who can steal these assets or intercept them in a cyberattack. Of course miners have an incentive to protect themselves from these uncertainties, but these are fundamentally unquantifiable contingencies.

There are three main types of attacks that canmake miners. One of them may have an economic basis (potential to make a profit), the other two are either random occurrences or attempts to undermine the trust in Bitcoin settlement guarantees.

- Double spending your coins (economic attack)

- The attacker spends his BTC on the recipient's addressand at the same time starts mining a branch in which this transaction is missing or sent back to the address of the attacker. The recipient initially sees the transaction confirmed, until the attacker publishes a longer chain without the original transaction. The recipient no longer has BTC, and the attacker keeps the original BTC.

- Block transaction processing by mining empty blocks (non-economic attack)

- The attacker constantly broadcasts empty blocks,to prevent network users from making transactions. Since the attacker will, by definition, have more than 50% of the total hashing power of the network, honest miners will not be able to add their block to the blockchain, since the attacker will have the opportunity to reorganize the chain by removing non-empty blocks from it. This is a non-economic attack, as the attacker will have to buy or seize mining equipment, the necessary infrastructure and electricity, without earning anything. When the attacker stops burning resources, honest miners can continue to work as usual.

- Deep reorganization (non-economic attack)

- The attacker starts secretly mining a branch withempty blocks. Waits for a sufficiently large number of blocks to be mined, and then broadcasts a longer chain of empty blocks to the network of nodes, thereby deleting transactions that users thought were already confirmed. Again, this is a non-economic attack as the attacker burns resources without getting anything in return.

Anti-fragile Bitcoin

Commissions will increase if needed

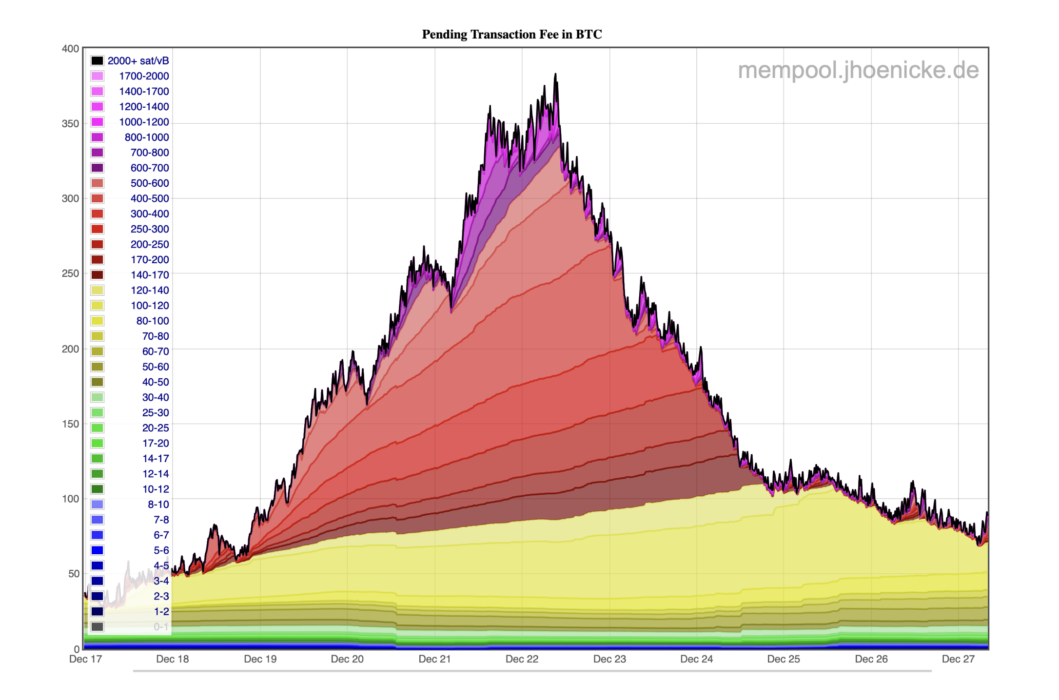

Are empty blocks mined?The mempool will fill up with transactions at ever higher fee rates as senders compete with each other to get into the next blocks. And this is not a theoretical assumption. We have seen what happens when demand for Bitcoin block space exceeds supply (see the December 2017 Bitcoin mempool visualization below).

Bitcoin Mempool Transaction Fee Rates

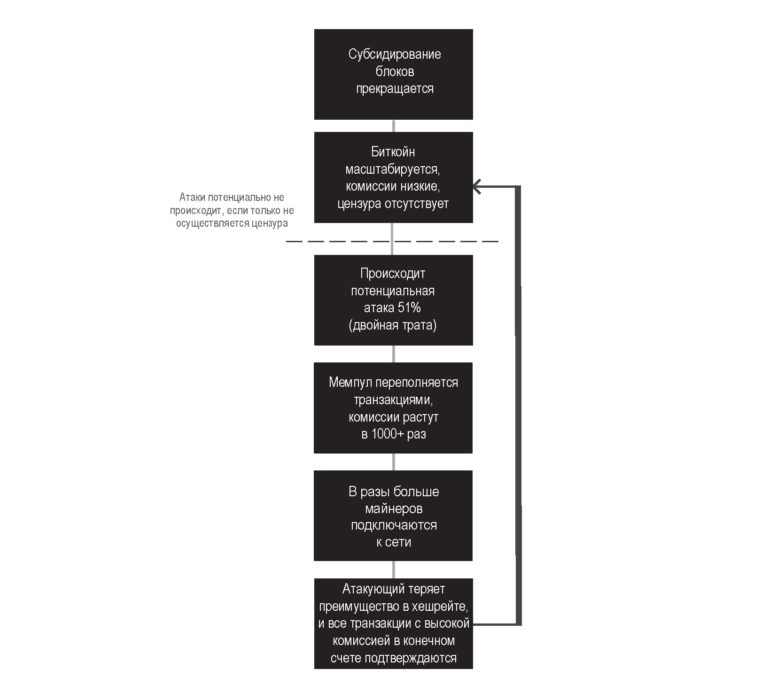

When attacking with empty blocks in the interests ofBitcoin users increase the commission rate so that the transaction is included in the next block. The more empty blocks there are (the longer the attack continues), the more pending transactions accumulate in the mempool. The commission rate may increase from 1 to >1000 sat./vByte. The reward for one block can increase from almost 0 BTC to 10+ BTC with the current block size of 1 million vBytes.

This is an anti-fragile system, and empty block attackwill be immediately met with an endless market counterattack in the form of high transaction fees. And it is likely that knowledge of this market counterattack, if not the cost of conducting the attack itself, will be what deters a potential attacker from carrying it out.

This solves the empty block attack problem, butwhat if an attacker secretly mines an alternate branch for 24 hours and then pushes this longer branch of empty blocks to the network, which all nodes on the network will automatically consider valid? All transactions that have received confirmation in the last 24 hours will now have zero confirmations according to the longest proof-of-work chain and will be returned to the mempool.

This attack will also be repelled in a similar way.All previous transactors (senders or recipients) will try to use CPFP (Child Pays for Parent) or RBF (Replace-By-Fee) capabilities to get their transactions confirmed as quickly as possible.

For example, if someone sent you 100 BTC,the transaction received 23 confirmations, you were confident in the finality of the settlement, but then the attacker broadcast a longer branch with empty blocks to the network without your transaction. That would be a disaster, because you lose 100 BTC that you thought were yours, right? Well, not exactly: you can push this now unconfirmed transaction through CPFP at a much higher fee, to be (conditionally) at the top of the now crowded mempool. You can raise your fee up to 1000+ Sat/vByte or whatever you want to get into the next fair block.

Please note that the fee increaseincreases the incentive for miners to connect to the network. Machines that could only be profitable at certain times of the day, at special rates for electricity, can now operate at almost any cost because their expected income increases by up to 1,000 times or more. With the growth of the commission, the amount of honest hashrate in the network increases, ultimately surpassing the power of the attacker.

Some might say that attack with empty blockscan also be economically profitable. Before broadcasting a longer chain of empty blocks to the network, an attacker can short Bitcoin in anticipation that the price will drop due to the attack. However, in the available examples of 51% attacks on Bitcoin Gold and BitcoinSV, the price did not fall during or immediately after the attack. Although these 51% attacks were double spends and not empty blocks, they show that a 51% attack may not hurt the price of an asset. In fact, during an attack with empty blocks, it would not be clear what the price could be, since no one can move coins (blocks are empty). Coins stuck on the exchanges can potentially still be traded, but there is no guarantee that the price will fall, especially since all users know that the attack must eventually end, because the attacker cannot burn resources forever. The moment the fee gets high enough to bring additional hashrate into the network, or when the attacker gives up, the attack fails.

Conclusion: The dynamic fee market of the Bitcoin network may make it resilient to attacks from potential adversaries.

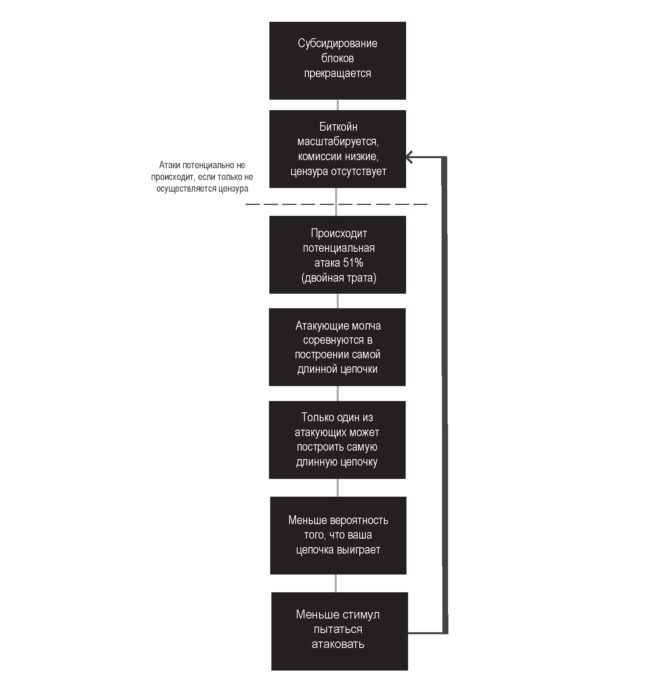

Attack paradox

For this attack to take place,an entity with a virtually infinite amount of resources must have a strong desire to try to destroy bitcoin without any economic incentives. By offering only empty blocks and blocking the ability of users to make on-chain transactions, this entity simply burns resources and energy. And the bigger Bitcoin gets, the more resources the attacker needs to do it.

If Bitcoin is «small» and does not undermine the value and position of its competitors in the cash field, the benefits of the attack will not be sufficient to justify the effort or expense.

If Bitcoin is large enough (say $100+trillion) and seriously undermines the value and position of their monetary competitors, then they are likely to be unable to successfully attack Bitcoin. Any attack will be met with a successful market counterattack with increased network fees, as explained above. If several unscrupulous actors try to attack Bitcoin at the same time, then each of them has an incentive to retreat by first enabling censored transactions with high fees - such a geopolitical prisoner's dilemma.

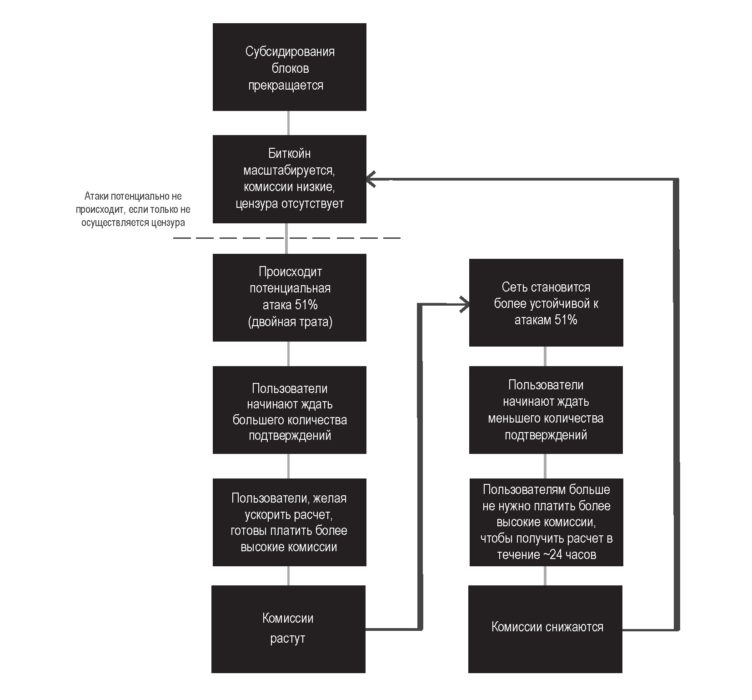

Market Feedback Cycle

Waiting for attackers

Finally, if there is no attack yet, but BTC recipientsfear that it may happen, they may expect more confirmations to have more confidence in the finality of their transaction.

This is also not a theoretical assumption. This is exactly how it happens with BCH, BSV and other altcoins.

Transactions are still broadcast andare confirmed, users buy and sell coins of these networks on numerous exchanges, despite the fact that «security» or the finality of settlement in these networks is much less reliable than in Bitcoin.

A great example is the BCH transaction on July 17th.2022. The transaction moved 113,356 BCH ($12.4 million). At that time, the block reward was only ~$800 (5 times less than the current amount of transaction fees in the average Bitcoin block).

In this case, it can be potentially profitable to double spend, and here's how to do it:

- Send 113,356 BCH to the exchange.

- Without an announcement, start a 51% attack on the network by mining a parallel chain that does not contain this transaction.

- Sell BCH for BTC.

- Withdraw BTC from the exchange.

- Broadcast your longer branch to the network, which does not include the original transaction of the BCH deposit to the exchange.

- Now the attacker has BTC, and the longest valid BCH chain says he has BCH too.

- The exchange that suffered from this double-spending lost $12.4 million.

This can happen even today and there seems to be an economic incentive for this, but in practice this rarely happens. Why?

Exchanges and other users now requiremore confirmations to consider the transaction final. Some exchanges require 100 confirmations for BCH, which is still less than 24 hours, but this protects them from double spending by increasing the amount of work, time, and energy required to carry out a 51% attack and reverse a transaction. Finally, waiting for a sufficient number of confirmations increases confidence in the calculation.

In addition, with double spending, attackersowe money to all their victims, so they will have to look for new victims for the next attack, while the attacker must be hidden under a pseudonym and not give himself away, and the victims are valuable enough that it makes sense for them to worry about this. It is unlikely that such an attack would be scalable.

Additionally, if users or exchanges believeSince receiving a significant number of network confirmations is critical, senders may be willing to pay a high commission for inclusion in the next block, so as not to wait even longer. That is, if an exchange requires 100 confirmations (~16.7 hours) and users are rushing to get a transaction settled, then they want confirmations to start arriving as soon as possible. And they may be willing to pay a high enough fee to have the transaction included in the next block. Naturally, these high fees can lead to more users feeling more confident about the finality of the settlement with fewer confirmations, and gradually the market will come to a natural equilibrium, even if there are some problems initially.

One more example:if many users try to double-spend by 51% attack on the network, then all the attackers will compete with each other, which makes the task more difficult for each of them. This means that if the blockchain is truly insecure and double spending occurs (which is unlikely), then double spending is localized to only one entity with more hash power than the others. In this example, the rest of the attempted 51% attacks will fail.

Finally, the majority of persons with capital forprofitable double spending by 51% attack, have no incentive to do so. They most likely hold a significant amount of BCH, BSV, or BTC, and do not appear to have any interest in disrupting the integrity of the network, of which they own a significant portion.

In short, there is an argument fordouble spending should already be happening on blockchains, especially weaker ones. However, they rarely happen in reality for a variety of reasons already discussed, and these attacks can be mitigated by requiring more confirmations to provide more confidence in the settlement of transactions.

In the worst case scenario, a 24-hour wait(144 confirmations) or a week (1008 confirmations) for the final settlement, without relying on any trusted intermediaries, will be of high value. Today, the finality of transactions in the Visa system and automated clearing houses is measured in weeks and months, and the cancellation of transactions is much easier than buying and managing most of the bitcoin hashrate. In addition, if on-chain transactions are only used for long-term cold storage and lightning channels, then long delays will not be a significant problem for users.

Conclusion

In the long term, the market maynaturally find an equilibrium for on-chain commissions. This may occur at a point where there is little demand for new scaling technologies and fees high enough to avoid censorship after X blocks. When will this moment come? It is impossible to know for sure, but it is safe to say that long-term «safety» Bitcoin is possible, and that miners will likely go through more scaling cycles where they earn more meaningful amounts in transaction fees as Bitcoin's adoption accelerates and it begins to be used as a medium of exchange.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>